An excellent start to Q3 as Bitcoin Price Renforcement the $12, 000 Take care of

The price tag on bitcoin includes cleared typically the $10, 1000 level yet again, but where next?

Following reaching a big near $14, 000 in June twenty sixth, the price of bitcoin then reduced sharply under the $10, 1000 psychological levels to a very low near $9600 just half a dozen days down the road.

Since bitcoin provides regained the particular critical 10 dollars, 000 degree, we look in the contributing causes of the current rally as well as the outlook to get bitcoin’s price in Q3 and Q4 2019.

Do you know the Contributing Causes of Bitcoin’s Current Rise?

Facebook’s Libra

About June eighteenth, Facebook released its cryptocurrency project Libra the revelation increased cryptocurrency costs, including bitcoin which flower from $9000 to $11000 in the 4 days next Libra’s statement.

Considering the fact that Libra will not be a decentralized and permissionless crypto-network, it's not necessarily seen as a hazard to bitcoin and therefore will not be expected to in a negative way impact on bitcoin’s price. On top of that, bitcoin as well differs to be able to Libra since it is not directed by virtually any central recognition, whether of which be a essential bank or maybe a multinational business.

Actually the opposite might even be a fact, where a heightened interest in cryptocurrency is developed by the introduction of Libra. At the the latest Bitcoin 2019 conference inside San Francisco, table moderator and even financial correspondent Max Kesier even declared CNBC’s Paul Kernen recently had an epiphany in phrases of bitcoin’s benefit and electric while speaking about the Libra project over a live instance of Squawk Box.

Any time a currency is certainly launched by way of a massive world wide web giant which could have excessive market electricity and recognizes a lot of information with regards to your friends and family, unexpectedly the idea out frontward by bitcoin makes even more sense to the majority of people and even becomes more desirable.

Libra may even represent a massive on-ramp for bitcoin, where more than two billion dollars Facebook customers will have a simpler route directly into bitcoin. Considering Libra is simply not a substitute to bitcoin, in addition to gets individuals to think about cash and different techniques of transacting, chances are Facebook’s despoliation into cryptocurrency will end up like a complement towards the market head.

Increased Mainstream Interest

Bitcoin has also witnessed elevated numbers of mainstream concern in recent several months as it returned off it is 2019 levels around $3, 000 throughout February 2019 to around $11, 000 for the duration of writing. A main gauge of well known interest in bitcoin is to check out how many Yahoo and google searches can be for bitcoin.

Typically the correlation involving bitcoin net searches together with fluctuations inside the price of bitcoin is as big as 85. 8% in accordance with recent explore. In an extremely digital financial system, it is user-friendly that net searches could possibly be leading signs or symptoms for client behavior. Possibly Google’s leader economist, Situasi Varian, produced a research standard linking pursuit of jobs together with unemployment grouping keywords along with the number of original claims of unemployment advantages.

For the reason that chart under shows, there is a recent uptick in the volume of Google looks for the term bitcoin. Since the commence of 2019, Google looks for bitcoin have already been on an up trend. Bitcoin is the most often Googled inside Nigeria, S. africa, Austria, Swiss, and the Holland according to Yahoo Trends.

Source: Google Trends

Forbes noted about June thirtieth that, the first time since the half truths market recently 2017 and even early 2018, the number of Yahoo searches for “bitcoin” has overtaken “Jesus”. Precisely what is also exciting is that the increase in search action for bitcoin is not shown for various other major cryptocurrencies such as Ethereum or Ripple; could it be a respected indicator yet again that a significant bull marketplace is underway?

A newly released report via digital advantage research organization Delphi Electronic digital makes the circumstance that inspiration from list price investors is certainly returning to typically the bitcoin industry. The ranking points to typically the increasing top quality on Grayscale’s Bitcoin Purchase Trust (GBTC), which allows buyers to access BTC and not having to worry about basic safety and safe-keeping.

Dovishness from the Federal Reserve

Several market bloggers maintain the US key bank, the particular Federal Hold, is accidentally pushing bitcoin to brand new highs. Because the financial crisis within 2007-2008, the particular policy associated with easy cash has inflamed the Federal government Reserve’s "balance sheet" to levels not observed before and more money suspended in the program thanks to quantitative easing.

