Are usually We within the Verge of the Epic Crypto Bull Operate?

There is certainly some degree of assuredness walking the current spike within the prices associated with cryptocurrencies. Marketplace indicators always forecast much more impressive cost performances in front of a out-and-out bull marketplace. You will concur that regardless of the outrageous cost predictions well-known in the last little while, compelling quarrels are support optimistic predictions for the crypto market in general. In light of the, I have chose to weigh within on this conversation. Here, I am going to explore the present state from the crypto marketplace and evaluate present marketplace conditions in order to 2017’s half truths run.

Typically the Bullish Point out of The Crypto Market

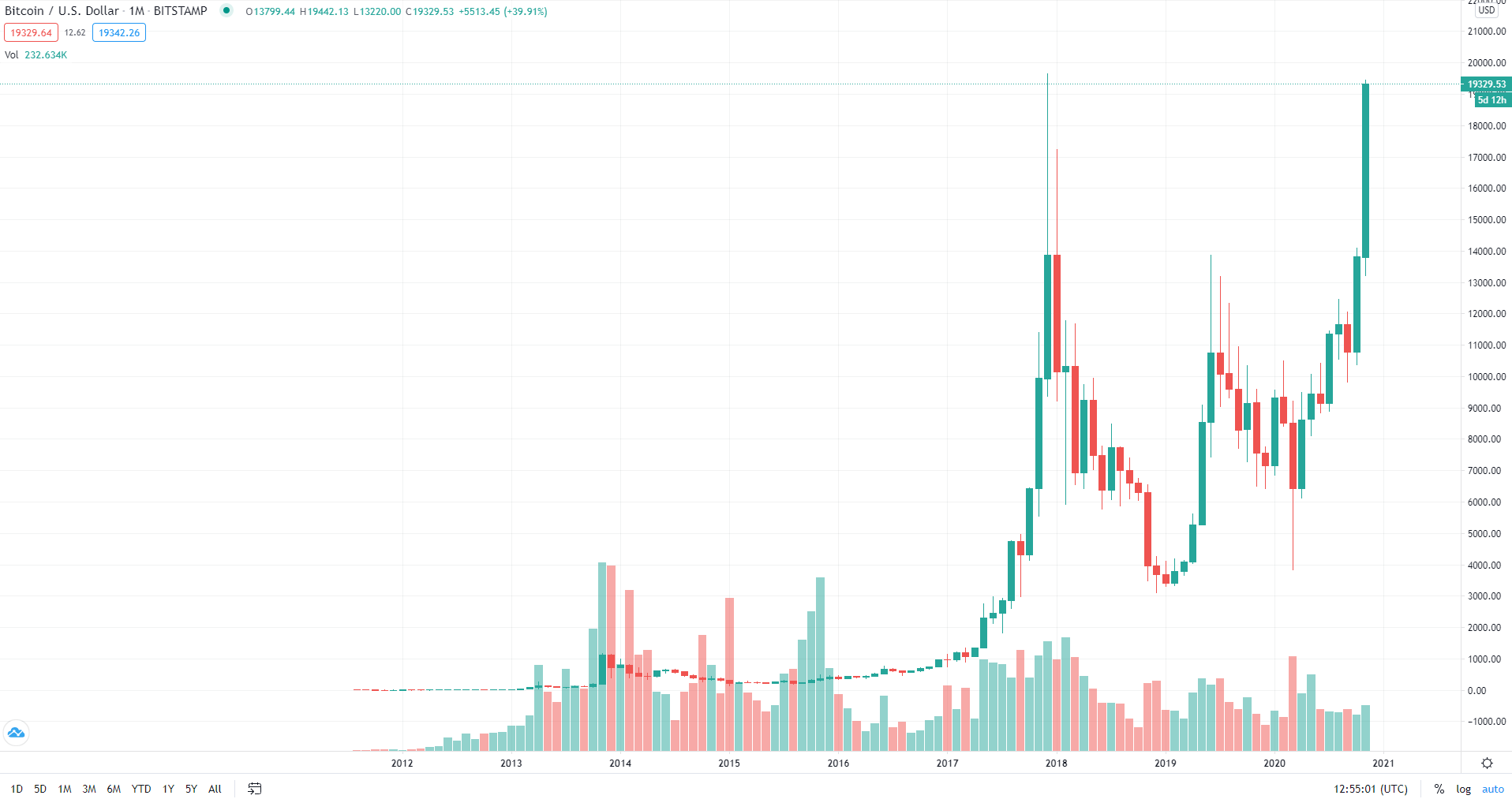

Several argue that the particular crypto marketplace, following the $3, 000 cost registered simply by Bitcoin keep away from 2018, experienced kicked away a half truths run because the start of the very first quarter associated with 2019. Although it is true the market experienced recovered continuously, it is a good way from reenacting the level of unpredictability associated with a half truths market. Although Bitcoin is usually fast getting close to its 2017 peak overall performance, the prices in the majority of cryptocurrencies, on the other hand, are not near what we should witnessed in the height in the Alt time of year of The month of january 2018. Therefore, it is secure to say that people are still in the early stages of the bull motion as professionals are not anticipating Bitcoin in order to peak in the near future.

