Coinbase Many Victories in The Well known Race and also other Developments Creating the Posture of Crypto In 2020

It is possible to factors constraining crypto’s well known movement. An example of such stands out as the apparent difficulties associated with the technological innovation, particularly when considering owning, storage, and transacting digital solutions. New traders have to get knowledgeable about a lot of vocable and bizarre systems ahead of they can get started enjoying the main advantages of participating in typically the crypto industry. The crypto space need to look for solutions to simplify processes involved in purchasing and expending crypto prior to technology can easily attain well known adoption, that Coinbase’s story regarding it is partnership by using VISA is a fantastic development with the crypto environment as a whole.

Here, I will check out Coinbase’s hottest milestone, it is potential influence on crypto’s well known growth, and also other new changes molding the continuing future of cryptocurrency technological innovation.

How come Coinbase’s Relationship with Visa for australia A Big Deal?

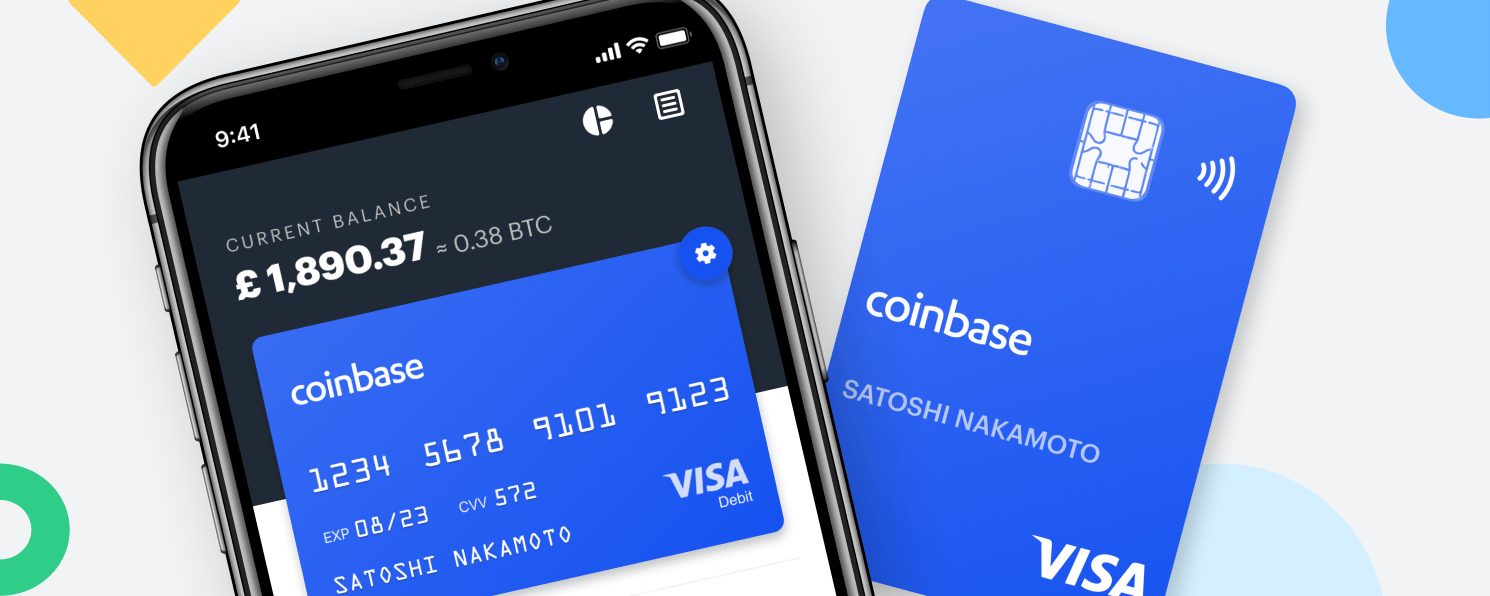

Coinbase Visa Credit Card

To the 19th involving February, Coinbase officially announced it has hit a deal along with Visa, which usually affirms the status quo as the “first pure-play cryptocurrency company to get Visa regular membership. ” Essentially, Coinbase is among the most first crypto debit cards service provider in order to earn the particular status of the principal person in Visa. Therefore, Coinbase does not go through third-parties before this issues Visa-backed crypto free e cards. One of the benefits of getting a Visa regular membership is that it enables Coinbase in order to stand being an intermediary among Visa along with other crypto companies looking to problem crypto free e cards based on Visa’s infrastructure.

Within the statement unveiled via their blog, Coinbase mentioned the fact that partnership will be better its crypto card expert services and extend its worldwide reach. The particular document scans:

“From funding getaways abroad to be able to trips about public move, Coinbase Credit card customers are responsible for their crypto work for these people in every day situations. Above half of consumers who’ve enrolled to Coinbase Card apply it regularly, having its usage peaking in the UK, implemented closely by simply USA, USA, and Portugal. Following the accomplishment of Coinbase Card, we are going to proud as the first enterprise in the crypto ecosystem for being granted Australian visa principal fitness center. This fitness center will permit us to supply more features when considering Coinbase Greeting card customers; right from additional products to support much more markets — all factors that will help to be able to evolve together with enrich typically the cryptocurrency settlement experience. ”

Coinbase’s latest take advantage of has reiterated its dominance in the rising crypto charge card marketplace. However , it truly is impossible to understand the importance of this without initially discussing your the crypto payment industry.