These kinds of policies need effectively fragile the US Bill and behavior to improve typically the competitiveness within the US financial system by maximizing exports. Yet , as the essential bank holdups hindrances impediments interest rate rises and shows further quantitative easing, shareholders have been spooked and came into so-called safe place assets just like gold, typically the Swiss Droit, the Japanese Yen and… bitcoin.

2 days prior to bitcoin entering the particular $10, 500 in late June, the particular Federal Hold Chairman Jerome Powell introduced the decision to maintain benchmark rates of interest steady with 2 . 25%-2. 5%. Due to growing geopolitical risks in addition to inflation, it truly is believed how the Fed is definitely under pressure to slice interest rates instead of normalize all of them.

At the begining of June, the particular Fed mentioned it was all set to cut interest levels, departing coming from a slow together with steady come back to historically common levels to receive interest rates. Yet , commentators experience noted of which in the current low-interest rate surroundings, reducing standard rates additionally is not apt to have the same result as it does during the financial disaster, when costs were of up to 5%. Consequently , the US essential bank is caused by turn to even more unconventional insurance policy tools over the following recession, which may include even more quantitative reducing.

Considering that the USD could be the world’s hold currency, the particular decisions upon monetary coverage have a large effect throughout financial marketplaces, including bitcoin. ING economist Robert Carnell stated in past due June that will, “It appears that the world is very awash together with money, that it must be creating economic asset value inflation where ever you look.. ” adding that will, “something is definitely wrong here”.

Once the rest of the earth wakes up towards the financial tips of banks in an attempt to retain the financial crisis regarding 2008, bitcoin will glow even more.

