Best 25 The majority of Profitable Cryptocurrencies

Within the last decade, we certainly have come to take hold of the stability of Bitcoin as an investment instrument. The particular sheer difference between the associated with Bitcoin in the early phase of lifetime and its present valuation is definitely indicative with the massive profit-generating capacity with the digital resource. As such, it is about as no real surprise that traders are significantly adopting Bitcoin as their hold asset.

Yet , there is even more to the crypto movement than Bitcoin. We have a horde regarding other successful cryptocurrencies around that are just as profitable. To be able to shed even more light within this, we have thought i would highlight the most notable 25 cryptocurrencies with the optimum ROI. In this article, we will check out the electronic digital assets who have generated the best returns to be able to early buyers. But first, learn about factors of which contribute to the long lasting viability regarding crypto properties and assets.

Why is Digital Property Profitable?

Employing Bitcoin for a case study, it is actually clear of which quality electronic digital assets are more likely to increase in value over the years. What exactly separates Bitcoin and other big performing cryptocurrencies from people with faded apart is that the triumphant ones own real-world utility bills that speak out loud with buyers. As an entrepreneur, the target is not to be able to indiscriminately agree to crypto assignments so long that they incorporate blockchain infrastructures together with functionalities. Alternatively, successful crypto investors sometimes seek out good quality assets aided by the potential involving contributing hugely to the crypto movement. It is actually such electronic digital assets of which tend to crank out the highest back in the long run.

To put it differently, it is advisable to find intending buyers to go with quality jobs by determining their long lasting viability. This may require thorough research to understand the particular scope regarding crypto jobs, the application of their very own digital belongings, the industry they will target, and the propensity to find short-term or long-term value gains. It is easy to handpick the most practical cryptocurrencies the instant your research covers these caveats. This specific brings us to another section, which often discusses the 2nd most vital issue to consider when looking for crypto purchase with exceptional returns.

Crypto Hodling Is definitely the Appropriate Method

The particular validation with this article’s goal to determine the almost all profitable cryptocurrencies rests on the particular assumption that will some buyers are still keeping the put accrued on the early stages of crypto projects. For example, we believed that there are people who continue to maintain Bitcoin obtained when the electronic asset would still be selling under the $1 budget range. The large size of income generated through the years exemplifies the particular investment benefits of high doing cryptocurrencies, which include Bitcoin. Therefore, bearing in mind the purchase price disparities regarding some crypto assets these days and what they will sold for after they launched, its clear which a long-term method remains the simplest way to approach crypto investments.

This specific notion is certainly evident in the set of digital properties and assets curated listed below. The highest containing digital properties and assets, as seen the pictures, have persisted for a day or more. Really the only exception is certainly Yearn. Pay for, which simply came on side this year.

How Did We Compile This List?

To make certain this guide mirrors the financial commitment viability involving cryptocurrencies effectively, we agreed to estimate typically the return-on-investment RETURN by taking into consideration the initial expense of investing in every single token and your current market price tag. For more perception on how to analyze ROI, remember to read this self-explanatory article in Investopedia. Furthermore, note that we now have limited our own search towards the top two hundred cryptocurrencies because ranked simply by Coinmarketcap. Without having further furore, here are the very best 25 the majority of profitable cryptocurrencies in the electronic asset marketplace.

bitcoin (BTC)

Unsurprisingly, bitcoin best this checklist with an believed 90799990% RETURN ON INVESTMENT generated to find investors who bought the particular digital advantage for $0. 025 dating back to 2010. The particular digital advantage launched last year in response to the particular perceived freewheeling approach regarding governments towards the global recession of 08. Satoshi Nakamoto, typically the creator involving Bitcoin, called it as a substitute for traditional fiscal systems, which will continue to bill economic insurance plans that warned to lead to inflation. Compared with conventional approaches, Satoshi ascertained that Bitcoin had a repaired supply of 21 years old million BTC and a trickling minting style that minimizes the number of loose change mined just about every four several years.

