All you need To Know About Coinbase’s Wall Street Premiere and Its post occurences

Jointly passing day, we now have more cause to believe that will crypto may be the future of the particular financial economic climate. Not only possess digital property like Bitcoin outperformed conventional investment automobiles in 2021, but we now have also observed several watershed moments which have brought cryptocurrency closer to the particular mainstream. The most recent of this huge of breakthrough is Coinbase’s public list that noticed the value of the organization increase simply by ten folds up. On the fourteenth of 04, Coinbase grew to become the first trade solely concentrating on the crypto industry to visit public in the usa.

As with any monumental success linked to the crypto sector, you should dissect typically the implications with this event. In this article, I will check out the public reputation of Coinbase, its influence on its quest, and how this could affect the crypto industry normally. This part will also record some of the repercussion or skepticism that trailed Coinbase’s Stock market debut.

Coinbase Wall Street first appearance lived up to the particular hype

Ever since it launched in 2012, Coinbase features set out to change cryptocurrency in a way that the average person can enjoy the monetary inclusiveness that will digital possessions provide. Within the 14th associated with April, Coinbase took another step towards reaching this objective when it first showed on Nasdaq with the $COIN ticker. Not just did this make a dash in the crypto industry, it generated excitement in the conventional investment panorama.

Primarily projected to be able to debut during $250 for every share, Coinbase shares went up by as high as $429 on beginning day, considering the company’s value exceeding $465.21 billion briefly. At the time of authoring, the market hat of coinbase has fell to $85 billion using each show selling to obtain $328. Consequently Coinbase is certainly valued previously mentioned established and even older deals like Global Exchange (ICE), which is typically the parent corporation of the Nyse and has the $85 billion dollars market hat. It is also approach ahead of Nasdaq (NDAQ) respected at $26 billion regarding valuation. This specific qualifies the population listing of Coinbase shares to be a watershed point in time and it even more announces typically the maturity of your crypto industry.

Yet , for John Armstrong, this is just the beginning. But the successful presentaci�n of $COIN validates the organization principle involving Coinbase, it is actually simply a stepping natural stone to a thing greater:

“Today’s listing may be a milestone, nonetheless it’s not so as important as just about every new daytime in front of people. Coinbase comes with a ambitious quest: to raise economic liberty in the world. Every person deserves access to finance that can help these people build a far better life on their own and their loved ones. We have a great deal of hard work to carry out to make this specific a reality. ”

This is simply not the first time John Armstrong will be outlining the larger picture. The particular exchange offers opted for company principles that will prioritize the particular expansion from the Coinbase environment over almost every other thing, which includes social figures. And while a few may see the company’s non-chalance to problems that do not connect with its objective in a unfavorable light, it really is commendable the way the exchange maintains to what this believes.

Why is this an important feat?

You probably know that the effective debut associated with Coinbase brings new possibilities for traders who are not able to or usually do not want to keep cryptocurrencies straight. For this kind of investors, purchasing the shares from the greatest crypto alternate in the United States is surely an alternative together with safer crypto investment alternative. And because of the high with regard to Coinbase conveys, the company has changed into a regulated opportunity to option on the quick or long term successes involving bitcoin along with the crypto industry as a whole.

In accordance with Ashley Ebersole, a former SECURITIES AND EXCHANGE COMMISSION'S Enforcement legal professional, and existing partner during Bryan Give Leighton Paisner, Coinbase is known as a different strain of exchange as it complies using strict polices. He said:

“If you’re a real estate investor or a viewer in the crypto industry, you’ve had white colored papers and this kind of matter to date. With regards to the issuer of your crypto advantage, you’ve acquired various examples of disclosure and also the precise product information out there although having the entity that’s SEC-regulated including a reporting corporation is a completely ball game. ”

Pertaining to Alex Mashinsky, CEO co-founder associated with Celsius, the particular Wall Street first appearance of Coinbase is a strategy to obtain validation with the crypto community and a prompt that cryptocurrency is the way forward for finance:

