All you need to know about Bitcoin Halving inside 2020

Bitcoin, the world’s leading cryptocurrency in the world comes much of their value in addition to appeal inside scarcity. As opposed to fiat foreign currencies that can be branded and generated within circulation by way of a process called quantitative reducing, Bitcoin is often a scarce item with a tough cap regarding 21 , 000, 000 coins.

The particular scarcity regarding bitcoin takes a mechanism where the bitcoins brought into circulating are restricted in order to manage a perfect equilibrium between source and request.

In contrast to fiat money in which the issuance and governance of new cash are manipulated by a core authority, brand new bitcoins usually are brought into blood flow by miners through a praise system designed for solving a fancy mathematical program.

Miners solve some sort of block involving transactions just about every 10 minutes possibly even and acquire what is known for a block recompense. This corner reward ascertains the number of bitcoins brought into stream every day.

In line with the bitcoin community, the wedge reward is certainly cut straight into half every single 210, 1000 blocks. It is called bitcoin halving or halvening.

What Is Bitcoin Halving

The bitcoin protocol is more or a reduced amount of like a lotto system through which miners – individuals, corporations, or corporations spent a ton of money in starting out highly customized equipment to receive maintaining typically the network – compete to fix a very sophisticated mathematical bigger picture in exchange to receive block stimulant on fresh bitcoins.

The perfect solution is to the response sometimes is determined by luck, but in addition on the level of processing power that every miner includes. Miners have much of his or her processing power via building exploration farms, which can be large facilities playing machine to 1000s of ASICs – specialized cryptocurrency mining machines.

Once the first prevent was extracted in 2009, the particular block incentive was fifty bitcoins. It was cut by 50 % in 2012 in order to 25 prevents and cut in half once again in 2016 to the current associated with 12. five bitcoins.

This specific slashing regarding block returns every several years roughly is what is generally known as Bitcoin halving. That affects the quantity of bitcoins which goes into the blood supply and by off shoot, its price tag as well.

Because of bitcoin halving, all the bitcoins in the world only will be totally mined back in 2140 or right after depending on several factors.

Bitcoin halving 2012

The very first (genesis) bitcoin block has been mined upon Jan. several, 2009 once the block prize was initially fifty bitcoins. The particular reward has been halved in order to 25 upon Nov. twenty-eight, 2012, once the first bitcoin halving happened. Each bitcoin unit price around $11 at the time.

1 year after the gmc halving, the buying price of bitcoin increased to a fresh high of $1, 100. It absolutely was not discovered at the time. It absolutely was only a 2010 after the halving but bitcoin’s price possessed grown 100x. The half truths market would not last long along with the price of bitcoin eventually droped to $220. Its price tag fluctuated by simply failed to separate the $1, 000 damaged spot.

Even though the price acquired significantly been down, the good thing is that it was nonetheless 20 days higher than it is pre-halving price.