A new crypto credit card system is among the viable methods of spending cryptocurrencies, as it gives similar repayment features available on conventional charge cards. The only variation is that although conventional charge cards enable fedex transactions, crypto cards, however, provide quick crypto repayment services. Hence, crypto slots, with the help of crypto debit cards, could make crypto obligations in on the net or physical shops.

non-etheless, there is one particular factor which enables the entire procedure possible in addition to reliable. Each crypto charge card professional must incorporate with one of the main card infrastructures licensed to provide payment companies to several regions. Right now, the two cards payment system processors that will fit this particular description usually are Mastercard in addition to Visa, as being the majority of crypto card issuers include pitched their particular tent together with either of these to cash in on their superior payment system and safety measures.

Could is a offered, not till recently include any of the lively crypto charge card suppliers had immediate dealings together with Visa. Rather, these agencies had to endure intermediaries, known as Bin beneficiaries, licensed while principal associates of Visa for australia, before they could leverage the particular infrastructures with the card transaction processor. Since it is with every program involving middlemen, this business type comes with questions that contrain the crypto debit cards market. For just one, Visa may decide to slice ties having a Bin bring in, which will not directly cripple confer with all the crypto card suppliers it runs. Also, choosing an intermediary-based model increases the amount compensated to access the transaction network.

We certainly have seen this kind of narrative enjoy in 2018 when Australian visa suddenly trim ties by using WaveCrest, some sort of Gibraltar-based trash can sponsor. Australian visa stated of which “non-compliance by using operational rules” on the part of WaveCrest had obligated it to look at this action. Sad to say, this event a new damning influence on prominent crypto card service providers, which have implemented the trash can sponsor his or her access indicate the Australian visa payment community. Crypto debit cards aimed toward Europe-based crypto holders such as Xapo, Wirex, Bitpay, Cryptopay, and Bitwala became unnecessary overnight.

Subsequent these situations, the crypto debit cards industry strike a obstacle, as some cards providers needed to streamline the particular scope of the businesses in order to regions where they continue to had access to Visa’s payment facilities. Others are not as privileged since they needed to suspend businesses altogether. Consequently , it comes being a bit of pain relief to discover that will crypto cards providers include begun to get away around rubbish bin sponsors in addition to facilitate a much more reliable and fewer expensive method to offer their particular users Visa-enabled crypto transaction services.

On the flip side, some crypto card service providers have wanted a a reduced amount of volatile alternative, which is China-based financial service plan corporation, Unionpay. One of the COOs of the networks using Unionpay as an alternative to some sort of Mastercard/Visa-centric gardening noted the reason is easier to take advantage payment products because both sides rely on a basic model. Crypterium’s Chief Running Officer, Austin texas Kim, discussed:

Crypterium’s Chief Running Officer, Austin texas Kim

“Both Visa Mastercard enable you to develop credit cards for specific regions such as the United States, South usa, Europe, and so forth UnionPay, on the other hand, divides the entire world into 2 regions: The far east and the remaining world. It is in-line with our dedication to function clients through every part of the world. ”

So how exactly does Coinbase’s Brand new Milestone Impact the Crypto Area as A Whole?

Aside from being an unparalleled feat, Coinbase’s status being a principal person in the system bodes nicely for the crypto space. First of all, this accomplishment elevates Coinbase to the location of a rubbish bin sponsor. Therefore, emerging crypto debit cards providers may partner with Coinbase to access Visa transaction infrastructures, rather than relying on intermediaries with little if any knowledge at all of crypto technology. Juan Villaverde associated with Weiss Rankings echoed this particular sentiment any time speaking to CoinTelegraph. He explained:

Juan Villaverde of Weiss Ratings

“Other crypto corporations could potentially head to Coinbase to be able to issue their unique cards, as opposed to having to count on more traditional fiscal companies. Commonly, the latter are more unwilling to deal with crypto companies. This can create fresh opportunities for many people other tools. ”

This remains to be seen in the event Coinbase can capitalize with this potential method to obtain revenue, info allege how the crypto company is demonstrating no curiosity about operating as being a bin bring in “anytime before long. ” However, for every crypto debit credit card provider on the market, there is nothing as rewarding as skipping intermediate agencies required to access payment systems. These companies will quite become primary members his or her self. Fortunately, Coinbase has provided a new template to do this. Crypto charge card suppliers are now aware about the possibility of obtaining Visa membership rights. I believe which a majority of all of them have already executed plans in order to rid his or her self of thirdparty entities.