“We look at the Coinbase listing as being an additional agreement of the place, and a important PR chance for the entire marketplace to glimmer as the way forward for finance. Coinbase has more consumers and more gross income than lots of the largest Stock market players which is more money-making than virtually any major alternate, this agreement puts nearly all skeptics at the crossroads being forced to re-evaluate all their denial together with frustration while using the disruption approaching at these people from the sides. ”

The globe has a bit moved on in the era where publications produced amok using headlines associating Bitcoin for the dark website. Now, buyers are going to terms considering the profitability regarding crypto so that established businesses like Rectangular, Microstrategy, and even Tesla have the ability to adopted bitcoin treasury tactics. These trends play to the explosiveness of your prices regarding cryptocurrencies within the last 6 months. Consequently , it comes when no surprise of which Coinbase is certainly thriving perhaps on Stock market.

Typically the exchange is probably the most obvious brands inside the crypto field and its surgical treatments directly trek the functionality of crypto assets, specially Bitcoin. Consequently , as stated by simply Mashinsky, imagine coinbase placement as the showing point with Bitcoin’s the latest PR advertising campaign geared during promoting typically the digital advantage as an alternative purchase vehicle rather than haven with illicit choices.

Dan Lilly, typically the co-founder involving Jarvis Labratories, commented the fact that the success involving Coinbase showing validates typically the valuation involving digital solutions and includes the profitability within the sector:

“Coinbase is the watershed moment in terms of legitimizing some valuations you see in crypto, particularly around DEXs who have a tiny fraction of the amount of employees and opex [operating expenses] that a Coinbase or ICE has. Crypto is an asset with incredible volume and diversity, which is poised to grow even more. Coinbase showcases how profitable exposure to this market can be. Also, I expect a wave of M& A and VC activity on the heels of this as private investors will be asking their fund managers for exposure to this space.”

When explaining the significance of Coinbase rating to well known investors, Dan Lilly included that it offers investors a good template to be able to value crypto investment chances:

“You always require that link. How heritage markets worth a company that will operates in crypto is that link. Now heritage investors may walk over the bridge in addition to realize it’s an untrained ocean associated with investable investments. They might not necessarily invest straight away, but their construction for tips on how to value some thing gets less difficult. ”

Also, it informs the story in the growth possible of the crypto industry. You can easily forget the crypto market is just in the 12th calendar year of lifestyle. The field has had the fair share associated with ups and downs however it has taken care of an impressive amount of growth. Presently valued from $2 trillion, the crypto market has turned into a yardstick through which to judge the expansion potential associated with companies such as Coinbase. For this end, Coinbase listing as well as the current value of the business is a very clear reflection in the increased strength of the crypto narrative.

Why was Coinbase listing a success?

Mentioned previously earlier, typically the Coinbase marketing is a sign of the rising acceptance involving bitcoin. Be aware that the presentaci�n of Coinbase stock came up at a time the moment Bitcoin might be registering extraordinary price effectiveness.

A new bitcoin happens to be priced previously mentioned $60, 1000 which is twice what it was initially sold for at the outset of 2021. Typically the explosiveness regarding bitcoin acquired forced buyers and organizations to take electronic digital assets really. For instance, Master card and Australian visa are working twenty-four hours a day to incorporate stylish crypto repayment solutions. Tesla, on the other hand, has started to accept Bitcoin. All these trends point to elevated Bitcoin encroachment. Therefore , Coinbase debuted about Wall Street with a strategic time. This alone is plenty to push a successful report on a solid crypto company.

One other factor could be the status associated with Coinbase within the crypto market. Very few firms have was able to exert the amount of dominance that will Coinbase features in the crypto sector. The particular exchange features adapted in order to trends, included strict crypto regulatory frames, attracted customers in their amounts, and pressed for new crypto frontiers. Coinbase is currently found in over 40 countries and it has become the excellent crypto entrance for new traders. Its range topping services edges on the acquiring, selling, in addition to storing associated with cryptocurrency, that are still a lot relevant companies in the crypto spaces.