Upcoming Block Reward Halving

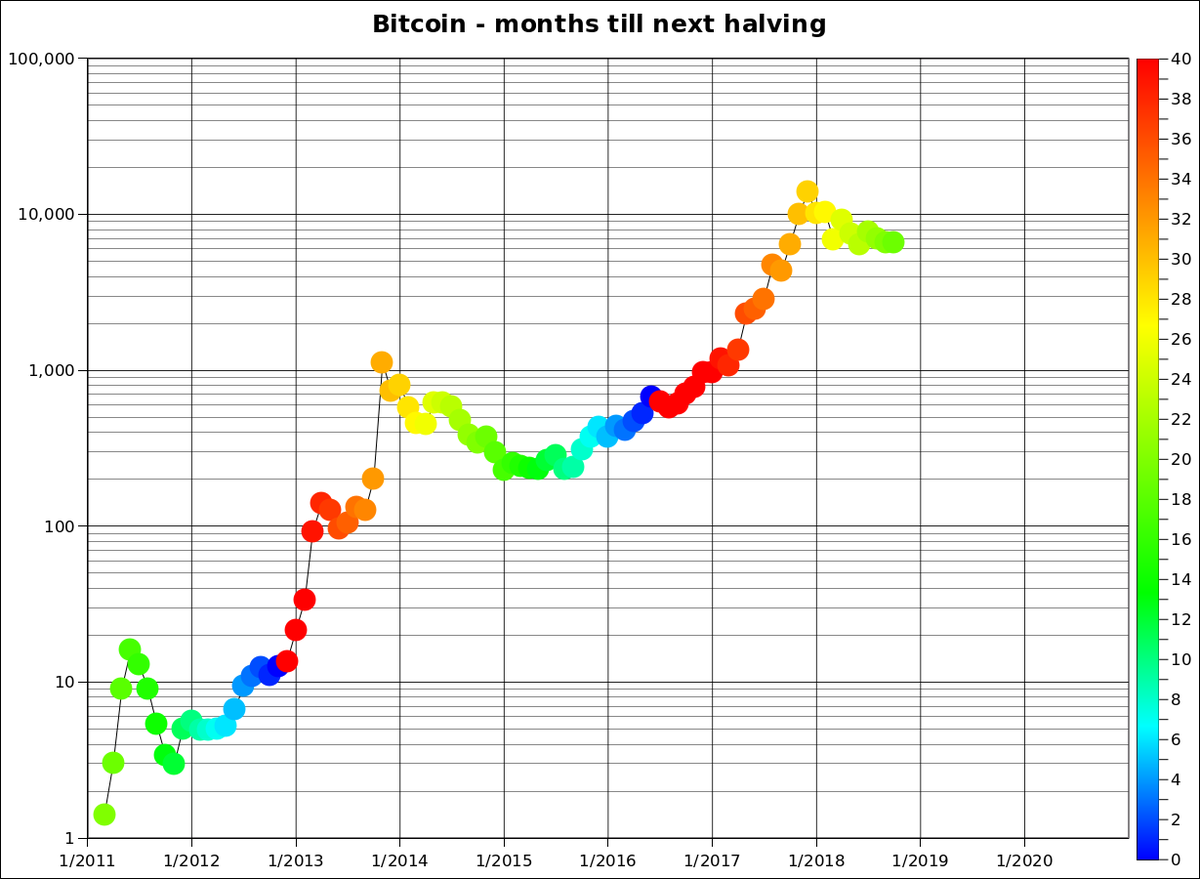

Bitcoin’s block reward halving is a result of occur between May 2020, less than twelve months away. Generally, the prohibit reward miners receive with respect to mining is definitely cut by 50 % roughly every single four yrs. Once these types of block compensate halvings happen, the providing pressure about bitcoin is definitely reduced, due to the fact miners today effectively make half just as much as they utilized to, in bitcoin terms.

Because event treatments, bitcoin have to display a lot more bullish power as marketplaces price in case. Historically, we now have seen the price tag on bitcoin embrace the increase to the halving and in the examples below months.

The particular chart under illustrates how the appreciation within the price of bitcoin is far more inhospitable after the prohibit reward halving, but really does start escalating about 10-14 months ahead of the event too.

Source: @100trillionUSD

Elevated Volume to Bitcoin Futures and options Contracts

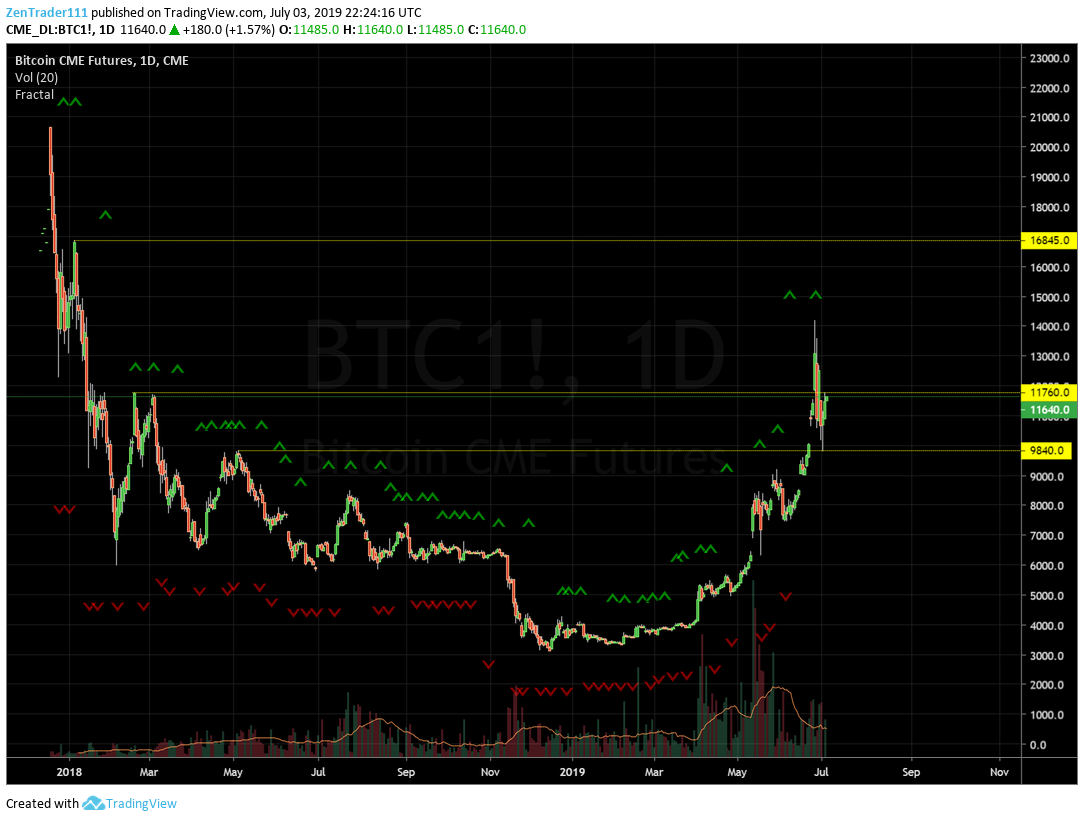

The particular CME commenced offering bitcoin futures deals towards the conclusion of 2017 while bitcoin was close to its top of 20 dollars, 000. Nevertheless , the volume aimed at trading these types of contracts had been quite low. Nevertheless , in recent months which has changed in addition to played an important part in bitcoin’s recent move.

