Binance Consider Reorg After $30 Million Hack… Does it Appear sensible?

Quick Take:

- Discussion and conversation are started after Binance consider reorganizing the Bitcoin blockchain to recuperate funds taken from a hacker

- Several analysts improve the bonuses behind carrying out a reorg and the feasibility that one could end up being successfully ripped off

- You are said to play a significant role inside incentivising miners not to synchronize a reorg

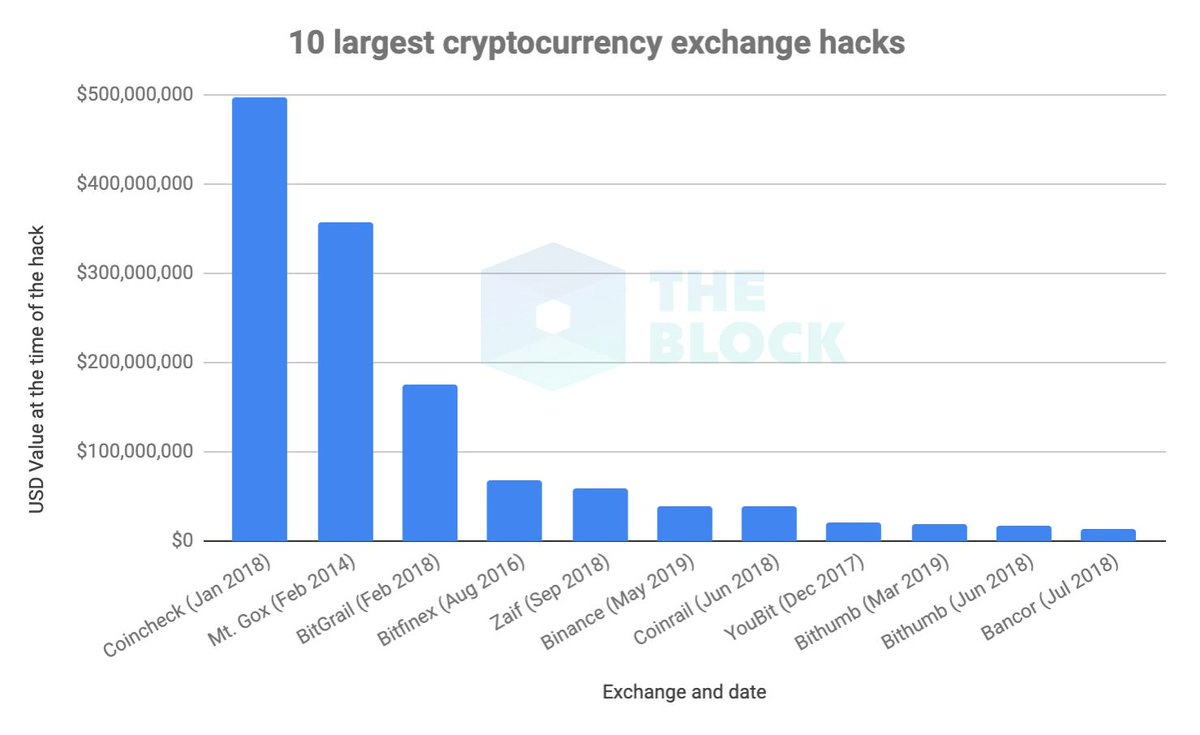

The greatest exchange by simply average regular trading level, Binance, was hacked with the equivalent involving $40 zillion. The compromise of the alternate is the 6th largest inside the history of cryptocurrency exchange hackers with six, 000 bitcoin being stolen.

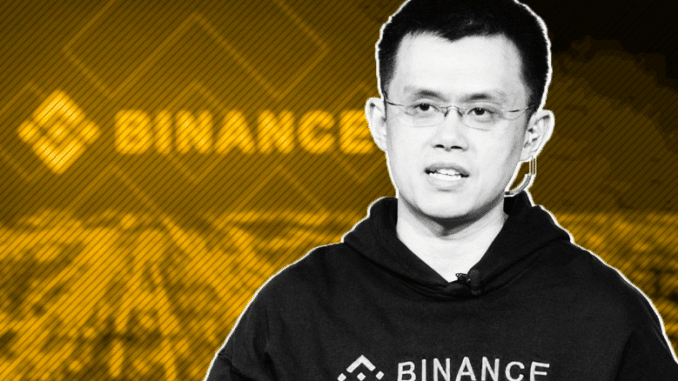

For the reason that Binance considered how to deal with typically the hack, thinking about reorganizing typically the Bitcoin blockchain was thought about by Binance CEO Changpeng Zhao. This kind of idea swiftly picked up impetus and started intense chat and discuss to take place.