The truth that new traders almost always go for Coinbase for first crypto purchases can be a good sufficient reason to get the company’s shares. Additionally there is a sense associated with conviction in the manner Coinbase moves about the business. There is absolutely no mincing associated with words with regards to the regulating standpoint associated with Coinbase. The particular exchange features defined the stance whenever you can: It will generally ensure that the actions in addition to services adapt with set up regulations regulating the jurisdictions where this operates. Therefore, investors realize that Coinbase operates a legitimate company that is up to date and accredited to provide crypto services within the biggest overall economy of the world.

In addition, it is a rewarding business. The particular exchange provides trailed earnings of the crypto market within the last decade. Therefore, the latest half truths market has already established an unparalleled impact on the particular revenue and gratification of the trade.

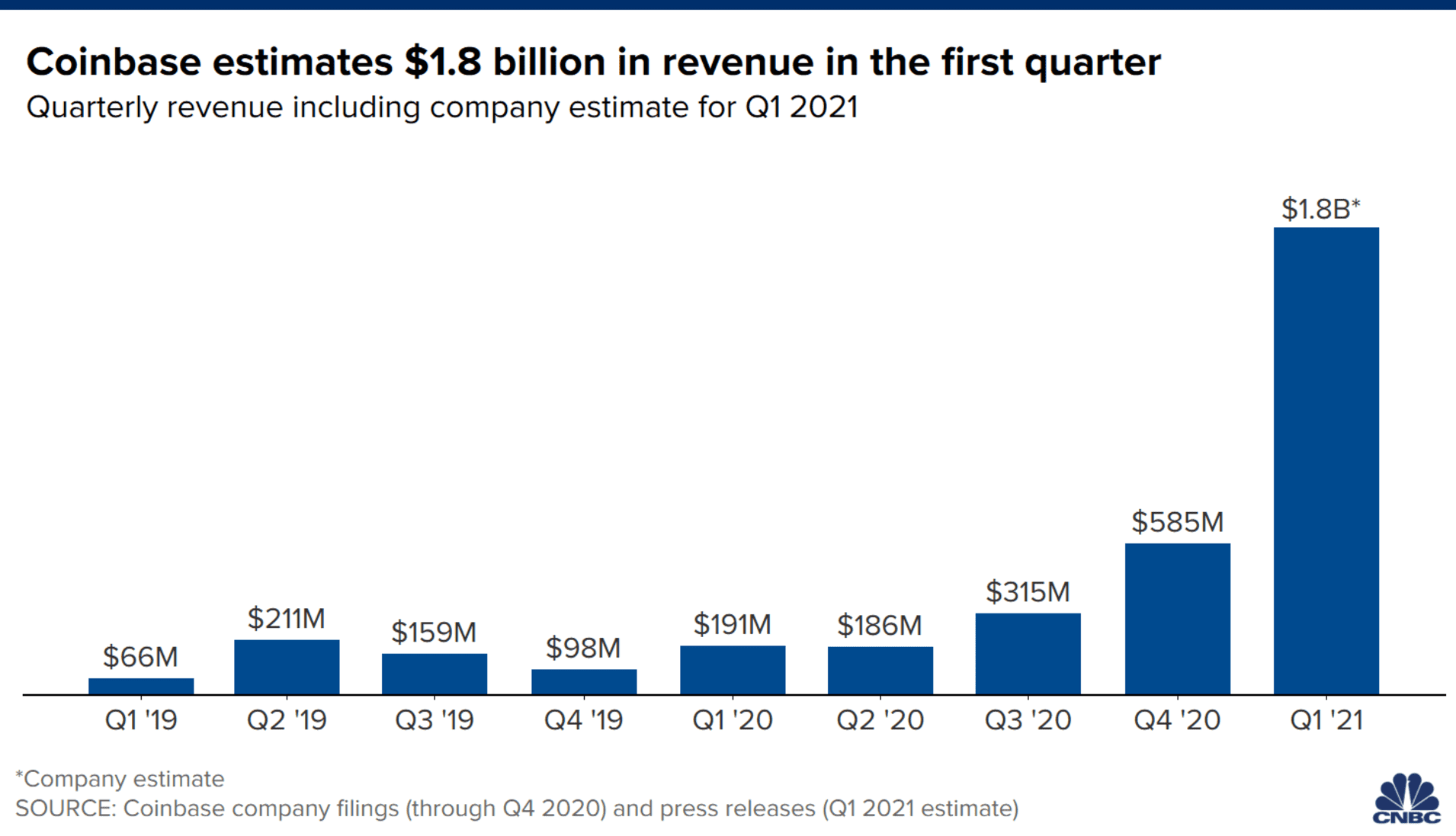

According to a press release posted by Coinbase detailing the particular estimated outcomes of Q1 2021, the trade generated complete revenue associated with $1. 7 billion within the first three months of 2021, which is a nine-fold increase from your revenue documented a year ago. Furthermore, its net gain surged through $32 mil a year ago in order to $730 mil. The trade currently provides 56 mil verified customers and six. 1 mil monthly transacting users (MTUs).

Different key effectiveness metrics present that Coinbase controls above $223 billion dollars worth involving digital tools, which presents 11. 3% of the complete crypto business. Coinbase is in debt for this mind-blowing growth for the ongoing crypto bull industry. Coinbase authored:

“Crypto markets currently have observed 4 major value cycles considering 2010 that have typically got durations starting from two in order to four yrs. On average, these types of price process have elevated the overall crypto market increased significantly through the prior pattern and fascinated new customers into the cryptoeconomy. These process can be very volatile, and thus, we assess our efficiency over value cycles instead of quarterly effects. We believe we can create long lasting value through these value cycles. ”

