Ways to Survive Typically the Crypto Collision And Encourage Long-term Revenue

Unpredictability is perhaps by far the most appealing aspect of the crypto market in order to new buyers. The prices regarding digital belongings have registered unprecedented uptrends since the 365 days began. Subsequently, this has sparked the increase of buyers looking to create high income amidst the particular institutional plagiarism of cryptocurrency.

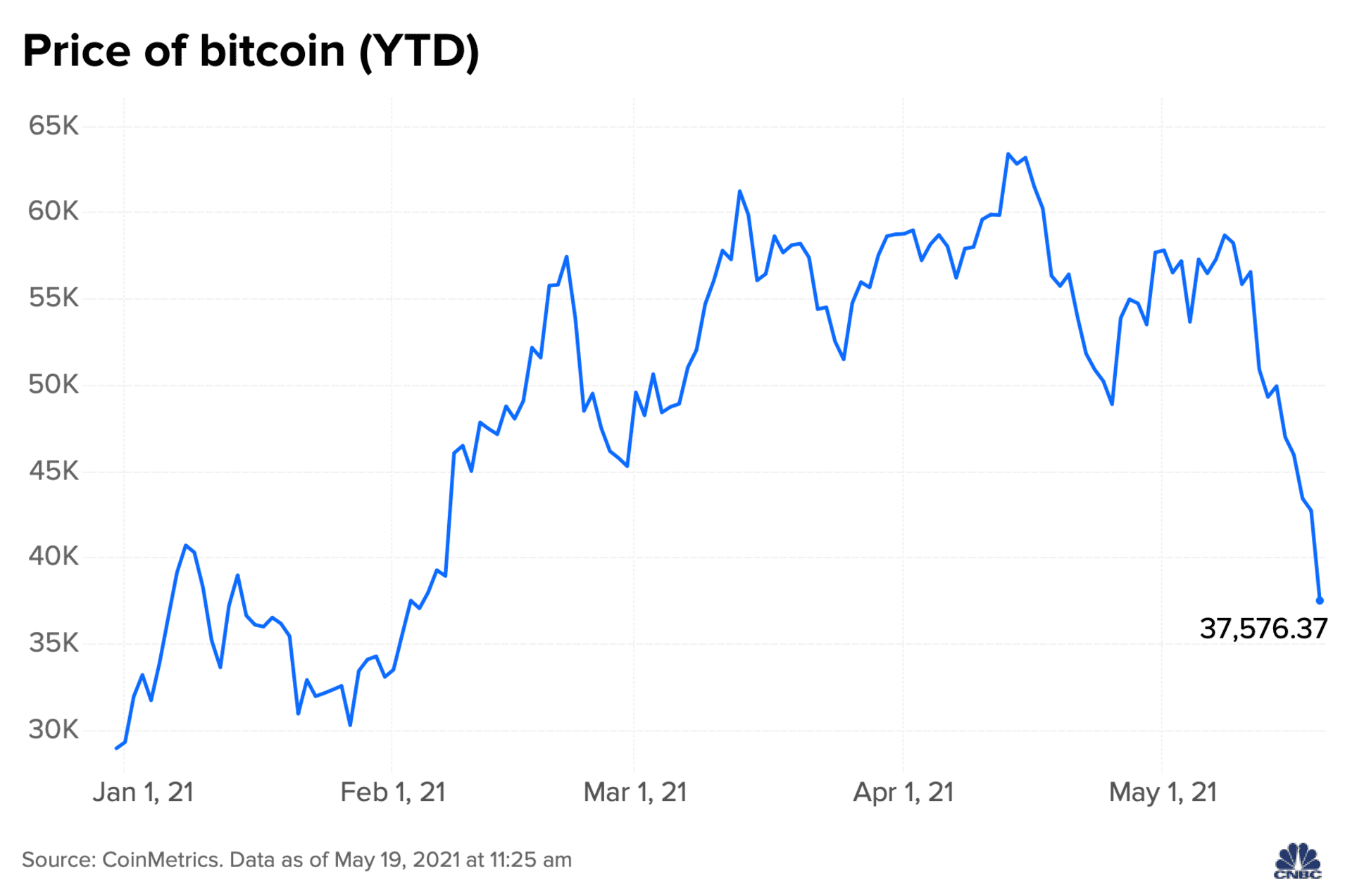

Yet , all this evolved when the crypto market reacted negatively into a series of happenings. At the time of penning, Bitcoin, typically the world’s most favored cryptocurrency, possessed fallen by simply 47% inside the space involving 4 weeks. For some experienced crypto investors, this may be a common likelihood in the crypto market. Consequently , the latest crypto crash may not come as a surprise neither will the effects lead them to panic. In comparison, it must be challenging for new traders to procedure the current price fall and set in the appropriate ways of negate the effects.