These kinds of incorporations, with an extent, take a significant affect on the price tag trajectory involving Bitcoin mainly because it launched last season. Individuals together with corporations that happen to be aware of typically the inflation-hedging potential of Bitcoin have commenced to commit a present of their stock portfolio to the electronic digital asset. Guru believe that right here is the main adding to factor to be able to Bitcoin’s new price rallies. Subsequently, typically the cryptocurrency contains surpassed it is previous perfect high as the price short of money beyond typically the $20, 1000 mark the first time. Notably, this market value of Bitcoin has increased by above 200% considering that the year developed.

Ethereum (ETH)

Next on our set of the most successful cryptocurrencies is certainly Ethereum, together with around 212, 000% RETURN ON INVESTMENT generated while at the time of publishing. Ethereum, in the 5 many years of existence, features proven further than any realistic doubt that it must be as practical as Bitcoin as an investment motor vehicle. Much of Ethereum’s viability comes from its capability to power pr�-r�glable decentralized applications named dapps. Lately, it has come forth as the link for the seriously acclaimed DeFi market. The degree of innovation that Ethereum powers includes often enjoyed a important role inside the growing with regard to crypto properties. For instance, i want to consider the very documented half truths run regarding 2017. Pros believe that typically the influx regarding decentralized apps and Primary coin promotions (ICO) aided propel the values of crypto assets to be able to new heights.

On the peak with this bull pattern, the price of ETH rose in order to $1, 4 hundred, which continue to stands for the reason that record. Earlier investors who the experience to cash-out at this point could have generated an astonishing 450, 000% ROI. Remember that we think of early buyers as persons or agencies who had purchased Ethereum to find $0. 311 during their ICO marketing campaign in 2014.

NEM (XEM)

XEM is the seventeenth most valuable cryptocurrency currently, due to its $2 billion industry cap. Using a circulating availability of 8, 8888888888, 999, 8888888888 XEM gold and silver coins priced at $0. 271 for every token, NEM, which will stands for Fresh Economy Activity, has come forth as one of the nearly all profitable purchases of the last ten years. The RETURN generated in the 5 several years that NEM has been detailed is ninety-seven, 285%. This can be so if most of us start establishing returns out of July 2015 when you XEM endroit sold for $0. 0002. Be aware that the price of XEM peaked located at $2. apr in Jan 2018.

NEM, through their native NIS1 blockchain, presented a new deal validation system, coined Evidence of Importance (PoI) algorithm in order to cement the place among the innovative environments for crypto platforms. As opposed to conventional blockchain consensus techniques, PoI establishes the importance credit score of individuals, based on their particular activities for the network, in addition to rewards these XEM appropriately. This model features helped the particular network preserve consensus altogether and, simultaneously, identify in addition to reward lively users. It truly is worth observing that NEM possesses additional functionalities that will allow it to assistance encrypted messages, multi-signature concern contracts a blockchain authentication system with respect to files.

Verge (XVG)

Originally named Dogecoindark, Verge is also a project that will delivered the most profitable electronic assets ever before. Its indigenous coin, XVG, has created 89, 175% ROI as it launched inside 2014 as being a fork regarding Peercoin. The particular mineable electronic asset features like Bitcoin, albeit using added privacy-focused applications. The particular founder regarding Verge, Mr. bieber Valo, created the system to enable a number of privacy-enhanced characteristics including, redirecting of orders on the VergePay wallet from the Tor system. Other benefits include dual-key stealth information, which enable senders to make temporal information for receivers, and trustless peer-to-peer orders across several blockchains.

The buying price of XVG happens to be hovering surrounding the $0. 007220 range, while the market hat is just over a $118, 1000, 000 amount. The property registered it is peak cost in December 2017 when one XVG people paid $0. three or more.