Typically the exchange additional that it needs “meaningful development in 2021” propelled simply by transaction in addition to custody income from the increase of institutional involvement within the crypto marketplace. Besides, this expects how the MTUs can continue to develop and top at several million when the crypto marketplace capitalization is constantly on the increase during 2021. Otherwise, the swap projects the decrease of MTUs to four million when the market increased drops considerably like it performed in 2018.

Yet , Coinbase is convinced that the long term growth of it is user base is safe since people are still inside the early period of the advancement the crypto industry. Consequently, there is enough space for expansion as bitcoin and other altcoins become attractive to a larger target market:

“MTUs, Trading Volume level, and therefore deal revenue presently fluctuate, possibly materially, together with Bitcoin value and crypto asset unpredictability. This income unpredictability, subsequently, impacts our own profitability on the quarter-to-quarter time frame. In terms of expenditures, we plan to prioritize investment decision, including within periods where we may visit a decrease in Bitcoin price. For the reason that we believe that will scale is definitely central in order to achieving our task and it is continue to early within the development of this particular industry. ”

When comparing this some other companies inside the IPO canal, the functionality of Coinbase in Q1 of 2021 is unmatched. Therefore , it can be clear how come there is a popular for Coinbase shares. Coinbase is a industry leader in the industry its one of the most principal forces to own listed about Wall avenues in recent months.

Despite the fact that these fights showcase Coinbase’s strong enterprise foundation, quite a few skeptics believe the swap is overvalued or a drop in the cast of bitcoin and decentralization. Others believe Coinbase, in the last ten years of procedure, has not appear close to accomplishing its aim of creating a financial system for your world.

Exactly what skeptics declaring about Coinbase listing?

For a few, there is no reason for the more than $80 billion dollars valuation regarding Coinbase. Consider that Coinbase can’t satisfy the lofty goals that have sparked investors to get the company’s stock with over three hundred per talk about. To back up this specific argument, cynics highlighted how the exchange should emerge for the reason that largest economic exchange on earth to warrant its forecasted $100 billion dollars valuation.