Because of this, I got decided to talk about this crypto crash on length, recognize the instrumental factors, assess it using past marketplace collapse, in addition to explore the right response to decrease its affects.

What Caused The Crypto Crash?

All kinds of things was each and every one rosy inside the crypto ball until Could 12 the moment Elon Spray tweeted of which Tesla would definitely no longer be agreeing Bitcoin as a result of environmental considerations. This story changed typically the tides dramatically such that the buying price of Bitcoin fell into below the 50 dollars, 000 damaged spot for the first time throughout over 16 days. Although believed until this was a pure setback together with an opportunity with the crypto industry to gain even more momentum, some sort of barrage involving other unfavourable news obligated the price possibly lower. Leader among them is without a doubt China’s selection to exclude crypto mining and trading within its territory.

A further contributing issue is the reliving of crypto regulations because of the size adoption involving digital assets-based investment goods. Countries just like the United States would like to capitalize at the crypto fad to generate even more tax gross income. Regulators as well seem to experience intensified endeavors to protect shareholders against the inflow of “shit coins. ”

Additionally, a move in investment decision trend might have played into the market industry crash. JPMorgan believes that will institutional traders are moving their focus from risky markets towards the established investment decision opportunities such as Gold. The particular firm wrote:

“The Bitcoin circulation picture is constantly on the deteriorate and it is pointing in order to continued retrenchment by institutional investors… In the last month, Bitcoin futures marketplaces experienced their own steepest and much more sustained liquidation since the Bitcoin ascent began last Oct. ”

This coincided using the reopening associated with economies around the world. There is each reason to think that traders are looking to make use of the economic growth poised in order to accompany the simplicity lockdown guidelines. Mike Novogratz aptly summarizes typically the crypto challenge during a job interview with CNBC. He explained:

“A lot more individuals own crypto. Crypto features seeped in to pockets through out our culture and you a new confluence associated with events — a combination of Taxes Day, Elon Musk posts, whatnot, where you began breaking down the particular positivity within the price activity, and now we’ve got the liquidation occasion. ”

Although these elements seem to be benefits culprits, the particular unprecedented sell-off shows so why Bitcoin as well as other cryptocurrencies are thought to be very volatile. Only a few asset lessons out there could outlive the amount of bloodbath seen in the past 30 days. And yet, in order to long-term crypto proponents, it is nothing remarkable. Many believe that the is just a momentary setback to crypto coming to brand new all-time heights. non-etheless, it is very important ascertain the between a new correction as well as a bearish accident.

Some sort of Crypto Modification Or A Keep Market?