Yearn.Finance

Yearn.Finance is probably the most good additions to typically the crypto industry in 2020. The process presents aggregating tools for your network involving investors considering participating easily in the deliver farming Landscape designs of DeFi. Yearn. Solutions simplifies deliver farming into a broader entrepreneur sector. In so doing, it has become typically the de facto DeFi webpages for choices and men and women looking to monetize on the chances available on tools like Competition, Compound, and even Aave. Due to its operation, Desire. Finance supplies advanced aggregating tools to build the highest possible brings. For its issues, the process charges revulsion fees and even gas subsidization fees.

Presented in August regarding 2020, Desire. Finance’s indigenous token, YFI, has executed impressively until now. According to the Coinspeaker, the particular token first showed at $32. Its present price is $27, 777, which usually exemplifies the particular viability with the project because it went reside. Using this information, we approximated the RETURN ON INVESTMENT to be seventy, 000%.

Neo (NEO)

Placed as the twenty third most valuable cryptocurrency, NEO contains delivered mouth-watering returns to be able to investors who had been wise adequate to option on the supplying as far back as 2014 when it was still being known as Antshares. Neo talks about itself as being an ecosystem where digitized repayments, identities, together with assets are coming. The community, commonly marked as the Offshore version involving Ethereum, delivers smart deal infrastructure in decentralized software and looks to turn into the satisfactory template in future net architectures.

NEO is a pre-mined digital advantage with a highest supply of 75 million gold and silver coins. Of this entire supply, seventy five million NEO is already inside circulation. Many of us estimated typically the ROI regarding NEO being 57, 000% if early on investors who bought it on the original ICO price of $0. 032 promote at the market place value of $17. 50. Be aware that those who distributed their NEO stash on the peak associated with $196 regarding January 2018 would have developed over six-hundred, 000% RETURN.

Dash (DASH)

Like Neo, DASH is without a doubt focusing on developing on Bitcoin by cultivating privacy-enhanced attributes and more quickly transactions. Sprinkle launched as the fork involving Litecoin throughout 2014, together with ever since, it includes gone to transform its treatments by a review of unique attributes that provide even more flexibility to be able to users. Pursuing these implementations, participants are in possession of access to be able to privacy-enabled trades, a two-layered network of which incentivizes systems, a security the usage that creates the immutability of Sprinkle blockchain, etc.

Typically the cryptocurrency’s industry cap might be slightly above $1 billion, turning it into the 25th most valuable electronic digital asset community in the world. With this data exhibiting $0. 0257 as the original price tag and $106 as the existing value of SPRINKLE, we projected that the cryptocurrency has a 52, 000% RETURN. As expected, this kind of comes almost nothing close to the earnings generated if the price of SPRINKLE peaked by $1, 642 in December 2017.

IOTA (MIOTA)

IOTA, special from the term “Internet associated with Things, ” is not the blockchain system per se. Rather, it uses a new proprietary system called Tangle to solve scalability issues. Tangle looks to set up a payment style compatible with typically the ultra-fast IoT technology by simply implementing a new network regarding nodes to verify the quality of ventures. As a result of this specific architecture, IOTA neither helps mining exercises nor should it impose costs on consumers. The central goal should be to enable a new seamless repayment network needed for smart equipment purported as the template needed for present and even future technological innovation designs.

Typically the ICO advertising campaign of IOTA, which was saved in 2015, was obviously a critical good results. Investors apparently bought every one of the 1 billion dollars tokens offered for sale for $0. 001 each. With the initial expense for buying 1 MIOTA, we predicted the RETURN generated over time to be all-around 33, 000%. The stability of this expression as an expenditure vehicle along with the uniqueness belonging to the project’s opportunity have located IOTA when the 32nd most beneficial digital property network inside the crypto marketplace.

