Eco-friendly Bitcoin Plus hash Level Migration: A new start For Bitcoin Mining

Certainly, mining hobbies will can quickly play a vital part in the Bitcoin economy for that very long time. So, it comes simply because no surprise of which Bitcoin exploration has invariably come being doubted whenever typically the sustainability involving Bitcoin will be discussed. Whenever we are not guarding the energy utilization rate on this hardware-intensive functioning, then most of us most certainly will probably be dissecting typically the regulatory significance of paying attention mining hobbies in a certain jurisdiction.

In a few rare circumstances, as we have seen in the last month or two, these two current narratives show the spot light to the discompose of Bitcon’s reputation Similarly, the bitcoin mining economic system is faced with a barrage regarding criticism due to the carbon impact. At the same time, it offers had to reshuffle amid a continuing crackdown inside China. Clearly, these two concerns have written for the expanding uncertainties regarding not just typically the Bitcoin exploration ecosystem but in addition the entire Bitcoin economy in particular.

Here, I will go over the visible impacts of an strained Bitcoin mining financial system, the conceivable long-term outcomes, and for what reason the situation is absolutely not as undesirable as they seem to be. But first, you should understand how Bitcoin mining performs and for what reason it has been precise in recent years.

How Does Bitcoin Mining Work?

How Does Bitcoin Mining Work

With the uninitiated, Bitcoin mining may be a computer-powered method that ascertains the agreement of Bitcoin transactions. In addition, it doubles simply because Bitcoin’s most important distribution method as powerful miners open newly struck coins simply because rewards. Consequently , we can admit Bitcoin miners play critical roles inside the Bitcoin financial system.

Curiously, anyone can be a miner since the Bitcoin ecosystem is certainly open and even decentralized. Create, there are not any governing or perhaps licensing our bodies that state requirements of starting some sort of Bitcoin exploration business.

Nevertheless , while there are not any stipulated worldwide regulatory frames for exploration Bitcoin, exploration comes with tricks that not directly set unsaid requirements for each aspiring Bitcoin miner. A large number of limitations include the energy-intensive nature associated with Bitcoin’s general opinion mechanism, which usually mandates miners to solve complicated puzzles prior to they can tasks transactions towards the blockchain.

These kinds of puzzles are incredibly difficult that will mining personal computers do not also attempt to resolve them mathematically. Instead, they will try to suppose the answer. The very first miner to resolve each problem gets the reverance of incorporating a prohibit of deals to Bitcoin’s blockchain. Subsequently, the system allows the particular miner to say the payment on each deal on the block in addition to an additional compensate of six. 25 BTC. As fulfilling as this enterprise is, the vitality intensiveness on the entire procedure often reduces the possibility of creating profits regularly.

For starters, miners have to use state-of-the-art and energy-intensive hardware to be able to power his or her mining surgical treatments. Since Bitcoin mining on its own is a zero-sum game, miners have to regularly scale his or her mining outcome to run a home based business00. The moment a new miner struggles to match or perhaps surpass the common mining outcome (or hash rate) regarding other miners, the a smaller amount probable which the mining enterprise would prosper. Unfortunately, typically the steady within the components specification with mining Bitcoin has also brought on an way up trajectory of this electricity demands. Every fresh mining machine connected to the community increases the electric power consumption metrics of Bitcoin.

In addition , these devices run twenty-four hours a day. In essence, miners have to put money into cooling systems to stop overheating. This specific inadvertently increases the electricity dependence on their Bitcoin mining businesses. When we make use of this into account, it truly is clear that will electricity makes up about almost ????? of the continuing expenditure of any Bitcoin miner.

Though this has end up being the present simple fact of the Bitcoin mining industry, it has never been in this manner. Bitcoin exploration has evolved over time such that it may be unsustainable relating to hobbyists to be able to profitably get involved in the environment. Earlier throughout Bitcoin’s record, a Bitcoin miner would not need to shop for sophisticated exploration equipment to perform a money-making mining organization. Instead, all of the they necessary were day-to-day CPU-powered pcs since the opposition was comparatively low. Yet , as soon as exploration became a luxurious crypto go, there was a scientific shift to be able to institutionalized exploration operations.