The Crypto Modification Or A Keep Market

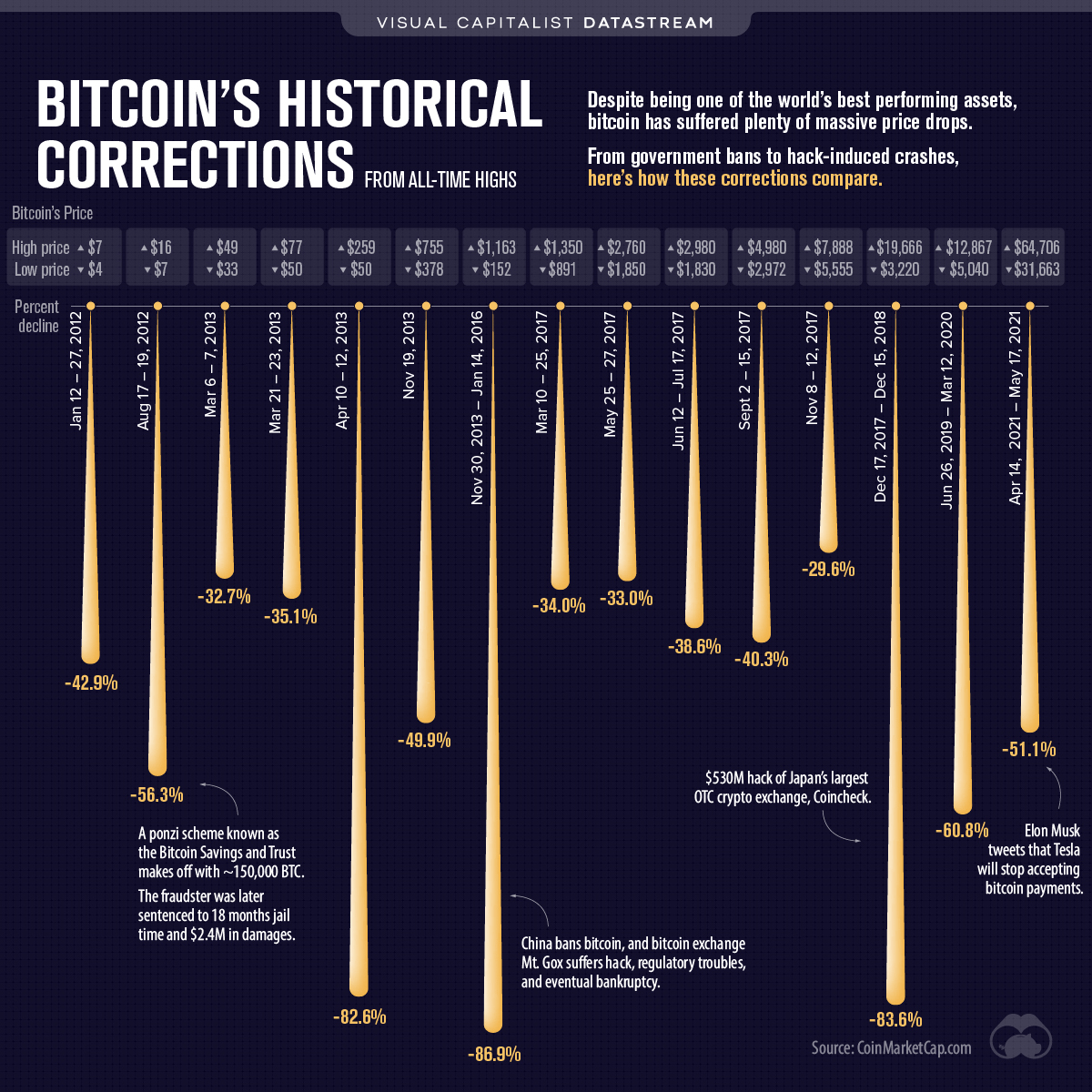

Bitcoin’s historical modifications (source:Visual Capitalist)

As defined by Ollie Leech on Condesk, the correction takes place as a result of the buying fatigue on the part of high investors:

“These (price correction) usually signify bullish dealers have become depleted and will need time to merge and bring back. Exhaustion develops when a most buyers comes with bought the actual asset in addition to no more fresh buyers showing to support typically the uptrend. Should sell orders placed continue to load in without other people on the other side within the order publication buying these people, prices commence to fall. ”

In comparison, a price accident somewhat foreshadows extended intervals of marketplace downturns. Parasite also additional that some other technical aspects and minimal events may also spur the particular occurrences associated with price modifications:

“Corrections can be affected by small events yet tend to be started by specialized factors like buyers operating into solid resistance levels, using up trading quantity and unfavorable discrepancies among Bitcoin’s cost and signals that determine its energy like the Family member Strength Catalog (RSI). ”

Because of the unprecedented unpredictability of the costs of electronic assets, It is hard to distinguish in between a crypto price static correction and a accident. In standard markets, a new 20% value downturn is sufficient reason in order to anticipate a new bear marketplace. Conversely, Bitcoin, the most popular gold coin, has noted wild value swings coming to the $64, 000 optimum price emerge April.

This is simply not the first time how the price features dipped simply by over twenty percent. However , the between this particular current market issue and previous modifications is the period it took to join up a consistent drop in price. With one stage, the price chop down by 33% in the area of one day. In the conventional investment panorama, such a high and prolonged price motion are considered tell-tale indications of an approaching bearish operate.

