Bitwise Shines Mild on the Crypto Market

Included in their work to establish the first bitcoin ETF, Bitwise delivered a new presentation towards the Securities in addition to Exchange Fee (SEC). The particular presentation protected extensive researching carried out by key element personnel inside Bitwise Advantage Management in addition to delved serious into the bitcoin market to expose several conclusions that have shaken the crypto world in order to its main.

Because of their studies, leading cryptocurrency data installer CoinMarketCap includes admitted of which inaccuracies featured in their info are indeed appropriate. Apart from info concerns, Bitwise has shone a light over the inner functions of the cryptocurrency market the reasons why they will feel the marketplace is ready for those to release the ETF.

Artificial volumes

A recent Cryptolinks content covered your research report by simply Coventure Money which exhibited inconsistencies inside the reported amount of exchanges to make a strong circumstance that the majority of major exchanges really are reporting manufactured volume quotes. The Bitwise report delved even further in this together with analysed files in a variety of ways like analysing buy books, make trades histories, distributes, trade measurements, and level.

The information was offered in a way to make a solid case towards multiple trades reporting quantities orders associated with magnitude greater than leading trade Coinbase Professional. Some of the important exchanges the particular Bitwise think are confirming artificial quantities include CoinBene, EXX, BitForex.

Source: Bitwise Report

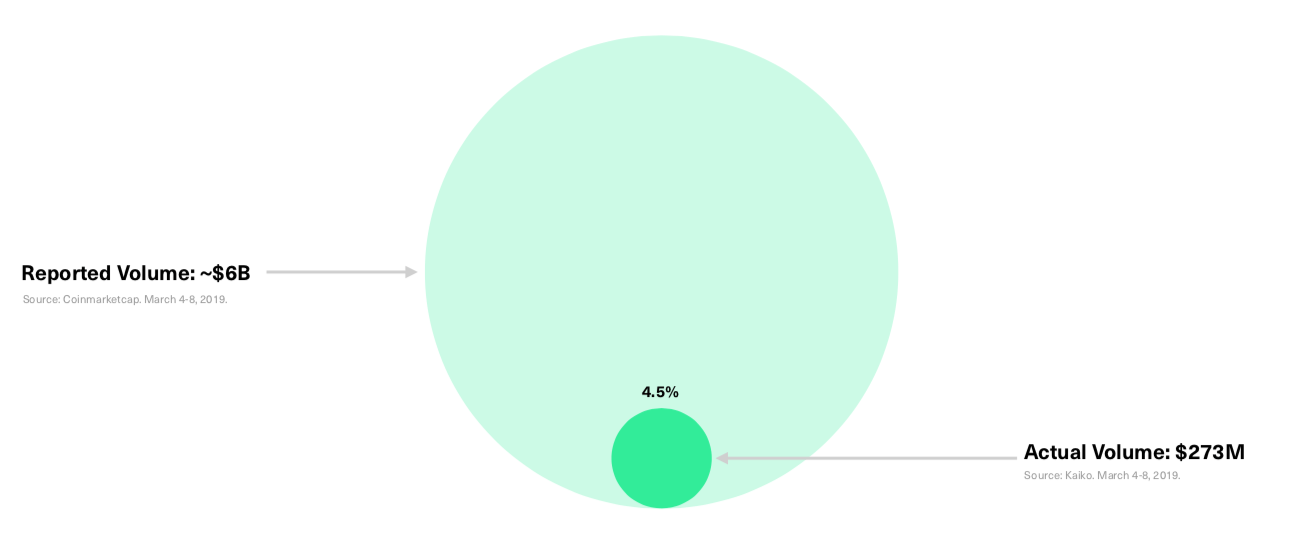

Typically the reported day-to-day volume for any bitcoin marketplace is noted mainly because $6 billion dollars. The result of typically the report asserted that all-around 95% on this is likely to be man-made and the genuine traded amount of the bitcoin market is prone to be $273 million.

With the analysis, 10 of the best 81 exchanges analysed were considered to be reporting authentic volume. They are the trades that Bitwise will basic the charges mechanism for the proposed ETF upon and are also the following:

● Binance

● Bitfinex

● Kraken

● Bitstamp

● Coinbase

● bitFlyer

● Gemini

● itBit

● Bittrex

● Poloniex

Inspite of the actual volume level being probably a small fraction of noted volume, the particular Bitwise account presents the particular bitcoin marketplace as incredibly liquid in addition to highly immune to market adjustment. We talk about some of the major developments said by Bitwise for precisely why this is under.

Just how can exchanges synthetically inflate his or her volumes?

