The partnership Between Bitcoin Halving, Exploration Profitability, together with Speculation

Typically the prevailing story of the approaching bitcoin halving centers all-around its identified impact on the price tag on bitcoin. A substantial fraction regarding crypto fans believes which the price of bitcoin will spike as a result of elevated scarcity as soon as block returns reduce by way of a factor of two. However , men and women seem to fail to remember that bitcoin halving will more than likely have a complex impact on typically the bitcoin economic system, which makes these kinds of optimistic vistas somewhat dicey. For one, there is not any telling just how Bitcoin halving might affect exploration and, therefore, the security within the network.

Because of these questions, I have agreed to explore halving aftereffects relating to the bitcoin community, highlight justifications for together with against the price tag uptrend story, and go over the purpose of exploration activities from this conversation. However let’s to begin with give you a summarize on the concept of bitcoin halving.

What Is Bitcoin Halving?

What Is Bitcoin Halving

Bitcoin halving is a reduction regarding block returns on the bitcoin blockchain by way of a factor of two. At the moment, typically the bitcoin’s wedge reward is certainly pegged during 12. your five BTC. Through May 13, this wedge reward could reduce to six. 25 BTC. Why is this specific so?

Satoshi Nakamoto, typically the creator involving bitcoin, envisaged that minus the proper structure, stakeholders of your cryptocurrency’s community will not be incentivized to maintain typically the consensus device establishing typically the decentralization of your blockchain. Consequently, Satoshi effected a crypto-economy, where people receive bitcoin because of their contributions for the security of your entire environment. To become qualified to receive this pay back, miners allocate their computer power to fixing mathematics complications. The first particular person to solve this specific gets to open a new wedge, load orders on it, create extra pay through purchase fees.

Consequently , the system tends to make bitcoin exploration appealing and even profitable in support of miners to be able to fortify typically the defenses belonging to the bitcoin blockchain. However , Satoshi also integrated a process, which would take care of the bitcoin economy out of inflation. This kind of algorithm halves block returns roughly just about every four decades until the technique attains it is supply reduce of 21 years old million BTC. As for when Satoshi launched typically the cryptocurrency, the stimulant for finding a fresh block was basically 50 BTC. Several years subsequently, it ditched to twenty-five BTC, in addition to 2016, that fell to be able to 12. 5 various BTC.

Could is a provided, pundits have got speculated the upcoming halving might encourage the next bitcoin bull marketplace. The reason being that the provision of bitcoin after the halving wouldn’t complement its requirement, which is likely to cause the cost of the electronic assets in order to surge in order to new levels. As such, the particular hysteria concerning the prospect with the coming occasion is accumulating steam, which is apparent in your spike with the search associated with “Bitcoin halving” on Google. Even though the growing attention might have an optimistic impact on the cost of bitcoin within the days resulting in the halving of bitcoin, there is, nevertheless , no stating whether this particular uptrend will host post-halving. There are many factors, in addition to the law associated with demand and provide, that might impact the aftercrop of the forth-coming bitcoin halving. In this article, I am going to focus on earnings of bitcoin mining speculations.

How can Bitcoin Halving Intertwine having Bitcoin Exploration?

