The greatest Crypto Staking Guide: Everything required to Know About Staking Cryptocurrency

Certainly, the developing crypto economic climate houses a multitude of concepts distinctively conceived in order to optimize the particular workings associated with blockchain as well as many infrastructures. One of these ideas that you almost certainly encounter frequently is crypto staking. The significance of this system to the procedures of a number of blockchains and decentralized applications causes it to be a top top priority for new traders looking to discover the fundamentals regarding crypto in addition to blockchain technology.

So, we have develop a comprehensive cryptocurrency staking guide of which discusses anything from the types of staking to the method involved.

What Is Staking?

Blockchain networks considering establishing some sort of decentralized type of governance need to select the ideal consensus components. The preferred opinion model should highlight typically the network’s stand before security, typically the accepted amount of decentralization, along with the projected scale the environment. When most of these factors can be put into mulling over, it becomes better to identify the most effective system for that given crypto operation system. Apart from the well-liked Proof of Work-powered mining technique, there is a wide range of alternative opinion models.

Talking about alternative general opinion mechanism, staking is broadly considered the less resource-intensive option to crypto mining. Rather than requiring miners to make their pc power to the particular validation security requirements of the system, staking requires a more power-efficient route. Right here, network systems indicate their own interest in getting validators simply by locking money on the blockchain. This motion underscores the particular participant’s dedication to ensuring that this network keeps a secure condition. Like crypto mining, people who partake in staking opportunities remain a chance of getting rewards and becoming a percentage on each deal they confirm.

So that it is really worth, we can liken crypto staking to the react of adding funds inside a fixed cost savings bank account to create interest. Nevertheless , the process around staking as well as its role within blockchain security helps it be a lot more superior. Also, the particular staked cash are always by means of the blockchain’s native bridal party, and the system can choose in order to reward validators with the exact same coin yet another unique group of tokens. The greater tokens a person stake, the larger your chances of being a validator.

What Is Proof of Stake?

For anyone familiar with typically the intricacies regarding bitcoin exploration, it is common reassurance that miners must solve problematic puzzles to be able to earn the possibility of finding a fresh block and even playing a serious role inside the network’s purchase validation method. The manner of working that control buttons the whole of this method is the Evidence of Work (PoW) mechanism. Much like mining about blockchains demands PoW process, a special manner of working also affects staking about blockchains. Referred to as Proof of Share (PoS) opinion mechanism, this specific protocol selections validators in the pool of people or choices that have reached the blockchain’s staking demands.

Likewise, it provides the mandatory policies to make certain validators stick to their responsibilities and do not perform actions that can jeopardize the safety or quality of the community. To this ending, validators of which fail to abide by predefined demands could suffer a loss of their secured coins or perhaps be free from long run staking showcases the blockchain network.

What Is the History of Staking?

Evidence of stake primary came to typically the limelight news, when Sun-drenched King together with Scott Wci?? detailed some sort of hybrid opinion model of which supports staking in Peercoin‘s paper. This specific project in the beginning combined PoW and Detras to achieve general opinion. Typically the energy-consuming dynamics of PoW motivated typically the creation with this alternative style. although this specific solution has evolved just how decentralized blockchains achieve opinion, PoS has its a lot of sets regarding challenges. Over time, crypto jobs have created diverse strategies to eliminate these kinds of limitations.

Several main soreness points may limit typically the efficiency involving PoS:

Distribution: There must be an first method of disbursing coins rather to consumers before awe-inspiring staking prerequisites and allocating rewards to be able to nodes of which meet the requirements of a triumphant staking analyze.

Monopolization: Whilst nodes with all the highest amount of staked cash could come out as validators repeatedly, it really is imperative in order to implement the right system to lessen the propensity for any monopoly.

51% Attacks: As PoW blockchains are vunerable to 51% strikes. PoS systems must also present viable safety measures fail-safes to reduce the possibility of agencies with 51% stake excess weight. For those who are not necessarily sufficiently well informed on this safety measures threat, 51% attack takes place when an organization controls over fifty percent of the networks’ hash charge or exploration economy. The same goes to staking as an organization that handles over 50 percent of the overall coins secured on the system can make an attempt to alter the blockchain data.