Binance Coin (BNB)

Binance Coin is probably the many alternate cryptocurrencies we certainly have today. Typically the BNB ICO crowdsale started off 13 days prior to official introduce of Binance Exchange throughout 2017. You probably know that BNB was initially a ERC-20 expression (or Ethereum-based coin). Yet , after the Binance Chain travelled live in 2019, all present Ethereum-based BNBs were inter-changeable for the existing BEP2 patterned BNB, which can be native for the Binance blockchain. As it is system major exchange cryptocurrencies, BNB functions because the economic point for the Binance ecosystem. Put simply, it is the major means of deciding fees within the platform as well as the portal in order to access numerous symbol sale promotions on Binance Launchpad.

You will find currently more than 144 mil BNB within circulation costing $32 every. Considering that every token recently had an initial associated with $0. one back in 2017, The RETURN ON INVESTMENT generated is usually nothing lower than 32, 000%. In line with this particular impressive cost performance, the marketplace size of BNB has risen up to $4. five billion rapidly when compared with13623 little more than 3 years.

Nano (NANO)

Nano can be another lightweight variation of Bitcoin that concentrates on simplifying speeding up deal processes. To do this, the system opted for an alternative solution design towards the commonly used blockchain architecture. Right here, the facilities relies on a allocated ledger-modeled program, called Aimed Acyclic Chart (DAG), that provides a quicker, cheaper, energy-efficient deal validation procedure. As such, Ridotto does not need mining but rather utilizes the voting system called Open up Representative Voting (ORV). This method entails system participants in order to vote for associates that use up the part of validators. Since these types of representatives aren't rewarded for contributions, most transactions carried out on the Ridotto network have time.

Amazingly, NANO, initially called XRB, launched within 2015 using a public tap, which compensated individuals with bridal party for finishing a captcha challenge. Even though this implies that early traders got RIDOTTO for free, all of us adopted Coinmarketcap’s historical cost data to look for the returns produced over the years. Based on the coin metric site, the cost of 1 RIDOTTO, as of 03 2017, has been $0. 008. Using the present value of the particular digital resource, we determined the RETURN ON INVESTMENT to be inside the 14, 500% range.

Monero (XMR)

Like Verge and Dash, Monero concentrates on enabling invisiblity and assisting privacy-enhanced dealings. To this finish, the system uses sophisticated cryptography in order to obscure the particular identities associated with recipients senders. You probably know that within 2014 Monero forked from your existing blockchain network called Bytecoin. Plus unlike virtually all other privacy-focused coins, this sets the privacy-feature since default. Put simply, all dealings executed around the platform instantly evokes the particular identity safety feature in the network.

Most of competing sites are selectively transparent for the reason that users might choose to use the obfuscation protocol. Term unique gain that Monero has will be decision to make certain mining might be democratized, not like what we need in the Bitcoin network. Exploration on the Monero blockchain would not require virtually any specialized appliances. At the time of making, there are above 17. six million XMR priced at $156. 36 throughout circulation. Those who invested if the coin appeared to be selling in $1. forty-nine in May 2014 have accumulated 10, 390% ROI eventually.

XRP (XRP)

XRP possesses one of the most questionable crypto architectures, but which has not ended it by emerging for the reason that third most widely used digital advantage with a $25 billion marketplace size. Many argue that the particular payment system possesses components of centralization which can be in contrast to the basics of cryptocurrency. While this has always been a bone fragments of a contentious, XRP possesses since appeared as a exclusive blend of quick, scalable, in addition to affordable repayment infrastructures. XRP looks to produce a viable alternative to established nevertheless inefficient electronic asset systems and standard remittance methods alike. Such as many of the jobs mentioned until now, XRP failed to incorporate blockchain as its root technology. In comparison, it followed a sent out ledger make-up that is without any cumbersome, pricey, or energy-consuming consensus systems. Here, designated validators, which include financial institutions in addition to universities, uncover the quality of deals.

Given that XRP released, it has loved a significant subsequent that has powered both the worth and marketplace size in order to record-breaking standing. According to Coinmarketcap, the price of one XRP has been $0. 005 in August 2013. Investors who cashed in about this opportunity might have generated close to 10, 000% ROI.

