Bitcoin versus Bitcoin SV: Which can be the Real Bitcoin? – Dissimilarities Explained along with the Truth Shown

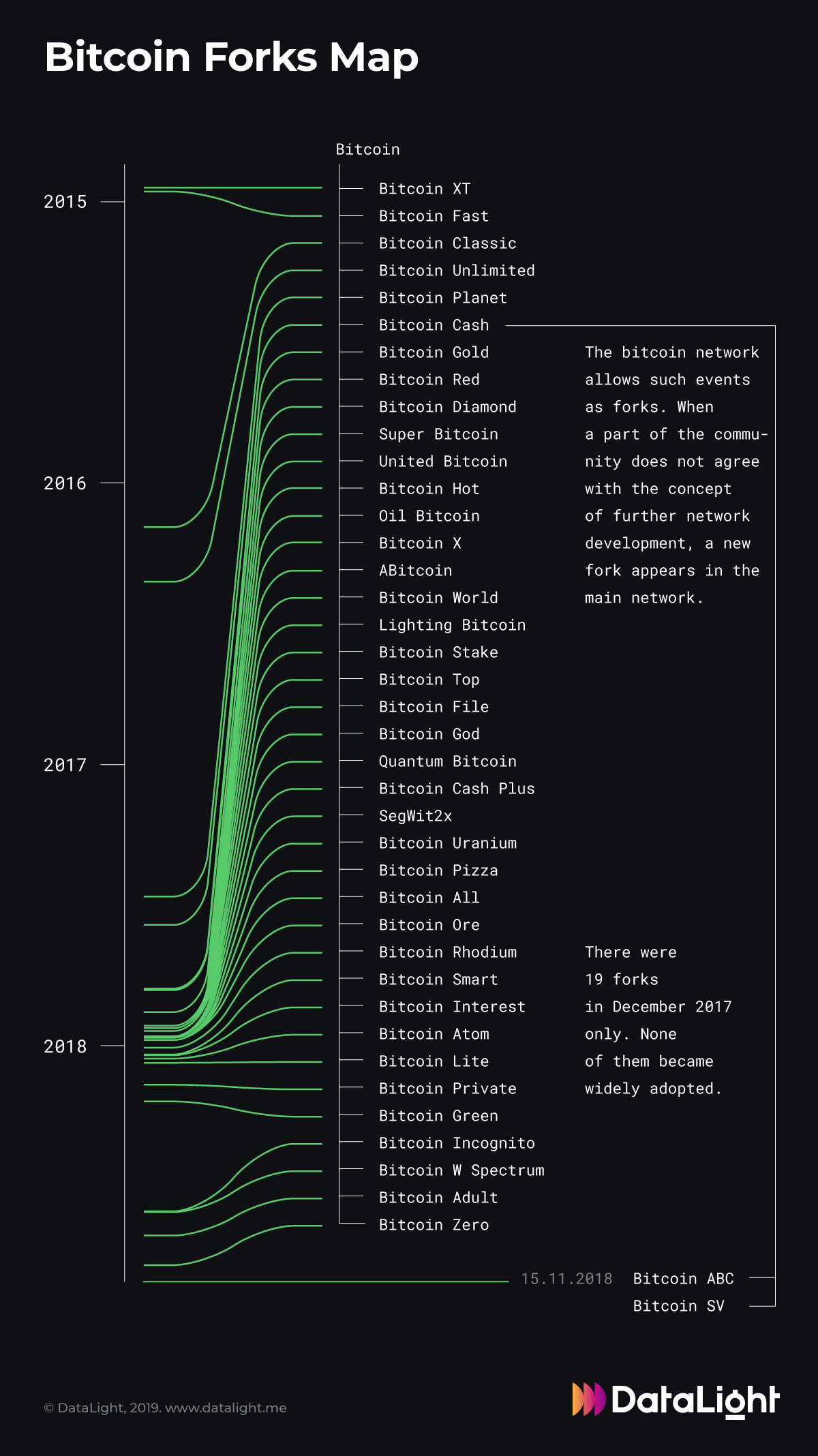

Bitcoin fractured throughout 2017 bringing about the generation of Bitcoin Cash (BCH) and separated the community in two campement. This is difficult for anyone who comes with joined cryptocurrency during or right after 2017, particularly with regards where is the “real” bitcoin. This kind of confusion was basically further exponentially boosted by Bitcoin SV’s separated from Bitcoin Cash in September 2018.

You will find currently 3 cryptocurrencies made up of the word ‘bitcoin’ in their brand in the top by marketplace capitalization!