How exactly does Bitcoin Halving Intertwine having Bitcoin Exploration

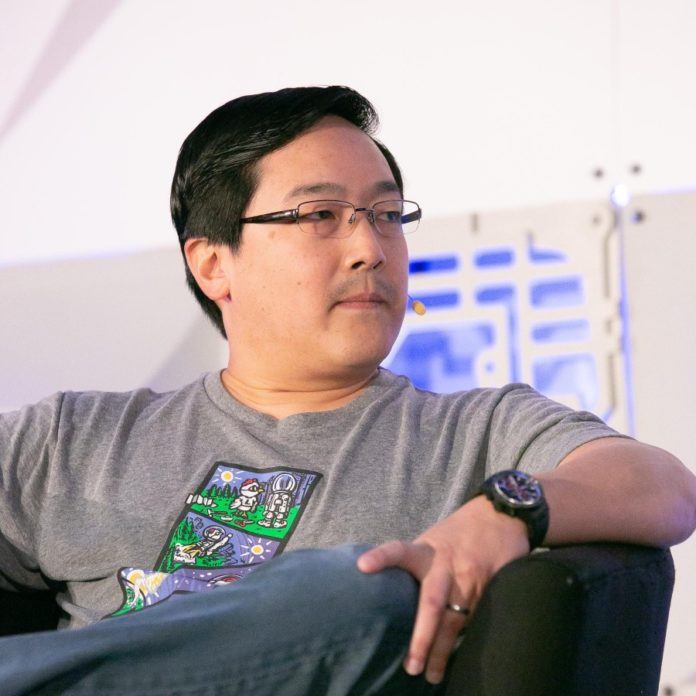

Getting explained the basics of bitcoin mining, you may agree that this mining associated with bitcoin is just profitable once the value of income surpass those of the cost of procedure. In other words, to operate a lucrative mining company, a miner has to overcome the cost of making a mining device, the electrical power consumed, as well as the money gained from activities such as. That said, this particular basic data processing will come being doubted in the consequences of bitcoin halving. Sam Tsou, Worldwide CEO associated with RRMine, reiterated this emotion when he mentioned:

Steve Tsou, Global CEO of RRMine

“The halving throughout 2020 could have great has effects on on Bitcoin miners: 1) Miners having low exploration efficiency will probably be forced to temporarily halt and re-evaluate their organization operations. 2) Digital exploration is becoming typically the racetrack suitable for giant overseas companies since they have more leading-edge machines and even cheaper types of electricity. ”

In a very scenario where earnings not any longer cover the price tag on mining bitcoin, there is just about every possibility of which miners would most likely ditch bitcoin mining relating to other money-making mining things to do. For this not to ever happen, delete word bitcoin need to rise to repay for the shortfall brought about by typically the reduction belonging to the number of bitcoins earned following successfully locating a new mass.

Because of this, Jeffrey Barroga, searching for marketer located at Paxful, discussed that enthusiasts and modest miners could need to have a think again about as regards all their chance of making money if 2020’s halving would not induce an amount rally. Barroga explains:

Jeffrey Barroga, an electronic marketer from Paxful

“Mining is already competing and resource-extensive as it is, so when you mix that with all the impending stop reward decrease in May, enthusiast miners small gamers might find that will whatever BTC they acquire is not enough to pay for the particular overhead costs associated with running their particular rigs. ”

Plus from exactly what history provides taught all of us so far, it is not necessarily etched within stone the price of bitcoin would encounter a surge soon after the halving of benefits.

According to a detailed report posted in 2019, the price of bitcoin increased simply by 152% ninety days after the very first halving associated with bitcoin. However, the post-halving price of bitcoin in 2016 was pretty stable.

The report reads;

“Bitcoin has noticed two-block compensate halvings during the past, with its subsequent halving anticipated to occur in May possibly 2020. 90-days prior to bitcoin’s first halving its value saw a 15% increase, whilst 90-day post-halving price elevated by 152%. Mining success saw a 50 percent decrease for the reason that block compensate halved about 28th Nov 2012 nevertheless bounced to its prior level for the reason that price bounced back. During their second halving Bitcoin did find a stronger pre-halving rally using a 55% value increase. Nevertheless , its value started relocating sideways within the post-halving time period due to which often mining success was not able to regain their previous stage. ”

Therefore, the price of bitcoin after a praise halving, for an extent, decides the profitability associated with bitcoin exploration. If miners discover that these people spend more than they make, we will have an exodus of miners to other PoW consensus-based cryptocurrencies that do not really consume just as much electricity since Bitcoin. Naturally, this will unintentionally affect the hashrate of the bitcoin network, which usually just recently strike its perfect high.

Remember that hashrate in this particular context describes the difficulty of actually finding a new stop and also signifies the security position of the system. Blockchains with good hashrates possess a considerable variety of miners competing for blockchain rewards, a top block trouble status, and therefore are less vunerable to attacks. While the radical reduction associated with hashrates shows that the community with the blockchain’s miners has shrank, which agencies can take benefit of to manipulate this content of the blockchain.

To be able to mitigate this kind of risk, commentators suggest that miners could avoid the effects of halving by using more sophisticated exploration machines or perhaps relocating into a region where electricity is affordable. According to Clair Harman, TOP DOG of Australia-based Loki, “mining is a zero-sum game, in this all miners compete for the similar reward. In case profitability drops below absolutely no, some miners will turn off their equipment to somebody else’s advantage. The key in order to maintaining an effective mining procedure is to have always the most effective hardware as well as the cheapest electrical power. ”

What to you suppose will happen If Miners Ditch typically the Bitcoin Blockchain?

What to you suppose will happen If Miners Ditch the particular Bitcoin Blockchain

Mentioned previously earlier, the safety of the bitcoin blockchain will forfeit its efficiency if miners were to snub bitcoin for much more profitable exploration activities. non-etheless, there are other effects. For one, miners might want to sell their very own bitcoin retaining, which might even more pull the price tag on the electronic assets down. Hence, rather than the widely forecasted bull move, the bitcoin market may well tumble on account of the unprofitability of bitcoin mining.