Likewise not supporting is the computer design of the particular Bitcoin process that boosts the mining trouble, whenever you will find a surge inside active Bitcoin miners. Right away the system realizes more mining rigs are linked, it immediately sets a better difficulty stage for the questions. In summary, electrical energy, the cost of shopping for and sustaining mining equipment, and exploration difficulty are a few of the elements that identify the profitability, or even lack thereof, of any Bitcoin miner.

Now that you�ve got some a higher level understanding of just how Bitcoin exploration operates, another section of information pinpoints difficulties talking points regarding Bitcoin exploration.

How come Bitcoin Exploration Gaining A negative Rep?

Exactly why is Bitcoin Exploration Gaining A negative Rep

Since discussed previously, mining is among the core aspects of the Bitcoin ecosystem. Consequently , an attack within the viability of the system is a trigger on Bitcoin itself. Keep in mind that I detailed electricity being a major necessity. Well, just by the current barrage associated with criticism, it truly is clear the high electrical energy consumption level of Bitcoin mining have not gone undetected. The popular media environmentalists likewise have continuing to rehash a incriminating narrative that will paints Bitcoin mining because the main reason in the unfolding global environment tale associated with woe.

From the time that Bitcoin leaked into the spot light, Bitcoin exploration operations attended under strong scrutiny numerous claiming that your energy-intensive design of the method underscores typically the fragility involving Bitcoin. A lot of argue that it is actually counter-intuitive to take an energy-intensive digital cash as the way forward for money. For a counterargument, Bitcoin proponents need claimed of which Bitcoin miners are extremely relying on clear energy with regards to mining experditions. Also, that they find it fornuftstridigt that Bitcoin has been precise, while the carbon dioxide footprints for the traditional fiscal market and also other industries have become unchecked.

Bobby Lee, an ex CEO regarding BTCC alternate, recently discussed:

“To be totally fair, most of the other sectors use a lots of electricity: aluminium, steel, silver and gold mining — they all use up a lot of electrical power and utilize a lot of power, whether it’s electricity or even fossil gas energy. In the long run, it’s a few judgment which activity is usually good or even bad. The solution here will be entirely very subjective: For some, it’s good in order to mine yellow metal or procedure steel, whilst mining Bitcoin is eco destructive. On the other hand, I would believe mining Bitcoin is good, and running gold steel is usually wasting cash, energy resources. In the end, it’s very subjective. ”

Could back and forth is a huge recurring template since 2017, it finally had a limiting and functioning for impact on delete word Bitcoin the moment Tesla and your CEO, Elon Musk, corrected the plan to begin with accepting Bitcoin payments. In a very statement supporting this selection, Musk discussed that it grew to be necessary to assessment its Bitcoin payment embracing plans following discovering typically the carbon impact of the electronic digital asset.

Next announcement, the buying price of Bitcoin damaged by fifty percent in a matter of days and nights. Notably, this coincided having China’s go on to shut down crypto mining treatments in the country. Though it is hard to trust that China’s decision been a result of environmental considerations, it have have an far more critical influence on the Bitcoin mining financial system since 65% of the Bitcoin hash speed was made within the Far east jurisdiction.

Why Did China Ban Crypto Mining?

Why Did China Ban Crypto Mining

Chinese language miners usually made up a big chunk in the Bitcoin exploration community simply because they have access to inexpensive electricity and they are somewhat geographically advantaged to stay the same legislation with main Bitcoin equipment mining companies. The mixture of these two aspects has preferred Bitcoin exploration in The far east such that it probably is increasingly mind boggling that the Bitcoin network hash rate has been concentrated inside a particular nation.

Numerous feared of which China may easily monetize on it is dominance inside the Bitcoin exploration economy to be able to attack or perhaps collectively prefer or in opposition to upgrades. So, it was pleasantly surprised to many if the Chinese administration decided to de-activate the country’s crypto exploration economy. Certainly, as noted simply by Kelsie Nabben, a specialist at RMIT Blockchain Blockchain Innovation, it was part of the government’s plan to impact operations associated with currencies rivalling with its recently introduced core bank-backed electronic yuan:

“China’s policy position on Bitcoin seeks “financial stability social order” and is probably the result of geopolitical interests linked to the desire to take out competitors to be able to its own countrywide digital foreign exchange, the electronic digital yuan, besides its explained goals regarding lowering carbon emissions in addition to redirecting vitality toward additional industries. ”

How can China’s Attack Impact Bitcoin?

