Half a dozen Cryptocurrency Deals to Keep a close look on throughout 2019

Lots of will be delighted to see the back side of 2018. 2019 has technically arrived and even investors and even traders the same have fresh price estimations, hopes, and even dreams. Rates always rob the demonstrate but the deals play a crucial role inside bringing of which show to be able to us. There are a few big trends scheduled to happen in the change ecosystem inside 2019. Many of us present the real key players to help keep an eye as well as the key days to take note of inside your diary

1. Bring on Bakkt

The highly anticipated Bakkt exchange is defined to introduce in 2019. The alternate was at first scheduled to be able to launch throughout 2018 ahead of being sent back to Jan 24th. It includes now recently been further late and at the moment has an unstable launch night out. One of the main reasons of which Bakkt might be generating a lot of hype is caused by it simply being backed by typically the Intercontinental Alternate (ICE), typically the parent enterprise of the Nyse. The first product or service planned for being launched in Bakkt will be first ever yourself delivered bitcoin futures plans. This means that if the financial options contracts contract runs out, holders are getting their settlement in bitcoin instead of CHF. The later arrival involving Bakkt – whenever that will be – could mark typically the arrival of an considerable amount of institutional investors to be able to cryptocurrencies. Things that Bakkt are taking – such as expecting approval from CFTC (a regulatory body system for futures) for the goods it ideas to introduce. – should build a even more regulated environment far more attracting institutional shareholders.

2. Enter ErisX

Some other highly awaited exchange having to attract institutional investors is normally ErisX. ErisX is being introduced by Eris Exchange, the exchange running since the year of 2010. ErisX ideas to unveiling both location and options contracts products to have cryptocurrencies. The same as Bakkt, ErisX is also expecting approval in the CFTC ahead of launching many so to construct a regulated stock trading environment. ErisX has developed significant relationships with previously regulated choices including TD Ameritrade along with the Chicago Aboard Options Change. The spot tools are planned being launched throughout Q2 involving 2019 even though the futures tools are planned being launched inside the second 50 % of 2019.

3. What about Binance?

Binance only introduced in 2017 and swiftly became the greatest exchange by simply trading level. 2018 was obviously a big period for Binance. The hq for the enterprise moved to Fanghiglia. The main rider for this act was the Maltese government setting up a regulatory system for businesses with the cryptocurrency and blockchain space.

Binance also launched their first crypto-to-fiat exchange in the course of 2018. Typically the exchange premiered in Uganda and encourages trading amongst the Ugandan Shilling and bitcoin or azure. There are also strategies to unveiling an change which will help in trading amongst the Euro and even Swiss Droit with important cryptocurrencies. A new fiat change in Singapore has also been having testing. This activity inside the fiat-to-crypto room gives rise to an intense possibility of which Binance may well claim a tremendous share of your fiat-to-crypto industry in 2019 and adopt major deals such as Coinbase.