Nothing at Stake: This specific challenge comes up when 2 nodes satisfy the set of circumstances governing the particular creation of recent blocks. In cases like this, two brand new blocks is going to be created in addition to signed simply by both systems. under standard circumstances, the particular operations regarding subsequent validators will orphan one of these gentle forks. Within a scenario where subsequent validators choose to verify transactions to both forked restaurants, the blockchain will become prone to double-spending. Validators can afford in order to validate deals on several chains as the resource necessary for staking is not really as strenuous as the power-consuming process of exploration cryptocurrency.

Just how Has Detr�s Blockchains Got into with These Staking Challenges?

In summary, there have been many attempts simply by PoS blockchains to eliminate the result of these difficulties on the quality of their staking-powered consensus process.

Distribution: Peercoin, being the very first network to add staking, put in place PoW for the initial endroit distribution version for its local cryptocurrency. With the early level of improvement, mining dished up as the most important supply to achieve Peercoin together with PoS grew to be more visible once the distribution had been realized. The same applies to be able to Ethereum, which will currently relies upon PoW to achieve validation together with distribution nonetheless has an continual PoS improvement planned to be able to oust ETH mining.

Additional crypto tasks that got PoS because their primary general opinion model through the scratch made a fortune on symbol sales by way of Initial gold coin offerings and so on to deliver cryptocurrencies amongst interested traders.

Monopolization: To get Peercoin, a good implementation known as “Coin Age” was brought to ensure that rich investors usually do not dominate the staking transaction affirmation systems. Right here, the process determines the particular dormant time period that secured coins. Proprietors of cash that have continued to be in a budget for more than thirty days have the greatest chance of becoming picked because the next validators.

51% Attack: The bigger the size of typically the staking overall economy of a blockchain network, the bottom the possibility of a 51% attack. This is due to it is very pricey to entice or obtain over 50 percent of the staking economy. This specific in itself can make established Detras blockchains a great deal harder in order to successfully encounter.

Nothing at Stake: Most of early iterations of Detr�s blockchains employed checkpoints to make sure that there are not any hard forks. In contrast, Ethereum and more modern iterations can be disincentivizing typically the signing involving orphaned hinders. Culprits will suffer all their levels, and they are in the long term banned right from staking.

Resulting from the unique options introduced simply by PoS-based blockchains, we have started to see a rise in staking opportunities. Each PoS blockchain has guidelines governing the particular operations from the validators. These types of rules retain the financial technical needs that every validator must satisfy. With this, the particular network may set the particular minimum quantity that can be secured and the scale the praise distributed in order to staking systems. It is worth mentioning the size of the particular stake often almost decides the number of money allocated while rewards.

What Are the Types of Staking?

The particular models meant for crypto staking can be categorized under 2 major groupings. The first is decentralized staking as the second occupies a more central version.

Decentralized Staking: This method employs a autonomous in addition to noncustodial approach to staking money and getting passive income. This particular staking program allows possible validators to possess full control of their validator and drawback keys. Even though a decentralized staking provider or dstaking service gives customizable validator setup in addition to management equipment, it does not include access in order to withdraw users’ funds or even sign deals on their behalf.