Yet , as discussed earlier, this kind of current market fad is a result of some sort of slew involving events identified to have limiting impacts relating to the global worldwide recognition of cryptocurrencies. Hence, we are going to witnessing exclusive situation where it is difficult to be able to gauge typically the probability of an long-term uptrend or the get started of a bearish run. Especially, Bitcoin in addition to a majority of altcoins have restored momentarily from lows captured at the level of the new crypto sell-off. Is this an indication of good things to occur, or just some sort of momentary cease-fire before the onslaught resume?

What Do Experts Think?

What Do Experts Think

Not surprisingly, most long lasting crypto advocates believe that the particular bull pattern, which started off inside March 2020, is definately not over. Bobby Lee, originator and TOP DOG of Entracte, a crypto wallet program, argued the apparent rift that is available between the crypto community China’s federal government has no long-term impact on the cost trajectory associated with Bitcoin. Shelter explained:

“China will prohibit Bitcoin all the time. By several future day, Bitcoin is going to be over hundred buck, 000 [China will] convey more regulatory companies [looking at it], and the query is, also can Tiongkok do to prohibit Bitcoin cryptocurrencies? This hasn’t currently banned almost everything. Now they’re going to pursue mining, seemingly. ”

Shelter further outlined the continuing approach associated with China in order to regulation, observing that we should never expect the to change the stance upon cryptocurrency in the future:

“China operates in the best way where these people rarely replace the rules. Transforming the rules can be quite controversial. Them is these people change observance. That’s exactly why these spoken announcements are only a signal towards the market, that will they’re likely to step up the particular enforcement once again. ”

As China has become at loggerheads with the crypto industry for a long time now, the newly suggested policies should never drastically change market circumstances. In other words, in the event that China’s regulating stance is the central reason for the most recent correction, next expect the market industry to come back in no time at all.

CNBC’s Kelly Evans lent your ex voice to the topic in a article named: The Crypto Crash. Right here, Kelly stresses that the present crash will not dilute the power of cryptocurrency:

“The biggest distinction between right now and the Bitcoin bust associated with 2017 is the fact that Bitcoin hardly encapsulates the field of crypto any longer. It’s only one piece of this. Meanwhile the particular crypto planet is off towards the races producing new transaction tools asset classes… There’s simply no putting the particular genie in that container. ”

Your own woman added the reason is also seeking less likely of which regulators may bar people from purchasing or employing digital tools:

“Will regulators conclusion the whole research? I uncertainty it. Of course, our Given is looking into their own electronic currency, that could undermine the particular appeal of plenty of stablecoins these days. But that may take a little bit. Yes, the particular IRS can be cracking upon unreported improvements from using or applying crypto, because they should–it’s property or home, after all, not necessarily money. (Similarly, they may prohibit the ability to employ crypto seeing that payment. ) But My partner and i don’t observe how or so why they would determine “no anybody can invest in (a. k. a new. own) crypto. ” It will be like expressing “you can’t own the brand new mini fat contracts” since they’re not necessarily physically deliverable. If everything, the feds seem to be tiptoeing towards codifying crypto as being a permanent area of the asset surroundings. ”

Crypto analyst, Dernier-n� Cowen, feels that although a come back is impending, it would have a lot more coming back the electronic asset in order to regain the already dropped momentum. This individual explained:

“I would be a lot more inclined to consider that it’s more likely that individuals spend a bit more time heading down before we all come back upward. If you think it’s going to jump and increase and put within a $200, 500 Bitcoin over the following few months, a person basically, now from where the price presently is, you should see an instantaneous rebound normally I don’t think we are able to make it. In case we get that will immediate come back and we commence moving support then might be it’s possible. Again, I’m just a little a lot more pessimistic about this rebounding that will quickly. ”

Regarding Peter Berezin, chief worldwide strategist on BCA Researching, the crypto crash can be far from more than. He noted the influx associated with strict restrictions would push the price of electronic assets actually lower. Berezin stated:

“The drubbing of which cryptocurrencies have obtained over the past 2 weeks is just a style of circumstances to come. Crypto markets could continue to experience tighter control. … Inside the near word, the pain inside crypto market segments could move down various other speculative properties and assets such as technical stocks. ”

Nikolaos Panigirtzoglou, the managing movie director at JPMorgan, also shared the same view, remembering that the the latest price restoration may not amount the end belonging to the market collision:

“Despite the restoration in rates to around $40k, the impetus signals, specifically the for a longer time lookback period of time one, continue to be problematic as the signal. It can be too early to be able to call the completed of the the latest Bitcoin downtrend. ”

Showing these ideas in mind, its safe to convey that no-one knows without a doubt whether the crypto market will recover or even go downslope from here. Consequently , it is under your control as an buyer to identify a method that works effectively for you and stay with it.