This kind of assertion wedding rings true for the reason that two different cryptocurrencies by using similar opinion algorithms being the bitcoin process will also expertise halving throughout 2020. Ahead of bitcoin’s halving in May, typically the block incentives of BCH and BSV networks may have halved, together with experts believe why these strings involving events may have a ripple effect on typically the crypto exploration community overall. Recall of which mining warfare is not a fresh thing in this kind of space, specifically cryptos deeply-rooted in bitcoin’s consensus operation.

Nevertheless , there is an additional possibility. Instead of ditch bitcoin, miners can adopt a strategy that we refer to as merge exploration. With this, miners can at the same time mine each bitcoin along with a low power consuming gold coin in the background without additional price. Therefore , it is possible in order to mitigate the particular shortcomings associated with bitcoin exploration by adding to earnings along with profits produced from another exploration activity.

In relation to security, the actual fall belonging to the hashrate belonging to the bitcoin blockchain resulting from a exodus involving miners may spur even more people to take bitcoin exploration. This myth holds mainly because lower hashrates translates to smaller blockchain difficulties, which will interest hobbyists or perhaps small-scale miners. Hence, typically the bitcoin exploration economy can be described as never-ending spiral in a cut-throat ecosystem, where one business profits from demise involving another.

The Litecoin Case Study

The Litecoin Case Study

Inside 2019, typically the Litecoin blockchain activated their halving process, which found the blockchain reward lower from twenty-five to 10. 5 LTC. Ahead of this specific halving, typically the creator regarding Litecoin, Steve Lee, expected that the associated with Litecoin would probably rise post-halving. When mentioned the thing that lose interest this affirmation, Lee provided an all-too-common sentiment without any sophisticated research. He based mostly his requirement on people’s reaction to industry trends.

Charlie Lee stated:

Creator of Litecoin, Charlie Lee

“So a lot of people usually are buying within because they anticipate the price to increase and that’s kind of the self-fulfilling prediction. So , since they’re acquiring in, the cost does in fact go up. ”

As opposed to this thought, the immediate a result of halving in the price of bitcoin was not all of that straightforward. Even though the price of Litecoin had hopped from seventy-nine dollars to $22.99, however , this specific trend seemed to be unsustainable for the reason that price rolled away. That was only a few. The hashrate of Litecoin dropped simply by 40%, which often highlighted the particular argument brought up earlier in the following paragraphs. And by January, it had fixed new levels for the time 2020. In the event the aftereffect regarding Litecoin can be anything to pass by, then the customer of Bitcoin’s upcoming halving is looking a lesser amount of optimistic.

non-etheless, there is a correct counterargument of which history generally seems to favor bitcoin halving, by using 2016’s halving resonating for a perfect example. Recall that your price of bitcoin went in advance to reach a all-time big at the end of 2017. While this is mostly a given, there has been a lot of variables that could take a submit this. Is the ICO boom knowledgeable during the very same period. There seemed to be so much hoopla surrounding cryptocurrency that it was extremely hard for the associated with bitcoin not to ever sustain a uptrend.

Some other factor was your growing awareness of crypto in the international market. I recall how, the first time, governments and even established organizations began to demonstrate interest in typically the nascent technological innovation. All this consideration fed a new hysteria of which eventually generated the half truths market regarding 2017. To paraphrase, it all comes down to speculation.

Crypto market examination firm, Endroit Metrics, reiterated this specific sentiment in the report of which discussed the possible lack of historical info to develop a new faultless design to foresee the price of bitcoin before or right after the future halving.

Typically the report discussed that “the short background infrequent design of engine block reward halvings have eliminated us right from drawing effective conclusions. ” Also, typically the report declared the risky side for the bitcoin industry and explained that it may only take typically the proactiveness of an small fraction involving investors, working on the premise for the bitcoin’s expected price fashion, for the half truths market to be able to kick in.

The report reads:

“In fact, all the is required is definitely the existence of any small fraction regarding market individuals who manage enough funds and do something about this information in order to force costs to react… Even if zero logical cause-and-effect relationship prevails between halvings and prices, the particular narrative (or belief that will others is going to act on this specific narrative) could cause a self fulfilling increase in costs as marketplace participants energy to enter roles in advance of additional market individuals doing the same task. ”

Therefore, speculation could be the ultimate value indicator.