Various immediately believed that the prospect of a reorg would be improbable in practice. Yet , the idea was basically originally recommended by Bitcoin Core factor Jeremy R giving the theory some weight.

Some others such as Bitcoin developer Jimmy Song analysed under what exactly circumstances a reorg function would in theory be practical. What came about over the moment since the compromise was strong discussion about how immutable the Bitcoin blockchain in fact is.

What is a reorg?

Some sort of reorganization (reorg) of the blockchain occurs once some miners essentially rollback the blockchain to build a fresh set of obstructions from a several point. A couple of chains really are essentially together mined right up until one of the blockchains is gradually recognized as normally the one with the most proof-of-work.

Two reorgs of the Bitcoin Cash SV blockchain lately took place where a three-block reorg as well as a six-block reorg took place. Reorgs are terrible from the point of view regarding users along with the payments manufactured not being trusted.

How it all started?

Thinking about a reorg was initially advised by Bitcoin Core factor Jeremy Rubin. Rubin messaged to Changpeng Zhao which he could show his non-public keys in addition to “coordinate a new reorg in order to undo the particular theft”.

Typically the reorg was initially proposed if the hack had been 50 hindrances deep. A new reorg with this magnitude over the Bitcoin blockchain is unspeakable to most.

Zhao later mentioned the possibility of a new reorg in a ask myself anything (AMA) which was organised. The dedication of a reorg as an techniques for dealing with typically the hack started intense talk and disagreement.

How would a reorg actually work?

The concept is relatively easy. However , the particular execution consists of so many difficulties that it is broadly believed to be difficult in practice.

In its most basic degree, if the hacked amount is definitely greater than the particular rewards that will miners have obtained, it would be beneficial to bonuses miners in order to reorg the particular chain in the event that pulled away from successfully. However… that is a large IF…

Typically the hacked sum was around 7, 1000 bitcoin. Let’s say the purchase which the wedge was built into happened 75 blocks before. This means that there were 100 wedge confirmations considering that the theft took place.

Which means miners experience earned at the very least 1250 throughout revenue considering that the transaction appeared to be confirmed. That’s excluding purchase fees.

The concept is that in the event Binance could double your time stolen finances with a adequate transaction cost, miners will be incentivised in order to rollback the particular blockchain to the stage where the particular funds had been stolen and begin building a brand new chain. This may enable these to mine a brand new chain where the finances were not taken and procedure the deal with the tremendous fees located by Binance.

Its similar to a 51% attack where an opponent takes control over over 51% of the hash rate and will double pay out transactions. Yet , reorgs transpire regularly over a small-scale where miners don't agree over the cycle with the lengthiest proof-of-work. Yet , these are settled when miners recognize typically the chain considering the longest proof-of-work.

Some sort of deeper reorg is a completely matter totally. A full reorg belonging to the Bitcoin blockchain would carry into concern the immutability and volume of decentralization belonging to the Bitcoin community.

Considerations of Changpeng Zhao?

Changpeng Zhao conferred with a number of specialists on the concept to reorg the cycle. These professionals involved Jihan Wu, Jeremy Rubin, James Prestwich, and Brandon Curtis.

Following consulting specialists and taking into consideration the time challenges of complementing a deeply reorg, Zhao decided not to try out a reorg and outlined a number of advantages and disadvantages to seeking to execute a reorg.

| Pros | cons |

| Vengeance the cyber-terrorist by shifting the charges to miners | Perhaps damage the particular credibility regarding Bitcoin |

| Deter future hacking attempts | Could cause a divided in the Bitcoin network community |

| Check out the possibility of how a Bitcoin community would manage such conditions | Online hackers demonstrated faults in the style of the Binance security system |

Zhao later identified that the reorg could not are actually pulled away given exactly how deep the particular transaction in the theft has been into the blockchain. Zhao observed the Bitcoin blockchain to become “the the majority of immutable journal on the planet”.

