How Different is Bitcoin from 2017?

Unpredictability has reentered the price of bitcoin but just how different is definitely the network by when the value surged inside 2017? We all break down the particular metrics that will quantify just how strong the particular bitcoin system actually is.

Quick take;

- The price tag on bitcoin is certainly starting to raise at a rate similar to the thing that was observed in 2017

- the Bitcoin network nowadays is far more protected than the one out of 2017 with increased hash charge and a higher distribution associated with hash charge in the exploration market

- Innovations built over Bitcoin applications meant for users also have had a incredible progression in the last two years

The price tag on bitcoin may be on the rise seeing that Consensus few days comes to an in depth. The last moment we viewed prices rising at this kind of fast pace was your speculative zest of 2017. Many are informed of 2017 as double-digit increases have been recorded inside the space of your day through the week.

The cost increases associated with 2017 had been both the good some a bad coming back the crypto industry. On the other hand, the price boosts gave cryptocurrencies mainstream interest. On the other hand, several poor tasks launched during this period that have considering that failed together with countless traders losing money.

A whole lot has changed because the last trend of high movements. The particular metrics driving a vehicle the health of the particular network, frequently called principles, are in a new far unique state these days than we were holding in 2017.

Technicals versus fundamentals

Basics are metrics that provide info on what the system is actually giving and how robust the system is. Offered the early period of the crypto markets, it truly is questionable simply how much fundamental metrics actually enjoy into value.

Concepts play a remarkably important role much more mature market segments such as equities. Over more than 100 years, analysts allow us valuation units for equities based on these kinds of fundamentals.

These kinds of models price equity using the fundamentals actual it. Experts typically definitely will agree above the model although argue above the input starting the style.

Because of this , that a share price may adjust for the earnings statement is not exactly what analysts approximated it would be. The particular valuation rapidly adjusts in order to reflect diverse fundamentals compared to were approximated.

Crypto markets are typically in a much before stage as compared to equities market segments and principles play a new far less natural part in value. Analyst Frank Burniske regarding Placeholder VC has been delivering some of the initial work in getting valuation products for crypto networks involving fundamentals to be able to calculate an amount.

Nevertheless , Burniske possesses noted that will such value models stay rudimentary. Because it stands, the first stage on the crypto marketplace means its much more controlled by the risky sentiment regarding traders in addition to investors.

Complex technical analysis is the instrument of choice amongst crypto marketplace participants. This type of analysis works well for identifying the particular direction of any trend in addition to gauging the particular sentiment regarding investors.

It is additionally a popular choice amongst retail buyers which consist of the vast majority of the particular cryptocurrency market. As opposed, equity market segments are typically made up of mostly institutional investors designed to use far more enhanced models to steer investment decision generating.

Nevertheless , as the crypto market continually mature, principles are expected to experience an increasingly natural part. Burniske foresees analysts converging on recognized valuation types for crypto networks continuing to move forward. While it got hundreds of years to travel to this point within the equity marketplaces, Burniske thinks it will take place orders regarding magnitude quicker in crypto.

The Fundamentals of Bitcoin

Despite the presence of the trend-based nature involving crypto industry prices, concepts play a major role throughout quantifying what exactly crypto sites actually furnish. One of the most significant fundamental metrics for proof-of-work chains just like bitcoin is a hash fee deployed in the network.

the hash rate is known as a measure of the amount of computing vitality can be deployed in the network simply by miners competitive to add transactions towards the blockchain. A better hash amount makes the system more expensive in order to attack.

Hash rates can not be compared among different proof-of-work chains because they typically make use of their own exploration algorithm however it can be useful for evaluating the development of hash rate with time.

