Usually are Centralized Trades Hurting the particular Efficacy associated with Crypto?

From your looks associated with things, the particular travails associated with crypto usually are one way or maybe the other associated with the functions of crypto exchanges. This particular assertion keeps, considering the variety of controversies these types of entities entice, and its results on the picture of crypto being a viable resource class. For just one, recent information relating to crypto exchanges shows the developing number of unexpected closures, visible hacks, troubling legal cases. The evident lack of specifications in the crypto exchange companies are one of the major factors behind concern in the market.

Consequently, it has become important to explore typically the workings regarding exchanges and just how their frailties tend to contrain the restaurant of crypto in the money market.

Exactly what are the Tasks Crypto Trades, And What makes them So Important?

Similar to the functions of their standard counterpart, a new crypto exchange’s primary position is to enable users to be able to trade properties and assets. However , in the matter of crypto deals, they simply facilitate trading between a couple of crypto properties and assets, or in between digital properties and assets and redbull currencies. Over time, we have seen how these kinds of entities took up even more functionalities inside the space. Typically the growing effect of crypto exchanges has got seen these people explore typically the crypto options contracts market and even introduce a fresh breed of crowdfunding mechanisms – the Initial Exchange Offering (IEO). However, the surge of centralization in this companies are causing people who lean in the direction of a purist notion associated with crypto in order to panic.

It of crypto enthusiasts price the decentralization concept of which crypto helps bring. They loathe to see central firms with the pinnacle belonging to the market, having little or no spot left for any autonomy of which crypto avails. If you definitely will recall, this matter had started tension involving crypto deals and bridal party developers. When a Vitalik Buterin outburst this past year gave the city a fresh perspective into this problem, yet, small has changed with reference to the founded pecking purchase in the crypto space. Exactly why then provides centralized crypto exchange carry on and flourish, whatever the explosion associated with scandals that will taint the efficacy?

crypto exchanges be the middlemen between dealers and the crypto market. So, they are the para facto entrance through which folks can access crypto. Because of this, they may continue to engage in vital assignments in the advancement cryptocurrency. In addition to creating a place for the standard crypto hustler to access digital solutions, these people – with an extent – have a declare in the failure or success of a expression. This affirmation holds considering the fact that startups must ensure that the tokens vocational on deals to give the project some sort of fighting option at tactical.