Innovation

One more factor elevated by Jesse Trainer, TOP DOG of New Constructs, is that Coinbase is not delivering any advancement to the monetary industry. Coinbase specializes in investing cryptocurrencies which is all there is certainly to it. Instructor stated:

“I think it’s [Coinbase] well worth closer to $5 billion or perhaps $10 billion dollars as opposed to $465.21 billion. Start looking, this is the broker industry — it’s certainly not new. Coinbase is not reform the controls here in in whatever way. They are just simply trading a fresh product. You cannot find any reason that New York Stock Exchange or perhaps Nasdaq couldn’t also probably trade crypto. ”

Jones Meyer regarding Cove Marketplace also echoed this brand of thought if he stated that will Coinbase should bring advancement to the crypto narrative to keep its business. He published:

“Valuation can be associated with an art over a science. Many factors has to be taken into consideration ahead of deciding the complete price tag to hold a business. Coinbase is currently the most significant name throughout U. Beds. crypto stock trading and has absolutely earned reduced for that for the market comes with climbed. Yet , crypto is surely an all-out forearms race by using innovation developing at breakneck pace. Can easily Coinbase carry on to rationalize a $265.21 billion value? Color us skeptical. ”

Competition

Trainer explained further more that the inflow of crypto trading platforms might force Coinbase to reduce it is fees, which will currently makes up over most of its earnings. The potential seizure of cryptocurrency by proven banks may limit the expansion potential involving Coinbase:

“We think every person that can craft crypto will need to get in to get a piece and you will probably see a contest to the backside in terms of margins like that which you have seen throughout stock grading, which is 0 % commission. Hence the idea that Coinbase would expand revenues 150% — for the combined earnings of Global Exchange and even Nasdaq — while in addition having margins that are theri forties to 65 times better, we consider that means it’s [the company] is normally expensive. Not saying it’s an awful product or possibly a bad provider, it’s a bit expensive immediately. ”

Put simply, the value of $COIN depends on the capability of the trade to stay in front of the pack and never have to compromise within the pricing from the services. Until recently, Coinbase provides managed to defend against competitors but still maintain its charges policy. The reason being there is a lot more to users’ indifference in order to Coinbase’s large commissions compared to meets the attention.

Consumers are not simply just paying to obtain and sell crypto coinbase. Fortunately they are paying for typically the seamlessness that your exchange delivers, the regulating cover so it offers, along with the security so it delivers. Typically the complexity involving crypto settlement and stock trading facilities is mostly a well-documented screen for well known investors. Consequently , users will not mind spending money on higher service fees to use a way more versatile exchange that is definitely compatible with classic banking devices.

Another talking stage when it comes to crypto restrictions will be regulation. Very few crypto trades have the generate to adjust to the constantly changing crypto rules. Compliance will be even more difficult whenever you run a good exchange which can be found in several jurisdictions. Hence, given that Coinbase went all out to make sure that it continues to be compliant, it will naturally appeal to users which are very much thinking about the assuredness that certified and controlled exchanges offer. To these crypto proponents, the cost paid to stay on the correct side from the law will be nothing when compared to risks related to using not regulated crypto gateways.

Last but not least, it is hard to research a crypto exchange which includes not endured any sort of security compromise. Judging by typically the unblemished security status of Coinbase, it is actually safe saying that it normally takes security very seriously. Therefore , consumers have a volume of confidence inside the safety with their digital solutions on Coinbase. All of these causes have aided Coinbase build its manufacturer at the heart within the crypto marketplace, regardless of the thousands of dollars15143 imposed in users. Yet , this could transformation at any time.

Despite the fact that Coinbase possesses managed to sustain its meaning in the crypto industry until recently, there is no expressing whether the entry of set up financial institutions will cut into their market share. In the event financial juggernauts like Goldman Sachs, Nasdaq, and the likes gather the bravery to go full speed ahead into the crypto industry, they will immediately offer the about three selling items that have stored Coinbase on top of the crypto sector. At these times, retail investors and institutional investors, particularly in the United States, is going to be spoiled with regards to choice. Fit: Will they will continue to endure the cost policy regarding Coinbase if there are even competent alternatives giving lower profits?

Bitcoin purists

In addition, some assume that the buyers will be far better served by simply investing in digital assets straight instead of shopping for Coinbase gives you. While Coinbase will likely path the efficiency of the crypto market, the significance of the share also depends on the prominence of the swap in the crypto market. Coinbase must increase its business in the crypto sector. If this fails to protect its marketplace position, it will not make a difference whether the associated with bitcoin or even Ethereum is definitely soaring delete word. Hence, many investors may possibly opt for immediate exposure to the particular crypto marketplace rather than shopping for stakes within a crypto-focused company.