In this posting, we will teach you the differences involving bitcoin (BTC) and bitcoin SV (BSV) trying to provide an solution on which will be the “real” bitcoin.

1st, we’ll clarify how this came to be there could be numerous or more compared to one ‘bitcoin’ in the first place. After that we’ll clarify the history associated with bitcoin, heading from the white-colored paper in order to its present state – as well as the origins of bitcoin SV – and evaluate the differences between two cryptocurrencies. Finally, we are going to move onto evaluating how to figure out which is the actual bitcoin.

Bitcoin: How can presently there be more as compared to one?

You will find two ways to produce a bitcoin spin-off; a signal fork or perhaps a hard shell. For example , litecoin is an sort of a signal fork, whilst BCH is definitely an example of a tough fork. Litecoin took the particular code associated with bitcoin, transformed it somewhat so purchases were quicker and less expensive, and a new new genesis block from the beginning. Bitcoin money, on the other hand, utilized a Miner Activated Difficult Fork to get rid of SegWit through bitcoin’s signal and spread BCH to each Bitcoin owner at a percentage of 1: one Bitcoin cases had to come to a decision whether to say their BCH and what related to it. The particular genesis obstruct of BTC and BCH are the same, hopefully which makes it clearer such a hard shell is.

The particular so-called tough forks regarding bitcoin will be displayed under. It is such as the process of mitosis, a copy on the bitcoin system and historical past to a certain stage is made, and perhaps a few guidelines or the atmosphere is converted to create anything slightly different.

History of Bitcoin

Bitcoin was born throughout January on the lookout for, 2009 when using the genesis engine block and the white paper was launched shortly prior to launch by simply someone, or maybe a group of people, so, who used the term Satoshi Nakamoto.

Nonetheless not much is well known about Nakamoto, but they led typically the implementation regarding Bitcoin right up until June last year shortly just before Gavin Andresen went to typically the CIA to clarify what Bitcoin was and even shortly just before Wikileaks started to accept bitcoin for via shawls by hoda after having out of the standard financial system.

Its Nakamoto’s point from the Bitcoin project of which eventually generated a lot of arguments in the technological path in the years ahead for the cryptocurrency. Following Nakamoto’s departure, a grouping of developers have been handed stewardship of the job, which included Gavin Andresen, and more – and in the end became generally known as Bitcoin Main.

Since stewards of the new, electronic sound cash, there were traditional views which experimentation must be kept down in the passions of safeguarding this new, special, and essential project.

Typically the reluctance to be able to scale about chain and even lift typically the block dimensions cap via 1MB, referred to as block dimensions debate, in addition to issues regarding censorship about Bitcoin’s main Reddit channel – r/Bitcoin – started to generate a sand wedge between ‘small blockers’ in addition to ‘big blockers’. Also, the particular Bitcoin Key team appeared to actively slow down alternative implementations of Bitcoin – for example btcsuite – which was declined and forced a team of developers to produce a new cryptocurrency, Decred. Likewise, Bitcoin Key were extremely uneasy together with Counterparty constructing on top of the particular Bitcoin blockchain, restricted Counterparty from constructing on Bitcoin in 2014 and not directly lead to the particular creation associated with Ethereum.

All these events produced people feel as though the development of Bitcoin was really centralized, as a group, be it natural or processed of people can determine what ought to and should not have to get added or even worked on. This particular sentiment has been galvanised as soon as SegWit, brief for Seperated Witness, has been activated using a soft shell on bitcoin during 2017.

A defieicency of SegWit was initially very good for the Bitcoin community, because it removed validations from the bitcoin transaction info and was initially originally will be included to be a compromise to be able to big blockers along with a growth to a 2MB block dimensions. However , simply SegWit gone ahead the big blockers in the community were feeling the need to break free from BTC and start bitcoin cash.

History of BSV

Bitcoin Satoshi’s Perspective (BSV) divide from Bitcoin Cash together with was guided by Craig Wright, Jimmy Nguyen, together with Calvin Ayre, from nChain and CoinGeek respectively. Typically the rift was basically caused by a couple of major arguments.

To start with, bitcoin SV sought to be able to appeal to individuals who wanted a more substantial block scale 128MB and even more radical on-chain scaling, even though the remainder within the Bitcoin Funds movement guided by Roger Ver together with Jihan Wu – often known as Bitcoin LETER (Adjustable Engine block Size Cap) – chosen block measurements of 64MB.