So how exactly does The 4 year Cycle Arrived at Play?

How can The 4 year Cycle Visited Play

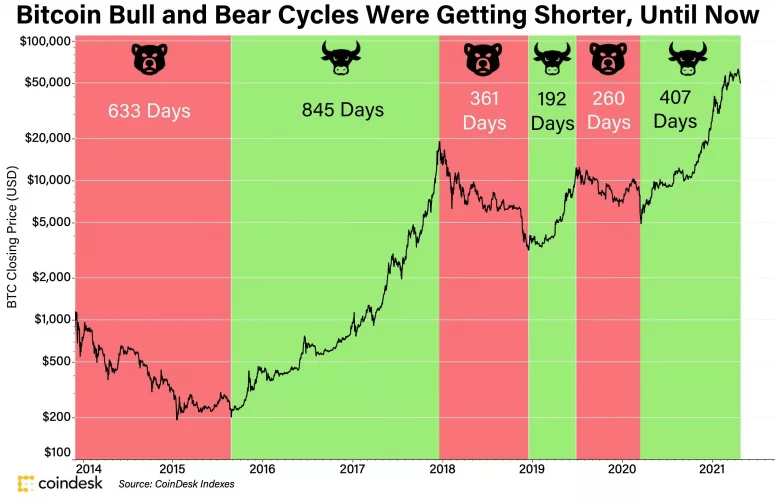

Traditional Bitcoin half truths and endure cycles (Source: Coindex Index)

Taking a look at the historic price tendency of Bitcoin, it is easy to determine a repeating pattern. Often there is a 4 year build-up to some new cost peak. Following a bear marketplace of 2018, avid Bitcoin proponents anticipate the price of the particular digital resource to maximum in the shutting months associated with 2021 or even early 2022. The current marketplace condition will not resonate along with historical cost patterns. And thus, it is easy to understand why some think that the price of Bitcoin would come back quickly and place up unparalleled price motions for the rest of 2021.

Cowen captured this specific train regarding thought when discussing each possible cases that could trek present industry conditions:

“What I would tell you is without a doubt I think you will discover two key trains involving thought below. The first one currently being the 4 year cycle. In addition to that circumstance, if you’re expecting typically the four-year spiral to play out and about, then you may possibly expect a reasonably large bounce in order that we get spine on track. To enable us for those rather high statistics by the 3 rd quarter or perhaps fourth 1 / 4 we need to have a bounce comparatively soon in order that we get spine on track. In order that would be if you consider it’s planning to peak this coming year. And the different one of training would be the prolonging cycles. And also this one would are more along the lines of convinced that it’s planning to take a touch longer and this a reaccumulation phase will not be the most detrimental thing in the world relating to Bitcoin. ”

Although the 4 year cycle is a huge recurring subject in the crypto market, the industry has changed greatly since the previous bear industry. For one, institutional investors contain entered the industry en masse. Consequently, there is no declaring if the 4 year cycle nonetheless holds.

How to overcome The Current Crypto Market

There are numerous ways to deal with the unpredictability of the costs of electronic assets. These types of measures usually are critical within a market routine such as this. Listed here are some of the methods you can implement as a dealing mechanism.

