Decred’s Ambitious Perspective for a Genuinely Decentralized Change

Decred, an open resource cryptocurrency task that released in 2016, released the very first specification from the decentralized exchange (DEX) on July 31st through GitHub.

Inspired by bitcoin, Decred (DCR) works with a hybrid Evidence of Work/Proof involving Stake opinion mechanism which is one of the most well-liked altcoins. Decred have been implementing a DEX since Summer 2018 and definitely will feature on-chain atomic trades, a technological innovation the decentralized project contains improved upon recently.

What are Issues with Central Crypto Deals?

The need and curiosity for decentralized exchanges has long been rising for many years now and is also a consequence of poor experiences and even occurrences regarding centralized crypto exchanges including high-profile hackers as well as departure scams.

Lack of Privacy

Anyone who has used a Cryptocurrency exchange knows the lengthy procedure of posting identity files to stimulate your account or even raise your own trading limitations, as well as posting support seats when some thing on the trade goes wrong.

Due to a AML/KYC insurance plans, you have to release very vulnerable information to be able to exchanges to be able to trade in these tools such as public security statistics, addresses, photographs of your passport or drivers license and a photography of your facial area holding them.

When the exchange will not secure your own personal data efficiently, then it can end up being hacked and perhaps actually sold on the particular DarkNet; the risk that will some people would prefer to not take.

Centralized Exchanges are Custodial

Second of all, as the consumer you are not in charge of the money on the central exchange and also have no access to the personal keys. Consequently , if the trade gets hacked or leave scams, you might have no alternative and should trust the particular exchange to settle you.

Typically the custodial aspect of crypto exchanges in addition makes them invaluable targets suitable for hackers. That infographic programs, more than captal up to $1 billion worth involving bitcoin (and other cryptocurrency) have been thieved from central cryptocurrency deals by online hackers.

Naturally , there are some deals which have a new clean background and have under no circumstances been hacked. But the truth is that virtually any centralized change could potentially always be hacked eventually.

Typically the exchange might be entirely in charge of the financial transactions on the program and in typically the worst case scenario, the funds may be embezzled in case the operator for the exchange might be untrustworthy – as the circumstance of QuadrigaCX shows.

Higher frequency Trading and even Flash Fails

Some other problem is a defieicency of high frequency stock trading where classic financial organizations can use HFT algorithms with an effect on cryptocurrency markets.

The entire aim of cryptocurrency was to develop a new economic climate that was targeted at and more effective, however , heritage financial institutions can use HFTs to pose the price finding process fairly.

These types of algorithms present liquidity, nonetheless it is footloose meaning that fluid can go away in a matter of seconds. Therefore, we witness so-called “flash crashes” – where the price tag on a cryptocurrency can crash dramatically quickly and effortlesly, causing liquidations and hence failures for investors on that will platform.

Listing Fees and Trading Fees

With the developers together with contributors to be able to cryptocurrency assignments, it is frustrating when a many good do the job has been executed advancing a certain coin then an alternate asks for some sort of ridiculous value for it for being listed. Here lies a second problem with centralized crypto trades; extortion associated with cryptocurrency tasks through substantial listing charges.

Its thought that report fees go into the thousands and thousands for top-tier exchanges. Among the only trades to display their listing cost publicly can be Cryptopia, using fees lessen around 20 dollars, 000 roughly. But jobs can expect to cover at least a single BTC to find smaller trades, rising because popularity of the particular exchange goes up.

Substantial listing charges prevent pretty launched money from getting more investors and traders. While well-funded coins can pay for these results, many smaller sized projects which can be doing modern things are remaining to fend for themselves.

In the same way, for consumers, trading costs can sooner or later add up and even cost dealers and buyers a lot of money. There may be usually fees to pay in and take away cryptocurrencies, in addition to trading costs to open or perhaps close a new trade.

Occasionally, the charges to first deposit and pull away can be abnormal and not consistent with a blockchain network’s suggested fees. Although such charges generate added revenue for your exchange, these people introduce a lot more friction for the purpose of crypto investors and hinder the user encounter.

