Can easily Binance unveiling the first principal decentralized change (DEX)?

Binance quickly went up to control the Cryptocurrency exchange company. The trade only released in This summer of 2017 despite other major trades launching this year or previously. Binance finished its ICO in This summer 2017 elevating $15 mil to fund the introduction of its trade. By The month of january of 2018, it had currently progressed to the level where this accounted for the biggest amount of investing volume amongst top cryptocurrency exchanges.

Binance has been growing into a number of other areas of enterprise such as releasing fiat in order to Cryptocurrency exchanges in many jurisdictions. Nevertheless , one task that Binance seems decided on make a accomplishment is the establish of its decentralized exchange that is set to end up being fully functional sometime in the very first half of 2019. So far, zero DEX possesses succeeded inside achieving any kind of substantial fluid or invasion. The vast majority of DEX’s operating these days account for lower than $1 million inside daily buying and selling volume. The regular daily amount of Binance through 2018 seemed to be approximately $1. 6 billion dollars. Can the many dominant push in the cryptocurrency exchange enterprise crack the particular DEX trouble and make this a success? We all analyse the difficulties that DEX’s have experienced so far and exactly what Binance can be proposing which could make them establish the first extensively adopted DEX.

What advantages does a DEX bring?

Just before presenting typically the challenges of an DEX, it is actually worth considering what are advantages to be able to users. The key advantage is based on the custody of the children of solutions. When capital are kept on a central exchange, typically the custody is without a doubt transferred to typically the exchange. Typically the phrase when you don’t carry your tactics, you don’t hold the cryptocurrency is without a doubt widely distributed for this reason. DEX’s are built over a blockchain and therefore users are definitely not transferring typically the ownership with their assets into a third party. They may have their own concentrate on on the blockchain and they have whole control over estate assets. Another advantage into a DEX stands out as the idea of decentralization. Many cryptocurrency enthusiasts really are opposed to thinking about centralized people controlling all their ability to sell and buy cryptocurrencies. DEX’s don’t count on any one business as the DEX is ruled and obtained by a decentralized network involving computers.

What are challenges of which previous deals have encountered?

The very first and greatest challenge that will DEX’s currently have faced is the chicken in addition to egg trouble of fluid. Liquidity is needed to make an swap attractive to investors but investors are required to create the fluid. This has been an important challenge of previous DEX’s and every DEX has failed to create levels of fluid even near to that of central counterparts. Binance truly has a massive benefit inside tackling this challenge. Binance has indicated that they can be incentivising traders in order to transition their very own liquidity from other centralized swap to their DEX by offering greater discounts about trading costs.

The other major problem is the throughput together with latency concerns associated with DEXs. With a DEX operating over a blockchain, it is actually subject to typically the throughput together with latency limits of the blockchain it is made upon. A lot of major DEXs have been made upon Ethereum which has a 15-second block moment. Some of the DEX’s have discussed this by simply facilitating typically the order publication off-chain nonetheless there are still a lot of limitations. Dealers still have to hold back for the engine block to be combined with confirm the trade happens to be executed. On top of that, fees have been completely charged to achieve cancelling order placed making it an extremely unattractive means to fix market designers. Binance devoted huge amounts of options in making an system to handle billions of15506 volume inside their traditional alternate. Their buy matching powerplant can match 1 ) 4 zillion orders every second. Yet , non-e on this matters in terms of their DEX. Binance comes with other alternatives when it comes to making the DEX in the right way. Typically the DEX should operate on Binance Chain, Binance’s own local blockchain. The particular Binance Sequence will use typically the Tendermint opinion protocol a relatively new technological innovation but will cause 1 next block intervals. This will be order placed of value faster as compared to any DEX currently running.

Virtually any problems that could pop up while using the DEX?

Along with Tendermint as being a new technology rather than released in to production in a large scale item, there may be several security dangers. The Binance Chain will not be since secure since larger open public blockchains such as Ethereum. Nevertheless , tradeoffs are now being made to assist in the speed in addition to Binance possess a good background with safety measures practices therefore it is unlikely how the DEX is going to be fully released unless it is very secure.