Buy The Dip

Buy The Dip

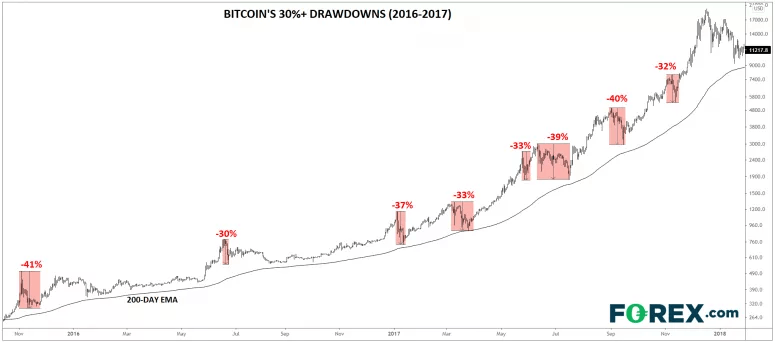

Bitcoin’s 30%+ price dips (Source: Forex.com)

Typically the sudden along with prices is often a blessing throughout disguise to the interested in investing in more Cryptocurrencies. Purchasing the dip comprises calculated ways to purchase electronic digital assets if they are experiencing modifications. Hence, typically the $30, 1000 Bitcoin price tag low captured recently has been the best access point for buying typically the dip. In case the value of Bitcoin recovers together with subsequently is higher than its $64, 000 perfect high, consequently those who acquired the drop would come through as some of the most extremely profitable shareholders.

Dernier-n� Cowen explains to you a similar opinion as he states that the found market circumstance provides adequate opportunity to reaccumulate Bitcoin:

“What I would state for this period is that Bitcoin is being really gracious. And exactly what it’s possibly allowing individuals to do will be reaccumulate prior to a progress later on this particular cycle to that particular six-figure mark… It enables these [new] guys to obtain it in a discount… Within the grand plan, if you’re operating fairly deterministically with this problem on a six-figure Bitcoin later on this period, something beneath $40, 500 isn’t the particular worst cost in the world. Additionally, it depends on your own risk threshold. It could very easily continue to fall. And that’s why I believe a DCA (dollar-cost average) strategy is among the most appropriate technique for Bitcoin. ”

Before starting buying the drop, you should even so ascertain the most effective entry point. Mentioned previously earlier, it is actually too early to look for the long-term price tag movement involving crypto solutions following the maintained downtrends. Consequently , buying Bitcoin at $30, 000 could prove to be whether wise or perhaps foolish selection in the long run. A very cautious route to this challenge is the dollar-cost average tactic.

What is dollar-cost averaging?

Dollar-cost averaging is actually a measured make an work to make routine and fixed acquisitions of an property to negate the impact involving volatility. Basically, you put in a specific amount in a very digital property at repaired intervals. This kind of eliminates the advantages of investing with the best access point. Also, scattering your financial commitment across repaired intervals minimizes the risks linked to lump-sum acquisitions.

As an example, if you plan on investment $1, 1000 in Bitcoin, you can stretch your expenditure across four weeks. In weekly, you will sow $250 no matter the changes in the associated with Bitcoin. Utilizing this, it is possible to capitalize on price scoops. The more the buying price of Bitcoin scoops, the more earnings your dollar-cost average tactic generates. Basically, dollar-cost hitting is the ideal expenditure model to receive bear market segments or expanded periods involving price modifications.

More over, it swiftly loses their potency in the event the price of typically the asset is normally recovering or perhaps exhibiting indications of a half truths cycle. Having each acquire, you normally buy the advantage at a a little bit higher pace. In the end, you'll notice the potential revenue is lower than you could have manufactured if you had used a huge in the electronic digital asset.

Hodl

For people who do not have additional funds in order to throw at the particular crypto marketplace, the next reasonable step is always to hold their particular positions till prices restore. Although this is simply not as easy as this might sound, it is the just way you are able to protect your self from long term losses. There exists a strong chance that the crypto assets would likely recover and also outperform their particular current top prices. Therefore, it is common feeling to weather conditions the price modifications and sell only if the value of the particular asset features recovered. Loss become permanent when you choose to sell your own holdings under your price.

Nevertheless , note that you will not accurately anticipate how long it will take for your market in order to rebound and begin yielding income. For example , it was a little while until roughly two years for traders that got bought Bitcoin at $18, 000 within 2017 in order to recoup their particular investments. Therefore, it could consider weeks, a few months or yrs, for Bitcoin to retest the $60, 000 level. So , should you be opting for the particular hodl choice, then be ready to maintain your location for the long haul.