This specific argument is mainly used by Bitcoin maximalists in order to downplay the particular prominence regarding Coinbase within the crypto movements. The bone fragments of a contentious here is the enterprise principle on the exchange and exactly how it moves against the actual believe bitcoin stands for. Bitcoin purists aren't all that discussed about the thought that Coinbase shares offer you exposure to the particular bitcoin marketplace. To them, it truly is impossible to take pleasure from the benefits of bitcoin by buying a new stake within a centralized swap. Why is this specific so?

For starters, the alternate holds simply just $230 zillion worth involving bitcoin in its balance sheet. To set this in to perspective, Microstrategy, which lately started attaining bitcoin is the owner of over $2 billion really worth of the crypto asset. Tesla bought $1. 5 billion dollars worth associated with bitcoin recording. Therefore , it appears that Coinbase, that has operated within the crypto field since this year and is in debt for its success towards the performance associated with bitcoin, is just not heavily committed to the bitcoin market.

Additionally , there are instances where the actions as well as inactions involving Coinbase proved that it would not value typically the privacy from the users. Located at one level, the alternate bought a cctv tool, which will it afterward sold to p Enforcement White house and the Irs. For a enterprise whose quest is to permit an open fiscal infrastructure, the organization ideals involving Coinbase improves some considerations. How do you offer an open fiscal terrain while not preserving typically the privacy involving participants?

Price cycles

This kind of last level also produces in mind typically the volatility for the crypto industry and how typically the fate involving digital tools would have a large impact on earnings of Coinbase. Recall of which Coinbase said that price tag cycles find out the profitability from the exchange. Even more users are more likely to use the program when Bitcoin and other recognized cryptocurrencies can be recording confident price activities. Therefore , hold markets, which will normally are 2 years, may play in the value of $COIN.

Based on an evaluation authored simply by David Coach and printed on MarketWatch, Coinbase will see a new cut in the revenue anytime there is a reduced demand for cryptocurrencies. The assertion reads:

“In 2020, bitcoin and ethereum accounted for 56% of Coinbase’s trading amount and the same percentage involving transaction earnings. Should with regard to these two cryptocurrencies decline with no offsetting embrace new cryptocurrencies, Coinbase may see important cuts to be able to its stock trading volume and even transaction earnings. ”

DeFi

Addititionally there is the pending emergence regarding decentralized money. For what its worth, this specific innovative strategy that offers noncustodial financial products can be increasingly becoming a new mainstay within the crypto marketplace so much so the fact that value of the particular assets secured in the appearing sector currently have risen simply by $40 billion dollars in a room of a year. Using Uniswap as an example, Jones Meyer explained the fact that the explosiveness involving decentralized deals will decrease the market share involving Coinbase. She wrote:

“Uniswap, the most active decentralized exchange (DEX), recently reached $100 billion throughout cumulative perfect volume. Even though that pyl?ne in comparison to Coinbase’s all-time amount of more than $450 billion, Coinbase was founded news, whereas Uniswap didn’t receive its get started until later 2018… Right up until more files is available, no matter whether Uniswap, and a lesser scope Sushiswap, can easily overtake central exchanges just like Coinbase may be a matter of point of view. It’s possible they can each and every one co-exist, nonetheless Uniswap could end up choosing a huge b�quille out of Coinbase’s pie. ”

Be aware that many of these cynics are not discussing the fact that Coinbase is a good company. Nearly all are however asking yourself its existing valuation and your capacity to preserve it.

Can this as the beginning of numerous IPO results in the crypto industry?