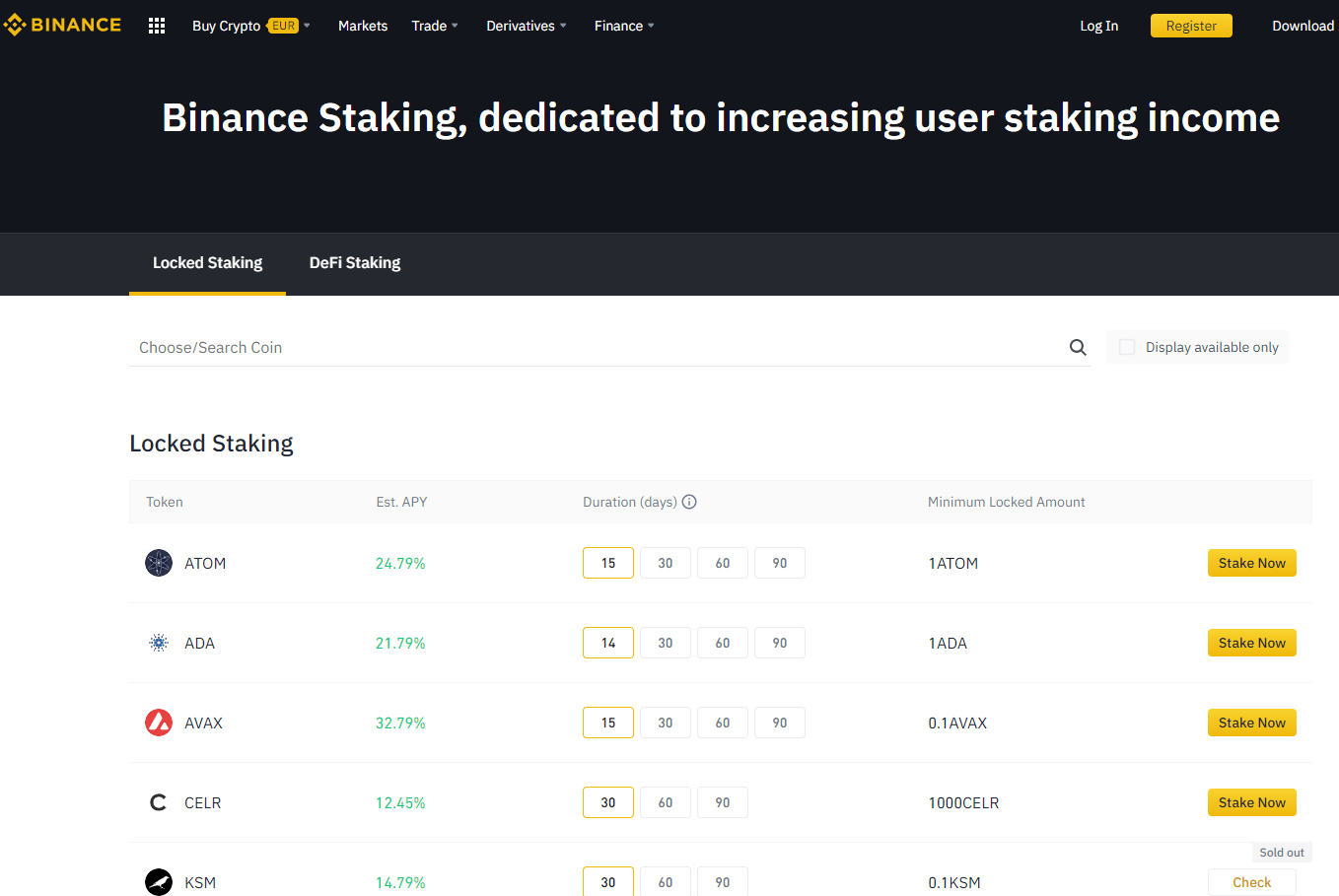

Centralized Staking. Expert services that adopt a central model typically maintain guardianship of the validator keys in addition to withdrawal take a moment. In essence, buyers only have to put in funds in the platform, the service provider occupies the responsibility regarding validating deals. Since the huge increase of crypto staking, we now have witnessed a lot more platforms, specifically exchanges, giving staking expert services that do not necessarily come with the particular intricacies linked to self staking.

Decentralized Staking Versus Centralized Staking

Possessing discussed the basic principles of both equally methodologies, it is essential to highlight the advantages and disadvantages. For starters, centralized staking delivers painless onboarding extr�mit� that have are liked by individuals who are definitely not ready to introduce the technological aspect of staking. Depending on the insurance policy of the program, you can even share an amount below the blockchain’s minimum share size. Yet , these positive aspects come at the cost. typically the custodial-based style of these crypto staking websites may open users to be able to risks just like slashing charges or profits / losses as a result of hackers. Also, typically the service subtracts commissions in rewards.