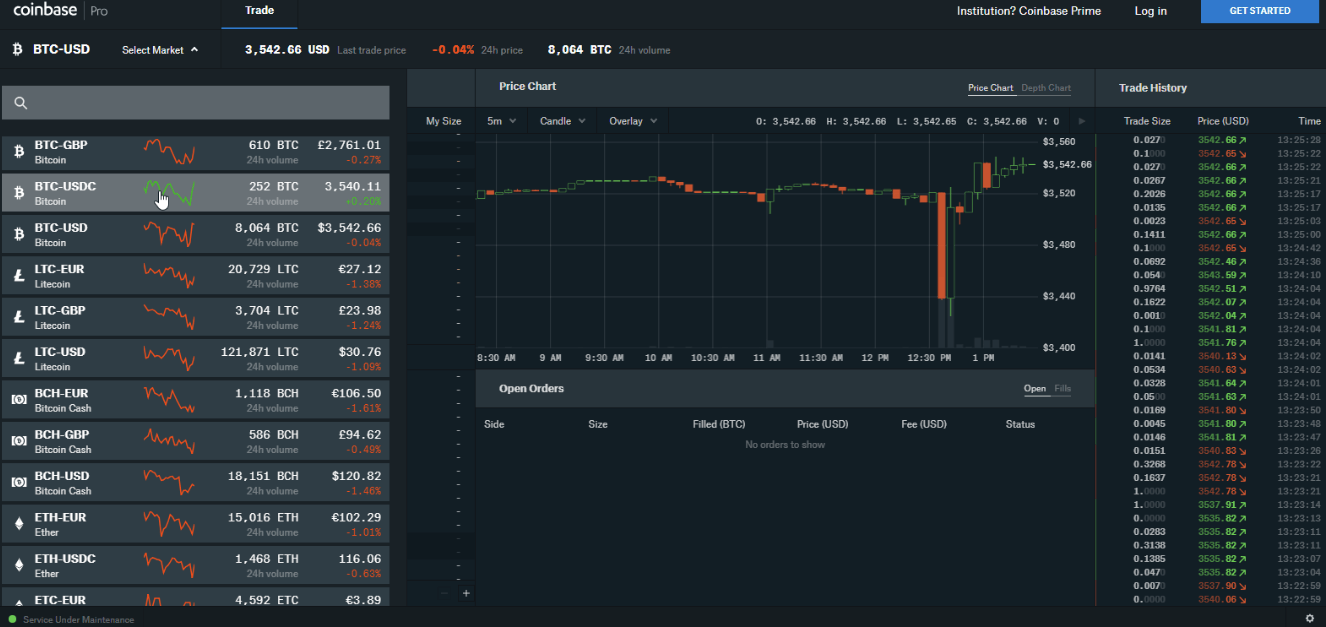

4. More Cryptocurrencies for Coinbase?

Talking about Coinbase, the policy when considering listing cryptocurrencies changed visiting the end involving 2018. Coinbase set up some sort of structure where any job could sign up for have their cryptocurrency or expression listed in Coinbase. For years, there was simply a small number of cryptocurrencies listed in Coinbase. This kind of included bitcoin, ether, bitcoin cash, litecoin, and at some sort of later level ether common. However , typically the listings sped up as 2018 was overall with 0x Project, Standard Attention Expression, Decentraland, Social, Loom Community, and Golem all classified by the final 1 / 4. More seo backlinks are looking probable for 2019!

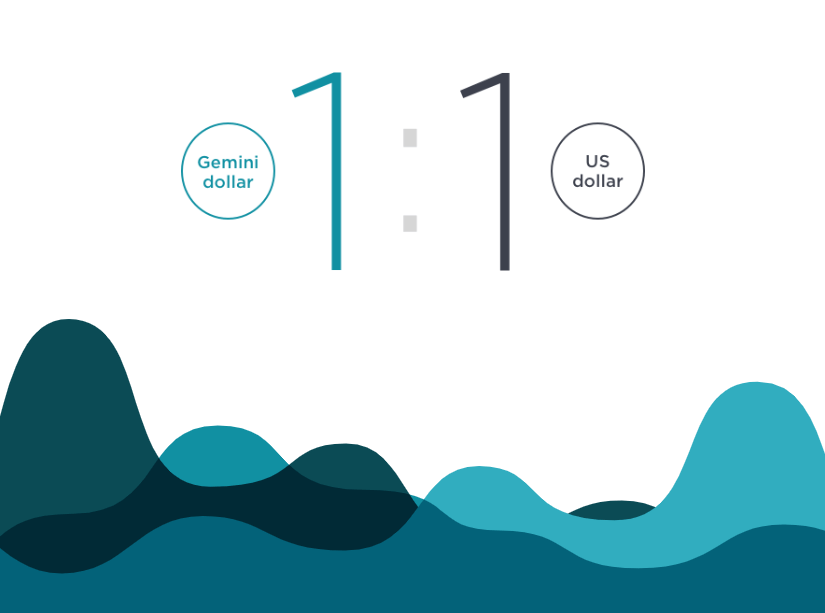

5. Gemini Gearing up for Anything Else?

Gemini also built some shuffles in 2018. They introduced their USD-backed stablecoin – the Gemini dollar. Typically the dominant stablecoin remains CHF Tether irrespective of increasing numbers of controversy. 2018 was a thrashing year of USD Tether. The company lurking behind the stablecoin – Tether limited – finished the relationship with the auditor early on in the year. Tether also did not hold it is value to be able to USD fatal crashes to zero. 85 every USD throughout October. By using Gemini setting the Gemini dollar in a FDIC covered by insurance bank that is definitely audited, it's going to interesting to verify that it can task Tether with the number one CHF stablecoin location.