There are lots of approaches which deals can use to get about synthetically pumping way up their volumes of prints. We reviewed these in greater detail in the examination of the CoVenture research nevertheless the main approaches are rinse trading together with a transaction rate mining.

Highlighted developments in the Crypto markets

Source: Bitwise Report

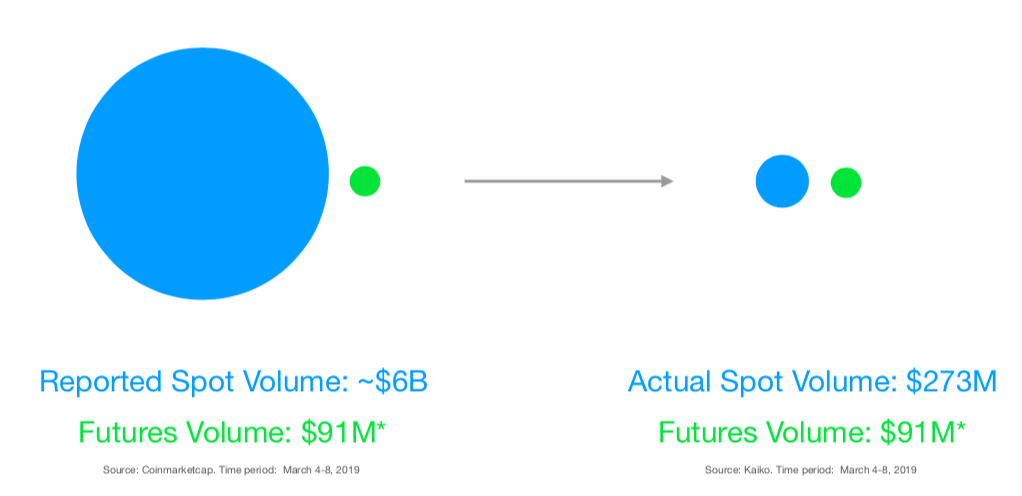

In case the actual stock trading is in fact all around 95% below reported volumes of prints, this means typically the futures industry holds a lot more significance relating to the price of bitcoin. Bitwise corroborate this point by simply noting that your launch for the futures corresponded closely aided by the all-time a lot of bitcoin assisting the first two-sided market together with means of hedge for bitcoin.

Having CBOE just lately after saying that they will always be discontinuing all their bitcoin options contracts, the CME will work a more natural part than ever. Another development of which followed following your launch involving bitcoin options contracts was a lot of institutional industry makers embarking the bitcoin market.

These kinds of market creators include Her Street, Stream Traders, and even Susquehanna. Typically the report in addition noted typically the launch regarding lending products by simply entities for instance Genesis International Capital when playing a crucial role inside the development of a new liquid bitcoin market.

Can there be attractive accommodement opportunities?

It really is commonly considered by newbies in the cryptocurrency marketplace that easy cash can be made out of arbitraging involving the price differences among significant exchanges. The particular report features highlighted these price differences are likely because of the artificial quantity reported by trades such as CoinBene and that hardly any arbitrage possibilities exist actually among the eight exchange known to be confirming real quantity above.

Typically the ten deals are taken into account to exchange punches effectively for a unified price tag and there are simply a handful of situations where deals deviated higher than 1% along with the lasted more than 90 seconds. In addition, it noted of which any accommodement opportunities of which seem to happen from bitcoin trading at the premium the moment paired in opposition to stablecoin USD tether (USDT) are actually due to USDT fluctuating within value towards USD erase any time adjusted properly.

Breaking down the Bitwise ETF

Bitwise have properly analysed past ETF slaps in the facerndown, veto and have believed responses by SEC to be able to carefully put together their ETF to meet the real key criteria given. Bitwise produced the recommended ETF in like manner make it really difficult to shape the price. Additionally, they noted all their plans to utilize a third-party governed and covered by insurance custodian for getting the bitcoin which is located for the issuance of ETF shares.

In case Bitwise effectively gains authorization for the ETF, the listing trade will be NEW YORK STOCK EXCHANGE Arca. NEW YORK STOCK EXCHANGE Arca is part of the Intermarket Surveillance Team which will give a surveilled marketplace that was mentioned as with a lack of the application from the Winklevoss twin babies to release a bitcoin ETF.

Total, the declaration demonstrates of which Bitwise own meticulously planned the details regarding launching a new bitcoin ETF. Apart from furnishing promising prospective that we could see a bitcoin ETF in the future, the declaration also offers an insightful check out the state of this bitcoin industry as it is an acronym.