Because chart listed below shows, the amount on the CME for bitcoin futures contracts provides steadily increased over time, showing greater fascination with the monetary instrument would be regarded bullish meant for bitcoin.

On, may 13, 2019 the CME bitcoin options contracts contract found its optimum ever one-day volume. Because saying should go amongst dealers, price uses volume. If you have a large in the amount of an asset, their price will abide by shortly after, and also this holds true with bitcoin at the same time.

Throughout June, typically the bitcoin options contracts contracts to the CME establish a record achievable open fascination, with 6th, 609 long term contracts at the end of Summer and has recently been steadily growing over the last eight months. This may be a key pointer of with regard to bitcoin and even signals of which traditional invest types really are paying deeper attention to the main cryptocurrency. The quantity of large wide open interest owners – that happen to be investors which may have contracts well worth at least twenty-five BTC – has also just lately hit a fresh high of forty-nine, up out of 46 within the last week involving June.

Very best Outlook intended for Bitcoin’s Cost for the Rest of 2019?

Where next for bitcoin? Effectively, we look for what bloggers and the chart have to say.

Reputed technical expert Peter Brandt recently explained that bitcoin has went into its “fourth parabolic phase” and is “taking aim at $265.21, 000”. Whilst strictly an amount prediction relating to Q3, it will do go to present how increased traders consider bitcoin may go in the longer term, where Brandt added, “No other industry in my forty-five years of stock trading has gone parabolic on a journal chart in this fashion. Bitcoin can be described as market just like no other. ”

It’s not just Brandt who is convinced bitcoin provides extensive of place to the benefit. Binance’s corporation strategy business office (BSO), Wacholderbranntwein Chao, includes forecast bitcoin to reach around $50, 1000 and $465.21, 000 at the conclusion of 2019.

Paul Novogratz, leader of crypto investment team fund Universe Digital, reckons that bitcoin will change between 10 dollars, 000 in order to $14, 500 in the near future prior to trying to retake the perfect high close to $20, 500 by the end associated with Q3 2019.

The chart below for the CME bitcoin futures contracts demonstrates if a break up of $11, 760 arises, then we have to see a speedy move inside the next fractal resistance on $16, 845. However , in the event the $11, 760 level retains as tough resistance, subsequently we can expect bitcoin to jump between $9, 840 in addition to $11, 760.

In case the volume continue to be keep coursing into the CME bitcoin options contracts contracts, then that should be high for bitcoin over the long run. In particular, we wish to see a fresh new high in the quantity traded should be expected fresh altitudes in the associated with bitcoin. Otherwise, if amount dwindles out of current degrees and dries up, we need to prepare for ways to the downside.

The particular weekly graph below implies that if bitcoin can shut above $11, 760, then your all-time large is in view, as recommended by Paul Novogratz. Nevertheless , the current spike in order to $14, 500 could be a hurdle, as if bitcoin does not approach above the current high prior to July fifteen, then a fractal resistance may form from $14, 169.

However, if bitcoin manages to maneuver higher than $14, 170 simply by July fifteen, then this ought to give verification that bitcoin will check it’s perfect high close to $20, 500 and possibly lengthen beyond this particular level.

An individual concern in regards to the weekly data is that, presently, the current candlestick looks like typically the pattern referred to as dragonfly doji, which could be regarded as bearish, since it is occurring in the course of an way up trend. A new dragonfly doji usually implies that a top rated is in, although we will must wait for the regular candlestick to shut before making virtually any definitive decision.

Another factor to think about over the following five weeks or so may be the policy from the Federal Book. If the geopolitical situation aggravates and the Given maintains the dovish position, then this ought to bode nicely for bitcoin going forward.

You could find a work schedule of the Federal government Reserve conferences here and when they make notices signaling the move to quantitative easing or even other non-traditional policies, after that bitcoin’s cost should advantage over the moderate term. Rate of interest decisions are usually announced by the end every few months, with the following due upon July 30-31, where home loan cut ought to boost the high mood with regard to bitcoin.