As opposed, dstaking symbolizes users having full autonomy over all their operations. Consequently, there is not as much chance of sacrificing funds as a result of negligence belonging to the staking system. This type of staking also helps catapult engagement in blockchain sites. The democratization of staking activities bodes well for any security associated with PoS blockchains. The higher the amount of nodes integrating self-staking, the low the possibility of the event of a 51% attack.

What Are the Types of PoS?

Since you have a basic knowledge of the concept of staking and Evidence of stake, the following section can help you dissect a few of the popular iterations of Detras. Here, we are going to highlight the particular factors which make each special.

Delegated Proof of Stake

Call to mind that we identified PoS as being an algorithm of which oversees the staking in blockchains, handpicks validators, allot roles, and even distribute returns accordingly. Could design developed the basis involving PoS iterations, the put into practice alterations placed each adaptation apart from the classic model. As an example, Delegated Evidence of Stake (DPoS) utilizes some sort of voting technique for an far more scalable purchase validation method. Here, the quantity of coins secured determines typically the voting benefits of each staking node. And also this node can make to decide witnesses and even delegates, that happen to be tasked while using the role involving managing typically the network and even establishing opinion. Delegates are elected to be able to oversee typically the governance belonging to the network, when Witnesses work as validators. Daniel Larimer made this opinion mechanism throughout 2014.

Such as the regular Detras model, the particular network incentivizes witnesses to keep the blockchain. In turn, these people allocate section of the received benefits to their electors. The voting power or even stake scale individual electors determines their own share from the earnings. Therefore, DPoS wants reduce the quantity of validating systems to enhance system performance. Using the inputs of the handful of selected delegates, DPoS blockchains can perform consensus and allow governance guidelines almost instantly. Therefore , there is no need for all your nodes from the network in order to partake in the particular daily system management jobs.

Though this system has built itself up as a feasible blockchain opinion model, that sacrifices decentralization for scalability. Since it chooses a handful of delegates, the community relies heavily on typically the inputs of your small amount of its systems for its business. In essence, this kind of diminishes typically the trustless characteristic originally imagined for permissionless blockchains.

Nevertheless , one could believe voting upon DPoS blockchains is an continuing process. Consequently , witnesses should keep an acceptable track record to hold their spot as validators. It is also well worth mentioning until this consensus version comes with a standing scoring technique that helps electors assess the activities of witnesses. Each DPoS-based blockchain can make the number of witnesses required to manage the community and designate tasks with each. In a circumstance where some sort of witness does not find a fresh block with the allotted moment, the community will bypass such a validating node together with downgrade it is reputation credit report scoring. Hence, this kind of shows that this kind of consensus version has set mechanisms set up to ensure that witnesses maintain the highest possible standard involving operation. Instances of blockchains applying this model involving staking can be EOS, Tron, and Steemit.

Liquid Proof of Staking

Water Proof of Risk is similar to DPoS as it offers token cases with voting rights allows these to vote for delegates. non-etheless, it goes slightly further in order to democratize the machine. It allows liquid democracy which allows arr�ters to choose delegates and pull away their ballots whenever they have the operations in the delegate usually do not represent their particular interests. Apart from, delegates may also transfer the particular voting legal rights to other delegates. The fluidity of this system makes it more desirable for little nodes to engage in the general opinion process. Another unique factor about Water Proof of Risk is that arr�ters do not need to exchange the possession of their money to delegates. With this, the particular validators face of shedding their secured coins within an event associated with double-spending. Among the prominent blockchains utilizing this technique is Tezos.

Bonded Proof of Stake

Fused Proof of Risk (BPoS) is similar to DPoS. It is optionally available to choose delegation in addition to stakes will be noncustodial. Nevertheless , in the case of BPoS, the validators and delegators will lose a promote of their buy-ins if determined dishonest or even inefficient. Therefore, delegators should take extra care as soon as voting to validators. Such as LPoS, this method solves a few of the limitations regarding Delegated Evidence of stake.

Leased Proof of Stake

This particular consensus design reinvents the particular proof of risk mechanism so that nodes may lease their own tokens in order to mining systems to boost the particular probability of actually finding new prevents. This system enables participants which are running complete nodes to possess a direct effect on the staking economy because they can secure their assets within cold storage space and use it since financial support from reputable organizations for exploration nodes. Remember that the possession of the bridal party in question is just not transferred to the particular masternodes. Therefore, no obvious security dangers arise out of this noncustodial staking system. Among the blockchain systems utilizing it is Dunes.