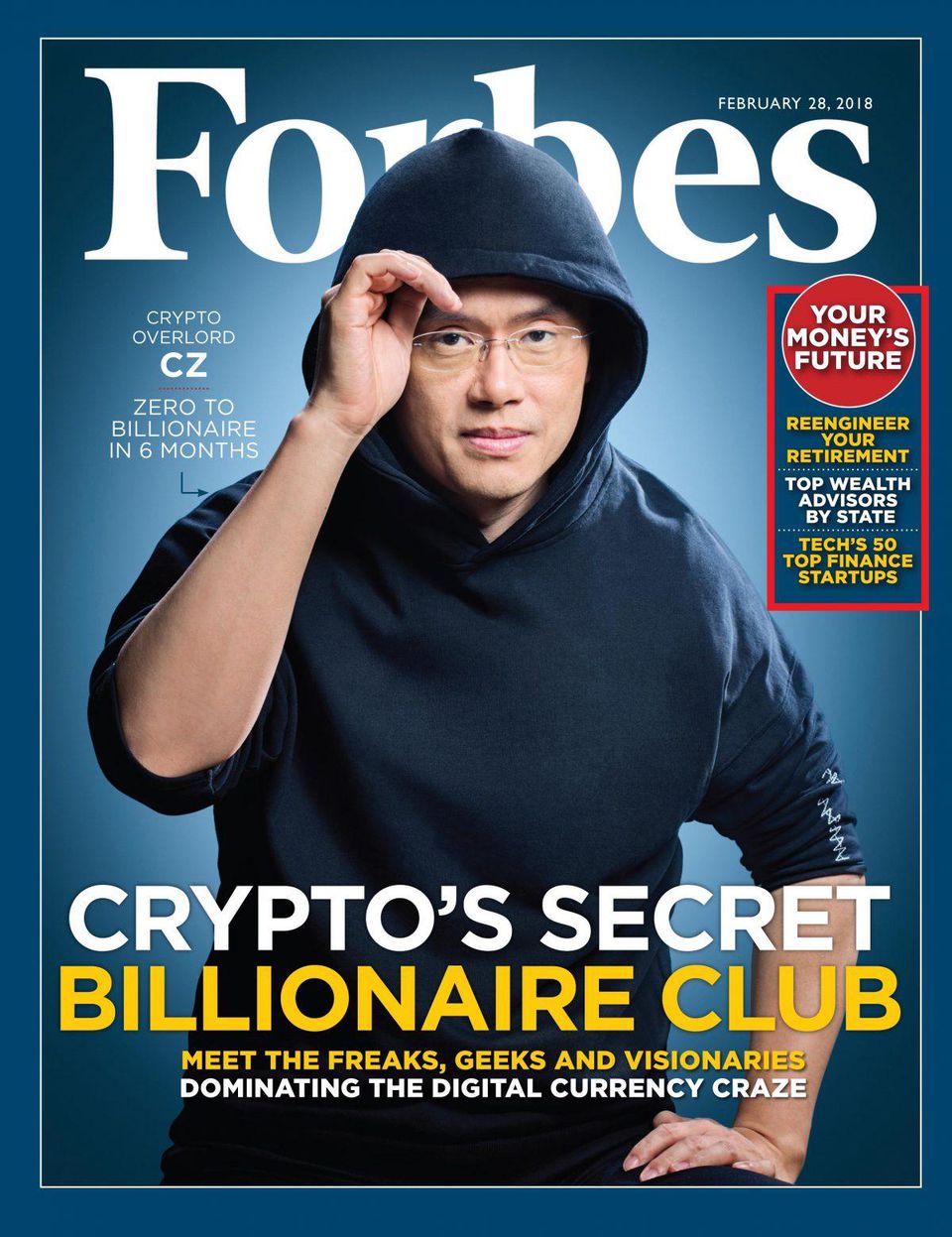

For this end, there has been allegations counter-allegations in relation to the excessive fees recharged for real estate coins, especially on well-known crypto trades. On Oct 28, CoinTelegraph pointed out how Blockstack paid Binance $250, 1000 to record its STX coin. Though both parties need since discussed that the settlement was a non-reflex long-term settlement, which will make certain that STX is always listed in Binance down the road, still the full deal implies the variation between startup companies with infinite resources the actual that can scarcely afford the quality services in exchanges.

According to Blockstack’s CEO,

“This long-term repayment is meant to consider the Blockstack ecosystem simply by incentivizing Binance in order to list Piles over a long time and lines up well with the long-term concentrate. The advertising fee is really a joint advertising campaign that we intend to run afterwards, again which is not a ‘listing fee’ yet a marketing strategy that we intend to launch soon. ”

Honestly, it is even now unclear for what reason an alternate – in whose CEO possessed previously explained would never give some thought to money as the criterion relating to listing bridal party – might backtrack together with accept settlement from a itc to guarantee long term listing positive aspects. This action betrays “the funds is not relevant” image of which Binance is intending to job. There are good believe that similar technicalities sign up for exchanges of which claim to offense zero rating fees. An example of such platforms is OKex, as the head regarding operations, Andy Cheung, apparently wrote that will:

“We don’t possess a standard list fee. A few 3rd party price could get such as conformity, legal due diligence from the project with regards to listing, dependant on the complexity of the symbol structure design. ”

If this sounds the case, consequently controversies with regards to listing service fees will not stop anytime soon, given that exchanges pick not to make conditions when considering enlisting bridal party public.

Faraway from fees, it may be rampant in support of crypto exchanges to be able to fall recipient of one way of attack as well as other. As i have said earlier, central crypto deals are middlemen. Therefore , whosoever chooses to work with their networks must spend his or her tools to them ahead of executing positions. Hence, crypto exchanges can be a form of custodial solutions, because they are charged aided by the responsibility involving safekeeping typically the assets consumers leave inside their care.

