Precisely what is Bitcoin’s Halving and How come it Impact the Price of Bitcoin?

Soon after 01: 00 on May twenty-two, 2020, Bitcoin will undertake its 3 rd block pay back halving.

But what does the term ‘Bitcoin halving’ actually mean? So how exactly does it impact the price of bitcoin? And just how you can plan for it? How can it sign up for other cryptocurrencies? We summarize the responses.

Are usually Bitcoin wedge reward halving?

Bitcoin is decentralized, meaning there is not any central guru issuing typically the cryptocurrency, contrary to fiat values such as the US ALL Dollar or perhaps the British Single pound, which have banks for the reasons issuing and even stabilising a new currency.

Alternatively, computing vitality is dedicated to the Bitcoin network to ‘mine’ bitcoins, i just. e., to fix computation concerns and what is transactions relating to the network. To be able to incentivise together with bootstrap typically the Bitcoin community, miners can be rewarded per block that they mine, by using what’s known as the ‘block remuneration. ’ In order that means just about every ten or so minutes, a engine block of bitcoin transactions might be added to typically the blockchain by simply miners in addition to a block remuneration is acquired.

Within the first 4 years of Bitcoin, the stop reward had been 50 bitcoin, meaning that in case a single miner mined the block, he'd have received 55 bitcoins in order to his finances once the stop was affirmed. However , during writing, the particular block encourage is 13. 5 bitcoin. Once the 3rd block encourage halving occurs, it is slice in half once again to 6. twenty five. And every 210, 000 obstructs (or approximately 4 years) the stop reward halves and is constantly on the do so till the predetermined, assigned supply of twenty one million is definitely reached. This method ensures as time passes that bitcoin is more difficult to my own and it is such as digging more deeply for golden until you include extracted in addition to depleted all the gold ore.

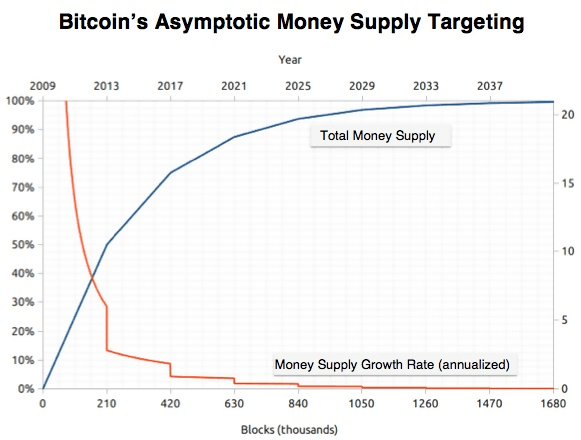

The the hinder reward halving and lessening rate regarding supply of bitcoin is known as ‘asymptotic money source targeting’ where bitcoin expectations a fixed reduce of twenty-one million and may slowly attain this reduce over time. By simply 2024, practically 94 per cent of all bitcoin will be extracted and we will always be at hinder number 787, 500. Additionally until hinder number 6th, 930, 1000 – back in 2140 – until the bitcoin block returns will be fatigued completely and even 100 percent of bitcoins will probably be in circulating; this is showed in the information below.

Source: Nakamoto Institute

How exactly does the Halving Affect the Bitcoin Price and even Ecosystem?

With time, as the level of provide is reducing, the pumpiing in the strategy is decreasing besides making bitcoin more appealing to fedex currencies where inflation is usually higher. Following the next halving in 2020, the pumpiing in the Bitcoin economy is going to be lower than those of most created economies, we. e., lower than 2 %. As the cash supply development rate drops over time, all of us also anticipate inflation in order to fall proportionately.

Because of this, we assume bitcoin to understand in benefit against fedex currencies working up to the halving and/or pursuing the halving, whilst in the general within the long term. Used, we have viewed an increase in value volatility pursuing the previous bitcoin block compensate halving functions and a rise in price next each halving.

Employing halvings to obtain and sell cryptocurrencies is a sort of carry change, that is traditionally created by taking advantage of rates of interest in increased countries to save cash and make interest, borrowing within lower rate of interest countries. Rather, we are acquiring (crypto-)currencies which have a lower pumpiing rate making use of (fiat) foreign currencies with a increased inflation charge.