Tendencies tend to be replicated, especially when these people deliver remarkable results. Consequently , it is not crazy to expect a lot more crypto firms to go community. While using the efficiency of Nasdaq and the Birmingham Stock Exchange being a reference, Brian Jones, key marketing strategies for the purpose of Capital. possuindo, explained that will crypto trades are more compared to capable of flourishing in the share markets:

“It is another action for cryptocurrencies being regarded as shifting more into the popular. If this carries on, and there are zero signs however of that halting, then trades for buying in addition to selling must do well. It truly is by no means an ideal comparison of training course, but shown shares regarding exchanges for example Nasdaq the London Stock market have correspondingly done perfectly over the years. ”

Kraken

One of many companies that may likely perform an GOING PUBLIC in the approaching year is normally Kraken, a US-based crypto exchange including a direct competition to Coinbase. Like Coinbase, Kraken provides a sound enterprise brand and contains managed to manage the questions of the crypto market. Due to volatility regarding Bitcoin, Kraken recorded the explosion regarding trading amount and the influx of recent users inside Q1 2021.

Based on CNBC, the location trading quantity surged for an unprecedented $160 billion, that is 1 . five times what was documented in the whole of 2020. The trade also noticed four occasions the number of brand new users documented in the 2nd half of 2020. While activities on the unparalleled growth caused by the surge of crypto prices, Jesse Powell, TOP DOG and co-founder of Kraken, explained how the exchange features exceeded most expectations:

“For us, virtually any volatility is normally good although it’s consistently better as soon as it’s on how up. The initial quarter only completely blew away typically the entirety regarding last year. Many of us beat previous year’s quantities by the end regarding February. The complete market has truly just increased. ”

In addition, he explained that Kraken is looking to be able to conduct an immediate listing inside 2022 when Coinbase would. However , for the moment, they are inside talks using investors to install a new rounded of private money, which could boost the value of typically the exchange to be able to $20 billion dollars. Powell explained:

“We have been in a few talks to perform another circular. We’ve type of been stalling a bit to find out where the particular Coinbase value comes in at. We suspect that the cost is going to pump higher than it is often trading in. We’re not really in a rush to boost capital… The main reason to do it might just be to create on more strategic traders who can assist us along with geographic growth and development. ”

Head Kerr, TOP DOG of Poivri�re Labs, mentioned that the activities of explains to you of crypto exchanges, just like Kraken, in secondary market segments are a sign of the good results that awaits them in Wall Street. Kerr explained:

“It bodes properly for additional U. S i9000. exchanges such as Kraken which often seems to be getting ready to follow match. Shares associated with Coinbase in addition to Kraken already are trading properly on supplementary markets such as Sharespost in addition to Linqto together with heavy many, ”

Gemini

An additional exchange which could follow Coinbase’s lead is usually Gemini. As well situated in us states, Gemini has generated a reputable crypto exchange that is certainly very much familiar and up to date with regulating requirements. Despite the fact that smaller in comparison with Coinbase and even Kraken, it offers the sort regarding business structure that would interest Wall Street buyers.

Binance

Then there is Binance, the largest crypto exchange internationally. Typically the exchange at the moment averages above $60 billion dollars worth involving trades regular and unearths its users into a wide variety of altcoins. Like Coinbase, Binance searching for to build up its environment such that it could possibly cater to each of the crypto demands of its consumers. Apart from the alternate platform, Binance offers financial commitment accounts, some sort of crypto charge card, staking services, in addition to a p2p community to consumers

As Coinbase in addition provides a equivalent suite involving services, it can be clear of which both tools are challenging for industry dominance to the global stage. Therefore , it could be interesting to verify that Binance definitely will consider planning public and even whether it could possibly manage to get past Coinbase’s existing $85 billion dollars market hat. Judging by it is market share along with the valuation structure set by simply Coinbase explains to you, nothing is quitting Binance out of hitting the $465.21 billion industry cap.

Final Thoughts

As you may would have found, the presentaci�n of Coinbase on Stock market generated many talking points. There is no appropriate way to assess the initial and long term impact on this event. Yet , I am certain the reason is only the commencement of well known crossover to receive crypto corporations, particularly the multi-million dollar valued deals. Expect even more crypto corporations to get on this movement in the next year or two.

Plus although cynics have downplayed the value of Coinbase or forecasted potential problems, what matters is usually how this validates the particular crypto market. The success of the particular Coinbase real estate showcases the particular investment possible of the crypto industry. Additionally, it set the valuation platform for some other exchanges. Overall, this is a succeed for the crypto sector.