Take, for instance, HitBTC containing charged very good fees in order to deposit in addition to withdraw specific coins upon its system. Because customers do not have control of what the swap operators perform, they possibly have to deal with the high charges or select another system.

Exactly how are Decentralized Trades Addressing Problems?

Decentralized exchanges (DEXs) generally speaking are an make an attempt to address the problems outlined over in one method or another. Largely they take cannonade the custodial nature associated with centralized trades and try to place the user completely control of their particular funds although they are investing.

Considering decentralized trades are not work or managed by a individual entity, they will get around AML/KYC as there is not any company that may submit regulating authorities or even address they might send a new correspondence in order to and there is zero central stage of invasion for cyber criminals. With no KYC, users could set up a merchant account easily with the email address in addition to password. This is the positive element of the buying and selling experience since it is convenient in addition to preserves your current privacy.

Likewise, it is much easier for gold coins to get shown on selected DEXs, using Bisq in addition to CryptoBridge offering as good examples. The two DEXs currently have added lots of coins, many of them fairly released, that have not necessarily managed to get about enough central exchanges. Using Bisq, its as easy as forking the software to be able to compatible with the particular coin’s style and it can end up being added to the particular DEX as soon as it is combined into the leader branch of the particular DEX’s style.

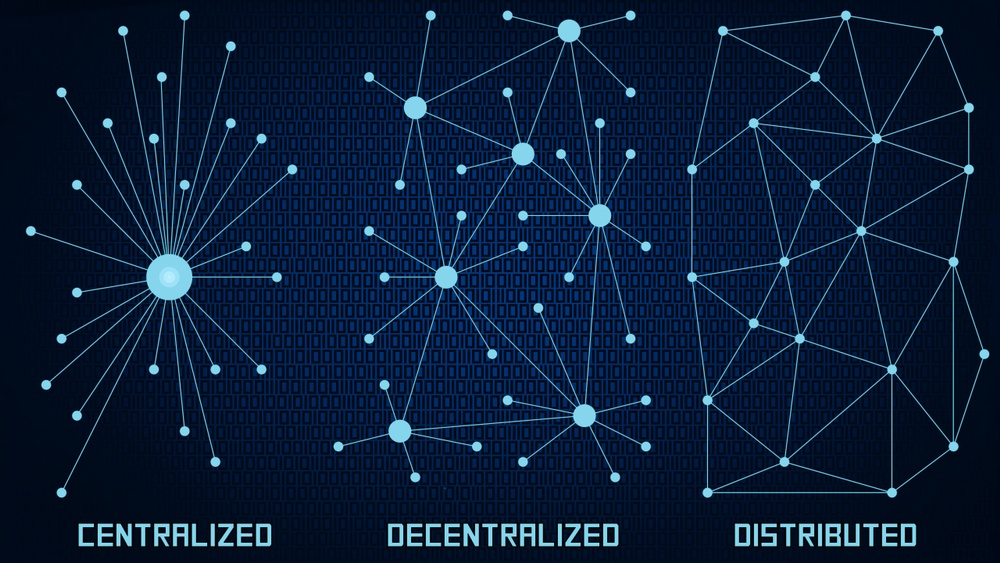

Rather than being on the inside managed controlled, DEXs are operate by a system of systems distributed all over the world, similar to Bitcoin, where trading are done in the peer-to-peer vogue, allowing a person in one region to change bitcoin to obtain ether using another person internationally. Typically the trades are carried out directly from every single participant’s billfolds – as opposed to from a central hot jean pocket owned because of the exchange – and this can be finished with atomic trades or another alternative of brilliant contracts technological innovation.

Atomic swaps permit you to trade a new coin from blockchain together with another gold coin on a several blockchain devoid of relying on a reliable third party and in addition they can either be achieved on-chain, thus coins will be directly transmitted from their major chains, or even off-chain, applying payment stations similar to the Super Network.

In order to burst into on-chain atomic trades is to crack the blockchain itself, the industry costly and hard exercise. The technical introduction to on-chain atomic swaps within the Decred DEX can be found right here. Since the swap takes place on-chain, clients are required to pay deal fees and can require a good knowledge of the specific crypto-asset you might be trading, for example using command word line purses and operating full client and so on.

