Typically the Beacon Sequence: A Critical Moment inside the Ethereum installment payments on your 0 Story

Following a launch for the Ethereum installment payments on your 0 advance payment contract, typically the crypto place is ready to observe one of the most important events of 2020. Associated with a January 1st establish date to Phase zero of Ethereum’s upcoming number of upgrades has got sparked across the world hysteria seeing that participants observe in anticipation of the particular implementation regarding staking in the Ethereum environment. Behind these excitements will be shades of uncertainty stemming through the fact that inspite of the promise regarding mouthwatering rewards, the world’s second most widely used network should journey to the unknown. On this page, I will discover all the factors involved, in addition to highlight the particular worst-case situation.

What is Ethereum 2.0?

Ethereum 2 . zero is a continuous series of advances that want to evolve typically the infrastructures for the Ethereum blockchain to improve it is operations. In other words, Ethereum 2.0 is definitely an advanced type of the existing mainnet poised in order to mitigate repeating shortcomings. Among the frailties focused by this update is the insufficient scalable infrastructures. Hence, when all would go to plan, these types of upgrades may put an end to repeating cases associated with congestion high deal fees. Particularly, Ethereum second . 0 desires to15325 extend the particular network’s ability to 10, 500 transactions for each second from your meager fifteen TPS founded as the optimum speed in the Ethereum one 0 blockchain.

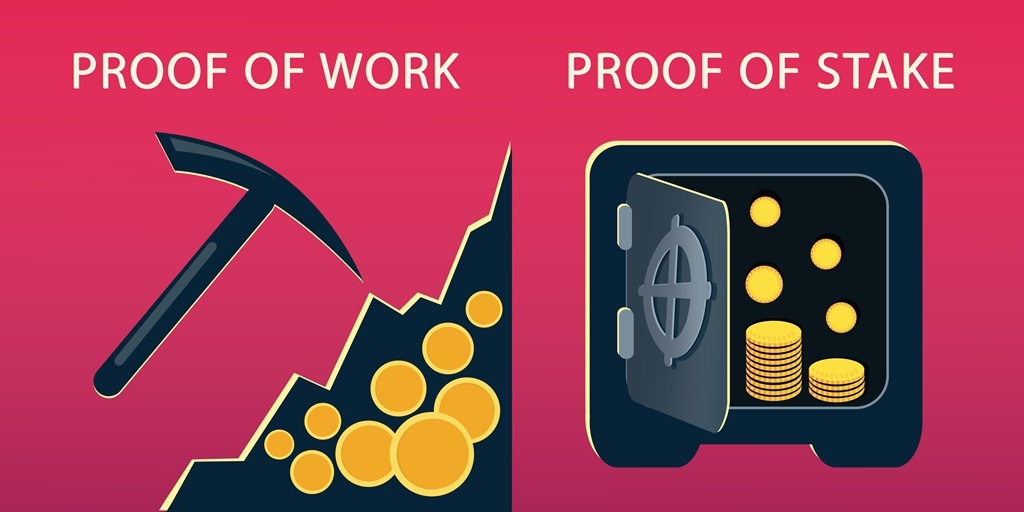

Among the systemic modifications projected to create this high goal attainable is the in order to a staking-powered validation program. In other words, the particular Ethereum system, which presently utilizes the particular Proof-of-Work general opinion mechanism, will certainly gradually expose the Proof-of-stake model and finally phase away mining procedures. As such, beginning with the 1st associated with December, projected for the reason that genesis regarding Ethereum 2 . not 0, individuals of the Ethereum ecosystem could stake ETH for varying rewards.

Exactly why is Ethereum second . 0 Bringing out Staking?

One of the most potent reasons why staking is definitely an integral setup of Eth2 is that it can be a relatively quicker process of validating transactions. As opposed to the PoW model, which often only enables a successive mode associated with validation, Detras offers a program where validators can perform their particular duties synchronously. Another reason is it is a less expensive approach while validators need not purchase engineered high-priced and power-consuming mining components. As an alternative, participants could run the Ethereum staking operation from your consumer laptop or computer.