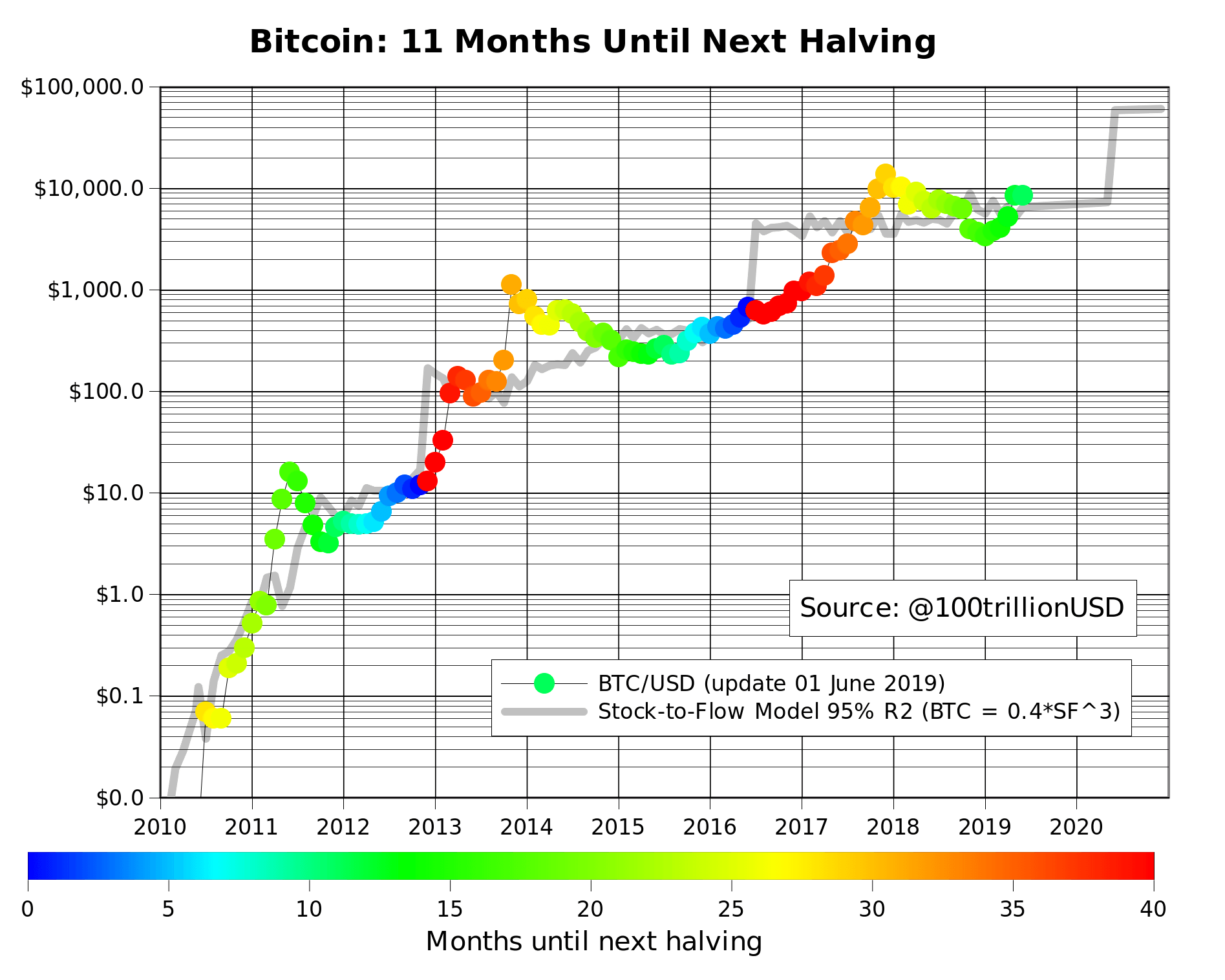

As an example, the graph and or below signifies that bitcoin’s price tag has traditionally jumped bigger following a halving. The purple dots are based on the time period right after a halving, displaying of which in these cycles, price comes with jumped greatly. For two involving bitcoin’s past halvings, instant price effect was to grow from $12 to $265.21 in 2013 and right from $700 to be able to $1, 1000 in 2016.

The retail price appreciation generally seems to last all around 10 many months after every single halving, mainly because indicated because of the chart where the apple dots format with every single peak. The sunshine blue spots also programs a steady within the price of bitcoin as the halving approaches, indicating you want to starting up buying in bitcoin on a regular basis 5-10 many months before the halving.

Source: @100trillionUSD

As a way the halving occurs on, may 22, 2020, the best way to make is to invest in a fixed level of bitcoin once a week up until typically the halving – starting that kicks off in august 22, 2019 – together with accumulate following your halving right up until 10 several months after the function – all around March twenty-two, 2021, after which the market really should have reached it is peak.