As stated earlier, the particular Bitcoin exploration crackdown within China has already established an impact around the price of electronic assets adversely. However , aside from its obvious effect on prices, it has triggered a bit of reshuffling in the Bitcoin mining economic climate. Since absolutely nothing less than 65% of Bitcoin’s hash price was added by The far east, the arr�t of Chinese language miners leaves a gaping hole within the Bitcoin exploration ecosystem. Essentially, the number of miners has decreased significantly within the last two months.

Typically, large Oriental miners would like to relocate his or her businesses some other Bitcoin mining-friendly countries. Yet , this is easier in theory. For instance, Oriental miners own begun to uncover that most of these electric system is not appropriate for the methods of various other countries. Consequently , they are not only will be relocating, they need to remodel his or her setup in a manner that fits into typically the electric type of their vacation spot country.

Likewise, they need to discuss with exclusive or government-backed power plant life to ensure that these people reach realistic electricity obtain supply contracts. It is critical to keep your electricity price close to the actual previously appreciated in Cina. Lastly, they have to consider choosing regions together with clean powers.

You probably know that it may consider several months for the miners in order to eventually set up a base and initiate mining surgical procedures. In that time, they can be forced to commit some of their Bitcoin holdings in order to finance this specific capital-intensive immigration. Historically, if more Bitcoin floods the market industry, the price of the particular digital advantage always falls. Therefore , in the long term, a massive immigration of hash rates can put providing pressure about Chinese miners. Annabelle Huang, head regarding GlobalX on Amber Party highlighted the particular selling stress on China miners being a contributing aspect to the downturn of the costs of cryptocurrencies:

“Following Inner Mongolia and Xinjiang, Sichuan state officially turn off BTC exploration earlier recently despite hydro being a healthier option compared to coal-based exploration. Coupled with Fed’s hawkish emotions, we did find a significant sell-off in the crypto markets. The particular shutdown within Sichuan arrived as a slight surprise and certain will cause medium-term selling stress from miners who levered up to size their procedure during the half truths run recording. ”

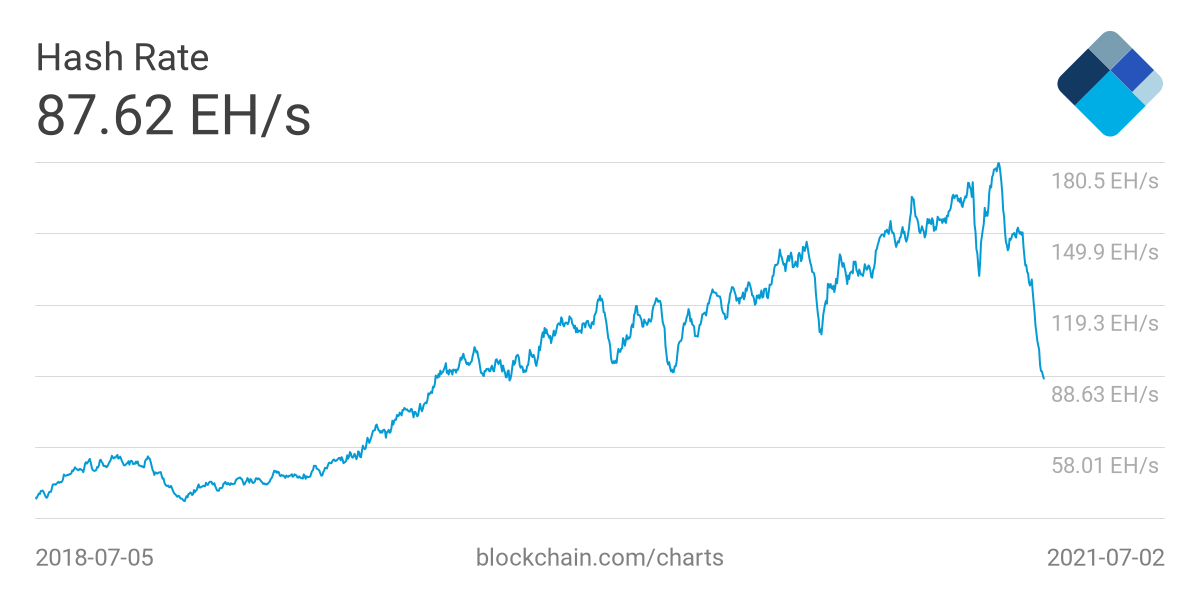

Bitcoin network hash rate 7-day average.