Stratis STRAX

Stratis is usually a blockchain-as-a-service program that offers organization end-to-end remedies for the expansion, testing, and even deployment of these blockchain remedies. Launched inside 2016, Stratis provides an permitting environment to the development, routine maintenance, and working of permissioned and decentralized blockchain infrastructures. The aim is to make processes mixed up in creation repairs and maintanance of blockchains as soft as possible. To the end, typically the network will allow entities to be able to launch his or her projects about sidechains of which interact with their core cycle and local token, STRAT.

Could functionality powered the job to stardom, Stratis additionally introduced a fresh blockchain by using added attributes that build up the opportunity of its environment. Subsequently, the woking platform has reinvented its tokenomics by implementing STRAX being the native expression of its environment. Starting from August 2020, Stratis implemented a symbol exchange method that allows STRAT holders to be able to swap the tokens with the newly brought in STRAX endroit at a one-to-one ratio. In accordance with CoinTelegraph, each and every STRAT expression had an primary price of $0. 007 because it launched. And even judging by the latest valuation regarding STRAX, typically the project includes generated the 8, 600% ROI needed for early buyers.

Chainlink (LINK)

ChainLink gows best because it capabilities like a tokenized oracle community poised to remove the siloed nature regarding blockchain sites and sensible contracts. Consequently , Chainlink attaches smart legal papers with real world or actual entities. Consider it the connection between legal papers and actual applications. Basically, it has become one of many platforms of which benefited in the explosiveness of your decentralized pay for landscape of which solely relies upon smart legal papers for the setup of financial operations. With Chainlink Oracle, sensible contracts could track off-chain parameters, just like temperature, selling price, and moment, for even operations when parties fulfill the predefined words of clashes. The community distributes WEBSITE LINK tokens to be able to node workers who produce accurate info to requiring contracts.

Chainlink held their ICO inside September 2017 and increased $32 thousand. Each expression valued during $0. nineteen during the ICO sale at this moment costs $13 today. Consequently, early buyers have now registered a remarkable almost 8, 000% RETURN in three years.

Sia SC

Sia may be a blockchain-powered passed out cloud storage area platform. By simply implementing blockchain as the main technology of applications, Tanto has efficiently established some sort of trustless together with secure architectural mastery for fog up storage. Typically the project implemented a token-based economy due to the marketplace where users can easily lease out and about unused storage devices and get paid Siacoin, typically the native electronic digital asset. Tanto believes of which its implementations give it another edge above established fog up storage treatment providers just like Amazon, Yahoo and google, and Microsoft company. One of the advantages it includes over it is competitors is the fact its decentralized architecture delivers users cut-throat rates together with an extra covering of security measure.

Released in 2015, Sia possesses generated remarkable returns in order to early buyers, thanks to the value performance regarding Siacoin. Based on data gathered from Coinmarketcap, the cost for choosing 1 Siacoin in August 2015 was $0. 000047. According to its present price of $0. 0037, the particular ROI holders at several, 772%.

THORChain

THORChain may be a noncustodial together with decentralized property swapping treatment. The job prides themselves on supplying a unique system that provides permissionless cross-chain fluidity pools. Therefore, these warm enable straightforward access to be able to on-chain alternate without having to wrapping or peg assets. For that reason, participants can easily share their cryptocurrencies on the fluidity pool to the chance of creating trading costs. The benefit of making use of this project is it exposes consumers to a manipulation-resistant price providing system. Moreover, users will make withdrawals in different cryptocurrency, due to cross-chain efficiency of the process.

To ensure this system runs smoothly, typically the protocol includes its local token, Rune, which in line with the information offered, makes up a new 50: 60 ratio of pools. Introduced last year, RUNE debuted about Coinmarketcap over the 24th regarding July 2019, priced $0. 016 for every token. Using a current value of $1. 09, early on investors own enjoyed 6th, 712% RETURN.