When you are at this, ensure that the particular digital investments you are committed to are ready for long lasting viability. Only a few cryptocurrencies that will made a new splash within the bull pattern of 2017 are still appropriate today. If you owned at one particular point and also the other committed to a gold coin with vulnerable fundamentals, you might not likely recover your investment decision. This is true within a scenario where you might have to await for years for your crypto marketplace to recover. Consequently , before you decide to hodl, ensure that the particular cryptocurrencies that comprise your collection are practical enough to survive a suffered bearish work.

Switch To Stablecoins

Stablecoins are the key source of steadiness in the customarily volatile crypto market. These kinds of coins can be pegged to be able to traditional tools or redbull currencies and tend to be unsusceptible to be able to volatile price tag movements just like the one experienced just lately. As such, it is about as hardly surprising that there is invariably an uptick in the with regard to stablecoins in the course of periods an excellent source of price changes. Paolo Ardoino, CTO involving Tether, emphasized that will excessive unpredictability often makes investors to maneuver their money to the stablecoin market:

“During these excessive episodes, we’ve historically witnessed an uptick in stablecoin activity, built evident by simply Tether’s new US$60 billion dollars milestone for the reason that demand developing. Events such as even help the ecosystem’s strength that help everyone redouble back to making rather than the muddinessconfusion of expression price income. ”

Thus, it is okay to exchange your volatile coins suitable for stablecoins and even wait the actual storm. You could switch when there is various level of quality regarding the initial and long term movement involving crypto rates.

Even though stablecoins can be proven glasses against unmatched volatility, there is also their own bed sets of downsides. The most visible is the enhanced regulatory overview of stablecoin activities. Employing regulated redbull currencies for the underlying peg for a stablecoin is bound to captivate the attention involving regulators. As well, not all companies are translucent about their treatments.

To stop all the governance and detailed controversies linked to centralized stablecoins, you should select established decentralized stablecoins just like DAI.

Isolate Promising Digital Assets

Isolate Promising Digital Assets

Often, it is time and even resource-intensive to separate your lives viable crypto projects via mediocre kinds, especially in a new bull industry. Entrepreneurs and even developers happen to be constantly taking advantage of various crypto trends to sell their products. It is more noticeable during half truths cycles when investors tend to be prone to afin de funds to the crypto industry indiscriminately. It's understandable that this undisciplined purchase strategy motivated the half truths market inside 2017 and even resulted in typically the explosion regarding initial endroit offerings (ICOs).

Within the aftermath from the market accident at the beginning of 2018, we started to witness the particular extent that scammers incompetent business owners or designers had profited off the ICO boom in the expense associated with investors. Just a handful of the particular crypto tasks that surfaced during the levels of this expense frenzy continue to be operational. And thus, it is a great deal easier to distinguish between badly conceived crypto projects viable types when the companies are relatively silent.

Consequently, this market collision provides a eye-port to reflect on the market, distinguish hidden jewels, and sow at all their early level of improvement. The target is to find out beyond typically the hype together with accumulate several crypto solutions as you possibly can. Be aware that this requires some sort of long-term financial commitment strategy. It is actually almost impossible to be able to predict the length of time it would have for these bridal party or loose change to generate extraordinary returns in investments. Therefore , once you have done due diligence together with confirmed typically the long-term stability of the electronic digital asset, you could have to with patience wait for that to generate important yields. You may well be wondering: Precisely how then will i know definitely that a crypto token is without a doubt viable?

Find out how to identify feasible crypto assignments

Be familiar with utility within the product

Really for crypto startups in order to jump with trends with no really creating new paradigms that could fixed their products a part or attract a broad visitors. The quality of the particular utility of any crypto merchandise has a robust bearing about its long lasting valuation. Therefore, invest reliably by taking you a chance to understand the operation of the task, what it has, and how it could improve current systems.

The good news is, a majority of crypto projects really are open source. Basically, you can exam the process independently to verify that there are not any bugs or perhaps other technological issues that may undermine typically the viability belonging to the product. Even though researching fresh crypto assignments, you should travel as far as researching them with present solutions or perhaps other tournaments. If there is not any obvious advantages that this cool product offers, therefore there is a 0 % chance it can easily make a little in an previously saturated market.

As well, confirm that typically the lofty desired goals set because of the development workforce are doable. It is better to be able to opt for assignments with sensible solutions in order to go for people that have unproven together with bogus architectures.