Additionally, changes to typically the bitcoin program – which will code bitcoin transactions – forced typically the BCH activity to splinter. During September 2018, Bitcoin ABC announced two fresh opcodes for the bitcoin funds scripts, often known as op_checkdatasig and op_checkdataverify, which has a hard pay. What these kinds of opcodes does in effect was going to introduce some sort of functionality almost like smart plans, Permitting financial transactions to check together with validate typically the signature by using an external belief, coming from a dependable data source or perhaps oracle.

Yet , to some bitcoin cash proponents, this transformation was not component to Satoshi Nakamoto’s original eye-sight and they dreamed of a bitcoin that dished up the original eye-sight. As a result, bitcoin SV forked away from bitcoin cash to clear out these opcodes and enormity on-chain towards a more aggressively. Bitcoin SV as well reactivated a couple of opcodes which are originally included by Satoshi himself, often known as OP_LSHIFT together with OP_RSHIFT.

The particular split was your eventual results of a series of “hash wars” where BSV in addition to BCH vied for the label Bitcoin Money and ticker BCH about exchanges, in addition to used their very own resources in order to commit hashpower to their particular chains. BCH eventually triumphed in by the end regarding November 2018, getting the keep your bitcoin money name in addition to ticker about exchanges, as the other cycle was referred to as Bitcoin SV.

Craig Wright’s Claims to the Satoshi Nakamoto Name

Given that we’re speaking about BTC compared to BSV, we have to mention Craig Wright’s claims to be Satoshi Nakamoto – which is not however proven effectively. If Craig Wright may be the real Satoshi Nakamoto, after that surely, BSV is the actual bitcoin? Possibly, but simply no so quick, there is no conclusive proof of this particular statement however.

Wright had apparently proven having been the originator of bitcoin with a personal of a personal key of the address linked to the ninth obstruct in Bitcoin’s history. Nevertheless , Dan Kaminsky later debunks his state.

The only method for Wright to demonstrate he is Satoshi is to indication something new, in our, to demonstrate he has those important factors, which is however to be completed.

Right after between BTC and BSV:

Scaling

Difficulties difference in between bitcoin in addition to bitcoin SV is the prohibit size in addition to approach to running. While bitcoin focuses on a mixture of careful on-chain scaling, in addition to experimental off-chain scaling, like the Lightning System, bitcoin SV focuses their efforts about on-chain running.

Bitcoin SV does not have SegWit and it has a much increased block scale 128MB in comparison to Bitcoin’s effective block scale roughly 4MB. However , the specific average prevent size is increased for bitcoin, as it recieve more users and much more transactions. It might be interesting to find out what happens if there had been much more utilization on the bitcoin SV string to see if their own scaling statements are authenticated.

Circulating Supply

However, you might expect the particular circulating flow of bitcoin in addition to bitcoin sv to be the similar, they actually fluctuate, with bitcoin at seventeen, 734, 262 and bitcoin SV with 17, 811, 452 during writing. The particular faster charge of release of money for Bitcoin SV had been inherited coming from Bitcoin Money.

Nevertheless , data services are very misleading, because they do not are the cause of the gold coin that were not really claimed throughout the fork. Approximately around four. 5 mil BSV cash were stated out of any 17. five million, however the market cover is determined as if seventeen. 5 mil are actually moving. This means fluid will be reduced for BSV compared to BTC and that indicates more knee-jerk movements pertaining to BSV within the markets. Furthermore, BSV is usually scarcer compared to BTC whenever we account for unclaimed coins, when demand actually does increase, the value of BSV may boost significantly.

Bitcoin Cash a new higher issuance rate as a result of an Emergency Difficulties Adjustment in the algorithm, generating BCH even more profitable to be able to mine as compared to BTC at the beginning. Since Bitcoin SV was basically forked out of Bitcoin Funds rather and even coins have been distributed in accordance with how much BCH you saved, Bitcoin SV has a better issuance cost than bitcoin.

Though both loose change will expertise halvings, typically the dates might differ a little due to variations in the rate of which blocks really are mined. Mainly because explained previously mentioned, the issuance of BCH and therefore BSV is more quickly than bitcoin’s. Bitcoin’s up coming halving is caused by occur Could 22, 2020, whereas BSV’s will be a little earlier, all around April 6th, 2020.

OpCodes

An extra difference pertains to op regulations.

Craig Wright and even Calvin Ayre created BSV with the aim of getting back to the original bitcoin 0. a single protocol and even maintaining a reliable protocol. Meaning Bitcoin SV reenabled opcodes, as mentioned previously. But so why were typically the opcodes impaired in Bitcoin? As a post by nChain explains, out from caution opcodes were impaired when a couple of bugs seen in the Bitcoin network inside June the year of 2010.

