Largest Scams as well as Hacks throughout Cryptocurrency Record

Cryptocurrencies could be an emerging discipline. It takes moment for the level of expertise from the section of consumers to be able to catch up with the hazards that move. Not only is it the emerging discipline but it also bargains in the field of electronic digital and sometimes unknown money. This will make it a ready place with hackers and even scammers the same. The first step to aid prevent in opposition to being hacked or ripped off is to be aware about what has got happened in past times. We include the major ripoffs which have occurred to date.

the Exchange Risk – Mt. Gox

The most significant hack inside the history of cryptocurrency occurred in 2014 when Mt. Gox possessed over 740, 000 Bitcoin stolen from exchange. Rather advice throughout cryptocurrencies to not ever leave the funds by using an exchange and also this hack remains to be referred to currently. When consumers store the funds in exchanges, they are simply handing in the control of the funds for the exchange.

When the compromise, Mt. Gox was coping with over 70 percent of the purchase volume taking place in Bitcoin. Users who their finances hacked have not acquired any settlement back inspite of the value of Bitcoin drastically growing since the moments of the compromise.

Due to the fact that this time, there are numerous even more exchange hackers with Bitfinex being a second notable compromise. It is always critical to remember that forcing your capital on an alternate exposes the funds to the type of threat.

The particular Too Very good to be Legitimate – Bitconnect

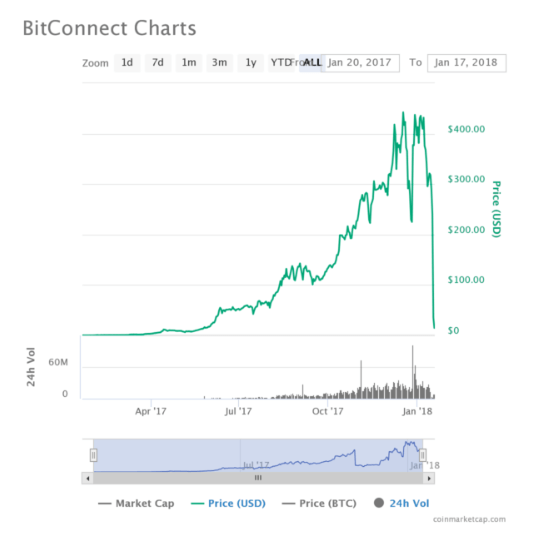

A recent con was peer-to-peer lending program Bitconnect. Typically the cryptocurrency accumulated huge amounts of awareness before eventually being showed be a con. Many have been aware it absolutely was a scam ahead of it falling apart but there seemed to be also significant support associated with Bitconnect out of investors.

Typically the cryptocurrency guaranteed returns depending on peer-to-peer financing. Bitconnect certain investors 1% daily exponentially boosted returns. At the end of 2017 early 2018, the company confronted legal problems which resulted in the price of the particular cryptocurrency a crash.

Bitconnect was methodized as a Ponzi scheme while using the price of typically the cryptocurrency according to new entrepreneur capital moving. It is important to take into account this con in cryptocurrencies as some others operate very much the same. Cryptocurrencies including Onecoin had been organised inside the same composition as a Ponzi scheme. The typical rule of thumb as if it is also good being true, that probably is normally.