Masternode Proof of Stake

As the name signifies, this staking consensus program favors masternodes that can risk a large number of cash. The minimal stake dimension for blockchains with masternode-based PoS is generally very high. The particular ideology at the rear of this approach presumes that systems that are prepared to commit a substantial stake dimension have more to reduce than normal nodes. Therefore, they have a lot more at stake and can likely make sure the safety from the network. Generally, this general opinion model will be paired with some other mechanisms such as PoW PoS. A first-rate example of blockchains that have integrated the Masternode Proof of Risk system is Splash.

Other Staking Terminologies

Possessing explored a number of the variants for the Proof of Share consensus device, it is vital to focus on common staking terminologies you could encounter inside the crypto market.

Lockup Period

Oftentimes, nodes need to lock the coins for that set period of time to take a position a chance involving partaking inside the validation method and get paid rewards. Dependant upon the rules regulating staking with your preferred blockchain network, do not have access to your secured coins before the said lockup period elapses. In contrast, numerous PoS-based sites allow staking nodes to try as they hope with their secured coins.

Cold Staking

Frigid staking just might be the most trusted way to share coins about blockchain sites and it is largely associated with noncustodial staking components. The client has to fasten the secured coin in a offline billfold until the lockup period elapses. This approach restrictions the security hazards as cold storage (offline wallets) are certainly not as vunerable to hacks since the online options. However , failing to maintain the particular set quantity of coins within the designated off-line wallet can lead to the loss of staking rewards.

Staking Rewards

Since it is with nearly all blockchain surgical treatments, Proof of share blockchains incentivize participation. To paraphrase, the blockchain distributes returns based on the share size of each and every node. Be aware that staking returns varies around multiple blockchains. Some crypto networks might want to reward systems with the identical type of expression they secured. Conversely, certain may make profit on the staking process to be able to allocate an entirely different type regarding coin. These kinds of rewards typically include the costs charged to each transaction authenticated by the staking node.

Especially, certain different versions of the Evidence of Stake device restrict all their reward offer to the purchase fees developed from every single block. Below, validators and even delegators simply get to get transaction service fees.

Staking Pools

The particular crypto community has invariably identified solutions to encourage engagement and democratize opportunities. Evoke that the Detr�s mechanism establish minimum prerequisites for anyone able to stake the coins. These kinds of requirements add the least availablility of coins satisfactory and the technological resources forced to meet the requirements of being some sort of validator or perhaps delegate. Concerned nodes which can not connect with these prerequisites can become a member of pools concerning added staking weight. Consequently, staking warm are sites of shareholders that incorporate their means, especially fiscal strength, to increase their odds of earning staking rewards.

This method is suitable for people who can not satisfy the minimum risk size when it comes to intending validators. They can sign up for staking private pools, deposit the amount of coins they wish to stake, or more the possibility of obtaining rewards. it truly is worth observing that the sum contributed or even deposited the share this represents within the total risk of the staking pool identify the percentage on the reward spread to each individual.

Yet , as it is by using mining warm, there are variables that you must give consideration to before getting accepted into a staking pool. For starters, take the time to explore the service charge policy for the pool seller. You may need to make certain information in connection with the membership service fees, the revulsion limits, typically the lockup period of time, and the pay deducted through your earnings. As well, you should examine the effectiveness of the pool area provider. Do not forget that the actions or perhaps inactions for the pool seller may open you to the chance of losing some sort of fraction of the whole of your financial commitment.

Proof of Stake VS Proof of Work

The easiest method to compare and contrast evidence of stake proof of function is to spotlight the benefits and drawbacks of staking-based consensus designs. For those who are not too familiar with PoW, it is merely a more funds and energy-intensive method of reaching consensus finding brand new blocks. Right here, nodes resolve puzzles along with specialized or even generic processing hardware to generate new prevents. The system allocates benefits to prosperous nodes allows these to receive the deal fees produced on their brand new blocks.

