Will certainly Concentration associated with Wealth Keep Bitcoin Back again?

It’s been contested in economics for decades; may wealth inequality matter?, How s inequality very best addressed? At present the discuss comes to crypto, with buffs questioning if the fair partition is possible and also desirable inside the Bitcoin environment.

Is Bitcoin Wealth Too Concentrated?

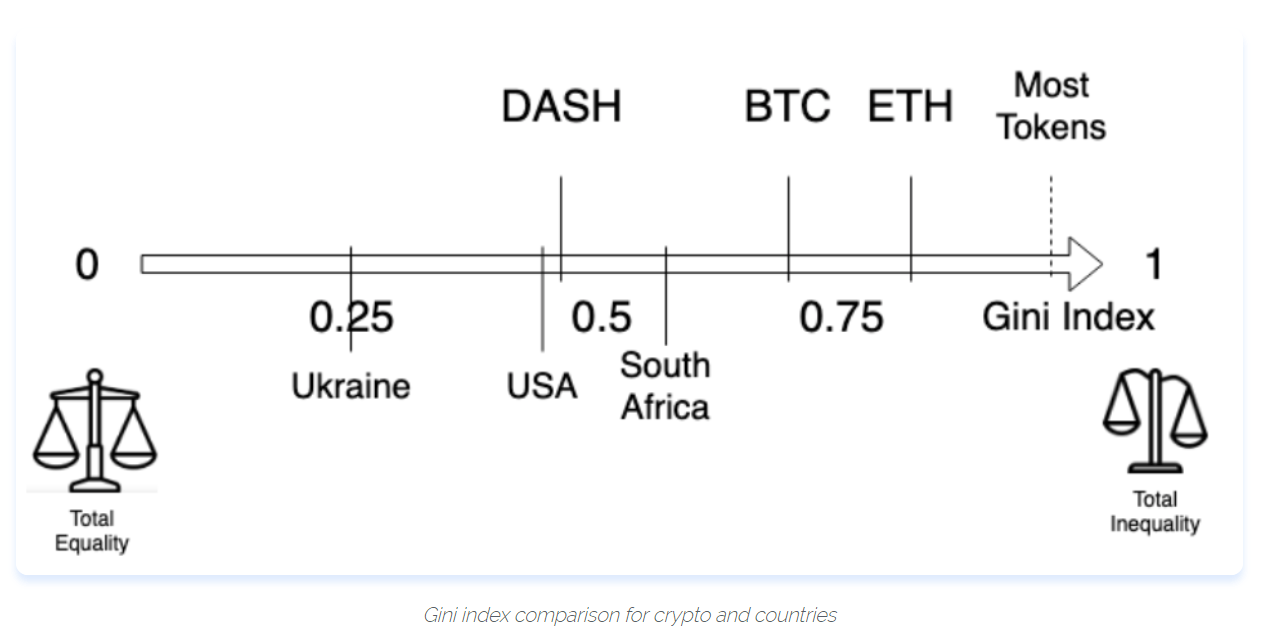

The particular wealth submission is highly unequal in the world today and it has been increasing over the course of the particular 20th hundred years, as layed out in Jones Pikkety’s popular book Capital in the 21st Century. Latest research by PARSIQ demonstrates the GINI measure with respect to Bitcoin is definitely higher than To the south Africa’s, where the GINI measure signifies how far a new country’s prosperity is from your totally identical distribution. This particular data stage has triggered people to inquire if the prosperity disparities within Bitcoin, which usually seem to be even worse than in the particular legacy economic climate, are keeping bitcoin back again.

For that reason, the flow of money amongst crypto-assets has become a subject matter of active discussion, when using the motion contested by Vinny Lingham together with Dan Arranged on a TruStory podcast. On-chain data signifies that around a couple of percent involving bitcoin billfolds own approximately 80 percent coming from all circulating bitcoin, leading authorities to argue of which wealth awareness is protecting against the crypto-asset from starting to be sound funds.

Yet , Bitcoin supporters argue that on-chain data is without a doubt misleading, ever since wallets usually are not analogous having individuals. A person might own multiple wallet, or perhaps one pockets could work for more than one person. As an example, it is renowned that bitcoin whales, just who hold a lot of the cryptocurrency, often bust their convention up in multiple deals with. Also, we can say that some bitcoin addresses participate in exchanges that addresses characterize all of the people who are actively buying and selling at that swap.