Bitcoin halving 2016

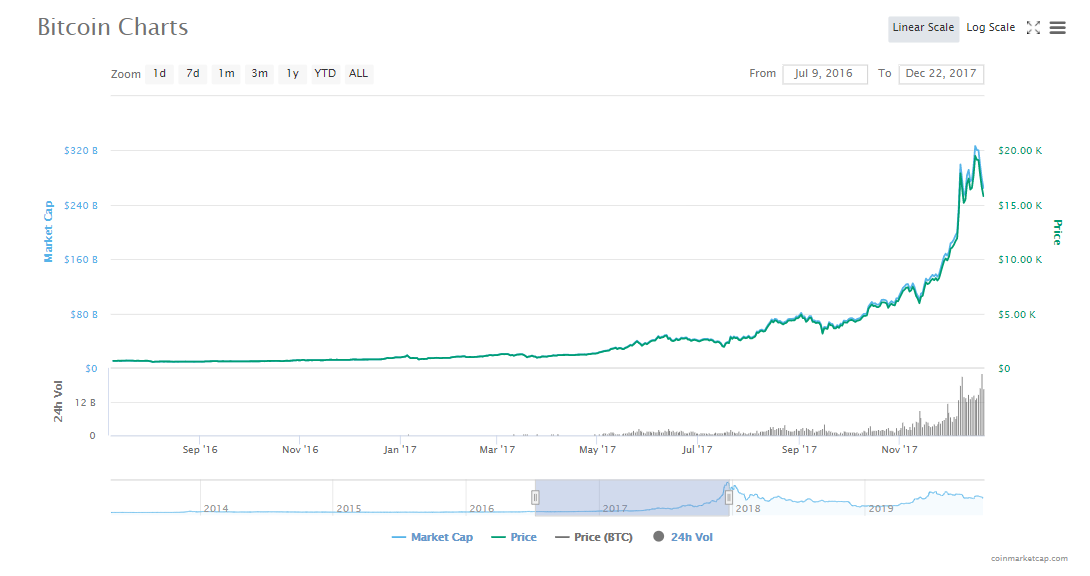

The 2nd bitcoin halving happened within July 2016, with stop rewards slice from twenty five to 12.5 BTC. It really is probably probably the most important halvening events due to the price of bitcoin surged in order to its perfect high price.

The spike in Bitcoin Price was initially important for the wedding because it enticed government control as well as institutional investors.

When needed of the halving event, on the lookout for July, bitcoin was investing around $666 according to CoinMarketCap data. Within just 18 months, the price got skyrocketed in order to nearly 20 dollars, 000.

Bitcoin skyrockets right after second halving. //Source: CoinMarketCap

Bitcoin grew by simply nearly two to three, 000 per cent since between your day of this second halving and its perfect high. All of it happened in a space regarding 528 days and nights.

Importance of the second halving

Typically the run-up for the all-time big was principally driven by simply speculation above all else. The high price tag attracted many attention right from governments, specifically Asian places that designed to regulate the in the interest of guarding investors.

As well, initial endroit offerings have been booming. Corporations would simply just write a uncomplicated white regular and sell the tokens for the public. It absolutely was a ride and funds was coming in inside together with out.

However the ride had been unsustainable as well as the prices needed to normalize. Inside a week, bitcoin’s price experienced fallen coming from $19, 000+ to around $14, 000.

The start of the new year (2018) did not jason derulo in good fortunes. The whole market went under into one of the very most brutal winter seasons the youthful industry provides ever observed.

Beyond $600 billion dollars was easily wiped away from the marketplace and by the completed of 2018, bitcoin was basically going for just beneath $4, 1000.

Many organisations shut down workplaces. Others, that will managed to endure, were required to downsize simply by cutting employees and stopping some of their businesses.

However it was during this time period that institutional money had been flowing in to the industry. Innovations were arriving. The ICO boom slowed up. The industry had been growing in a steady speed.

The particular retail traders who had end up being the backbone in the industry had been making method for institutions.

2019 has all this time been a good 2010 for bitcoin. Its price tag peaked previously mentioned $13, 1000 in Summer and has for the best part of the 2010, traded involving $8, 1000 and $12, 000.

Contrasting the first 2 bitcoin halvings

Evaluating the halving events this year and 2016 could give to us a clear indicator of what to anticipate in the 2020 halving occasion.

Possibility of a bull market

Background statistics usually do not lie. Both previous bitcoin halvings happen to be a prompt in moving bitcoin right into a new half truths market.

The cost of bitcoin rises in anticipation of the particular bitcoin halvings as well as a few months after the occasion itself.

It is just after a halving event that will bitcoin attained its perfect high.

Significant rallies associated with between 13, 000 in addition to 13, 500 percent within the two halvings

Let’s first look at the 2012 bitcoin halving:

Bitcoin needed concerning 513 days and nights to move from its pre-halving bottom to be able to all-time-high following your halving. The retail price spiked coming from a bottom involving $2. 01 to a a lot of $270. 94. The leading electronic digital asset came back by as much as thirteen, 304 pct within this period of time.

Let’s take a look at the 2nd halving.

Bitcoin took 1068 days to understand from its pre-halving bottom regarding $164. 01 to it is post-halving a lot of $20, 1000. This is a move of doze, 168 pct.

Typically the similarity amongst the two occurrences is that a rise of involving 12, 1000 and thirteen, 000 pct was knowledgeable from the bottom prior to halving for the highest selling price after the halving event.

Yet , the most important big difference is that the next halving function required two times as much time to join up the same amount involving growth.

This specific takes us all to the 3rd halving celebration.

Bitcoin halving 2020

Thirdly halvening function or Bitcoin halving 2020 might be expected to be held on May 21 years old. The corner reward should decrease right from 12. 6 to 7. 25 BTC.

a single, 800 bitcoins are made per day on the current block out reward, which number is going to decrease simply by 50 percent in order to 900 once the halving occurs.