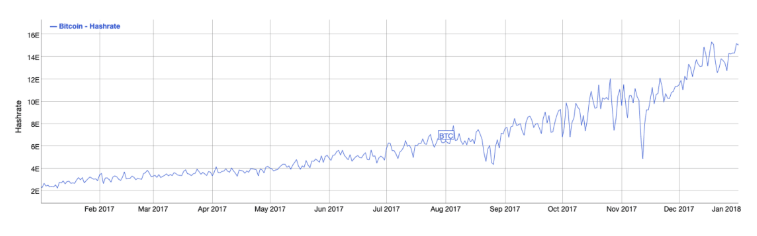

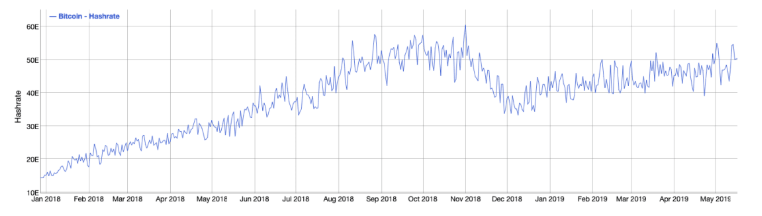

Typically the hash cost in 2017 ranged from installment payments on your 4 EH/s to a a lot of 15. 0 EH/s which has a gradual maximize taking place in the year. Typically the hash cost has more as compared to tripled subsequently with existing figures currently being around 65 EH/s.

A very high of approximately 58 EH/s was written in The fall of 2018 nonetheless a sharp shed in the rates led to some sort of drop throughout miner earnings. This lead to huge amounts of miners coming off the internet.

Yet , the hash rate implies little whether it is overly centered in a small lots of entities. In the event that an entity possesses 51% of your hash pace, they can implement double pay out attacks and in addition carry out deeply reorganizations of your blockchain.

An excessive amount of concentration associated with hash electrical power makes the system vulnerable to some entities carrying out these strikes. The risk of an excessive amount of concentration within the bitcoin system is also higher together with Bitmain proudly owning AntPool in addition to BTC. possuindo as well as becoming an investor within ViaBTC.

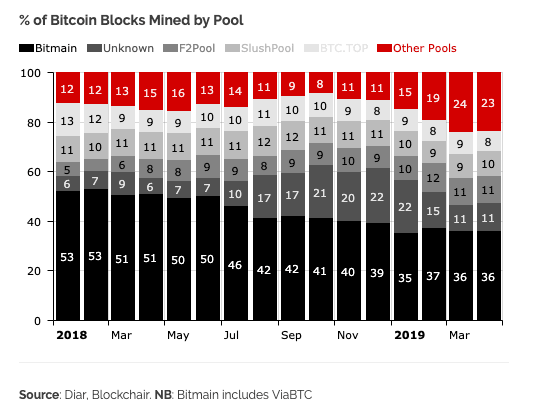

Inside 2017, Bitmain controlled roughly 50% on the hash amount. Recent exploration finds how the control of hash rate is diluted at this point than it had been in 2017.

The particular share associated with hash charge controlled simply by smaller exploration pools features almost bending since this past year while the reveal of hash rate manipulated by Bitmain-related pools features decreased coming from ~50% in order to 36% within April. This particular demonstrates the Bitcoin system is not only anchored by a higher amount of hash power nonetheless it is also taking advantage of a greater level of concentration.

On-Chain Bitcoin Fundamentals

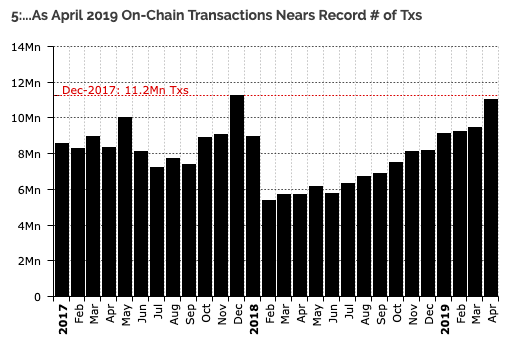

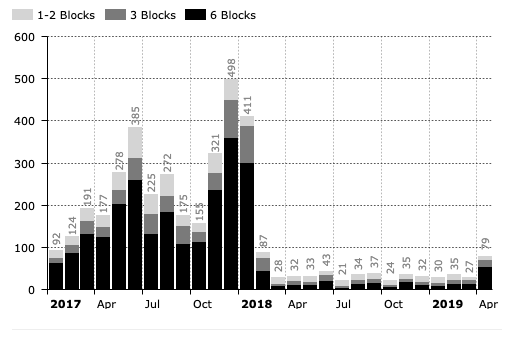

As the hash level has increased, the amount of transactions getting recorded on the particular Bitcoin blockchain has become below report figures. Nevertheless , the on-chain transactions noted in 04 have been going back near top levels.