The main topic of Bitcoin’s prosperity distribution captivated a energetic discussion upon Twitter carrying out a live discussion between Vinny Lingham associated with Civic Dan Kept, the inventor of ZeroBlock and co-founder of Interchange – that was acquired from the crypto trade Kraken. Lingham kicked from the debate simply by postulating in case bitcoin increased to 10 dollars million bucks, would it be considered a problem regarding society in case less than 1% of the populace owned a big majority of the particular world’s prosperity?

Scheduled argued of which bitcoin’s introduction was the fairest that could be regularly be conceived, seeing that Satoshi unveiled the whitepaper two months ahead of the project started out and shared the exchange publicly for all to start exploration on Jan 3, yr. While some may well argue that Satoshi has anywhere close to a single million gold and silver coins and could hold a lot of riches and ability, Held states that after a decade, the enigmatic creator regarding Bitcoin hasn't touched the ones coins its expected Satoshi will never engage them, seeing that he has suggested in the past they does not care concerning money.

Scheduled also listed that every bitcoin gained by simply an individual was initially earned, through buying or perhaps mining that, and it has not been acquired by way of force or perhaps it was certainly not reappropriated, making it different from various other asset lessons. Held in addition questioned the GINI assess to look at typically the wealth variation in bitcoin, as it is accustomed to measure riches inequality in a country, and no make use of GINI to obtain assets just like gold. In addition, it is difficult to acquire the data wanted to assess riches concentration besides for Bitcoin but for properties and assets like silver precious metal.

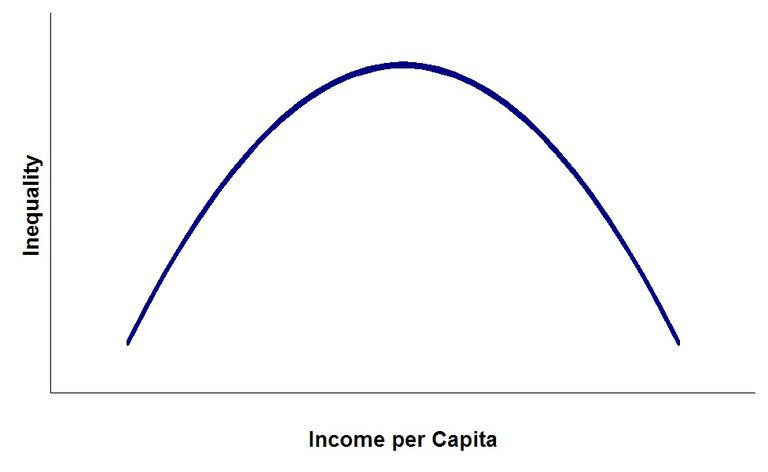

Another point to give consideration to is that bitcoin is a very vibrant ecosystem. Monetary theory shows that economies expertise rising inequality over time when the system will grow and productivity is obtained. A few people have wealthy when the economy designed but then a spot is hit where even more resources really are exploited and even inequality begins to decline mainly because participation throughout productive task increases.

The partnership between monetary activity and even inequality is referred to as the Kuznets curve, created below.

Hence the debate about the wealth awareness of bitcoin could be quick. The system remains to be developing which is just over a decade old. As increasing numbers of participants become a member of the Bitcoin ecosystem, we could reasonably count on that inequality follows typically the pattern stated above.

As an example, large bitcoin holders commence businesses in addition to employ folks from outside of the Bitcoin environment, with bitcoin news companies serving as being a good sort of this. Like large bitcoin holders commence businesses or even spend their very own gains, you will find a trickle lower effect in order to to reduce inequality.