Bitcoin network hash rate 7-day average. Supply: Blockchain. possuindo

Alternatively, the Cina crackdown possesses reduced the particular competitiveness on the Bitcoin exploration economy. Merely a fraction regarding miners continue to be operational. As a result, mining trouble has skilled a downwards correction. To put it differently, it is a much more profitable in order to mine Bitcoin presently. Daniel Frumkin, exploration researcher from Braiins Slushpool do this known within an interview with Cointelegraph:

“Difficulty has gone lower in about three of the previous four changes, and the subsequent adjustment might be the largest downwards adjustment inside Bitcoin’s historical past. For miners outside of Cina who concentrate on maximizing their very own BTC piling up, this is an outstanding opportunity for the reason that hash benefit (BTC/TH/day) is definitely increasing swiftly during a period when everyone would have already been expecting the alternative. ”

Based on Frumklin, the particular void still left by Oriental miners has grown the profitability regarding miners consist of regions significantly. Unlike Oriental miners, miners in other countries may use this chance to accumulate Bitcoin.

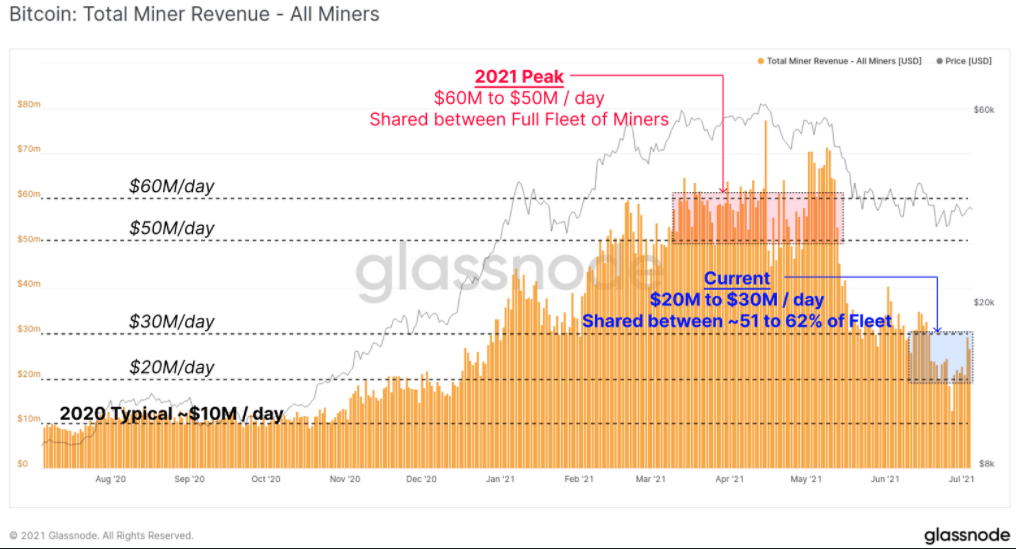

Bitcoin mining income distribution annotated chart.

Bitcoin mining income distribution annotated chart. Resource: Glassnode

In a recent report, Glassnode compared typically the economic effects on Chinese language miners and the counterparts far away. It figured the current Bitcoin market supply set up fascinating dynamics:

“We have a very intriguing dynamic where approximately fifty percent of the hash power happens to be offline together with incurring several costs as a result of logistics and simply simply not hashing, having components that’s definitely not currently doing work, and the different 50% comes with essentially witnessed half the competition disappear the community. Whilst typically the protocol’s at present issuing identical number of silver and gold coins as it on a regular basis does, possessing difficulty twisted down, we’re now in times where one half the community has bending their source of income and the partner of the community is essentially building nothing. ”

An additional notable impact was the increase of second-hand mining equipment in the market. Too much mining equipment in the worldwide market offers forced the cost to along with the interim. As mentioned by Frumklin, small scale miners, especially contains can use this particular opportunity to level up their own mining procedures:

“Many smaller-scale miners use thirdparty hosting products and services that offer far better electricity costs than generally found on standard energy plants. Since this internet hosting capacity is at high demand, it’s likely not too easy for the ones miners to be able to scale at this moment. However , virtually any miners using off-grid features (e. h. next to petrol wells) or perhaps who in any other case have primary access by some source of excessive energy are typically a better job to start exploration or to degree up as compared to at any time in past times year or so mainly because hardware is less expensive and more obtainable, and the hash value (BTC/TH/day) is all of a sudden high. ”

