Fresh Research Best parts Volume Treatment From Major Cryptocurrency Deals!

Just lately released explore by CoVenture, an alternative property manager which has a division specializing in cryptocurrencies, contains highlighted that any of us cannot put your trust in the volume individuals we see in exchanges in a very lot of conditions. The history delved in different ways of which exchanges synthetically pump up the transaction volumes of prints. The history was made using files and explore compiled right from CryptoCompare, CoinOne, and the Blockchain Transparency Commence.

Who are the main culprits?

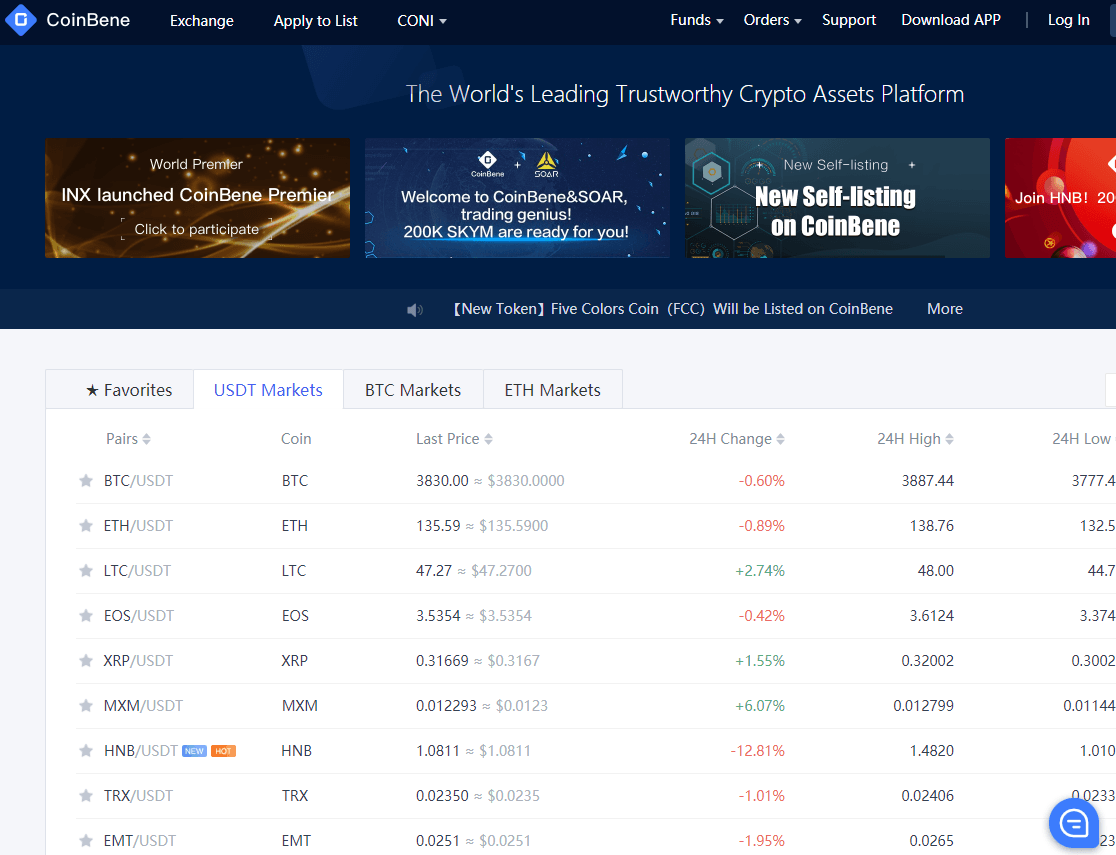

Several exchanges that happen to be commonly top among the exchanges by simply trading volumes of prints on CoinMarketCap are already identified as having less than 1% of the reported volume level as being real volume. A few of the exchanges pointed out in the state for having sketchy volume would be the following:

- Bithumb

- ZB

- CoinBene

- EXX

- Fcoin

- OKEx

- OEX

What are ways that typically the exchanges shape their level?

The primary way that will exchanges may artificially fill their quantity is via wash investing. Wash investing is efficiently the trade buying and selling their very own products providing to pump upward their quantity figures. Clean trading is definitely an illegal exercise in the conventional markets however the lack of rules for cryptocurrency organizations has made that possible for deals to execute this training without any consequences. It is difficult to be able to prove rinse trading exist but many factors can produce a strong advantages of showing deals conduct this kind of practice. Variables such as a large number of API trades going on, lack of movements despite a very high number of tradings, and duplicated trades going on at the same price tag are all a sign of rinse trading.

The second way that Cryptocurrency exchanges can be artificially pumping up their level is a quite recent phenomenon often known as transaction service charge mining. Commonly, exchanges make money using taking a service charge from dealers when they spot trades. Purchase fee exploration has turned this model in its brain and has essentially compensated dealers in the deals native expression for making positions. The standard trading charges are gathered in crypto or fedex but the investors are later reimbursed within the native symbol of the swap. Traders are usually reimbursed excessively. For example , an investor may be returned 120% associated with what they compensated in investing fees. This gives traders having a greater motivation to make a large number of investments. The state noted that will 12% associated with cryptocurrency trades had a deal fee exploration model. A few examples of trades that utilize this model usually are CoinBene in addition to Bit-Z.

It might be worth remembering that deals will often have their unique proprietary stock trading desk where they can cash in on the activities that be held on the alternate. Exchanges sometimes claim the cause of the existence of these kinds of proprietary stock trading desks will be to add fluidity to the alternate. However , typically the proprietary stock trading desks can frequently make a lot of earnings and have the good thing about being able to make use of data definitely not accessible to normalcy users for the exchange.