Regardless of the one-second stop times, the particular DEX can still likely end up being unattractive to a lot of market producers and will be totally infeasible for the purpose of high-frequency investors. There is also the chance that traders still prefer throughput and fluid over guardianship of their possessions despite Binance incentivising investors to change to the swap.

Where does it stand now?

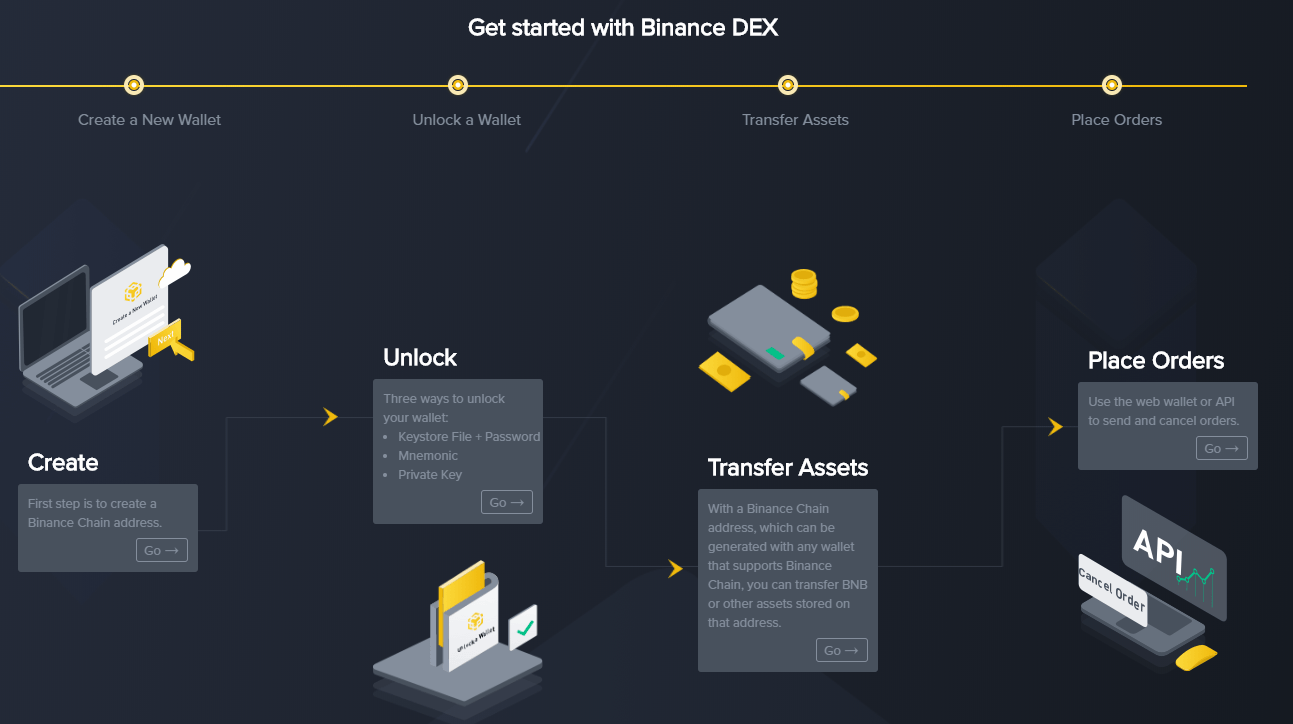

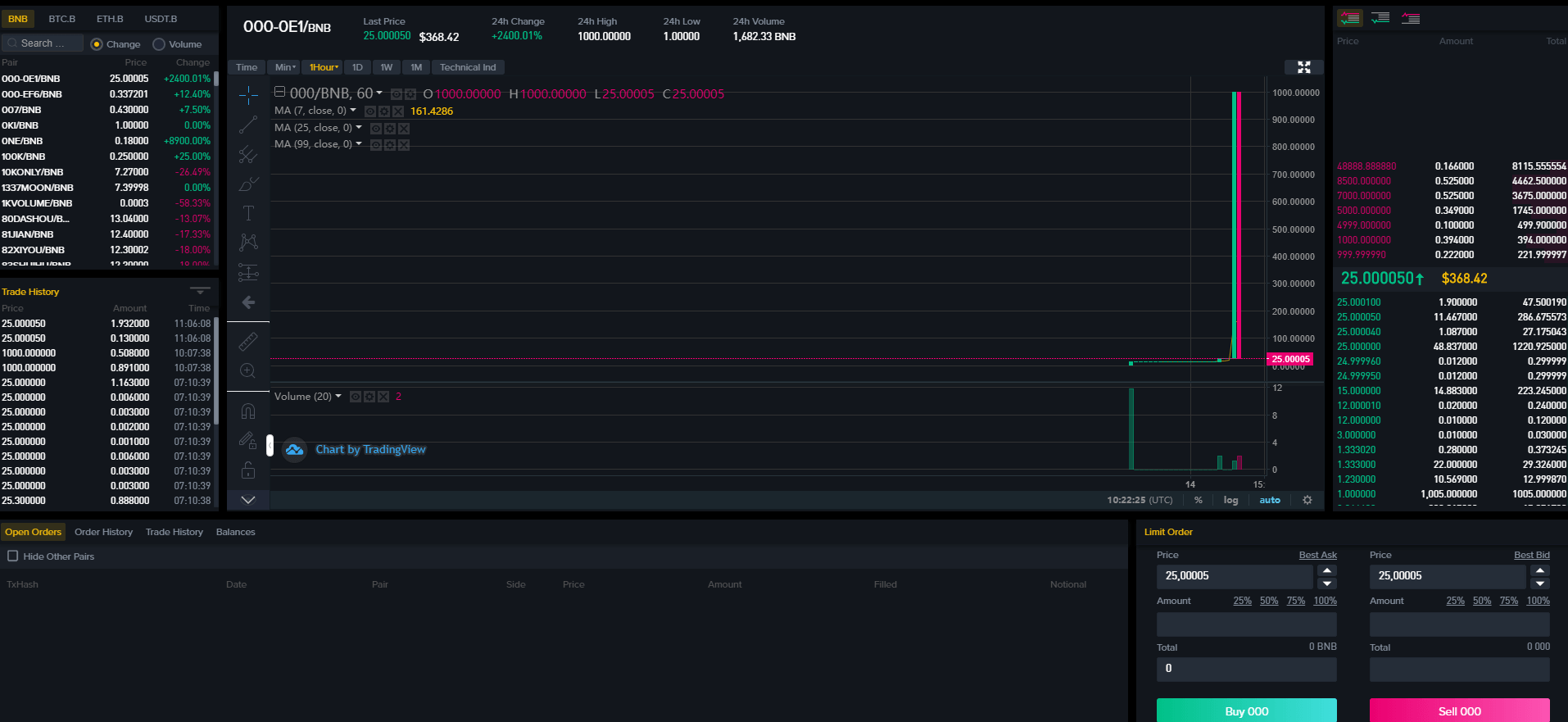

The particular Binance String is currently within testnet stage and investors are able to move Binance’s indigenous token, BNB, for the exchange. The key network is normally aimed to always be launched in the first 50 % of 2019. Binance has basically acknowledged that DEX will probably be cannibalizing all their centralized business design. But they picture it generating positive impact in BNB and they will cash in on this as a result of large amounts involving BNB that they hold. Efficiently launching some sort of DEX is 1 thing. Introducing a DEX to take on volumes found on important centralized deals is a thing that has never been found. So far, Binance has completed everything they've been determined to carry out. By the end involving 2019, organic beef see the earliest DEX efficiently competing having major deals.