Apart from, Best Bitcoin Lending Websites offer cases an opportunity to employ their coalition as security to access fiat financial loans. Regardless of the method you plan upon using these programs, we claim that you check out understand the basics of crypto lending systems before going unreserved to adopt their particular services. Therefore, we have devoted this evaluation section in order to crypto financial loan platforms. Right here, we will discover the key functions of the solutions and the benefits. Likewise, we will expose you to factors which could help you select the right types as well as our own list of the very best crypto financing platforms providing services in order to participants.

Exactly what are Crypto Financing Sites or even best bitcoin lending websites

The idea of crypto bank loan has evolved over time, as we have commenced to see fresh variations of which border about automated and even trustless methods. Nevertheless, the notion still centres around lodging digital properties and assets to internet sites where attracted borrowers could access these people and pay returning with pursuits. Notwithstanding, that entails certain technicalities and even clauses that may seem incredibly elusive to people fresh to crypto loaning terminologies. For starters, you must fully understand interest rates, establish the increasing rates, and even explore regulations detailing just how price changes affect your wages or their impact on collateralized assets.

Determining crypto financing platforms from your vantage stage of debtors is quite distinctive from the above-stated description. For this set of crypto enthusiasts, the crypto financing platform provides more reasonable rates of interest compared to exactly what banks provide. Also, this enables a method, which assists them prevent the need to trade their crypto stash in order to fiat cash whenever they wish to expand their own businesses or even finance task management. Instead, all your mate needs do will be adopt the crypto mortgage service, downpayment the required quantity of cryptocurrency since collateral, access fedex money. With this particular, it is obvious that crypto holders don't just bypass problems of swapping cryptocurrencies, these sheets a means to avert tax responsibilities imposed upon crypto professionals whenever they transform their loge to fedex currencies.

Consequently, the concept of crypto loan provides two different groups of clientele with diverse needs, and also this has spurred typically the proliferation involving services supplying loaning establishments to crypto holders.

The kinds of Crypto Loaning Websites

Typically the crypto loaning service industry houses remedies looking to try out elements of invention to the technique of giving out crypto loans and even offering profits diversification products and services to crypto holders. Could is a presented, there are a few variations regarding crypto loaning services using the level of autonomy offered to consumers. They are central, semi-decentralized, and even Defi crypto lending products and services.

Centralized Crypto Loan Platforms

During this variation, typically the service enabler has total control over personal loan matching, interest levels, the confirmation of personal loan contracts, the payment regarding profits. In other words, these personal loan services edge on more advanced processes, which in turn translates to thousands of dollars15143 and adamant service composition. On the benefit, centralized crypto lending tools are ideal for crypto holders that happen to be not also keen on taking on the responsibility regarding negotiating legal papers.

Semi-Decentralized Crypto Loaning Platforms

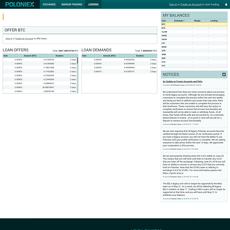

As opposed to the completely centralized lending facilities, semi-decentralized lending expert services borders on the p2p construction that simplifies certain techniques involved in handing out or obtaining loans. This specific variation is starting to become quite popular, like service providers typically set up infrastructures that current users a qualification of autonomy as regards financing or asking for cryptocurrency or even fiat cash. In some cases, these types of platforms integrate smart legal agreements to create an element of decentralization to their expert services. However , system still keeps partial control of the surgical procedures of the financing system. This dictates rates of interest, lockup durations, or complementing criteria.

Decentralized or Defi Crypto Loaning Networks

Since it is with semi-decentralized crypto loaning platforms, decentralized networks put into practice smart legal papers to decentralize the process interested in disbursing negotiations and doing the words of a deal to the correspondence. Here, these kinds of networks will include a distributed style where consumers get to access full autonomy over his or her activities. Moreover, it produces trustless methods that platform credit scores about immutable and even transparent data stored about blockchains and even established by way of consensus. Additionally, a decentralized lending community allows consumers to set reasonably competitive rates. To the disadvantages, this variant of lending establishments is not when popular when other products, which has minimal the volume regarding processed loan products and the likelihood of quickly finding ideal matches.

Do you know the Benefits of Implementing A Crypto Lending System?

Financing cryptocurrency is perfect for crypto slots who have electronic assets saved somewhere in addition to would want to boost the profits created from long lasting investment methods. In other words, you might increase your cash flow by making your current crypto on the market to firms in addition to individuals aiming to borrow crypto and pay rear with pursuits.

Likewise, you could reap the benefits of these companies by choosing to receive financial loans at prices that are less than what finance institutions would typically offer you. Likewise, receiving fedex loans by means of crypto collaterals is a more affordable way of financing projects. This particular assertion comes from the fact that you can bypass swap fees. Remember that you are required to state the profits in addition to losses created from crypto activities only if you swap your electronic assets in order to fiat cash. And so, crypto lending amenities present just one way of accessing fedex money with no necessarily liquidating your investments and producing yourself prone to tax guidelines.

What are Factors to Consider Think about A Crypto Lending Center?

Possessing explained the basic principles and features about cryptocurrency loaning platforms, you certainly will agree of which lending bitcoin and other cryptocurrencies require that you just take the time to check out a lot of information. It looks to familiarizes you with integral components that would allow you to pick feasible solutions.