Stellar (XLM)

When Stellar introduced in 2014, the center goal on this offering was going to create a international payment together with asset storage area system with the unbanked. Immediately afterward, typically the network reinvented itself as the blockchain linking infrastructure to receive inter-bank trades. With its local coin, Lumen (XLM), Fantastic provides quickly and low cost cross line payments. These kinds of functionalities act like what XRP offers ever since Stellar was basically originally some sort of fork within the Ripple Process before the improvement team rewrote the coupon code. Per the idea of center contributors, Fantastic creates a performing convergence level between redbull currencies together with digital solutions, as it should allow substance conversion regarding the two merchandise.

You will discover over 20 billion dollars Lumens throughout circulation, which can be about half within the maximum offer. Owing to the caliber of Stellar, the buying price of XLM comes with surged to be able to $0. 182249 from an original cost of $0. 0031 that kicks off in august 2014. Most of us estimated typically the ROI for being nothing down below 5, 500%.

Ark (ARK)

Such as many of the cryptocurrencies highlighted within this guide, ARK is targeted on establishing interoperability between some sort of horde involving blockchains to be able to power the ecosystem which has a wide array useful cases. Typically the interesting element about this job is that the method is fully custom and without any the frequently used smart deal system. Rather than the independent contract characteristic, the platform employs custom ventures, a broad collection of programming 'languages', and common sense. Along with this different model came up added uses like variable payment and even multi-signature.

Right from all hints, it appears that ARK’s architecture was convincing adequate to encourage investors. In the course of its ICO campaign, one particular ARK people paid just $0. 01. Yet , at the time of making, the price at present hovers about the $0. 40 mark. Following analyzing typically the revenue made over the years, typically the ROI was standing at 5, 100%.

Reddcoin (RDD)

Reddcoin is basically a cryptocurrency designed for showing and other sociable payments. This powers the particular Redd environment, which mostly functions as being a platform where users could fund or even raise cash for numerous causes. The particular digital resource, which released in 2014, comes with a cheap transaction ability that provides an easy and successful means of moving funds within the Redd system. As a shell of Litecoin itself, Reddcoin solves a few of the issues common with other systems. Ultimately, this presents the chance to profit from content within the Redd system and finance social movements.

Coinmarketcap started checking Reddcoin for the 10th associated with February 2014 when the value was hanging around $0. 000026. having a current value at $0. 001055, earlier investors include generated near to 3, 900% ROI within 6 years.

Kusama (KSM)

Self-acclaimed as the undomesticated cousin regarding Polkadot, Kusama key functionalities provide a scalable in addition to interoperable environment for blockchain developers. This particular team used a blockchain development system introduced simply by Parity Technologies. With this style decision, Kusama shares related functionalities together with Polkadot because it allows interoperable characteristics that are lack on set up blockchain systems. Due to the modern power of this particular project, programmers tend to put it to use as a basic testbed for applications in addition to blockchain options.

Some other similarity involving Polkadot and even Kusama is they both characteristic on-chain governance. In other words, choices or men and women holding Kusama (KSM) bridal party have voting rights to be able to influence alterations. Interestingly, Kusama launched as being an airdrop to Polkadot’s early buyers. For each DOT symbol they obtained, they obtain an equivalent range of KSM. Other folks obtained KSM via a frictional faucet which has since already been decommissioned. Based on Coinmarketcap, Kusama has an RETURN ON INVESTMENT of 3, 272%, if worked out from January when the symbol first presented on their site.

Syscoin (SYS)

Based on the platform’s web site, Syscoin “provides trustless interoperability with Ethereum ERC-20, symbol & resource microtransactions, in addition to Bitcoin-core-compliant merge-mined security. ” Hence, this particular blockchain system uses a home security alarm similar to the Evidence of Work system utilized by Bitcoin. However , the sole difference is it is not while power strenuous as Bitcoin, and even miners can use the power spent on mining Bitcoin to merge-mine Syscoin. More importantly, Syscoin reportedly interoperates with virtually any ERC-20 based mostly token, which can be remarkable itself. These uses make Syscoin a viable repayment network with good throughput, minimal transaction expense, and good security systems.