Issue projection is normally anything to pass, then there may be each possibility that will digital resources, which includes Bitcoin, would certainly surpass earlier price information and set brand new ones within the coming weeks. Much of this particular forecast depends on the following aspects.

The particular Institutional Fascination with Cryptocurrency

During 2020, institutional investors include shifted their very own attention to the particular crypto marketplace due to pumpiing arising from the particular pandemic-induced recession. Now nowadays, investors will be coming to phrases with the possible of cryptocurrencies, particularly Bitcoin, and its inflation-hedging attributes. Mike Trabucco, a new quantitative dealer at Chopera Research, do this known within a recent tweet where he described the primary reasons for the particular upsurge in the value of Bitcoin. He published:

“My take can be: eh very likely a combination. I think that Biden’s victory along with the vaccines have been net good for vitamin e. g. CRIMINAL which has both equally short- together with long-term relationship to BTC in the COVID era, which will contributed. In addition to also reliable a lot of classic companies as well as entities — banks, off-set funds, hit-or-miss rich persons, thought teams leaders, tech corporations, Wyoming senators, etc . — signaling help for BTC, which both equally directly (buying) and not directly (sentiment) has a bearing on its price tag up. ”

Within the last few months, progressively more high-profile men and women and choices have widely endorsed crypto by revealing that they acquired allocated a portion of their properties to one or maybe more coins. As an example, Square acquired over 50 dollars million well worth of Bitcoin to store to be a reverse advantage. Developments similar to this give the normal investor somewhat more confidence to research the opportunities frequent in the crypto industry.

True to this observation, a survey simply by financial bulletin organization deVere Group possesses revealed that a lot more high net worth folks are either thinking about investing in crypto, or they will already perform. The study interviewed about 700 billionaires from a wide selection of regions and located that 73% (an enhance of 5%) maintained a new crypto high stance. Based on the CEO in addition to founder regarding deVere Party, Nigel Eco-friendly, Bitcoin’s pristine year-to-date efficiency has captivated the attention regarding wealthy buyers:

“As the review shows, this specific impressive functionality is painting the attention regarding wealthy buyers who progressively more understand that electronic digital currencies will be the future of funds and they don’t want to be still left in the past. ”

In addition, he additional that the rise in attention, as observed in the study, can be from the growing popularity of bitcoin by institutional investors. Eco-friendly wrote:

“No doubt that numerous of these HNWs who were polled have seen a major club of the price tag surge certainly is the growing fascination being depicted by institutional investors that happen to be capitalizing on benefit returns the fact that the digital property class happens to be offering. ”

Crypto Whales Continue to Hodl

Specialists believe that crypto whales have been in no hurry to cash-out and get profits. Rather, they always accumulate hold. Based on market metrics, there has been the shortage of retailers as a result of this particular unprecedented degree of accumulation. Jordan van sobre Poppe, the full-time investor at the Amsterdam Stock Exchange, echoed this thought while observing that this type of market pattern creates the best condition for any bullish operate. He tweeted:

“To be honest, a growing number of $BTC proceeding from trades towards cold wallet storage. Major listed corporations allocating money to $BTC. Is incredibly high. ”

As well, Glassnode says accumulation deals with account for a large proportion of bitcoin offer. Hence, there is also a rise in hodling activity, although the digital property has grown in price steadily the past few weeks. Glassnode wrote:

“Bitcoin accumulation is actually on a consistent upwards phenomena for months. installment payments on your 6M $BTC (14% involving supply) are held in deposits addresses. Deposits addresses really are defined as handles that have at the least 2 newly arriving transactions and still have never expended BTC. ”

This Bull Run Is A Bit Different

You will find a striking bit of between this kind of current half truths run and even 2017’s. In the last bull industry, Bitcoin set the cause in price functionality, only for altcoins to hit all their peak about a month subsequently. From that which you have experienced so far, it sounds as if a persistent trend is normally unraveling. Mainly because indicated previous, bitcoin is normally nearing it is peak selling price while altcoins are but to achieve the same feat. Then again, this market place movement has its own peculiarities, contrary to the previous you. The most effective is that shareholders and not full traders have reached the schutzhelm of this revival.

This means that the tendency for the price remove is very reduced. Investors need to ride out your ongoing recession. Therefore , they may not be in a hurry to offer their electronic assets. Subsequently, this helps to ensure that the supply regarding bitcoin remains to be low when compared to demand. Galen Moore, within a recent item on CoinDesk, investigated these conclusions, and described that it bodes well for your current half truths run. He or she stated:

“The number of the address holding at the very least 1 bitcoin increased in an unrelenting tempo from the stop of 2013 to the 2018 crash. That picked up once more in 2019, then flattened off once more this planting season. This is unlike the end involving 2017, given it soared into a peak when using the bitcoin price tag. Compare of which to the availablility of what we may call bitcoin “billionaires, ” addresses storing at least one particular, 000 BTC. These whales were trading into the approach in 2017. This time, typically the Bitcoin blockchain’s Forbes Record is growing, definitely not shrinking. ”

Exactly what do Experts Consider this New Say of Crypto Adoption?