In the past, the market actually reaches a top around 12 months following a halving, which means this is a good time to offer some of your own bitcoin coalition. Of course , now might be various and precipitate an extended bull marketplace, especially while awareness of bitcoin is a lot larger and the facilities has superior. You could also take those price targeted from the graph and or chart, which estimations a price of around $60, 500 by the time with the third halving.

One other effect of the particular halving can be on the environment, specifically the particular miners. Although miners at present get 13. 5 bitcoin for every block out they locate – that is on average every single ten a few minutes, they will only find 6. twenty five per block out every twenty minutes, minimizing their communautaire revenue in addition to cutting their very own profitability by 50 %. As a result, possibly miners can give up and prevent mining in the bitcoin system, or they are going to refuse to offer bitcoins created at a value below 20 dollars, 000 and be holders.

In the event that enough miners give up and the combined hashrate is substantial, the halving can also result in reduced hashrate, increased miner concentration in addition to increased with 51 percent episode. This problem turns into more evident as advantages are decreased over time in order to subsidize miners. No one is aware of if a marketplace for deal fees is going to be enough to maintain miners for the Bitcoin system and keep this secure in the long run, which is why additional cryptocurrencies employ different provide schedules, for example Monero in addition to Dogecoin.

Halvings may also in order to strengthen the particular perception regarding credibility of this bitcoin method, as each and every passing halving shows the particular network can be working seeing that planned and the rules are generally not being twisted. Central brokers will frequently meet create decisions about money in addition to interest rates, although halving incidents serve as pre-determined changes in the cryptocurrency’s monetary coverage.

Policymakers, or any individual for that matter, could not interfere inside the monetary insurance policy of bitcoin and stalls in abgefahren contrasts for the monetary insurance policy of the PEOPLE central banking concern, which has just lately suggested an excellent return to quantitative easing, a ultra-loose money policy of which aggressively extends the money offer and really exhibits the falseness and inequity of the existing financial system.

Altcoin Halvings

Lots of the leading altcoins are based on Bitcoin’s code, such as Litecoin, Vertcoin and Zcash to be able to new a number of. Since they show the same codebase as bitcoin, they also have typically the feature regarding block pay back halvings, and even investors are able to use this in making money over the volatility that accompany these wedge reward halvings.

Initially, we look with Litecoin’s prohibit reward halving and how you may prepare for this. Then we are going to look at 2 other altcoins, vertcoin in addition to zcash, in addition to answer the identical question. All of these altcoins are the major cryptocurrency prove respective methods, which are Scrypt, Lyra2REv3, in addition to Equihash.