Yet , for this being fully detailed, the first period of the Ethereum 2 . zero upgrade could implement the particular core expansion team telephone calls the bright spot chain. In line with the information on https://Ethereum.org/en/eth2/, the particular beacon cycle will jason derulo in Proof-of-staking functionality simply by registering in addition to coordinating validators. The file reads:

“The first component of Eth2 to be able to ship is definitely the beacon sequence. It won’t be totally operational without delay because there won’t be virtually any shard strings, so there’ll be not keep in synchronize other than themselves. Remember, typically the beacon chain’s main purpose in Eth2 is making certain all the shards have the a lot of up-to-date files. At first, typically the beacon sequence will be in charge of registering validators and managing everyone’s secured ETH. That is foundational for the rest of Eth2 and lies the foot work for the shard chains. Create, once the bright spot chain might be live, you’ll be able to stake your real ETH. Yet , staking throughout Phase zero is a verified transaction. An individual won’t manage to withdraw the ETH before the current sequence becomes a shard of Eth2 in Period 1 . 5 various. That’s mainly because staking throughout Phase zero will be addressed by a bright contract in mainnet (the Ethereum many of us use today). ”

While noted in this particular statement, as soon as staking begins, validators won't have access for their funds till phase one 5 roll-outs. Hence, this might induce several level of unwillingness on the part of individuals.

DeFi Poses Critical Threats to be able to Ethereum installment payments on your 0

Harry Ogilvie, TOP DOG of Secured, echoed this kind of sentiment in a very recent document where he / she explored typically the factors that can spur or perhaps limit engagement in Ethereum staking. Inside the article, Ogilvie explained that your introduction involving staking delivers true believers of the Ethereum a chance to present their determination to the community. He explained:

“These true believers, who were inside at the beginning when Ethereum’s ICO introduced, finally experience an opportunity to ensure that the network development to the next level regarding security. Long lasting ETH slots no doubt imagine a protect network support the health of typically the blockchain – and with that the price of his or her prized properties. All the while, they might earn various yield along the route. ”

Nevertheless , Ogilvie cautioned that staking is not for everybody because it needs a long-term dedication as benefits are irredeemable until the second option phases associated with Ethereum second . 0 go real time:

“Standing up systems in many of thirty-two ETH in addition to running these barely any kind of downtime as the assets will be locked on with what could end up being years won’t be for all – and it also shouldn’t end up being. Whether secured alone or even via a swimming pool, once a property is wear the Bright spot chain, there is not any going back towards the original. Stakers whose ETH will remain secured up until a new later stage must be ready to be secured into a long lasting commitment. ”

An identical point grew up by Consensys in a current report. The particular authors known that DeFi and its high-yielding liquidity gardening opportunities stay a potent danger to the achievement of Ethereum 2 . zero. The article reads:

“The logic is that Ethereum 2.0 needs ETH holders in order to lock up their particular funds inside a deposit get a adjustable return and much more disconcertingly, the currently unspecified amount of time. In the event that various DeFi protocols offer you higher comes back than Eth2 staking, ETH holders might elect in order to direct their particular ETH somewhere else, thus making Eth2 with no threshold associated with staked ETH required to provide it adequately secure decentralized. It is not necessarily unreasonable to be concerned that ETH holders would likely (at best) wait to determine how earlier staking comes back compare to DeFi returns, or even (at worst) decide completely not to “risk” locking upward ETH till Phase one 5 (which is likely a minimum of a year away) in case one more similar half truths run only occurs in the interim. ”

non-etheless, as featured in this storie, there is a likelihood that the DeFi landscape definitely will usher throughout projects created to tokenize typically the assets and even rewards secured on Ethereum 2 . zero. Despite the breakthrough of this sort of solutions, it can be impossible to be able to predict users’ propensity in support of locking ETH in the just-launched deposit deal:

“But just as the particular Q3 DeFi ushered within the concept of the derivative symbol that signifies a user’s pooled bridal party, we predict that suppliers could offer water tokens that will represent the significance of their secured ETH. Just time can tell just what choice ETH holders can make and what can drive their particular decision-making procedure in determining whether in order to stake delete word. Despite the pr�-r�glable rationality associated with Ethereum, people are not powered to decision-making by the range of a clever contract, in addition to considerations such as the amount of fluid an ETH holder may access, the particular volatility associated with Eth1. times vs Eth2, and the growing user connection with being an ETH holder are typical factors actively playing into the choice of whether in order to lock cash in a first deposit contract. ”

This particular observation is definitely coherent together with Ogilvie’s accept the risk/reward factor which could mold the particular decision-making associated with potential validators:

“Stakers need to consider the difficulty of operating nodes on the major string with the likelihood of being cut for faltering to stay upward persistently or even for some other issues like double-signing. Ethereum 2 . zero staking needs the dedication and trouble of keeping a client for years. All those inclined to aid network protection and generate steady produce may nevertheless shy away from the particular obligations associated with regularly maintaining their machines. ”

During your time on st. kitts are still concerns surrounding the particular attractiveness regarding Ethereum staking, the requirement that will at least of sixteen, 384 validators must locking mechanism ETH seven days before the suggested launch particular date for the bright spot chain continue to holds. The particular deposit agreement must maintain at least 524, 288 azure for staking to start. At the time of producing, the total amount regarding ether locked within the deposit agreement is forty-nine, 185 ETH, which is equal to $22, 559, 192.