A specific area which has increased is the charges paid. The above mentioned graph shows that the quantity of satoshis compensated per octet transferred is usually far beneath levels seen at the final peak.

Developments

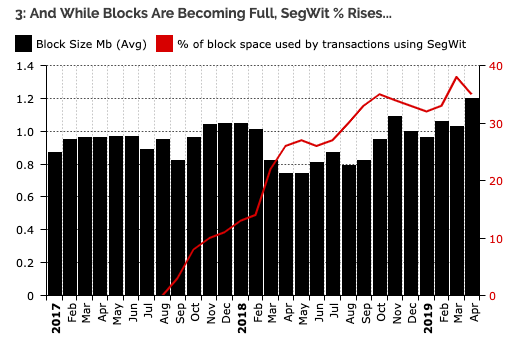

A primary reason noted with the lower charges observed could be the launch in addition to adoption associated with SegWit. The standard block dimensions are currently one 2 Megabytes with the present percentage associated with SegWit allowed blocks extracted estimated to get 35%.

SegWit was a questionable development within the bitcoin process that was applied via a soft fork inside 2017. Typically the soft hand was not and so controversial but you may be wondering what preceded it absolutely was.

Before implementation regarding SegWit, there initially were years of discourse and question regarding the rendering of SegWit along with a wedge size raise via a hard fork. This specific debate finally culminated considering the hard hand of Bitcoin Cash in September of 2017 which integrated a wedge size embrace their cycle split.

In the original Bitcoin chain, SegWit has been maximizing in embracement levels the latest Bitcoin Core up grade is also continually pushing miners in direction of updating to guide SegWit local addresses often known as bech32 deals with. It is presumed that Bitcoin Core might default to be able to being SegWit enabled by simply as early as up grade 0. nineteen. 0. The most up-to-date upgrade was basically 0. 16. 0.

Second Layer Developments

SegWit is mainly a new development focusing the scalability of the Bitcoin blockchain. Next layer remedies have also developed immensely seeing that 2017.

the Lightning Network is really a protocol which often facilitates the starting of bidirectional payment stations on top of the particular Bitcoin system. The process enables customers to send costs quickly using minimal costs. While not like secure like transferring through the Bitcoin blockchain, the particular protocol will use the Bitcoin blockchain like a settlement coating.

The particular Lightning System was still within an extremely earlier phase within 2017. They have since obtained much greater interest with much more developers teams focusing on the process. Circle Analysis reports within their Q1 2019 overview the number of stations opened value organised within these types of channels each increased totally in the very first quarter associated with 2019.

The particular Liquid sidechain is another 2nd layer alternative built together with Bitcoin. The particular sidechain premiered in March 2018 simply by Bitcoin progress company Blockstream and also allows low cost and quick transactions to happen.

The liquid is essentially some sort of blockchain designed on top of typically the Bitcoin community with different attributes and functionality than the Bitcoin network. Just as the Lightning Community, the The liquid sidechain doesn't have a the same promises as the Bitcoin blockchain nevertheless it is locating a strong apply case between companies that want to execute fast together with efficient moves.

Bitcoin User Applications

Apps that customers can use to employ the Bitcoin protocol have been at a a lot more rudimentary level in 2017 than they are really today. While using the growth of typically the crypto marketplace, several companies contain spawned to build using bitcoin a much less complicated process. Approximately the past months, Gemini seems to have launched a product or service that enables consumers to spend all their bitcoin having major organizations. Microsoft in addition announced that will have them building the identity management on top of Bitcoin.

We could also finding a finance market being developed based on bitcoin. BlockFi released their interest-earning deposit credit card where members can gain interest about bitcoin placed.

Can Bitcoin Continue to Increase?

Most likely the price of bitcoin will satisfy many parts of selling stress between at this point and its earlier all-time levels. However , a glance at the fundamentals signifies that the system is in the significantly better position at this point than it had been in 2017. Projects for example Lightning Network that have been at a basic phase within 2017 have experienced an enormous progression. The particular network by itself is also a lot more robust having a greater hash rate assisting it along with a greater submission of this hash rate.