Precisely what are some options that can be used?

CoinMarketCap remains to be the most popular method to obtain information in addition to data about cryptocurrencies. Nevertheless , CoinMarketCap comes with exchanges that will conduct clean trading in addition to transaction cost mining within their rankings. CoinMarketCap makes zero adjustments to the reported information and does not symbol the trades which use the particular transaction cost mining unit.

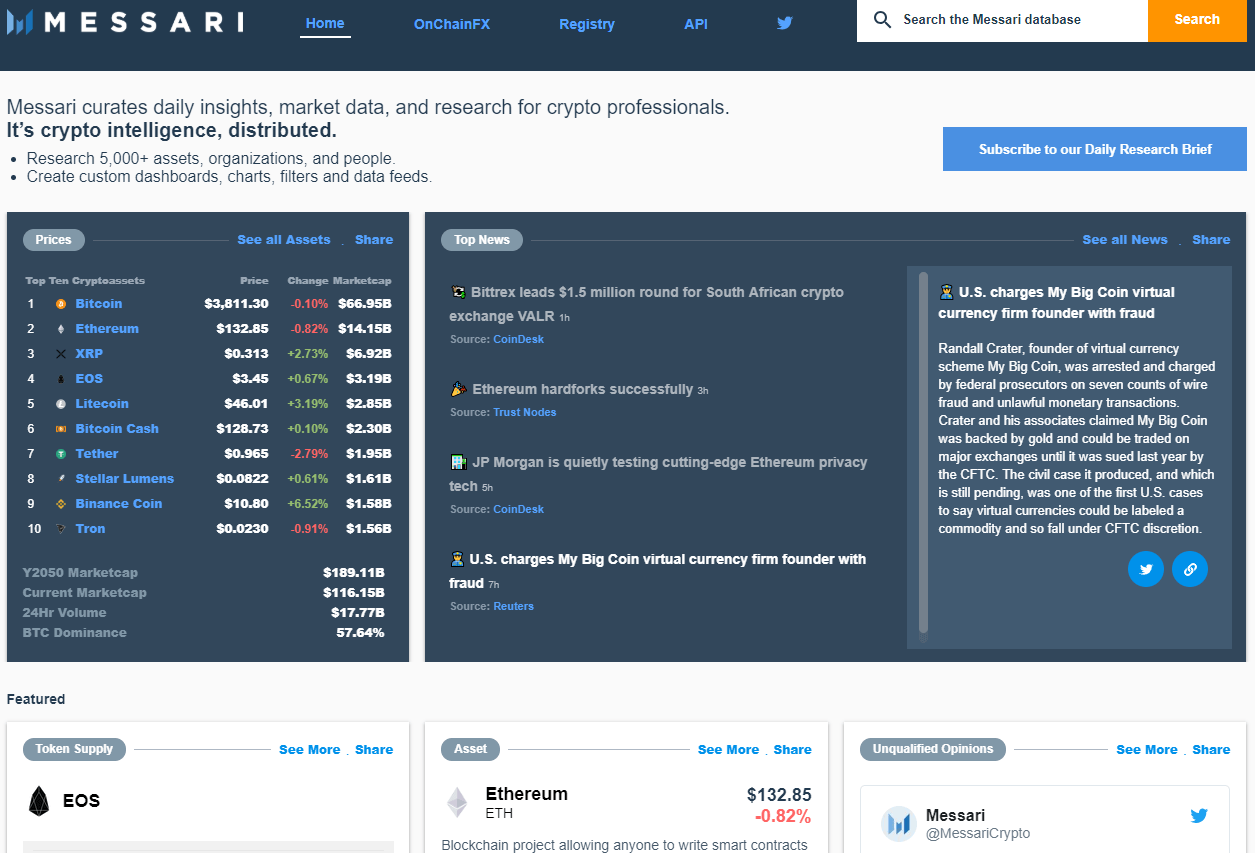

There are several alternatives that may be considered besides CoinMarketCap. Many data suppliers clearly take note the trades which have deal fee exploration. Others for example Messari make adjustments to many of their investing figures.

There has been also a selection of exchanges which are noted to acquire high numbers of liquidity. Typically the exchanges to acquire been taken into account to be the a lot of stable from report by using most appropriate volume individuals were our next:

- Bitstamp

- Kraken

- Bitfinex

Everthing else interesting from report?

Typically the report in addition mentioned investigate spanning out of December last year to The spring 2016 of which found some sort of statistical bring between bitcoin returns and even volume rates. However , newer figures out of research comprising from 12 , 2016 to be able to March 2018 shows that typically the statistical bring has split up. The the latest research in addition analysed if there was a keyword rich link between USD Tether issuance and bitcoin returns. Though it was came across that the issuance of tether has a smaller impact on stock trading volumes throughout bitcoin together with tether themselves, the effect might be short-lived and possesses no connection to bitcoin rewards. This was an appealing finding for the research several analysts need referred to typically the issuance involving tether for a key factor affecting price effectiveness.

What can I do?

Almost, there are a number regarding good takeaways which can be extracted from the research. That proves of which any amount figures needs to be taken using a grain regarding salt. Typically the bitcoin rule of “don’t trust, verify” stands solid in light of the research. Probably the most important considerations to take into consideration when choosing a good exchange will be liquidity. Investing on an illiquid exchange presents a high likelihood of volatile cost movements. Because of this, the most useful piece of advice which can be taken from the study is to select the exchanges which have built up a substantial reputation through the years. The research mentioned that 4 of the 5 exchanges which are likely to be confirming actual quantity were available since 2014 at the most recent. The 5th was Binance.