Frumklin added that will North American miners, in particular, are usually favorably situated to cash in on the continuing hash price migration as they are no more competitively disadvantaged. This individual explained:

“Meanwhile, many greater miners inside North America found sub-four and sub-three mere cents per kilo watt hour electricity, which can be on optimal or greater than the prices Far east miners were paying current years… Given that they’re not any longer facing a reasonably competitive disadvantage inside hardware purchase, the period is set for anyone North American exploration companies being dominant participants in the next several years. ”

In the long run, the get rid of in exploration difficulty would definitely attract fresh miners inside their numbers. Computer chip Spanos, typically the co-founder involving Zap Process, explained this is a good time for miners, who formerly wouldn’t have experienced a competing edge, to participate the Bitcoin mining economic climate:

“Bitcoin’s algorithm changes roughly each two weeks to permit one obstruct of purchases to be extracted every a couple of minutes. So , it’s become each easier and much more profitable in order to mine Bitcoin. That’s the recipe meant for enticing a lot more miners back. ”

Who Are The Winners And Losers?

Winners

The Bitcoin Ecosystem

Although China’s attack contributed to the purchase price slump regarding Bitcoin, additionally, it reinforced the particular sustainability regarding Bitcoin as it had typically defiled increased efforts simply by China to lock down the crypto market. Seeing that highlighted simply by Mike Novogratz Bitcoin has got largely sailed the dangers posed by the particular decisions of this Chinese govt.

It is additionally good the fact that the mining financial system is starting a major reshuffling. Thanks to the exclude on crypto mining throughout China, the state has shed its prominence in the Bitcoin mining industry. In the approaching months, particularly if offline exploration rigs go back online, count on a new Bitcoin mining buy evenly distributed between Bitcoin mining-friendly regions.

Moreover, the migrations of Far east miners to be able to regions recognized for their cheap and even renewable power options would inevitably help encourage a green Bitcoin mining economic system.