Check the development team’s reputation

When you must have determined the tool of the merchandise, the next step consists of the detailed research on the development staff. Not only is it a good idea to choose jobs headed simply by reputable stats, but it is additionally important to recognize how their particular experience in addition to expertise impact the growth possible of the task. You must make sure that the people who make up the enhancement team usually are versed within the realities with the targeted market.

You will find a limit towards the impact an item can make if those responsible for steering the development absence the experience in addition to skills needed to maneuver continuing limitations.

Opt for functioning products

Mentioned previously earlier, don't just base your choice on the benefit of the solution. You need to go one step further to verify that it is not only wishful considering. The best way to prevent projects that could later remain in the advancement stage would be to opt for online companies that curently have working items. It is simpler to gauge the particular viability of the project in case its item has already scaled the early phases of advancement. With this, about to catch basing your choice on guaranteed deliverables yet functioning techniques.

Earn Crypto Passively

Throughout a prolonged value correction, you'll want to accumulate cryptocurrencies by buying the particular dip. Nevertheless , if obtaining is not in the cards, you may as well locate means of creating crypto profits. For example , you may apply for roles in firms that pay for their staff in cryptocurrencies. With this, you'll want accumulated sufficient digital belongings by the time the following bull pattern begins.

A second possible income-generating opportunity particular to the crypto sphere might be staking. Below, you freeze or agree your crypto holdings in blockchains becoming a validator together with earn freshly minted silver and gold coins as incentives. Then you will find the option of loaning out your crypto for the probability of earning fascination. This approach is now popular within the last couple of years, due to emergence involving both central and decentralized lending networks.

Finally, you can participate in bounty marketing promotions, referral applications, and airdrops. All options usually are avenues in which you can earn cryptocurrencies for free. You merely need to whole specific responsibilities like mentioning a product on your family and friends, pursuing an account around social media picked platforms, retweeting posts, etc.

Nevertheless , while looking for ways to make passive crypto income, keep in mind that there are several dubious entities on the market trying to deceive you of the money or even steal your computer data. Hence, in case it is too good to be genuine, then it is most probably a scheme to deceive you. While appealing while crypto is usually, it is not the get-rich-quick structure. Anyone that claims you anything at all different may perhaps be looking to grab from you. Therefore, it is advisable to place your avarice in check any time dealing with cryptocurrencies.

Get involved with Crypto’s Enhancement

Anytime the value of crypto assets is not any more the particular talking points, programmers and the crypto community staff tend to emphasis more on their technical improvements. Hence, a new sustained value downtrend gives crypto individuals the opportunity of obtaining more active in the industry. You can begin by broadening your knowledge on the crypto surroundings. Learn about recently introduced principles and how they might improve the everyday lifestyles.

You may as well help the governance regarding decentralized methods. This requires typically the acquisition of voting rights as governance bridal party. In addition to ordering these bridal party, you can participate in governance division programs to be able to earn a new share of your token also have a claim on the way forward for the job. Note that a lot more people are mixed up in governance regarding such methods, the more decentralized they become.

Try The Traditional Asset Markets

Virtually anybody . that not everyone seems to be cut out to the wild selling price swings connected with digital properties and assets. Some don't just have the cravings for hazards required to outlive a 60 per cent price collision. And so, in this set of men and women, the only rational way of future a market static correction of this size is to get of the crypto market and even stick to advantage markets which are not prone to unnecessary volatility.

Professionals believe that the particular stock market may likely benefit from the current price accident as traders are likely transitioning their interest from risky assets in order to traditional possessions or stocks and shares poised to see price enhance due to the raising of lockdown restrictions. Consequently , if it is conventional asset marketplaces that are perfect for your danger appetite, do it now.

CONCLUSION

Simply because highlighted through this guide, typically the possible long term effects of typically the recent crypto crash are definitely not set in stone. Count on the market to be able to either bring back and proceed from where it prevented or vocational sideways for a short time before assessing new levels. Depending on the situations, it is advisable to fully understand the movements of the crypto market make up feasible strategies for handling unexpected crypt crashes.

This particular entails typically the reassessment involving one’s threat appetite along with the adoption involving investment approaches designed to help lessen and handle the impact involving unprecedented downtrends.