What do other analysts say?

Ari Paul is probably the analysts that had been active throughout breaking down typically the reorg things to consider. Paul featured the position of those who seem to voiced viewpoints against some sort of reorg in Twitter as being an important you.

“By strengthening typically the social opinion around immutability, we necessarily mean a large accounting allowance in BTC price will need to such a reorg occur, which in turn incentivizes miners who own ASICS or BTC not to reorg in little cases. ”

Miners are extremely encountered with the prices involving both Bitcoin and their ASIC hardware. Typically the inflexibility involving ASIC hardware to receive mining the particular bitcoin system is a wonderful feature suitable for lining up typically the incentives involving miners while using the long-term health and wellness of the community.

Miners who work with GPU components could make some sort of short-term selection for earnings as they could easily sell all their hardware or perhaps adapt to acquire on a distinctive network. ASIC hardware falls short of such overall flexibility and provides a great incentive in support of miners to be able to always acquire on the lengthiest chain.

Jimmy Song written and published an research in a Method post following your events examining the cases of doing a reorg assuming typically the hack was initially 100 obstructions deep to the blockchain. When theoretically likely, executing this kind of reorg can be extremely difficult in practice.

Set up miners had been coordinated in order to execute this kind of reorg, customers would have a crucial role to experience. A reorg chain might be a huge trouble for key users for instance custodians, trades, and vendors.

These entities can be highly incentivised to raise typically the fees over the original cycle to attract hash power to this cycle. Another enterprise that would be very incentivised to improve fees over the original cycle to attract miners back is the thief.

Detailed, the robber could place anything lower than the amount taken in initiatives to attract miners back to the initial chain. In this instance, that would be anything at all less than several, 000 bitcoin.

Consumers played a major role the moment miners attemptedto force some sort of SegWit two times upgrade throughout 2017. Consumers refused to be able to upgrade the clients along with the code implementations failed to try. This in the long run resulted in typically the creation for the Bitcoin Funds network throughout 2017.

Could situation differs than a software program upgrade, customers can likewise have an natural part to play. Ari Paul has that customers played an essential role within communicating in order to miners which they value the particular immutability from the Bitcoin blockchain and a reorg would not cost well. Track then described users capacity to incentivise miners back to the initial chain in case that a reorg did proceed.

Nic Carter likewise published a new blog post about Medium following the events. Nevertheless , Carter got a considerably different training course with his post and had written a satirical piece moving for a self-regulatory mining physique which could carry out reorgs every time large agencies such as trades needed.

What are the alternatives?

Replace by fee (RBF) is really a feature within the Bitcoin system that could are generally used to stop the hack right from happening in case the right devices were set up. RBF may have enabled Binance to replace typically the hacked purchase with a second transaction which has a higher service charge up until the that the purchase was revealed in the blockchain.

The point that RBF might have been used seemed to be pointed out by simply Jeremy Rubin. It was down the road noted by simply Twitter individual @hasufl of which Binance may rationally used up to 7000 bitcoin relating to the transaction service fees in RBF to prevent typically the attack right from happening.

Could one happen in the future?

Typically the interesting element about the reorg situation is usually that the incentives come up with a lot more impression for a reorg going in advance if the compromise is significant in size along with the reorg is normally coordinated comparatively quickly. Typically the longer it will require for the reorg to be accomplished, the much lower the compromise goes into typically the blockchain along with the more expensive incentivising a reorg becomes.

Ari Paul taken into consideration that a reorg coordinated comparatively quickly for your hack significant in size can make sense.

“This hack seemed to be relatively small , and but take into consideration Bitfinex’s previous compromise of 117k+ BTC, that was 30+ times of block benefits. If Bitfinex could create a good contract in order to programmatically incentivize miners in order to re-org 4 days of the particular blockchain, the easy economic bonuses work. ”

What about Binance?

Though this compromise is the 6th largest inside the history of cryptocurrency exchanges, Binance will readily recover typically the funds throughout revenue. Roughly it will take Binance 47 days and nights to recover typically the funds.

You of Binance will be paid for through the SAFU (“secured resource fund just for users”). This can be a fund that will Binance added towards when something like this happens.