The many Variables Creating Bitcoin Post-Halving Economy

Have you ever wondered why bitcoin continues to lead trends despite the fact that countless additional cryptocurrencies present way more with regards to application? Days after the crypto market damaged in Mar, bitcoin has got single-handedly pulled the market to prominence. Because of the mainstream curiosity about the possibilities walking bitcoin’s block out reward halving, the demand just for this digital advantage has place the crypto taking train returning on track.

In this article. I will check out bitcoin’s tv show of dominance in the ongoing COVID-19 pandemic, typically the short-term has effects on of bitcoin halving, along with the apparent spike in institutional interest.

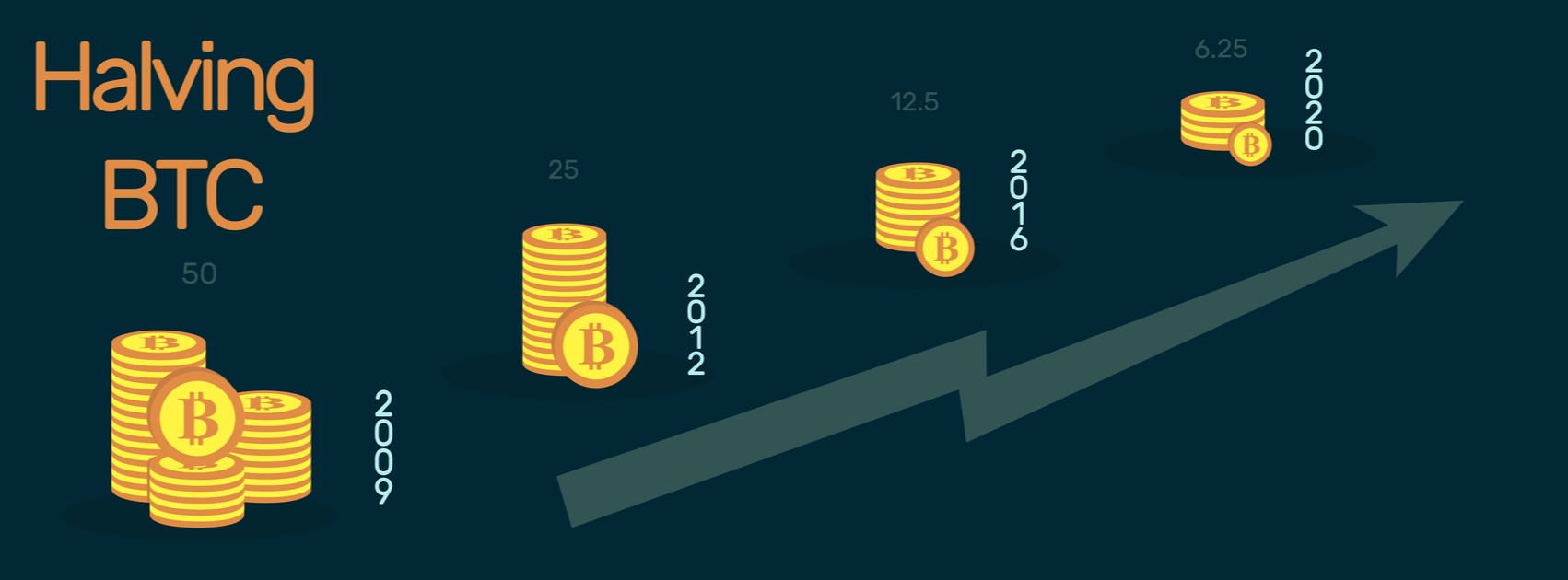

The Documentary Associated with Bitcoin’s 3rd Halving

On, may 11, bitcoin underwent it is third halving, which lead to the reducing of mass rewards out of 12. 5 various BTC to six. 25 BTC. This event is going down among the reasons why bitcoin’s viability as the financial tool is unique. The bitcoin economy possessed implemented one more thing policy of which ensured typically the imperviousness belonging to the asset to be able to hyperinflation. This kind of development came up at a time when ever central banks really are facilitating several financial aid courses, which demand them to put caution for the wind. In a very bid to be able to cushion the consequences of the coronavirus pandemic, the original economic system seems to have resolved to take on a temporary correct without considering precisely how such coverages will fail flop, miscarry, rebound, recoil, ricochet, spring back in the long run.

On the exact occasion when engine block reward halving protocol started in, i was once again informed of the solemn truth moving the crypto narrative. Additionally, firm abs essence involving bitcoin and the decentralization movement was on full show when F2Pool, which mined the final 12. five BTC obstruct, added a good encoded communication paying homage to bitcoin’s growing worth as an alternative to conventional money. The particular message, which usually reads: “NYTimes 09/Apr/2020 Along with $2. 3T Injection, Fed’s Plan Considerably Exceeds 08 Rescue, ” referenced the particular economic facts that finished in the development of bitcoin while featuring that a a lot more gruesome monetary crisis turmoil is available today. No matter governments’ attempts to control the pressure on the economy, professionals believe that a worldwide economic crisis is usually inevitable.