Additionally, Coinbase’s success is a tough indicator which the crypto room is started in the right direction. If perhaps simpler and even faster ways of transacting crypto is the aim, what better solution to establish this specific than to help make crypto free e cards way more reliable. Debit cards happen to be vital for the crypto well known adoption rule because they give you a medium to make use of digital values to pay inside conventional retailers or internet websites.

A primary reason why sellers and crypto holders are definitely not too inclined to adopting crypto cards is it is high-priced, which can be traced to the more advanced processes included in executing some sort of crypto card-enabled transaction. Yet again Coinbase comes with successfully bypassed one of these intermediaries, it is risk-free to say of which things are searching for for the crypto community. It is actually feasible the fact that the reduction in purchase fees would definitely trigger a influx involving crypto charge card consumers in the long run.

Coinbase Implements Username-Enabled Crypto Ventures

Pursuing the announcement from the Visa pub, Coinbase revealed times later it has started new features upon its finances that permit users to deliver crypto in order to usernames rather than wallet address. This growth conforms with all the ongoing force for less difficult crypto-enabled techniques that will attract a popular audience.

Whilst explaining the reason why for applying this function, Coinbase says its users usually encounter roadbloacks when sending crypto via wallet addresses. This argued that will availing a simpler mode regarding identifying crypto transaction receivers would get rid of the obstacles associated with extended and totally random pocket addresses.

The document reads:

“Human-readable addresses assist fix these types of problems. Nowadays there are services that will let you affiliate a short human-readable name along with your crypto tackles. […] We expect these enhancements will make cryptocurrency much easier to employ and help generate adoption having a more popular audience. ”

Crypto in mainstream TV

Crypto in mainstream TV

When we talk about adoption mainstream importance, popular Television show, The Simpsons, put the limelight on crypto in one from the latest shows. The show had Rick Parsons of massive Bang Concept explain the particular workings associated with cryptocurrency blockchain technologies. Later within the show, a note appeared upon screen detailing the recognized intricacies associated with cryptocurrency as well as the conundrum as a result of the unavailability of way of simplifying the idea. The information reads:

“Using the word “cryptocurrency” repeatedly although defining cryptocurrency makes it look like we have a new novice’s knowledge of cryptocurrency. Properly, that is a entire pile regarding cryptocurrency. In such a system, guidelines are described for the design of additional gadgets of cryptocurrency. They can be created by fedex like standard currency or perhaps thrown about randomly or even all provided to LeBron. ”

Wikipedia Is Not Considering Crypto

Within a separate state that tricked the suitability of crypto to popular systems, Jimmy wales, the particular co-founder associated with Wikipedia, says it is unsuccessful to present cryptocurrency technologies to the Wikipedia ecosystem. Any time asked in case a crypto-enabled program could help Wikipedia reward the particular platform’s members, Wales stressed that it was unsuccessful to do this kind of.

Wales explained:

Jimmy wales, typically the co-founder regarding Wikipedia

“This is a genuinely bad concept. It’s a perception that doesn’t actually job. If you take something which is a awful idea and set it in the blockchain, that will doesn’t actually make it a good idea. Making a mechanism where you successfully authenticate that will type of actions … isn’t going to aid in the quality of Wikipedia at all. […] To say in their eyes, you’re gonna have to pay or even put cash at risk so as to edit Wikipedia is completely ridiculous, ”

Nevertheless , he do mention that he or she is not in opposition to receiving crypto as contributions, as Wikipedia is a system invested in distributing knowledge, and contains accepted crypto donation given that 2014.

The financial institution of North america Unimpressed along with State-Backed Crypto

One more interesting article that could established the develop for crypto’s emergence within the global overall economy highlighted the particular reluctance associated with some banks to join the particular race to get a state-backed cryptocurrency. Timothy Street, Deputy Chief of the servants of the Standard bank of North america, mentioned within a recent speech that will Canada is just not interested in giving a main bank electronic currency sooner.

Lane stated:

Timothy Lane, Mouthpiece Governor with the Bank associated with Canada

“We have figured there is not the compelling situation to problem a CBDC at this time. Canadians will continue to be well-served by the current payment environment, provided it truly is modernized remains suit for objective. ”

This kind of revelation provides a surprise, when Canada was initially one of the few locations that acquired researched the notion heavily and initiated and even live-tested the same project about Corda. From Lane’s affirmation, it is risk-free to say of which regulators the Bank regarding Canada weren't impressed considering the results.

non-etheless, Lane included that Nova scotia will have most choice but for join typically the bandwagon any time private cryptocurrencies threaten typically the efficacy involving fiat values. It would appear that he can referring to crypto initiatives just like Libra, which may replace redbull money. Even though discussing the main reason whiy the Bank Involving Canada takes into account the inflow of these cryptocurrencies a hazard, Lane discussed that they are “a monopoly which would erode opposition and privateness and position an unpleasant challenge to be able to Canadian money sovereignty. ”

He added:

“It’s tough to anticipate if Libra will ever meet its claims or even enter into existence. Nonetheless it is a good example of the transformative technologies that impacts how the standard bank needs to reply to the future of cash, ”