Over 18 , 000, 000 bitcoins are already mined until now, leaving just less than 2 million money to be extracted. However , these types of will only end up being completely extracted in 2140 or after.

There are several similar correlations between the initial two bitcoin halvings that will allow experts to make a high case for the particular upcoming occasion.

The very first obvious result in is economics 101: legislation of source and desire. When the desire is excessive, the price is likely to go up.

In addition, bitcoin is without a doubt touted as the digital safe place in times of geopolitical instability. This kind of puts it inside the same conference with gold and silver coins such as your used watches.

With increased tensions developing in the world along with the halving event, the cost of bitcoin is probably set to get a bullish operate.

However many people is going to turn to famous data in order to plead their very own case for the particular optimism of this upcoming 2020 bitcoin halving.

Crypto experts in addition to analysts usually are hopeful how the halving occasion will come with higher price surges. And the common consensus is the fact that Bitcoin can surpass the all-time a lot of $20, 500 reached within 2017.

Morgan Creek Electronic digital Assets co-founder believed how the original cryptocurrency will attain $100, 500 by 2021.

“Supply-Demand economics continue to be valid. They are really a great way to establish the market selling price. So , in the event the demand for a new fixed-supply advantage increases, many of us continue to check out price thanks, ” said Pompliano.

Cryptocurrency exchange TOP DOG Jesse Powell is also hopeful about the halving event. He / she predicts it can easily reach an amount between $265.21, 000 together with $1 million.

“When I notice people discussing a bitcoin “correction” My spouse and i ’m pondering $100k, could be $1m. That’s what’s appropriate,” said Powell.

Jihan Wu, the particular co-founder in addition to former TOP DOG of bitcoin mining giant Bitmain is not sold-out on the forthcoming halving 2020 event. This individual believes that this first 2 halvings coincided with series of growth and bust line.

“Maybe people guess too much ahead of the halving, and you can’t sell typically the good reports anymore. Could be, this time a new bullish circuit is not approaching yet, ” said Wu.

A lot more people purchase event and its particular effect on Bitcoin price, FOMO could enjoy a huge function in driving a car the price excessive.

Will history repeat itself?

Let's assume that bitcoin bottomed in December 2018 at $3, 200, we are able to use the prior gains in order to predict their all-time excessive after the halving event. The main digital advantage as registered gains regarding at least 13, 000 per cent from its pre-halving bottom towards the post-halving bottom level.

Providing a few figures, it is typically predicted of which bitcoin promote for $384, 000 every unit should history should be to repeat themselves.

Nevertheless , it must be known that bitcoin is a relatively recent asset and no assurance that just what has occurred in the past may happen again these times. The outcome with the first halving event had been as good as anyone’s guess. Within the second halving, there were plenty of figures that will determined the cost of bitcoin.

The last halving will probably be different. What exactly is nearly clear is that institutional investors is going to be monitoring the particular developments in addition to wondering just what cause of thing to do.

We must not take with no consideration that Facebook’s foray in the crypto sector using its Libra task may possibly indirectly impact the final price regarding bitcoin. As the project alone doesn’t look like it will take away from unless this obtains regulating approval by lawmakers, Libra has been a significant boost when it comes to cryptocurrencies on the whole and bitcoin in particular.

In addition to an increase in source coupled with reduced supply will certainly propel the price tag on bitcoin following the halving celebration.

Bitcoin halving 2020 and miners

That people talk about typically the upcoming bitcoin 2020 halving and rule out the miners because they are immediately affected by the case. They will live through receiving much less bitcoins for a reward when considering maintaining typically the Bitcoin community.

This might cause quite a few miners to quit after the celebration though it's going to only a few miners who accomplish that. Other miners will keep on with the talk with the anticipation that the associated with the BTC will be more than the value they will receive by receiving a lot more bitcoins.

They will do this by simply holding onto the bitcoins together with not market them regarding lower prices. This can eventually increase the prices and permit the miners to make a income, despite their own block benefits being reduce in half.

Conclusions on Bitcoin halving 2020

The only real certainty up to now is that bitcoin halving is going to be happening among May June the coming year. How it can affect the marketplace if at all, continues to be anyone’s imagine.

The prior two related events point out a half truths run. Nevertheless , the circumstances next and now will vary. The market will no longer belongs to sells investors since it used. It truly is slowly getting swallowed simply by institutions which could replace the expected value movements once the event occurs.