BSV wants to reintroduce these opcodes to explore all of them further in addition to whether they need to remain handicapped.

Maturity

BTC is over ten years old whilst BSV continues to be very youthful, which have effects for their particular communities ecosystems.

Bitcoin is far more well known, has more product owner adoption, and it has a greater target audience on social networking. Contrast that will to bitcoin SV, that is a relatively new task with it almost all to gain, with increased merchants users in order to win over.

Decentralization/Usability

It ought to be mentioned there exists a lot of trade-off involving decentralization/security together with fast/low service fees & wonderful for a cryptocurrency network.

These types of trade offs have to be manufactured, and it can be useful to conceptualise the different bitcoin variants in this manner. It could be stated that Bitcoin will take decentralization/security a lot more seriously, reducing some facets of usability in addition to efficient deal, while BSV can be contended to take quick transactions, reduced fees in addition to usability a lot more seriously, most likely neglecting quite a few aspects of decentralization.

Roger Ver, a leading figure in Bitcoin Cash/ABC, provides stated formerly that Bitcoin Core is usually akin to research experiments having fun with Raspberry systems and that bitcoin has not advanced in reaching its authentic goals for example banking the particular unbanked bringing a well balanced and protected money in order to developing nations around the world.

Each of the sides in addition accuse the other person of inefficiencies in one of the grounds critical to be able to understanding bitcoin, with Bitcoin figureheads aiming to the BCH/BSV team’s not enough knowledge about laptop or computer science. Bitcoin SV encourage 0-confirmation ventures and have taken off replace-by-fee, whilst Bitcoin would not promote 0-confirmation transactions. Bitcoin SV cases that they aid merchant encroachment, whereas Bitcoin Core notice it as a basic safety risk.

Exactly how Determine That is the Real Bitcoin?

Satoshi was a wonderful thinker in addition to economist, but it really has been mentioned he/she/they wasn’t as good at encoding. As his / her ideas had been tested, bitcoin changed based on empirics rather than theory. For instance , one PROCESSOR one political election.

Some would say the real bitcoin stands out as the one closest the light paper, but the fact of the matter is that many creative ideas were untested then, yet again they are, we certainly have learned new pleasures, so the proper bitcoin will not be the one closest the light paper. Precisely what is probably suggested when people admit is that the proper bitcoin stands out as the one closest the beliefs and eye-sight set out inside the white magazine, such as the proper bitcoin really should be peer-to-peer electronic digital cash.