Whenever calculating the particular ROI associated with Syscoin, all of us found that will early traders paid $0. 0018 for that purchase of one SYS that kicks off in august 2014. With this particular Being the first tracked associated with Syscoin upon Coinmarketcap, all of us estimated the particular return on investment in order to fall inside the 3, 300% range.

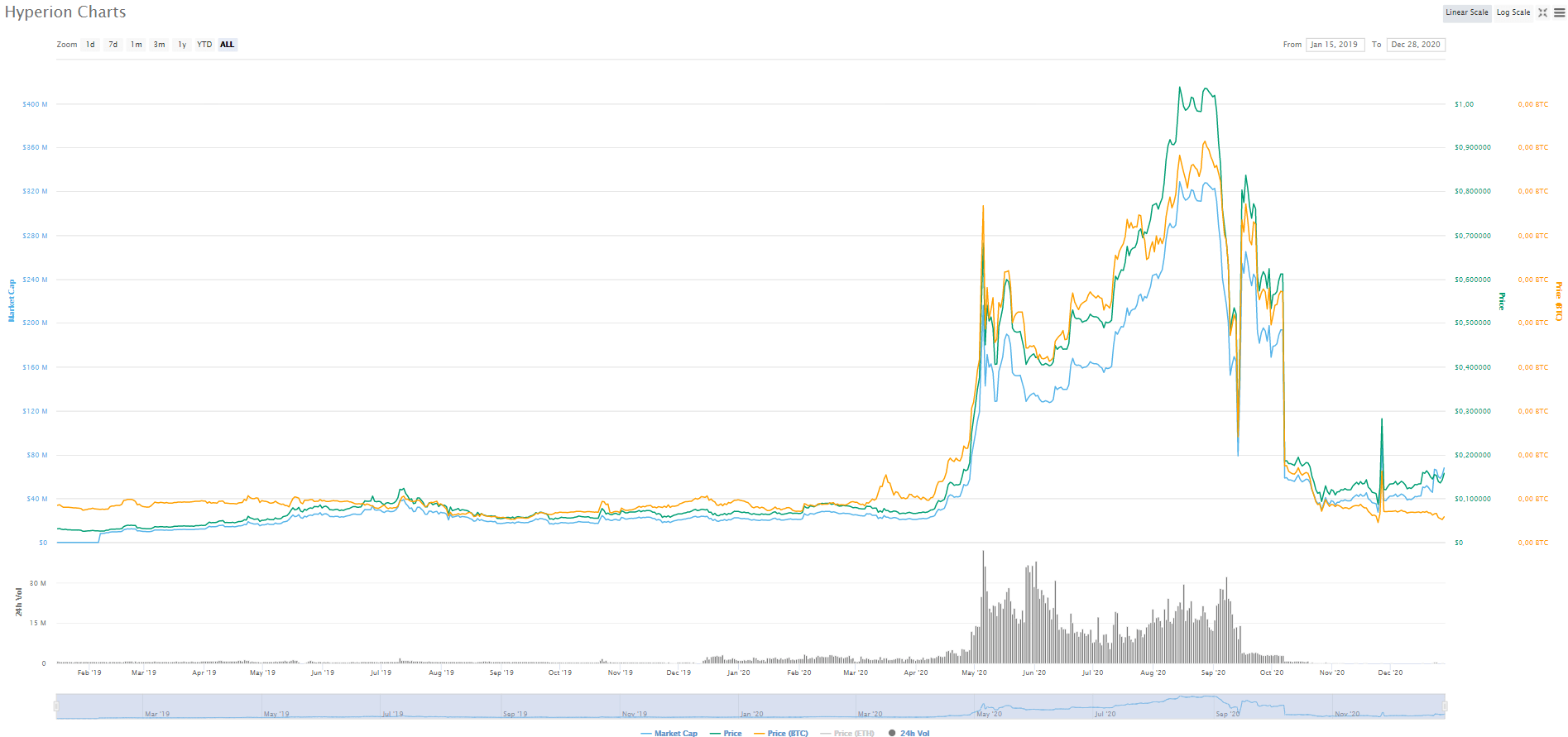

Decred (DCR)

Decred desires to15325 become a lasting store valuable the same way Bitcoin has become the first choice choice pertaining to institutional individual traders. To achieve this, Decred adopted the community-based cryptocurrency architecture along with in-built governance systems. This particular design includes a cross consensus system that brings together the Evidence of Work (POW) and Proof of Stake (PoS) models involving achieving purchase validity. Typically the long-term target for Decred is to come up as an r�parable, flexible, and even sustainable treasury where some sort of Decentralized Independent Organization (DAO) funds every one of the stakeholders belonging to the network consequently.

Taking initial cost ($1. 13) and the present price ($33. 70) associated with Decred into consideration, we approximated the RETURN ON INVESTMENT generated in order to fall inside the 2, 882% range. During the time of writing, Decred, with a marketplace size of $417 million, rates as the 53rd most valuable cryptocurrency.

Hyperion (HYN)

Hyperion desires to15325 provide better mapping expert services to over 8 billion folks and twelve billion gadgets. To this conclusion, Hyperion is definitely a decentralized map facilities that facilitates cryptography to find added security and safety. By taking on blockchain as the building block, Hyperion has established itself as being a self-governing in addition to sustainable chart economy. This specific architecture gives access in order to unique chart sharing technology securely. On account of cryptography implementations, the chart information or even locations regarding users will be encrypted. In addition, the platform bonuses users in order to contribute correct and beneficial map info. Subsequently, individuals reach general opinion to maintain the particular coherency of this map overall economy. Hyperion thinks that this technique is a viable alternative to existing umschl�sselung technology.