Nevertheless , considering the escalating rate associated with crypto hackers and thefts, it is very clear that the majority of these types of exchanges aren't doing sufficient to ensure the basic safety of their purses. More demanding is the embrace cases where crypto trades blame the particular inaccessibility associated with users’ crypto assets for the loss of exclusive keys. An initial of such a situation was noted earlier this year mainly because it was revealed that the passwords to QuadrigaCX’s wallet have been lost, following death of your crypto exchange’s CEO.

Remarkably, similar media has come forth with a slight twist. In November one particular, a local publication stated the fact that the founder together with CEO involving Zimbabwe-based crypto exchange, Golix, had shed the username and password of the exchange’s cold pockets containing bitcoin that well worth over 300 dollar, 000. This kind of report improves some really serious questions, simply because regulators throughout Zimbabwe possessed ordered typically the shutdown within the crypto alternate due to incompliance with regulating standards. Be aware that regulators possessed given this buy way ahead of news within the lost username and password broke. Consequently, one could imagine there is even more to this narrative, especially seeing that exit hoaxes are becoming commonplace in the place.

Within news, Canadian regulator – the Britich columbia Securities Charge BCSC – has taken charge of Einstein Deals. This improvement came following multiple grievances claimed so it had banned users right from accessing estate assets. According to the e book, the legitimate travails within the crypto alternate, its $12 million debts, and its decide to shut down sparked the watchdog to take instant action.

Additionally, it does not aid that the steps of not regulated crypto trades play a major role in america Securities in addition to Exchange Commission’s reluctance in order to approve a new crypto ETF. Note that the particular SEC has got highlighted value manipulations, which often some not regulated exchanges exercise, as one of the explanations why it has not necessarily changed their stance.

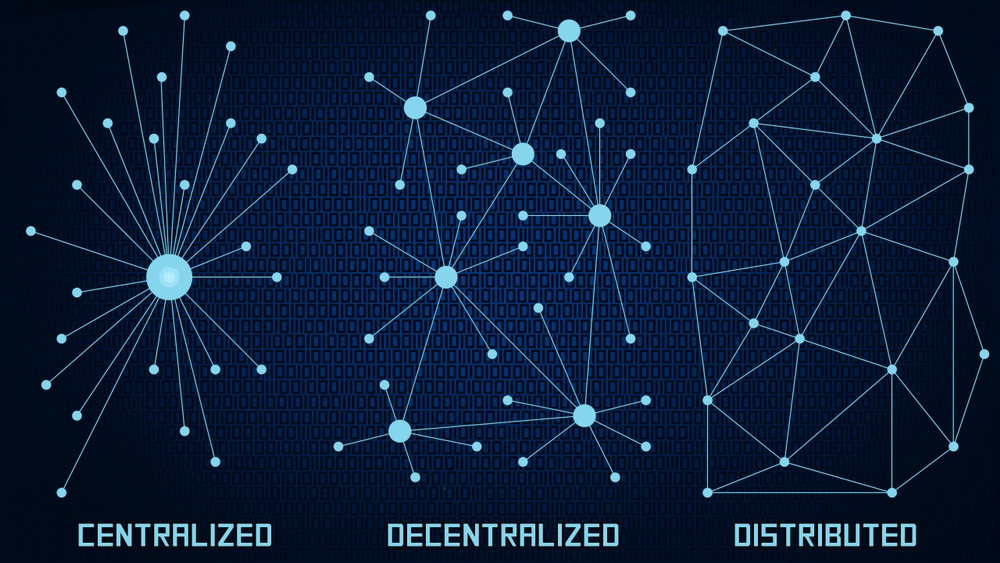

Getting examined the particular drawbacks associated with centralized crypto exchanges, you will find enough explanations why users startups ought to look for options. The obvious alternatives are usually decentralized exchanges DEX. Not like the central ones, DEX gives consumers a level involving autonomy above their things to do, as to be able to to send assets in the exchange’s pockets before running trades. Alternatively, decentralized deals rely on bright contracts of which automatically credit rating or charge users’ billfolds, whenever they accept a trade. Or in other words, a decentralized exchange is mostly a P2P community that provides users complete autonomy more than their assets permits immediate transactions.