Litecoin

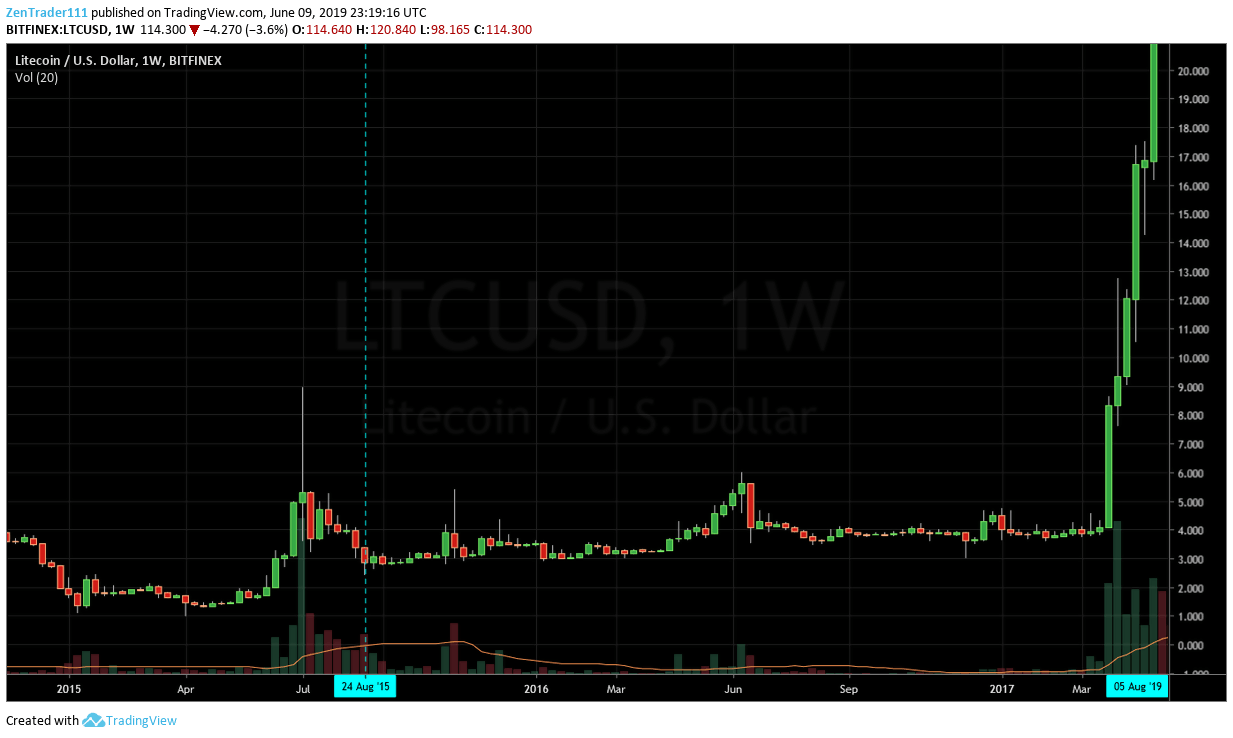

Litecoin will go through its 2nd block prize halving upon August five, 2019, trimming the prevent reward through 25 in order to 12. five, and the associated with is easily above hundred buck at the time of composing. Similar to Bitcoin, Litecoin will certainly undergo the halving each four many years, but as prevents are created faster within the altcoin, these people occur each and every 840, 500 blocks rather than every 210, 000 prevents. The pumpiing rate within the Litecoin program will tumble from close to 8 % to four percent right after August 2019.

For the previous Litecoin halving, the particular cryptocurrency skilled an enormous rally within the three months before the event, increasing more than five hundred percent. The particular fist halving occured upon August twenty six, 2015 as well as the price improved in the weeks prior to the halving, going through $1. fifty around the finish of Might 2015 in order to near $9 in mid-July 2015.

Adopting the halving, litecoin stabilised about $3. The cost was next boosted with the implementation associated with Segregated See and breached $20 2 yrs later within 2017.

The very best strategy for the particular upcoming halving is to obtain 3-6 several weeks before the halving, so only at that very minute, up until the particular halving arises and then most likely sell litecoin for bitcoin or fedex. If you believe Litecoin is going to continue to act as an important testbed for Bitcoin, then it will probably be worth holding litecoin as it tools more mutually exclusive features for instance Confidential Orders, which is most likely going to abide by in 6 months after the Aug 2019 halving.

Litecoin’s second halving may not reflection exactly what offers happened along with bitcoin. Litecoin’s transaction charges have never surpassed six % of the prevent rewards obtained by miners, suggesting that lots of miners can rush into mine litecoin before the halving and give rise to a move in its cost and/or leave the market following the halving mine a lot more profitable cash.

At worst, if the value does not enhance up to the halving, mining success could lose excessively the reduction in the particular block compensate may be sufficient for sufficient miners to stop, making Litecoin more unconfident. However , for the reason that cryptocurrency while using highest hashpower on the Scrypt mining routine, it’s a great unlikely probability.