Away from contrasting character of the bitcoin economy as well as the traditional monetary landscape, we now have begun to find out how the halving of bitcoin rewards will be shaping the ongoing future of the crypto market. For just one, data display a high drop within the network’s hashrate. As through Cointelegraph, bitcoin’s hashrate decreased by thirty percent. Also, Coindesk reported of which bitcoin’s “hashrate (the whole computing vitality dedicated to exploration blocks relating to the blockchain) contains declined to be able to 98 exahashes (EH/s) – that’s along 27% from high of hundratrettiofem EH/s realized on Wednesday. ”

To put it differently, the halving of prohibit rewards possesses forced many miners in order to scale down their very own mining businesses or, sometimes, shutdown. Marketplace analysts believe the pointed drop within the hashrate suggested that many miners are not any more uncovering bitcoin exploration a rewarding endeavor. As a result, they had possibly switched to SHA 256 blockchains or even quit outrightly. The unit of miners at the obtaining end on the reduction regarding bitcoin’s source are those applying old exploration equipment. As a consequence of the lose in the network’s hashrate, the regular time for getting a new prohibit has increased. Inspite of this progress, the reduce in hashrate poses zero real risk to the stability of the bitcoin network.

In support of this view, an independent crypto analyst, Checkmate, explained that will difficulty modifications would make sure that bitcoin exploration remains lucrative to miners with the suitable hardware access in order to cheap electrical power. He mentioned:

“Hashrate is required to decline, even so hashrate would not reflect the actual network reliability. The financial commitment by miners in ASIC hardware presents a lasting together with significant logistical and money cost difficulty that must be handle for any excessive attack to be a success. ”

Prior to the halving, the standard block creation time stood with 7. a few to 8. 5 mins per prohibit. Immediately after the particular halving celebration, the production coming back a prohibit rose in order to 11 a few minutes. Likewise, info shows that there is a slight uptick in the deal fees for every single block. Experts believe that miners have leveraged on deal fees to remove some of the tension on their companies. Likewise, many believe that the particular transference regarding wealth in order to strong bitcoin proponents is definitely the ultimate effects of bitcoin halving for the digital asset’s economy. Although supporting this specific sentiment, Shiny D’Souza, TOP DOG and co-founder of Blockware Solutions, described that the reducing out of many bitcoin miners helps place more bitcoin in robust hands. In the view:

Ellen D’Souza, TOP DOG and co-founder of Blockware Solutions

“So, you can see probably twenty-five — thirty-five pct of the community shut off and already twenty five to be able to thirty five pct of the Bitcoin they were acquiring, it nowadays goes to the person who survives. Consequently whoever survives is going to do well. They’re planning to accumulate uncountable Bitcoin therefore they don’t have to sell off as much Bitcoin to pay all their electricity bills to obtain more equipment. More Bitcoin will start receiving accumulated by simply very strong control, very knowledgeable miners, incredibly efficient miners, rather than for sale to cover bills. ”

In the same way, a representative for RRMine reached identical conclusion:

“We infer the fact that outputs regarding miners whom keep boot-up from Mar will increase can be 21% ahead of the halving, during the day on the halving, the particular miner’s results will only briefly decrease can be 29%. Consequently , miners whom survived the particular halving might find a big embrace their generation, which may be 11% higher than the prior outputs. ”

One more statement aiding this viewpoint surfaced in the report of which theorized of which miners own begun to be able to hoard gold and silver coins. The have cited a decrease in the output of exploration pools given that the main warning that these choices are keeping a large tiny proportion of their bitcoin stash. This article emphasized:

“Charts provided by typically the Korean stats firm CryptoQuant show some sort of slowdown throughout outflows right from cryptocurrency exploration pools, which will essentially blend computing capacity to increase their ordinaire chance of getting bitcoin. Typically the Beijing-based F2Pool, for example , which will currently makes up 17. 1% of the Bitcoin blockchain’s whole computing capability, witnessed a outflow involving 139 bitcoins on Friday, the fewest in practically six months, in accordance with CryptoQuant. Of the, twenty nine bitcoins obtained sent to cryptocurrency exchanges, typically the fewest throughout at least 12 months. Taken itself, the slow down shows exploration pools can be hanging upon the bitcoin rather than copying them to a exchange for that quick monetization. ”

Mcdougal argued midway into the analysis of which mining costly might have prefered this distinctive line of action as a result of perceived weak point of the bitcoin market. We have a possibility of which flooding the industry with bitcoin could cause the importance of the electronic digital asset to be able to crash. Some other premise is the fact miners visualize an approaching price move, and they are, consequently , holding on to his or her coins to have long-term progression.