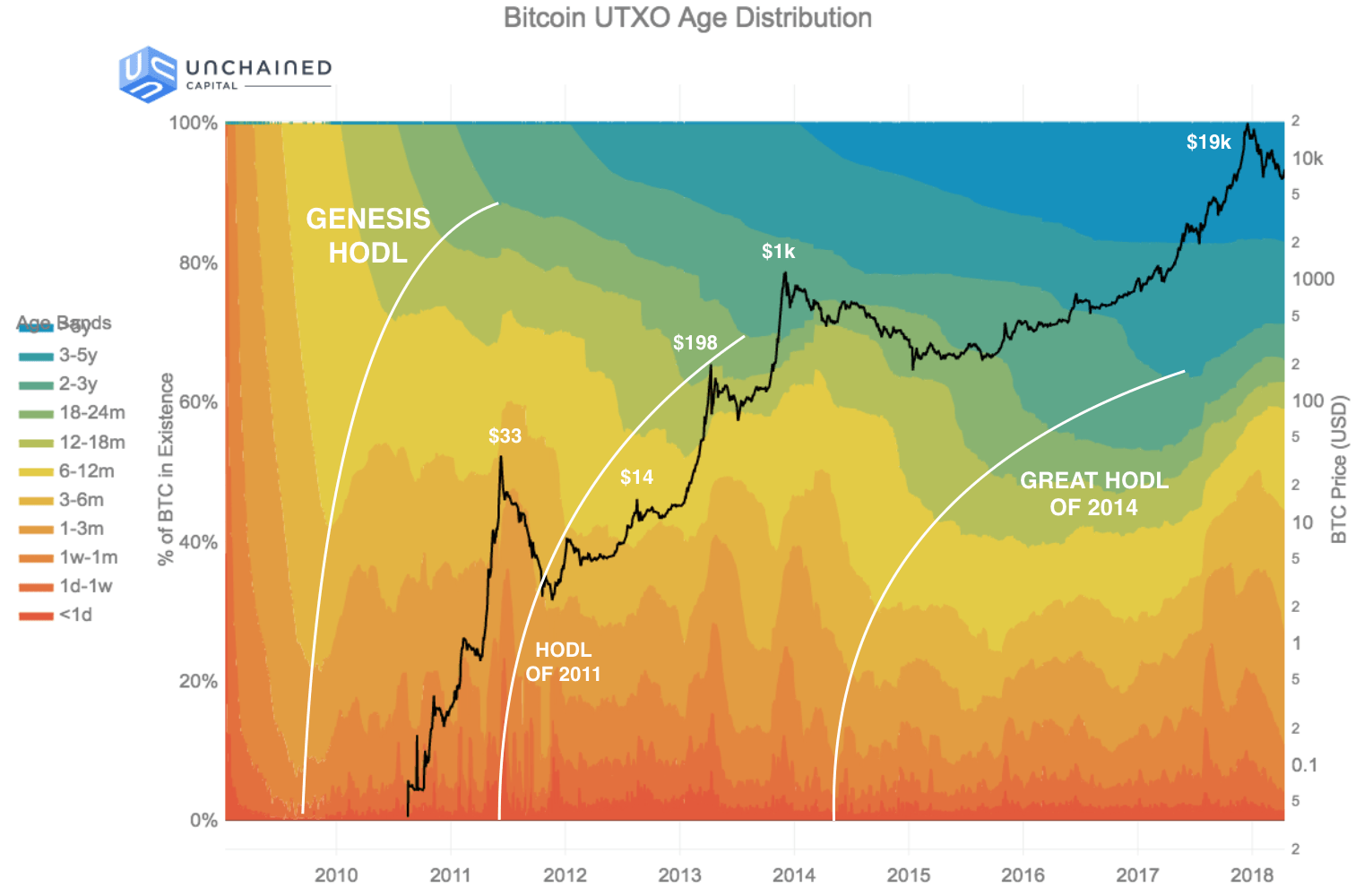

HODL Waves Present that Bitcoin Distribution contains Improved

Quarrelling in favour of the particular motion the fact that distribution regarding bitcoin will be better over time, Put on pointed in order to HODL surf, illustrated listed below. The particular HOLD surf analysis printed by Unchained Capital that will shows as being the price of bitcoin rises, a lot of bitcoins usually are transacted – suggesting the particular ownership of the people bitcoins usually are changing palms. Because people feel a lot more wealthy, these people cash out their own bitcoin benefits to buy some thing and a brand new holder purchases those cash, acting being an equalizing system over time.

A vital point increased in the TruStory debate is the fact Bitcoin distributed freely for your year . 5 with no price attached to these people. Early adopters took a tremendous risk by simply holding onto bitcoins from the beginning and there was clearly no warranties that it would most likely ever turn into valuable. Authorities of bitcoin’s wealth service seem to not in favor of the aspects of capitalism itself, while using the large bitcoin wealth an incentive for early on adoption.

In comparison to other resource classes, a person generally require permission associated with some sort, believe VC’s trading goods. However , along with Bitcoin, anybody can operate the software, therefore while the equal rights of end result may not be regarded as desirable, it is difficult to argue that this equality associated with opportunity had not been present with regard to Bitcoin.