Vertcoin

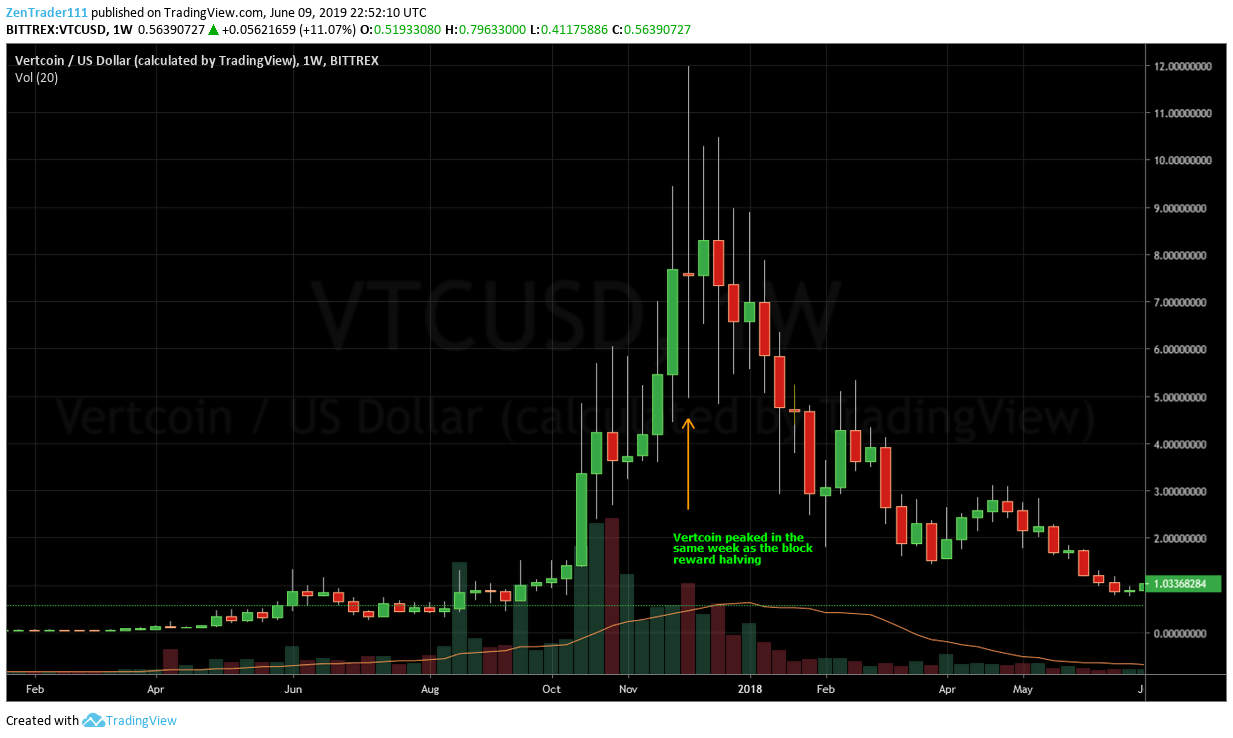

In December 2017, the bitcoin-derived cryptocurrency Vertcoin skilled its initially halving. A lot like litecoin, the purchase price appreciated swiftly in the increase to the celebration, but as the particular halving took place, the price begun to dwindle in addition to fall in order to previous ranges.

Being the chart beneath shows, the particular rise in vertcoin started in This summer 2017 in order to was highly valued less than $1, about 6 months before the halving. Then, within the run up towards the halving, the cost quickly valued from $1 to $7 over the weeks of associated with October, Nov and Dec, at which point the cost preaked close to $12 within the same 7 days as the obstruct reward halving. Following the halving, the price began to fall reached the near $2 by Feb 2018.

The following halving for the purpose of vertcoin can occur in past due 2021 as well as the best way to get ready is to get around 6-8 months ahead of the halving – May/July 2021 – promote just as the particular halving is definitely occuring or stuck in a job very brief timeframe prior to, or after, the big event.

Litecoin’s second halving will provide some sort of precedent for the altcoin’s next halving, and as a consequence Vertcoin’s halving in 2021. If price tag and exploration profitability immediately turn unfavourable in litecoin in the second halving, then it could possibly be safe to be able to assume that vertcoin will not work through its next halving both. However , any time litecoin will show positive price tag appreciation together with favourable exploration profitability following its next halving, it would be well worth taking the change on Vertcoin’s second halving.

ZCash

Privacy-focused altcoin Zcash could undergo their first halving in late 2020, as the first of all block was initially mined at the end of 2016. When sharing Bitcoin’s codebase, typically the altcoin shifts it a little bit to allow recommended private ventures using totally free knowledge evidence to hide the quantity sent, typically the receivers location, and the senders address.

Like with Bitcoin’s first halving in 2012, typically the block recompense will fit from 70 to twenty-five in late 2020 for Zcash. Zcash’s pioneers reward are likewise stopped following late 2020, which is not an attribute of Bitcoin.

At this time, 20 percent belonging to the block stimulant goes to typically the Zcash Electronic Coin provider, i. y., the pioneers of Zcash, while following your halving miners will get to hold the entire mass reward from there onwards. This could possibly induce even more miners for getting the Zcash blockchain, when the decision are not distorted because of the founder’s stimulant, which has been some sort of controversial issue in the cryptocurrency scene.

Typically the strategy in this article would be to invest in around 6-8 months ahead of the halving, proceeding off of how many other bitcoin-derived altcoins have done inside the run up with their halvings, expecting to to sell only before/after typically the halving at the end of 2020.

Make use of Halvings regarding Time-based Expense Strategies

In conclusion, you can use the particular timings in addition to precedents – if possible – of the halvings of bitcoin and bitcoin-derived cryptocurrencies in order to formulate basic investment methods.

Simply by dollar-cost hitting into ‘cryptocurrency X’ with a predetermined time and for a new predetermined timeframe, you can make investments based simply off of period rather than value.

For instance , you could acquire vertcoin 6-8 months prior to its halving, every week till it’s halving and then commence converting the earnings into bitcoin or the money of your choice; it’s really that easy!