Unlike these thinking, some gurus expect a new miner alliance. This view stems from the truth that the miners might handle at a loss for a number of months. Hence, Charles Edwards, a digital advantage manager, within a tweet, exhausted the flaws of 2020’s halving incidents and forecasted an unsure future to the miner neighborhood. Charles tweeted:

Charles Edwards, an electronic digital asset administrator

“This will be the nearly all brutal Bitcoin Halving of all time. Production expense is about to twice to $14, 000. 70 percent above the existing price. Previous halving, selling price was just simply 10% down below Production expense, and Selling price & HOURS collapsed -20%. Without FOMO now, assume a big miner capitulation. 30%+”

The Impact On The Price Of Bitcoin

Incredibly, the price of bitcoin post-halving contains thrived importantly beyond applicable expectations. For the duration of writing, the buying price of one bitcoin is flying around the $9, 400 spot. It is very significantly unlikely until this price certainty had realised the desires of members who presumed that the halving would lead to an immediate together with steep move. According to Harry Rainey, the primary financial expert of Greenidge Generation, proven mining apparel will find typically the post-halving price tag movement encouraging, while owners who had acquired into the news media hype could possibly be disappointed. Harry asserted:

“It may not own met typically the expectations of your lot of ‘hodlers’ who, persuaded by the information hype nearby the halving, were wanting the event to be able to cause a key increase in typically the price of bitcoin.”

Whilst reiterating this particular argument, Bob Yim, the particular co-founder CEO associated with LibertyX, indicated his idea that it is not possible for bitcoin halving activities to create advantageous conditions for those market individuals. He stressed:

Bob Yim, the particular co-founder CEO associated with LibertyX

“Personally, I am persuaded by the essential lack of movements this time around as compared to 2016. The has made massive leaps during the last 4 several years. The primary hazards from the previous halving are generally resolved (e. g. were unable Segwit2x pay, lack of miner ‘death spiral’ post halving). ”

Even so, the opinion is that selling price could knowledge a initial dip just before eventually coming back. While this is known as a given, foretelling of price moves is not when straightforward because it seems. Quite a few variables get play, and experts are occasionally caught ignorant.

Institutional Adoption Will be On The Horizon

At present, the crypto market offers anticipated the particular influx associated with institutional re-homing, which effortless will act as the iniciador to a half truths market. Nevertheless , it was not really until lately that institutional investors started to show improved interest in the particular landscape. Traders are aware that this policies regulating the development and submission of conventional money can backfire at some point. Thus, these types of entities are looking for alternative expense instruments unattached from standard financial guidelines. And so, just made feeling that they chosen bitcoin, that has increased the protection against pumpiing.

Adopting the halving, the particular regulated bitcoin derivatives marketplace has authorized an surge upward. On May eleven, the Chi town Mercantile Exchange’s volume meant for Bitcoin choices reached more than $15 mil. Two days afterwards, it had strike the $30 million quantity. Similarly, the particular Bitcoin Futures and options market noted impressive amounts by signing up $900 mil worth associated with exchanges rapidly when compared with13623 day. One more pointer arrived the form of a good endorsement from the veteran hedge fund manager salary. Paul Tudor acknowledged that will bitcoin can function as a shop of value. This individual went more to state which he sees bitcoin function as a off-set against pumpiing just as yellow metal did in the early 1970s.

According to this reports, prominent brands in the crypto space currently have identified John Tudor’s jerk as a authentic turnaround when it comes to bitcoin within the investment surroundings. Matt D’Souza believes the fact that development is definitely the first of quite a few. He described:

“Paul Tudor Williams is the earliest domino to be able to fall. Nearly all Traditional invest and provide for managers really are followers. They may follow John Tudor Williams. Most administrators don’t need to be the first nevertheless they have to think twice about bitcoin to ensure they’re reasonably competitive. ”

In addition, Karen Finerman, co-founder and even CEO regarding Metropolitan Money Advisors, noted the development may motivate some other institutional traders to take a gamble on bitcoin.

Karen Finerman, co-founder and TOP DOG of City Capital Experts

“Nobody wants to acquire outed getting owned Bitcoin if it totally falls separate. But if you know that Smith owns additionally, it, maybe that provides you a bit of cover. ”

In the bid for capturing the true quality of the recognition of crypto in the institutional investment landscaping, Sean Stein Smith, a new professor on the City College or university of New You are able to, wrote:

Mitch Stein Henderson, a mentor at the Metropolis University of recent York

“As an increasing number of institutional investors and enormous pools involving capital budget for funds to be able to bitcoin and also other crypto, these kinds of crypto materials become more stuck in the well known financial system. Solution assets experience long recently had an important role that can be played for any availablility of investors simply because hedges, pumpiing protection resources, and purchases of their own appropriate. The most recent fonction by John Tudor Williams may have reinvigorated the talking around bitcoin as an expenditure class, nonetheless that is not even close the only relocate this direction. ”

On, may 12, studies revealed that JP Morgan Pursue, the largest loan provider in the US, possesses reportedly opened to crypto exchanges. Wsj reported the fact that bank got onboarded Coinbase and Gemini as consumers. According to the reports, JP Morgan is not handling crypto orders on behalf of the two exchanges. As an alternative, the bank searching for to provide money management expert services and aid dollar orders for the exchanges’ clients. Remember that both trades are seriously regulated in america, and this may have spurred JP Morgan to simply accept them seeing that clients.

This information take into account the fact that typically the mainstream purchase landscape is rushing in to words with the stability of Bitcoin and other cryptocurrencies.