Miners In Other Countries

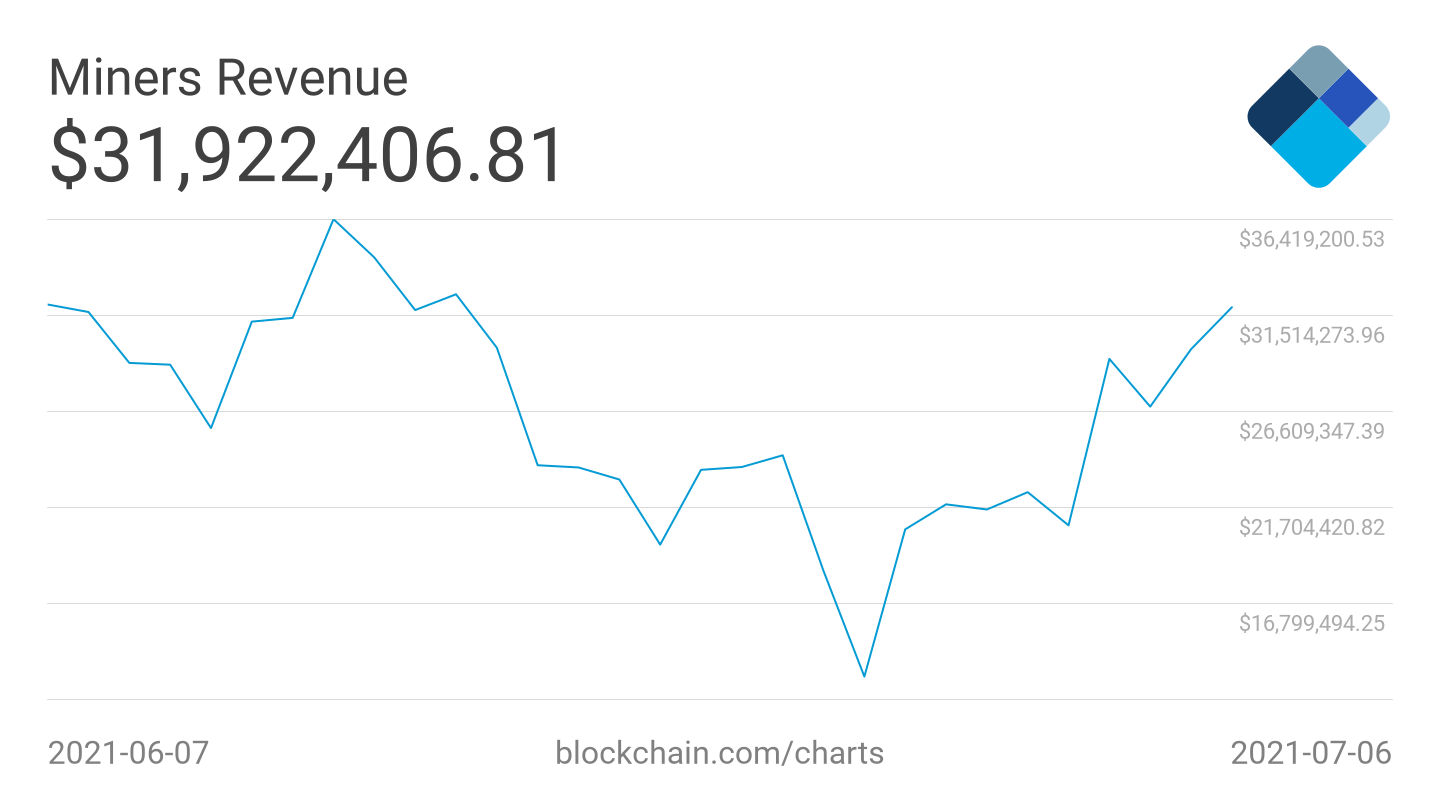

Bitcoin miner income chart. Resource: Blockchain

Mainly because discussed previous, the collision in exploration difficulty has grown the profitability involving Bitcoin exploration and lowered the prices involving mining accessories. In essence, miners that are nonetheless operational usually takes advantage of this kind of opportunity to enlarge their exploration operations so that they can continue to be competitive even if Chinese miners come back on the internet.

Districts With Present Crypto Exploration Economies

The particular U. H. has been recognized as the obvious place to go for migrating Chinese language miners. For example, States such as Texas Wyoming possess begun to use the high with regard to cheap clean electrical power. Canada is yet a suitable area, thanks to the large quantity of clean powers and its chilly climate. Khurram Shroff, TOP DOG of iMining and chief of IBC Group, commented that your reshuffling for the Bitcoin exploration market may offer lots of opportunities to Nova scotia:

“A shift regarding crypto exploration operations out from China might be a huge chance for Canada. Typically the Toronto Stock market recently posted the world’s first Bitcoin ETF, and so the nation is ahead of the shape, in terms of mainstreaming cryptocurrencies. ”

Throughout Asia, Kazakhstan seems to be an alternative potential place to go for miners. The us government recently passed a new crypto exploration bill that could impose added fees over the energy employed by crypto miners. Russia, Malaysia, and Usa are other places that crypto miners may consider.

Losers

Chinese Miners

It truly is never a satisfying process in order to relocate your company due to unexpected circumstances. These types of miners would need to spend a sizable chunk of these accumulated income to move and place up their very own hardware internationally. This is beyond the technical in addition to regulatory obstacles that they will most likely face as you go along.

China

Prior to the recent attack, China has been home to some multi-billion buck crypto exploration economy. A few hoped that this economic associated with Bitcoin exploration operations will be enough purpose to encourage the government to manage the industry instead of scrap this. But in conjunction with its crypto stance, The far east has chosen a total prohibit on crypto mining completely. While it might not be all that apparent at first, the particular migration associated with Bitcoin miners out of The far east would certainly keep a gap in the country’s economy.

Proof of Work (PoW) Mechanism

Proof of Work Mechanism

Call to mind that Bitcoin mining demands miners to fix complex complications. Well, typically the consensus device that affects this process is referred to as Proof-of-Work. The software utilizes a new compute-intensive type of validating ventures and rewards validators. Although high computational requirements with this mechanism produce added basic safety, it does promote the Bitcoin ecosystem to be able to regulatory moves.

Considering that miners have to collection mining rigs and make a deal for positive electricity offers, governments can certainly identify target all of them. Using Tiongkok as a example, Kelsie Nabben argued that will hardware needs of PoW consensus may inadvertently provide room designed for governments along with other entities in order to attack Bitcoin.