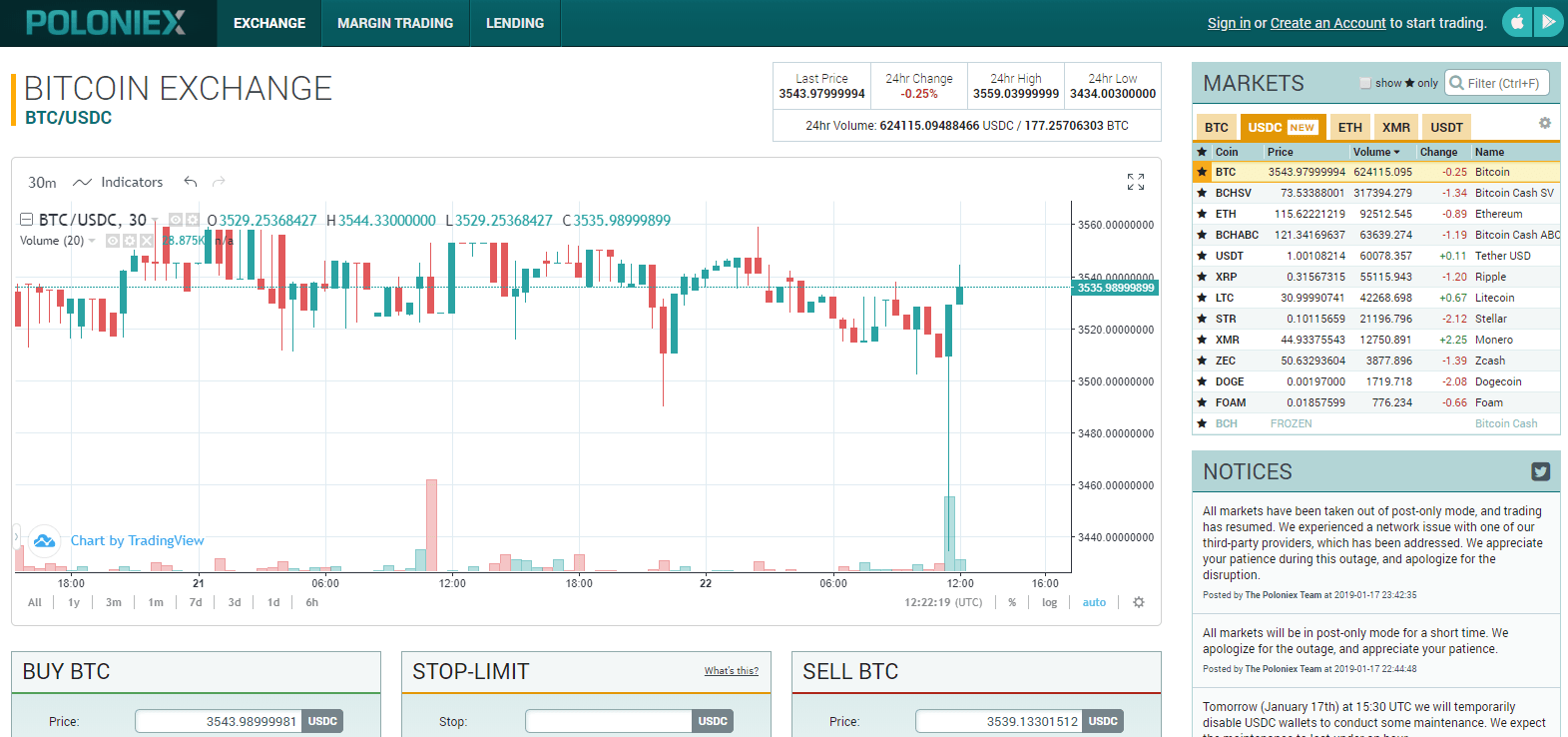

6. What is Poloniex Planning?

Earlier in 2018, Poloniex has been acquired from the Goldman Sachs backed organization Circle. There was clearly a lot of discuss what this could mean intended for Poloniex however, not a lot offers happened given that. It is possible Poloniex was attained for the sake of simply adding an additional company towards the balance sheet. Nevertheless – in case cryptocurrencies begin being delisted rapidly through Poloniex in the past year – some thing bigger might be in the functions. Delisting cryptocurrencies may imply that they are thinking about venturing Poloniex into as being a fiat-to-crypto exchange.