Drawback to existing DEXs will be often terrible liquidity as compared to centralized choices. There is not adequate usage to earn DEXs attractive to the majority of shareholders and dealers. But as brilliant contract together with privacy solutions evolve together with improve, hence will decentralized exchanges along with the volume will abide by naturally.

There are several flavours associated with DEXs which includes more central than other people, and Decred have already contended that we haven’t seen the pure decentralized exchange however. When launching their purpose to build the DEX back June 2018, Jake Yocom-Piatt mentioned that will existing DEXs have changed frictions coming from centralized trades such as a reliable third party but re-introduced their very own friction by means of a token or even blockchain.

Also, in an article from Forbes inside February 2019, Yocom-Piatt mentioned that while central exchanges currently have adopted a new profit-driven unit, so too possess some DEXs, “Centralized exchanges help make huge income on report fees in addition to trading costs. Some of the huge ones need ridiculous 6-, 7-, or 8-figure report fees. Almost all DEXs can also be based on a new profit-seeking unit that doesn’t always even fair participate in for full price traders. ”

An understanding of Decred’s Decentralized Swap

Decred isn’t trying to build a blockchain and work with a native symbol for its DEX. Instead, a new client-server unit will be used to check orders to ensure that no symbol or particular blockchain is needed to make trading.

Mainly because there will be not any native endroit, there will be a good playing discipline for job and trade for equally traders and even crypto assignments who want to have listed. Typically the DEX is only a suit maker and even communication pass on and consumers are in charge of their resources throught the complete trading method.

Yocom-Piatt has discussed previously which the client-server style for buy matching is probably the fairest strategies to match orders placed, “By carrying out pseudorandom buy matching inside epochs — say every single 10-60 moments — that puts every person on a far more level enjoying field regarding latency. ”

Subsequently, there is no benefits to any person due to their world wide web connectivity and no likelihood for top running (an unethical buying and selling practice where a broker using advance familiarity with a specific industry order for just a client gets a profit by simply placing an order because of their own internet page in advance of typically the client’s greater order).

Secondly, there will be no trading fees on the Decred DEX permit a smooth knowledge when buying and selling digital belongings. However , you will have a one time fee to registration to stop spam disorders and include DEX functioning expenses, configurable by DEX operators. Likewise, for cryptocurrency projects you can find no report fees but it will surely be simple and easy getting a gold coin trading survive the DEX.

Third, with details based on General population Key System (PKI) main pairs, dealers would be able to use a Decred DEX and then timestamp exchange files onto Politeia to build all their reputation as the reliable seller/buyer. Politeia is without a doubt Decred’s censorship resistant, blockchain-anchored public pitch system. As the voting technique geared towards decentralized decision making, Politeia will be used to be able to vote in a very transparent together with democratic approach on the DEX before it might be a reality.

Together with PKI crucial pairs, you do have a public crucial and private crucial. The public crucial identifies authenticates web servers and customers, while the related private truth is used to indication and allow orders along with other messages. The particular client’s open public and private important factors also gets rid of the need for email usernames and security passwords.

By using on-chain atomic swaps together with “pseudo-random epoch-based” order corresponding, trades can be secure, trustless and members are in charge of the tools the entire time. Yet , to suppress disruptive habits, registered clientele are guaranteed by the regulations of area conduct and you simply could get banned if you have a serious breach. The one time registration service charge can be used for the reason that collateral and stay used to suppress violations for the rules.

Nonetheless, Decred’s fascinating project is certainly one to watch and has the to the greatest DEX however. The DEX will at first feature Bitcoin (BTC) Decred (DCR) in the early stages as well as the GitHub specification mentions, “it is anticipated that advancement communities will certainly release their very own appropriately vetted plugins. ”

The next phase is for the pitch for the genuine development of typically the DEX, which has been published in August seventh, to be acknowledged on Politeia by the area. Developers uses the Set off programming words to build typically the parts needs to make the DEX server together with DEX consumer a reality. Do the job will be synchronised through a general population GitHub database lead by simply Decred contributing factors but also offered to anyone else after the open source Decred contractor technique.