“Hardware has always been a serious vulnerability throughout decentralized system. In blockchain-based cryptocurrency sites working on a proof-of-work (PoW) general opinion algorithm, like Bitcoin, the particular commonly decided record associated with transactions uses distributed system of computer systems. This is susceptible to structural fermage, including focus of equipment mining within industrial-scale industrial facilities in certain geographies (such since China), “premining” cryptocurrency along with upgraded equipment that is not however available to the particular broader marketplace (such since new design ASICs), or even supply string delays. ”

Nabben added how the growing industrialization of Bitcoin mining moves against the unique peer-to-peer type of the Bitcoin ecosystem:

“Having a majority of hashing power centered in one region, reliant about expensive components setups, and even subject to regulating crackdown is certainly antithetical for the “decentralized” diathesis of Bitcoin that was specified by Satoshi Nakamoto. Your initial vision regarding Bitcoin in the white old fashioned paper was a peer-to-peer system, where infrastructure could possibly be run by simply individuals over a general-purpose computer system in a handed out way (via CPU mining), so that the complete network wasn't able to be close by aiming for a single level of malfunction. ”

On top of that, Nabben asserted that the Bitcoin mining attack in Chinese suppliers shows as to why Ethereum’s go for the particular Proof of Risk (PoS) general opinion mechanism is a wise move:

“Attacking a Detr�s network is far more costly on time and funds than the expense of hiring or perhaps buying components to breach a PoW blockchain, as a possible attacker’s gold and silver coins can be immediately “slashed. ” Furthermore, it can be much less obvious to run a new PoS validator node over a laptop as compared to it is to any large-scale components mining functioning. If anyone could run a client from everywhere with consumer-grade equipment, then simply more men and women can engage in validating typically the network, so that it is more decentralized, and government bodies would realize its almost impossible to quit people via running systems. In contrast, the large energy-consuming production facilities found in Bitcoin mining are more easily qualified. ”

Is a Rehashed Bitcoin Environmental Unfriendliness A Fantasy?

May be the Rehashed Bitcoin Environmental Unfriendliness A Misconception

There may be truth inside the argument in support of and in opposition to Bitcoin’s ecologically unfriendly exploration process. In accordance with a report published with the University associated with Cambridge, Hydropower, which is a alternative energy source, makes up about 62% with the energy utilized by surveyed Bitcoin miners. The particular researchers had written:

“Hydropower is listed for the reason that number one source of power, with 62% of selected hashers demonstrating the fact that their exploration operations really are powered by simply hydroelectric electricity. Other types of clear energies (e. g. breezes and solar) rank further more down, in back of coal together with natural gas, which will respectively keep track of 38% together with 36% involving respondents’ capability sources. ”

You probably know that these conclusions contradict misguided claims of which Bitcoin exploration had basically contributed to the rise in the by using fossil gasoline energy. When a small percentage of Bitcoin miners nonetheless use precious fuel, it may not dominate the fact that certain miners happen to be conscious of the effect of their surgical treatments on the surroundings.

Reality learning to that miners have commenced to take environmentally friendly impact involving Bitcoin exploration seriously. Although argued simply by Hass McCook, a upon the market chartered expert engineer, the particular migration associated with Bitcoin miners will likely drive a solution Bitcoin exploration economy:

“…it would appear of which Bitcoin’s exhausts peaked some time ago, and luckliy, with the banning of Bitcoin mining throughout China, contains commenced it is aggressive walk down to 0 emission. It is predicted that at worst, emissions right from Bitcoin throughout five several years will be not more than a third from the emissions currently, and in a decade, Bitcoin should emit very little. ”

McCook, while referencing another report with the University regarding Cambridge, said that Bitcoin mining can certainly help offset the sur electricity developed. This disagreement highlights area of the study that will showed the fact that electricity ingested every year simply by idle gadgets in US ALL homes could power the particular Bitcoin exploration economy for more than 3 years. McCook wrote:

“While this may seem to be counter-intuitive, as soon as all of the info is aggregated and examined with common sense and book business and even economic frames, it can be conveniently seen of which Bitcoin stances almost no menace to the surroundings. Indeed, inside the best circumstance, Bitcoin could actively treat the environment by way of offsetting regarding flared methane and by controlling the key with an abundant, clear energy forthcoming. My spouse and i look forward to returning to this conjecture in 2026! ”