What Are the Advantages of Staking?

As with any crypto chance, staking offers its advantages as well as the downsides. Here are some of the advantages.

It Is Not Resources Intensive

Contrary to the PoW mechanism of which entails miners to solve very difficult puzzles, Detr�s only wants interest members to fasten or squander a specific amount of coins. It is not necessary to buy high-priced mining items or compensate exorbitant power bills. The cost effectiveness of this approach allows even more nodes to be able to participate immediately.

It Is Eco-Friendly

Professionals have elevated concerns on the negative effect of exploration on the atmosphere. The fact that miners have to eat so much power to create brand new blocks usually undermines the particular efficiency associated with PoW. Therefore, it is beneficial to opt for a good eco-friendly option like Detras.

It Is Scalable

Various variations regarding PoS do not need00 the advices of all the systems of the community before opinion can be achieved. Consequently, the process interested in validating ventures is not when cumbersome when PoW-powered exploration and governance operations. This specific modification permits scalable blockchain infrastructures. To paraphrase, this approach adds to the average moment it takes to be able to validate ventures on Detr�s blockchains.

Do you know the Disadvantages associated with Staking?

Many Variants Aren't as Decentralized as Expected of any Permissionless System

A few of the types of Detras highlighted before in this tutorial entail systems to choose representatives in addition to validators. Could is designed at strengthening the scalability of the system, it places a dent within the decentralization on the ecosystem. The particular entirety on the blockchain depends on the decision of a couple of participants to the smooth working of the method. Although these kinds of mechanisms add a voting method, there is no expressing how the attentiveness of electric power could impact the viability on the network.

Typically the Volatility regarding Staked Gold and silver coins Could Have an effect on Profitability

understanding fully nicely that cryptocurrencies are risky, there is an natural risk that is included with locking your own coins for any specified period. The recession of the associated with the gold coin will instantly cause the cost of your risk to drop. Also, this can devalue the particular rewards. In order to mitigate this particular risk, it really is imperative in order to opt for cash that have real-life use instances. We suggest that you prevent cryptocurrencies which have no other software other than staking. The flexibility of cash almost always decides their extensive viability. Essentially, it is a lot more advantageous to tools meant to your staking activities close to viable cash.

Is Staking Profitable?

Various factors could affect the profitability of a crypto staking business. Even though this model has eliminated the particular overhead price of electricity mining equipment, other factors may significantly enhance or reduce the profitability associated with staking cash. For one, the particular block prize of the system always performs a crucial role whenever estimating the actual returns in investment. As well, you should make size of typically the staking pool area into account in addition to the highest earnable reward. Do remember the general control that states that that systems with a significant stake measurement generate even more rewards.

Moreover, you can use particular tools such as Staking Advantages to idea the earnings your stake will probably generate. Based on Staking Advantages, the staking market limit currently worths $320 billion dollars, with some staking-based blockchains appealing over 300% annual compensate. At the time of producing, Cardano is definitely the blockchain task with the greatest staking overall economy. A report says the twelve-monthly reward created by staking nodes is definitely 11. 2%.

What are Requirements in Crypto Staking?

Every person or business intending to share cryptocurrency need to take the time to be familiar with rules regulating the staking operations belonging to the preferred pool area or blockchain. First and foremost, it is essential to identify typically the variant involving staking maintained the community. Your studies will go further to prepare an individual for the voyage ahead. You must check to see if you have to carry your loose change in an web based or real world wallet. In addition to, some blockchains incorporate certain node organized for delegators, delegates, and even validators. Consequently, you must make certain you meet the technological and components requirements. Various other requirements include things like:

24/7 Connectivity: Most of blockchains count on validators to make certain their systems are always web based. Failure to accomplish this may bring a penalty.

Supported Wallet: Often ascertain the wallet you wish to use facilitates crypto staking.

The Minimum Stake Size: Usually, blockchains in addition to staking regularly impose the particular minimum range of coins that will nodes could stake. Make sure that the value of your current holdings complements or is greater than these predetermined limits.