Precisely how Viable May be the Upcoming Ethereum 2 . zero?

For nearly a year at present, a vast selection of Ethereum production teams need initiated several tests to make certain Ethereum 2 . zero is free of bugs or even glitches. Yet , not all moved to schedule. Ben Edgington, a center contributor to be able to Ethereum installment payments on your 0 advances, noted this kind of fact in a very recent content on CoinDesk, where he diagnosed some of the troubles encountered over the last 2 a few months. He had written:

“Progress has not all of been simple. A few days following the start of the Condecoracion testnet, among the clients experienced a critical concern that damaged the cycle for a few days. Nevertheless this is what testnets are when it comes to. We retained the cycle running in addition to were able to take it back to complete health, using a slew regarding lessons figured out. ”

Moreover, Edgington described that these challenges taught they some important lessons. Moreover, as highlighted simply by Danny Thomas, a key researcher in the Ethereum Basis, “the occurrence on Condecoracion was considerably amplified with the failure with the dominant Prysm client, as we relocate toward mainnet, we, being a community, should consciously strive to remedy this particular. ”

Regardless of these challenges, Edgington feels that it is time and energy to deploy the particular beacon string as this numerous testing scrutiny provides helped they develop a durable infrastructure designed for Ethereum second . 0:

“This is why it is currently time to go real time with the bright spot chain. We now have tested the rest in every method we can: the particular deposit agreement has been officially verified; the particular deposit equipment have been audited; the specs has been audited; the bright spot chain is formally patterned; the client discovery process has been audited; the network protocol is audited; the particular crypto-economics have already been simulated; i'm running incentivized attack netting; we’ve already been doing felt testing; every single client possesses undergone one or more third-party stability audit. Numerous pairs regarding eyes currently have scrutinized the complete process during the last year. ”

Apart from, he alerts that the needs for becoming a member of the top notch team associated with validators might be quite challenging. However , this individual reiterated their resolve which of their team in order to champion the particular Ethereum second . 0 story. He furthermore revealed that you will find tools accessible to meet the infrastructural and financial requirements associated with Ethereum second . 0 staking:

“Staking, from the start, will never be for everyone. One of the reasons for this for could it be can be quite challenging technically. Stakers need to retain a machine running since close to day to day as possible. They have to keep their own systems safe and stay in the loop for of customer software up-dates. For those not really confident regarding hosting a staking node them selves, there are plenty of thirdparty services turning into available. Inside ConsenSys, our company is offering Codefi Staking, the white-label, turnkey solution for your business that want in order to stake upon Ethereum second . 0. ”

Such as Edgington mentioned, there are rooms of solutions that can help validators keep up with the requirements of Ethereum staking. If this turns out that this technicality involved with staking Ethereum is too hard to scale, aiming validators may switch to the greater flexible accommodating staking pools services.

Life After Phase 0 Of Ethereum2.0

As soon as phase zero goes reside, the next phase entails the particular deployment associated with shard stores to enable a strong blockchain environment. Shards are usually synchronously working chains working parallel towards the beacon string. Transactions carried out on each shard chain are usually transmitted towards the beacon string to ensure that the information across just about all shards are usually coherent. Nevertheless , there is no particular timeline for that implementation of the phase. Could is a provided, as Ogilvie wrote, it is important is that the items are arriving together effectively:

“Whatever the decision individuals make now, it is a crucial moment just for Ethereum as well as the blockchain neighborhood in general. While Ethereum second . 0 steps through the phases, the particular network must be able to achieve true scale. The blockchain having a current lethargic speed associated with 14 purchases per 2nd has evident limitations. Nevertheless Ethereum second . 0, together with the potential associated with reaching a hundred, 000 purchases per 2nd, could help the particular network understand its mentioned ambition to become a world personal computer. ”