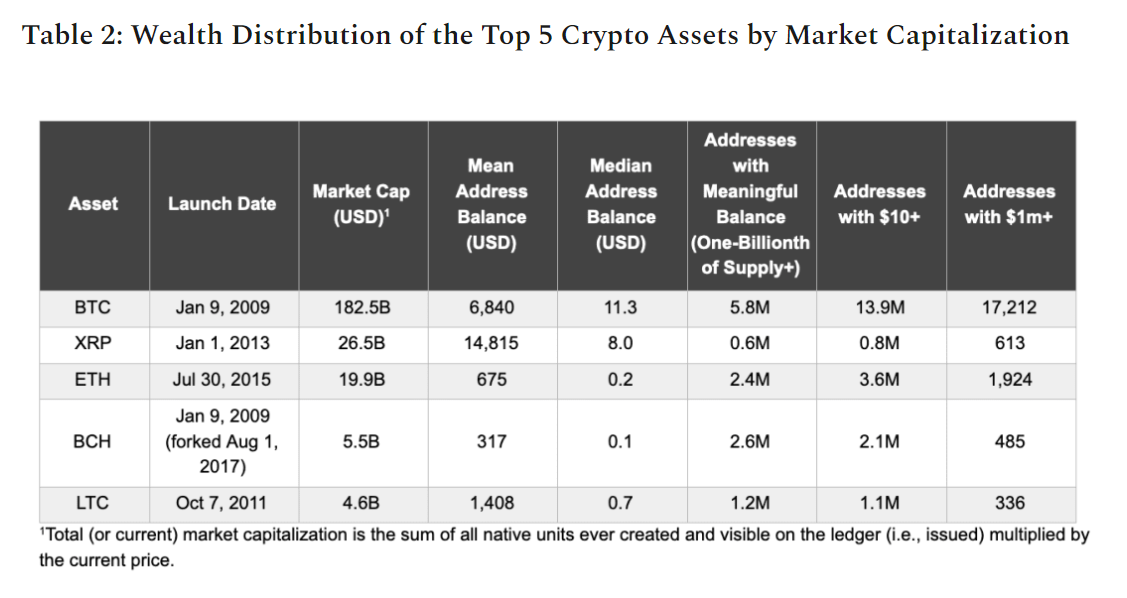

Even though a lot of bloggers focus on while using the GINI way of measuring inequality, some sort of post right from Coinmetrics analysed other methods for the major crypto-assets to realise a comparison. The show of which 5. main million bitcoin addresses have got a meaningful harmony, which is thought as one billionth of the whole supply. The quantity of addresses exceeding $10 is usually way bigger in Bitcoin (13. on the lookout for million) in comparison to the other major crypto-assets, just like 3. 6th million of Ethereum.

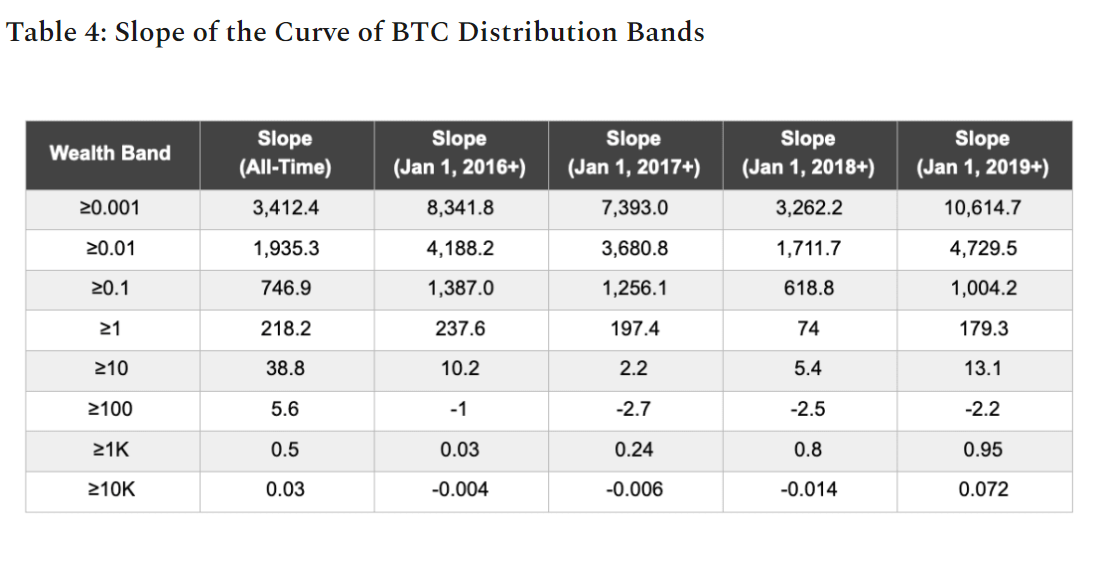

Coinmetrics also considered the prosperity distribution after some time, illustrating the existing rate regarding distribution making use of the number of information with Times amount of Bitcoin. The desk below demonstrates how the syndication has changed after some time and shows that every day, we all expect 179 new information to hold one or more bitcoin, based on the slope by January 2019.