As well, the issue of advertisement fees is without a doubt absent in a very DEX considering that the platform minimizes all middleman factor. Additionally, security together with anonymity is also benefits of providing a few solutions simply because KYC would not apply to a regular decentralized alternate. That said, a will count on that the aforementioned benefits may have sparked typically the emergence involving decentralized deals to the the top of market. Yet , this is not the truth. Instead, central ones can quickly dominate.

Why Is This the Case?

Decentralized exchanges possess struggled in order to record exactly the same level of fluid that the central exchanges control. According to specialists, centralized trades have had plenty of time to earn the believe in of crypto holders. They likewise have an edge more than DEX with regards to speed user encounter. To make issues worse, modifications in the advantages of decentralization, because influenced from the influx associated with hybrid decentralized exchanges, possess put a dent or dimple on the potential customer of trustless networks within the crypto trade market.

In the true impression, a fully decentralized exchange will need to bypass virtually any form of important authority. In the workings belonging to the new varieties of DEX showing up in the place, it is distinct that this need is becoming out of date. For instance, typically the structure involving Binance DEX shows that Changpeng Zhao continues to have significant suggestions in the governance of the swap. The same is valid for Huobi, which has made a fortune on their influence in order to launch a decentralized marketplace.

Therefore, KYC and even AML nonetheless feature in most of these tools, and the key aim of typically the governing crew is to produce profits. It has led various experts to relate to these deals as noncustodial exchanges, his or her capacity to give direct tradings is the different feature, placing them in addition to centralized tools.

Ever since we are about stuck with possessing centralized people dominate typically the crypto industry, are there solutions to mitigate typically the shortcomings of overly central market?

International Standards Changes the Surface

A defieicency of standards inside the crypto place has always been some sort of limiting matter for cryptocurrency. Experts experience blamed typically the recurrence involving security scams in the industry at the unavailability of worldwide standards which would govern typically the operations involving crypto deals. For a while, you aren't the right means could itc an alternate. It wasn’t until the growth of legislation that we started to see a even more structured industry emerge.

Consequently, some of the international regulatory criteria becoming typical is the need that crypto exchanges need to introduce KYC and AML procedures because of their users. Despite the fact that this has aided users discover the legitimate standing regarding exchanges, but, there is a ongoing notion of which regulators need to enforce even more standards to ascertain their believability.

Because of the importance of designed regulatory frames, regulators around the globe have shown some sort of spirited respond to the hazards unregulated deals pose. Found begun to be able to implement legislation, which will slowly move the operations involving such networks within their legal system. This is apparent in your number of crypto exchange-related reconstructs enacted over the world, with Hong Kong’s regulatory framework coming in as the latest.

Although it is common with regards to exchanges in order to complain in regards to the stiff specifications imposed with them, they must, nevertheless , realize that these are the first stage of access for new traders in the crypto space. Consequently , they must perform everything in their capacity to secure the interest of these customers. Just by the increase regarding legal steps taken towards defaulting trades, these agencies are apparently doing a lot more to stay within the law.

Acquire, for instance, the choice of several exchanges to quit rendering offerings to PEOPLE traders. This kind of development comes from the fact that deals are going to terms while using the consequences involving allowing consumers – no matter the crypto laws of their country – to be able to access all their infrastructures indiscriminately.

When it comes to clamor coming from some sectors that middlemen should have no put in place the crypto market, it is very important to note there was no method the crypto industry might have experienced that much development – in not enough time – with no help of centralized crypto exchanges. These kinds of platforms keep a familiar composition to those present in standard markets. Consequently, new traders do not have to begin from scratch, inside their quest to do crypto.

non-etheless, there is a spot for decentralization in this dialog, as it even more establishes the inclusion of of cryptocurrency. If crypto and blockchain technologies – with all of his or her disruptive ability – sees it difficult to call and make an impact in a of its principal sectors, subsequently its stability in a smaller amount receptive companies is doubtful. Therefore , typically the onus declines on stakeholders to ensure that decentralization – in its purest style – aims in the crypto exchange industry.