Lately, Jay Hao, CEO regarding OKex, likewise lent his / her voice for this argument. Within a post published about Cointelegraph, Hao also referenced the same have and listed that the strength consumed by simply Bitcoin miners is nowhere near how many other industries take in:

“Also, according to the CBECI, 25, 082 TWh of one's is manufactured in the world annual. Only twenty, 863 TWh is taken, meaning sixteen. 82% will be wasted. Bitcoin represents a power expenditure associated with 0. 47% of the complete energy created and only zero. 54% associated with total electrical power consumption globally. Another study recently launched by Universe Digital compares Bitcoin’s use of energy towards the use of banking companies and golden mining. Based on the document, the particular gold market uses 240. 61 TWh per year, as the banking program uses 263. 72 TWh. ”

Nevertheless , when it comes to the particular carbon impact of Bitcoin, there are great be concerned. The 2019 survey revealed that the particular carbon impact of Bitcoin ranges among 22 22. nine metric a lot of CO2. To place this in to perspective, this particular figure is just like the co2 emitted simply by Sri Lanka.

Because of this, Hao explained there is a need for your measured method the lowering of the using of fossil fuels by simply Bitcoin miners. He proceeded to propose to your lady the following:

“Fortunately, there are uncomplicated ways to balance the carbon dioxide footprint kept by Bitcoin. With the tokenization of tools, some corporations have decided to tokenize carbon dioxide credits, making it simpler for miners and all many involved in a way with the cryptocurrency industry to minimize the impact due to the technology of electrical power used in exploration machines. Seeking ahead, each of our attention really should be on the lowering of the consumption of fossil fuels, aided by the aim to dissipate the remaining carbon dioxide footprint. It is actually worth remembering that the ecological problem are not solved simply by lowering the use of non-renewable fuels. It is more importantly to optimize the generated power while concentrating on reducing any kind of waste unnecessary co2 emissions along the way. ”

What really does the Future Maintain For The Bitcoin Mining Marketplace?

What really does the Future Maintain For The Bitcoin Mining Marketplace

Advisors expect typically the mining problem of Bitcoin to recover when Chinese miners come back via the internet. In the meantime, the current Bitcoin miners will will continue to maintain big profitability until new miners manage to complete the hole kept by Offshore miners.

Additionally there is a high possibility that we will start to see a good influx associated with crypto exploration regulations. In the same way Kazakhstan provides opted in order to tax exploration operations, some other countries will attempt to cash in on the increase of exploration operations inside their jurisdictions. Additionally there is a slim opportunity that a few of this area will try to place a cover on the quantity of energy allocated to crypto miners. In some instances, this could be a direct result explosive with regard to energy.

Could is playing out and about, we should notice a significant embrace the use of clear energy to be able to power exploration farms. Despite, I do definitely not expect this kind of to put to be able to bed the more common belief of which Bitcoin is without a doubt environmentally malicious. It is time most of us start to recognize that some of the strategies on Bitcoin stem from your intentional attempt and downplay together with control typically the Bitcoin story. Note that almost all of Bitcoin’s electricity inefficiencies narratives are overblown. In his writeup, McCook best parts the tendency involving skeptics to be able to reference wrong data. He / she wrote:

“One of the most widely debunked, still widely referenced claims regarding ‘academia’ is the fact Bitcoin could single-handedly enhance the planet’s temps by a couple of degrees Grad. ”

In addition worth remembering is the frailty of Bitcoin in the US, specially now that the state is looking to be able to introduce searching for dollar. Fit: Will the PEOPLE view Bitcoin as a competition and ultimately opt to repeat China’s bar on Bitcoin mining?

Closing Thoughts

Without any doubt, the the latest showdown in between China the Bitcoin exploration community has received a serious influence on the aspect of the crypto market. Not merely has the associated with Bitcoin damaged, but also typically the mining difficulties has knowledgeable a similar downtrend. Perhaps, the first time, the Bitcoin community includes witnessed drawback of the progressively more industrialized Bitcoin mining economic system.

Relating to the upside, you can find hope that your reshuffling should ultimately bring about the decentralization of the crypto mining financial system. Likewise, you will discover reasons to feel that the exodus of Offshore miners may promote the utilization of clean electricity to acquire Bitcoin mainly because it has become significant to consider typically the carbon impact of Bitcoin and distinguish ways to generate Bitcoin exploration clean.