Concerning its purchase viability, typically the cryptocurrency includes generated all-around 2, 824% ROI for every the data on Coinmarketcap.

Maker (MKR)

MakerDAO is another DeFi-based project which includes done adequate to come up as one of the almost all profitable cryptocurrencies. This program functions equally as a decentralization organization including a stablecoin issuance system needed for DAI. In the most basic application form, MakerDAO runs the DAI ecosystem keep that the stablecoin remains chosen to the US ALL dollars. MKR, the governance token, democratizes the voting system of the woking platform. In essence, MKR holders could contribute to the governance of the DAI. As the DAI economy evolves, so will also the value of MKR surge.

Every the data in Coinmarketcap, typically the debut associated with MKR might be $22. 20, while it incorporates a current associated with $574. 91 per product. Due to this extraordinary price effectiveness, the RETURN has risen up to 2, 500% in just within 4 several years.

Litecoin (LTC)

Labeled the yellow metal to Bitcoin’s gold, Litecoin is among the earliest variations of Bitcoin that worked to improve within the performance in the original cryptocurrency protocol. The particular goal was going to deliver quicker transactions in addition to scalable infrastructures. Like Bitcoin, Litecoin has turned into a popular crypto payment technique even as key merchant crypto sites continue to keep integrate the network. Nevertheless , unlike Bitcoin, it uses the consensus system, called Scrypt Proof of Job mining duodecimal system, which allows customers to my own with GRAPHICS and Microprocessors.

Because of Litecoin’s knack for development, the price offers trailed Bitcoin’s success delivered amazing returns in order to early traders. For a more in depth analysis, all of us estimated the particular ROI to become around two, 635% because the initial price for purchasing 1 device of Litecoin was $4. 30, as well as the current price are $117.