When the numbers previously mentioned show, 2019 shows the very best rate of recent addresses sustaining at least zero. 001 bitcoin, suggesting of which 10, 614 new handles will hold at the least this volume every day. The quantity of addresses sustaining at least one bitcoin has gotten over time, although has increased for some other riches bands, exhibiting positive advancement over the past 36 months or so.

Bitcoin Inequality for a Function regarding Existing Inequality

Yet another way of taking a look at inequality within Bitcoin gets rid of the need to take a look at data upon addresses. Bitcoin analyst in addition to derivatives investor Bambou Organization looked at the particular distribution associated with bitcoin some in Sept 2017 utilizing a unique technique.

The assumption which a power laws applies to typically the distribution regarding bitcoin and this it significantly mirrors typically the distribution of worldwide wealth will not be too far fetched, as information are required to my very own and purchase bitcoin. While you may mine bitcoin on your notebook computer with ease at first, as the environment evolved consequently did the necessity to mine a new block and stay rewarded considering the block rewards.

The energy law is applicable to a lot of all natural phenomena although one manipulation was made for the model to be able to account for early on miners who seem to control a great deal of bitcoin – as you cannot find any parallel notion for international wealth. Osier Club in addition used targeted traffic statistics to be able to bitcoin web sites to arrive at a proposal of twenty-five million bitcoin holders.

Combining these assumptions, the show that your richest 30 % of bitcoin owners handle almost 99 percent for the supply – of course , these kinds of assumptions can be from Sept. 2010 2017 and would have adjusted significantly subsequently.

What you can do About Inequality in Bitcoin?

Whether inequality is really a problem worth attention is really as much like a philosophical query than costly economic 1. To those that believe in totally free markets capitalism, inequality does not matter a lot as the capitalist system benefits those who danger their funds. Either a person take the dangers or you don’t, and the different types of different people produces these types of inequalities all of us observe.

For the people more bending towards socialism or democratic socialism, inequality is important mainly because it affects people’s quality of life together with our health is largely driven by how very well we are undertaking as compared to many around people.

Some folk buy bitcoin not to possibly be rich, nonetheless because they need to avoid being poor. To be a fascinating research in budgetary economics, Bitcoin is still quite young and provides extensive of area to develop. It can be the case that will Bitcoin revolutionizes the economic climate and hyperbitcoinization pushes many people out of low income, to this kind of effect that will inequality may well not matter all the if everyone is able to meet their very own basic requires since the acquiring power of bitcoin is designed to enhance, not reduce as with fedex money, after some time. Also, simply by destroying the particular government’s capability to inflate bitcoin, using bitcoin as a arrange currency will no doubt have a very positive impact about income inequality, which has jumped since the conclusion of the money standard four decades ago.

Yet , the flip side is the fact we exchange our existing system which has a similar technique, but with a fresh aristocracy alternatively and it is challenging to say if that would be even more desirable compared to the system now we have.

Yet one thing that will affects inequality is schooling. As individuals become more informed, the possibilities available to them raises. Similarly, the greater people that are usually educated regarding Bitcoin, the greater buyers you will see and will accelerate the process of the particular HOLD dunes. Therefore , one method to decrease inequality in Bitcoin is to teach people about how exactly money works and what Bitcoin does to resolve the issues using the legacy economic climate.

Because there is no government or even central organization in bitcoin, there are simply no redistributive procedures for bitcoin holders in order to tax rich holders transfer advantages to lesser holders. Most solutions to Bitcoin’s wealth attention will be market-based solutions. Considering that financial addition is another crucial determinant associated with inequality, the suggested marketplace solution meant for Bitcoin’s prosperity concentration is always to build providers that permit individuals within developing nations around the world with no access to finance to access, and acquire a risk in, Bitcoin.

For example, the Lolli service offers cashback by means of bitcoin picking out goods from of their companions – providing people a simple way to be contained in the Bitcoin environment. Tremendously, this service plan is limited for the US, together with a similar service plan targeted at states with very low financial add-on could help lessen inequality inside of Bitcoin, by providing more persons a chance to get paid bitcoin.

For whether it is a urgent difficulty for Bitcoin, it is more than likely too early to consider inequality at present since the environment is still expanding. No one may consider inequality an issue of developing areas like Chinese suppliers or Of india yet, because they are still in the process of the process of fiscal development. When Bitcoin actually gets to critical size and demonstrates itself for a form of tone money together with alternative to redbull, then it could be the issue of inequality deserves even more attention.