Asheesh Birla, basic manager regarding RippleNet, highlighted this specific emerging trend in the recent meeting where they explored typically the damaging associated with Covid nineteen and how typically the crypto field has benefited from their website:

“In tandem, there’s more affinity for the space than previously with important companies just like PayPal and even Square setting their gambling bets on crypto, pushing that to the well known. Validation out there companies seems to have contributed to even more interest in typically the utility involving cryptocurrencies, and the ability to far better serve all their businesses and even customers. ”

Besides these real reviews, the large tendency regarding conventional investors to consider cryptocurrency comes from your increased strain on government authorities and their banks to take action in opposition to an forthcoming global fiscal meltdown. Simply because explained by Robert Belshe, TOP DOG at BitGo, the inflationary approach involving governments for the aftermath within the Coronavirus presented investors a new take on Bitcoin and its inflationary infrastructure:

“Prior to COVID-19, most people weren’t paying all the attention to the particular economic elements that make Bitcoin relevant. To be truthful, they didn’t need to. In the event you’re creating a return through the stock market, a person stay with everything you know, and you also don’t have to learning something brand new. But now that’s all improved with the outbreak — monetary policy world wide is triggering governments in order to wildly pic money, minimizing its benefit and triggering inflation. Buyers now fully grasp they have to succeed of this. ”

Belshe added of which investors contain begun to be able to enlighten their firm in the basic of the crypto market, and also this has ended in its expanding acceptance between investment management. He discussed:

“They are wondering a lot more queries and are holding the supporting of Bitcoin’s thesis — that an asset’s scarcity issues. Digital resources are a off-set against pumpiing and a secure store valuable. Investment market leaders such as John Tudor Smith, Stanley Druckemiller and Costs Miller usually are demonstrating that will Bitcoin is currently an important part associated with any profile. This year has taken so much doubt but individuals are feeling strengthened to educate their selves on what they have to do to have a go at crypto. All of the building blocks are usually in place — compliance, guardianship, liquidity, profile management wallet technologies, as well as taxes tools — giving traders the tools they have to invest in electronic assets. ”

Moreover, Tim Draper, Venture Capitalist and Bitcoin investor, echoed this feeling and expected that it would probably become hip to own Bitcoin due to the low incompetence regarding governments in relation to economic coverage:

“A lot of individuals, stuck within their homes lastly made you a chance to set up the Bitcoin budget, but the genuine impact associated with Covid is that the lockdown was damaging for many households, and when the federal government printed $13 trillion to attempt to put the bandaid onto it, it managed to get clear which you would rather become holding Bitcoin than these types of diluted dilutable bucks. I anticipate ‘fiduciary duty’ to right now include buying some Bitcoin as a off-set against authorities currency water damage and adjustment. ”

When sharing the view, Preston Byrne, Lover at Anderson Kill, S. C., opined that the surfacing perception of which dollars and also other fiat values are worsening due to a mix of factors seems to have helped crypto present it is case. They noted:

“The COVID-19 outbreak’s most real impact on crypto was acceptance of crypto’s core thesis that our communities are fragile and math concepts, not adult men, is likely to style a better basis with future cultural organization. Typically the reliance regarding practically every single major economic system on economic and budgetary stimulus to be afloat sturdy and increased public notion of the weak point of redbull money and even institutions. ‘Crypto, ’ apparent, is a different array of philosophy and aspects of interest starting from hard funds, to censorship-resistance, to secure calls. These technology are exclusively responsive to cultural and organization adaptation to be able to stressors who have dominated news in the last year, no matter if we’re discussing ‘Money machines go brr, ’ the continuing exodus via big technical, or popular social unrest in the urban centers. ”

Classic Assets Even more Volatile As compared to Bitcoin

Amongst this thrilling string regarding events, researching carried out by Vehicle Eck revealed that, contrary to popular opinion, bitcoin is a more stable asset than a significant percentage of S& P 500 stocks. Through its analysis, the exchange product issuer discovered that 29% of S& P 500 stocks had registered more volatility than bitcoin when analyzing the year-to-date performance. This figure dropped to 22% if fluctuations for a 90 days basis is used. The report reads:

“In our long-term study of bitcoin, we had compared bitcoin correlations to traditional asset classes and now see another interesting recent trend with its volatility. In our current volatility research, we compared the 90 day and year to date volatility—as measured by their daily standard deviation1 as of November 13, 2020—of bitcoin against the constituents of the S& P 500 Index. We found that bitcoin has exhibited lower volatility than 112 stocks of the S& P 500 in a 90 day period and 145 stocks YTD.”

Truck Eck, about what seems like an effort to assure regulators involving Bitcoin’s maturation, stated a You. S. bitcoin exchange-traded investment (ETF) will inherit an identical level of stableness. It extra:

“While there are no U.S. bitcoin exchange traded funds (ETFs) available today, we believe such products may show similar volatility characteristics—based on the comparison above—as many stocks in well-known indices and ETFs, such as the S& P 500 and related products.”