Lockup Periods: Many of us advise that you just verify typically the lockup length of your chosen blockchain or pool area. You must conform to this law or work the risks regarding forfeiting salary.

Will be Staking exactly the same thing as Produce Farming?

Certainly, there are some commonalities between staking and produce farming because they both need investors to carry coins on the platform to create profits. Nevertheless , the latter targets providing fluid for DeFi protocols, whilst the former offer consensus. Produce farmers locking mechanism funds about DeFi financing protocols in addition to receive the curiosity paid about loans seeing that rewards. In comparison, staking systems lock finances to become permitted partake in the particular transaction approval and governance processes of any blockchain. Likewise, staking results in a more steady passive income compared to yield gardening which is completely volatile.

What are Largest Staking Networks?

Cardano

Having a total marketplace capitalization really worth $21 billion dollars, Cardano is among the most set up crypto systems. The blockchain supports abordnung and staking. Interested traders can assign their risk via their particular wallets as being the process keeps a noncustodial construction. There is around over $13 billion really worth of WUJUD – the particular network’s indigenous coin – set aside while stake bonuses. The system distributes zero. 3% of the stash while staking advantages every a few days. Information shows that the particular annual encourage generated simply by investors is definitely 4. 28%. At the moment, the significance of the total amount of ADA secured on Cardano is around $14 billion. This particular figure signifies over 70 percent of the cryptocurrency’s market limit.

Polkadot

Polkadot and its local token, DEPARTMENT OF TRANSPORTATION, have continuing to rise in the last few months. The market increased of the symbol has already overtaken the 20 dollars billion draw and it is fast-becoming one of the first choice staking programs for buyers. With an twelve-monthly reward regarding 13. 54% up for grabs, staking has become an important component of the particular blockchain’s overall economy. There is more than $14 billion dollars worth regarding assets secured on Polkadot. This system uses a Selected Proof of Staking consensus system, which allows each and every node in order to nominate around 16 validators. Nominees who also eventually come to be elected towards the validator fixed share their very own rewards together with nominators. You probably know that the cheaper the number of Spots staked with a given period, the higher the particular rewards sent out to validators. Also, the particular protocol facilitates reward reducing as a system for penalizing defaulting validators and their nominators.

Avalanche

Increase has a marketplace cap associated with $2 billion dollars, while its staking economy will be valued in $7 billion dollars. This environment is a mixture of blockchains, that allows delegation-based staking. You can earn as much as 10. 41% annual incentive for charging AVAX – the platform’s native symbol – or even 11. 21% for validating transactions. Remember that you must secure at least twenty five AVAX with regard to 2weeks to become delegator.

Ethereum 2.0w

Pretty knowledge that Ethereum is the 2nd most valuable blockchain in the crypto market which its continuing foray in to the staking marketplace will change the mechanics of the whole ecosystem. Following a success from the early stage of the changeover from PoW to Detras, Ethereum offers gradually surfaced as one of the biggest staking-based crypto networks. Currently, over $4 billion really worth of ETH has been secured on the blockchain, even though traders can not pull away their money and benefits anytime soon. Staking Rewards estimations that the typical annual incentive that traders will produce is nine. 24%. There exists a wide variety of methods investors may stake upon Ethereum second . 0. You are able to run a validator node, make use of a validator-as-a-service service provider, stake via exchanges, or join a staking pool.

Algorand

Algorand utilizes the particular Pure Evidence of Stake general opinion mechanism to generate its system and confirm transactions. The whole value of assets staked presently on Algorand is $3 billion. Typically the network returns both online and offline users using an annual rewards set for 7. thirty percent. For now, Algorand allocates returns to every client participating in staking according to the proportionality of their levels. However , in the foreseeable future, the blockchain may develop new worthwhile metrics of which take into account the position of each buyer in community maintenance.

CONCLUSION

You can agree that will staking is usually fast becoming a huge subject, specifically now that a lot more networks need to capitalize within the benefits of staking-based blockchain general opinion. We are sure that this guide addresses the fundamentals of the crypto principle and presents you to a number of its technical issues. You can resource for more information upon Cryptolinks regarding the best staking tools in addition to websites.

Thank you for sharing the article.