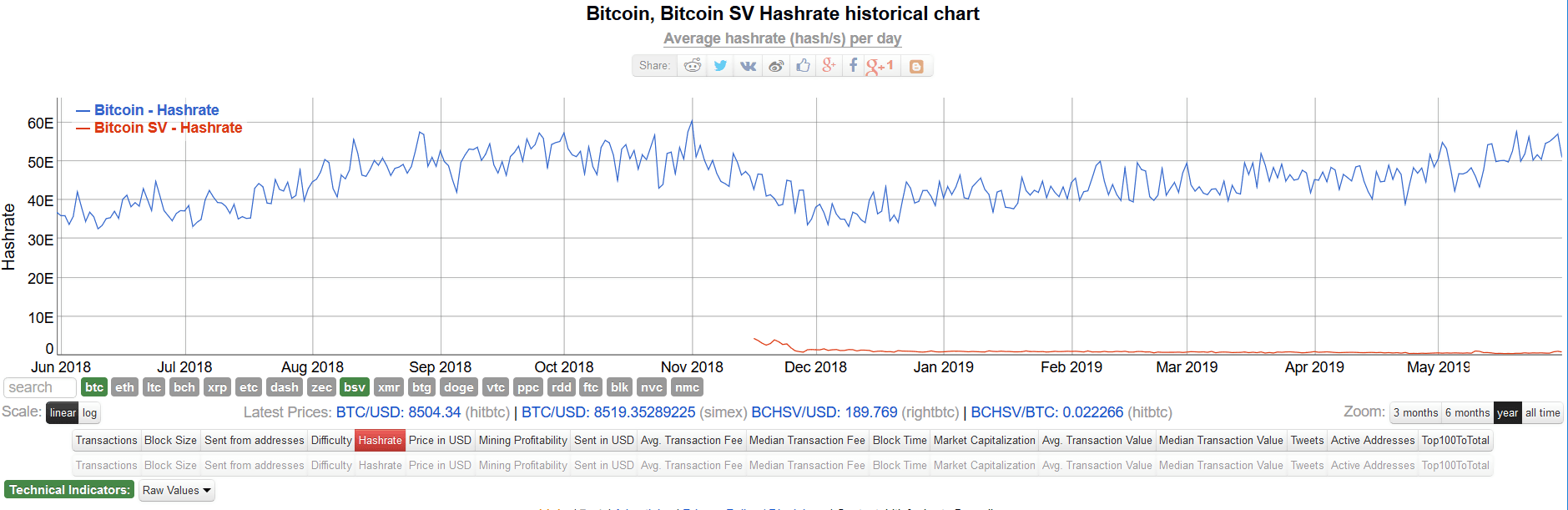

We're able to look at the distinctive players inside the ecosystem and discover what they consider is the realistic bitcoin. For starters, let’s check out miners. In which is most belonging to the hash cost? Is it having BTC or perhaps BSV? Effectively, BTC is the winner hands down. Typically the chart down below shows typically the hashrate of each and every network.

The particular hashrate regarding BTC dwarfs that of BSV.

Subsequent, we look on traders in addition to investors. The amount traded in addition to liquidity when it comes to bitcoin is a lot higher than BSV’s. According to OnChainFX. com, the particular reported allnight volume can be 24. two billion when it comes to BTC whilst for BSV it is about $612 , 000, 000. Also, the price tag on bitcoin can be near $9000 while BSV is currently just below $200, recommending the market can be telling us all BTC is definitely the real bitcoin. However , the market industry price will not always identical the benefit in order to society or even world in particular due to externalities, imperfect in addition to asymmetric details, etc ., thus using the basic market price to find out which is bitcoin is problematic.

Regarding development, bitcoin is approach ahead, using 581 contributing factors while bitcoin SV has got 0, in accordance with CoinGecko. There were 46 is committed to the last a month for BSV, whereas with BTC of which figure is certainly 154, providing a sense of this development action in recent days. So it is apparent that builders are choosing to be effective on Bitcoin rather than Bitcoin SV.

Lastly, we can take a look at merchants in addition to usage. Presently, bitcoin SV procedures about 1 tenth or even thereabouts from the number of dealings bitcoin procedures per day, showing much smaller utilization for BSV. While bitcoin is digesting around 370, 000 deal per day, BSV processes regarding 40, 500. Interestingly, the typical dollar associated with a deal on both systems are very comparable at this point with time. In terms of cost stability, bitcoin is less risky than in comparison to bitcoin sv over the latter’s short background.

However the crowd is not really always actually right. A new deep knowledge of the career fields of cryptography, computer programming, application development, sociology, psychology, in addition to economics have to assess the says of different cryptocurrencies.

Beauty of Bitcoin: Nobody Can Tell An individual What the Legitimate Bitcoin is normally, You Have to Opt for Yourself

Choose your toxic – each bitcoin bitcoin SV are problematic in different methods. But the great Bitcoin is it is permissionless – nobody can tell you to not work on bitcoin or inform you what the objective of bitcoin is. It really is subjective, based on who anyone asks, you will get various answers towards the question “what bitcoin may be the real 1? ”.

Comparable to any community good, for instance a park, nobody can tell you a person shouldn’t enjoy football right now there or have the BBQ along with your friends right now there, because it is for everybody to enjoy in addition to use. The truth that bitcoin is usually open source implies that if an organization manages in order to force a big change that is not exactly what some people consider represents exactly what bitcoin is usually, then they may restore the particular blockchain to be able to how it absolutely was prior to the transformation, and create a fresh version minus the change – which is fundamentally what happened by using SegWit, as i have said before. This market and the persons can finally decide for their particular own what the proper bitcoin is without a doubt.

Plainly, for now, BTC is the true bitcoin – although their lead relies upon the thriving execution and even adoption regarding second part solutions just like the Lightning Community. [First mover advantage – bitcoin. Examples of where first mover advantage worked and failed]. However , typically the debate of what is the legitimate bitcoin is normally unlikely to be able to cease the eventual victor of this conflict may not be typically the coin that is certainly currently inside the lead at this time.

Since it stands, bitcoin has proved to be an interesting test over the past 10 years or so, however it could take an additional decade, 2 decades, perhaps an additional century regarding bitcoin – or a rival – to actually achieve the initial aim of peer-to-peer, electronic money.

When cryptocurrency individuals might be discussing which is the true bitcoin, it could be that the best solution to the concern is that we’ll only find out once the hinder subsidy is finished from bitcoin – which can be estimated being around 2140. Then, the true bitcoin is the structure most miners are carrying on with to my very own without the hinder subsidy and then for the purchase fees simply, that is, really the only blockchain where transactions happen to be plentiful so that mining is certainly profitable available for miners.