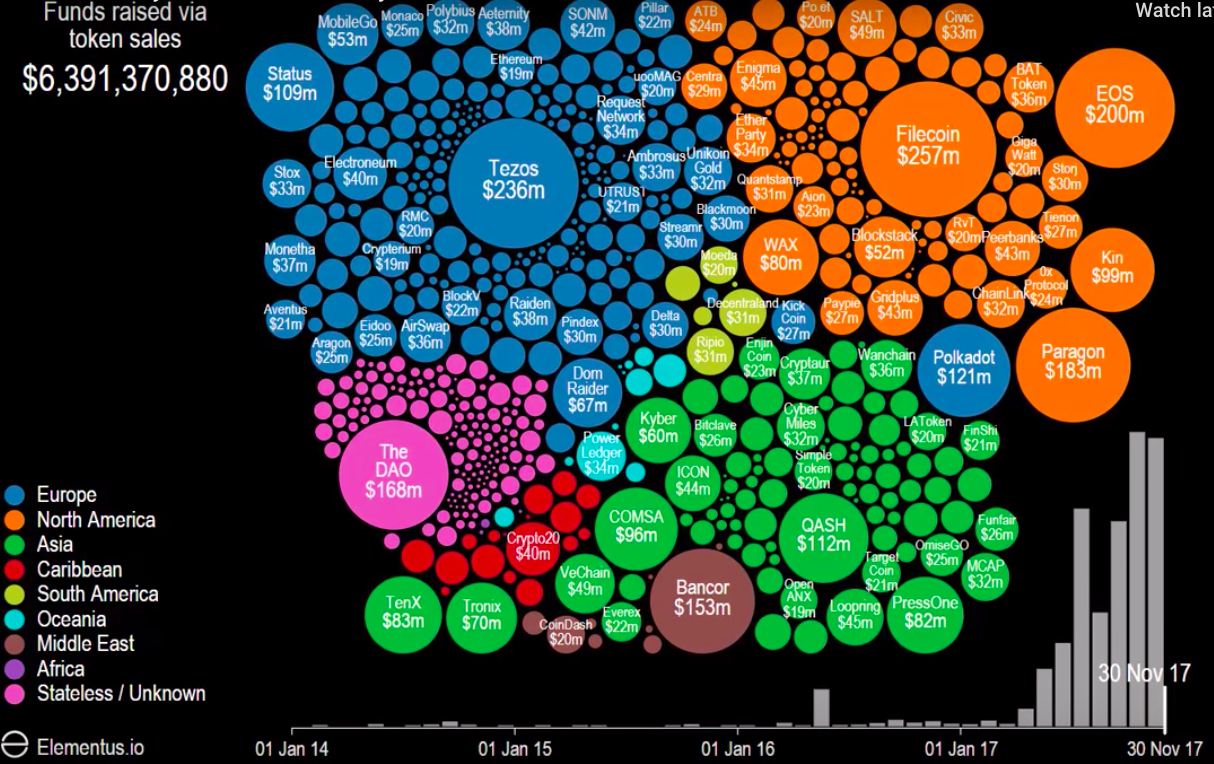

ICO Scams – Plexcoin

Preliminary Coin Products (ICOs) cracked in 2017. ICOs really are a new fund-collecting mechanism where teams increase funds by way of distributing a new cryptocurrency or even token linked to a project they will plan to build. If the task gets effectively developed, buyers hope the fact that token they will invested in is going to be worth much more.

The particular growing quantity of ICO’s offers resulted in presently there also is an increasing number of ICO’s that are scams. There has been countless leave scams where ICOs had been completed as well as the team vanished afterwards. All of the proper stations are typically setup such as a Telegram to help traders contribute and pretend LinkedIn information to represent they.

You can find often signals when an ICO is going to be a hoax. The deceitful Plexcoin ICO promised buyers an more than 1300% bring back in 30 days. The particular project brought up approximately $15 million by investors the founders guiding the task have due to the fact received calamit� from the United states of america SEC. In numerous of these situations, the team guiding the task is not known and go away after the ICO is comprehensive.

Deliver 1 ETH, Get two Back – Vitalik Non-Giver of Eth

This is certainly one of the more popular scams and it is still widespread. The rip-off is based on tempting individuals to send out cryptocurrency hoping to receive a better amount in exchange. So many people currently have caught at this time scam that will innovators in addition to influencers for example Vitalik Buterin have altered their social networking names in order to explicitly suggest that they are not giving out Ethereum. Con artists will continue to post looking to entice customers to send cryptocurrency.

Roughly approximately $1. 5 zillion has been conned from alluring users to deliver cryptocurrencies.

Safeguarding the Personal Key Checking the Open public Key

Rather advice throughout cryptocurrencies to be able to closely preserve your privately owned key. Disclosing your privately owned key to any individual provides access to the capital in the pockets. By adding your privately owned key in shared sources or fog up services, you will be running the chance of this information simply being accessed by simply someone else together with losing the funds.

Hoaxes have also been designed targeting anyone key. While you are sending capital, you need to know typically the recipient’s common address. A particular piece of malwares changes typically the user’s email address when you replicate it for the clipboard to a new address. When you attend paste typically the address, typically the scammer’s email address will be pasted instead along with the funds is going to the completely wrong account. This kind of emphasises the requirement to always check the email address when transmitting funds. You will discover no quotations for the amount of has been shed through privately owned key together with public vital scams together with hacks but it surely is certainly a large amount.