The Type of Lending Framework

Remember that we segmented crypto loaning facilities straight into three key groups. Each and every variation includes its pros and cons, and it is under your control to consider their particular frameworks and just how they impression your earnings or perhaps debts. For starters, people who require a degree of flexibility and good contract characteristic would by natural means find semi-decentralized and totally decentralized crypto lending features appealing. The same goes to individuals would you rather adhere to conventional loaning facilities created in fully-centralized business frames.

Typically the Jurisdiction That Crypto Loaning Platform Provides

Due to the nascent status of the business, it may prove difficult to get crypto financing platforms that will cater to a worldwide market. In many instances, these options are geo-selective because of the regulating irregularities hurting the crypto space. Therefore, credible financing facilities just offer services to many of these in nations around the world where they have got successfully scaled the regulating requirements meant for providing bank-related services. Because of this, all of us suggest that a person ensure that the particular crypto financing platform you are thinking about is a lawful in your legislation. By doing so, you are able to ascertain you are not vunerable to the risk of shedding funds resulting from actions used by regulators towards an unlawful crypto financing facility.

Typically the Cryptocurrency The fact that the Platform Helps

Generally, crypto financing services choose paying financial loans or passions in steady coins. The favorite stable money utilized in this particular niche usually are USDT, PAX, GUSD, DAI, and TUSD. While this can be a given, many allow customers to first deposit cryptocurrencies such as BTC in addition to ETH, as well as the interest you would probably access depends upon what type of crypto you first deposit. Therefore , you must pick financing solutions that will support the particular cryptocurrency you have and exploration interest rates provided for this kind of crypto. for example, for people who desire to lend bitcoin, we claim that you look to the best bitcoin lending websites.

The Fees Policy of The Platform

There are a great number of things to consider in such a section, because it determines your current profitability. Likewise, the coverage of the system you choose describes how good the loan service is. The initial thing to consider this can be a interest rates of this platform. Almost all crypto financing sites currently have unique prices for each reinforced cryptocurrency. Therefore , you ought to accomplish due diligence in order to pinpoint everything you stand in order to earn all in all. Secondly, figure out how the platform computes expected salary. Does it mixture interests? If you do, how does their compounding method works?

Up coming, take the time to explore the consequences involving fluctuations involving crypto’s industry valuation with your expected funds. Likewise, it is best to check for �tat that require people to advance payment more collaterals when the rates of cryptocurrencies dip. It's vital to ascertain lockup periods together with minimum/maximum tissue.

The particular Platform’s Interface and Style

Customer experience is a crucial factor to take into consideration when looking to take on the best crypto lending web-site. We propose that you select platforms having simple and makeup designs of which aid packing speed. In addition, we count on these approaches to make all their features and even services readily accessible, as it may determine the velocity at which consumers receive loan products or loan crypto. Additionally, it is crucial to opt for offerings with current earnings system and car loan calculator systems. Also, you should make certain that the platform works with with mobile phones by if possible availing some sort of mobile iphone app or making use of a mobile-friendly design.

The consumer Support belonging to the Crypto Loaning Solution

At the moment, a majority of crypto lending alternatives have the particular English variety of their web pages, which punctuates the current siloed status within the market. In spite of this affirmation, you should make certain that the customer help system of the woking platform under consideration provides your unique demands. This need encompasses words compatibility, some sort of 24/7 reviews mechanism, together with a broad assortment of customer support programs. With all this kind of, you can ensure that you can access representatives at the time you need guidance.

The safety of The Crypto Lending Alternative

Due to the fact this program entails that you simply deposit your current crypto deposit as guarantee or to provide it out in order to borrowers, a person, therefore , have to do extensive researching regarding the safe practices of the system. Here, you need to explore the particular measures followed to guarantee the safety of investments. Some of the stability measures to buy are two-factor authentication methods, encryption methods, and pocket security characteristics. Ensure that system has done sufficient to safeguard their wallets and handbags from strikes by incorporating multi-sig functions or even distributing investments across several wallets. Likewise, it is a as well as if your desired crypto financing solution shops users’ investments with covered crypto guardianship platforms.

Just how Did followmycal.compile Their List of The very best Crypto Financing Platforms?

Crypto lending alternatives are becoming normal tropes inside the crypto place. As such, we certainly have painstakingly researched platforms offering crypto mortgage loan services together with picked those who have shown that they can belong to the best echelon within the budding industry. To do this, most of us implemented a natural research method that enclosed on the referrals listed in information.

To put it differently, we explored the lawful standings regarding crypto financing platforms in various regions to look for the jurisdiction they will cater to. Furthermore, we explored the cryptocurrencies that each facilitates and how their very own crypto match ups impacts their very own statuses like solutions directed at a wider demographic regarding participants. Subsequent, we took you a chance to assess rates of interest, compounding prices, lockup durations, maximum/minimum deposit, and program charges. Figuring out fully properly that this researching section implies the profitability these platforms, we all, therefore , as opposed rates appropriately and gauged the flexibility on the pricing approach to each crypto lending alternative.

Following this rigorous procedure, we investigated the user software of each system and made certain that only individuals with premium customer experience in addition to mobile-friendly models featured on this site. Furthermore, we assessed the customer assistance system of those sites reviewed in addition to based their very own scores for the quality on the feedback systems found on each and every as well as their very own accessibility. Finally, we evaluated the security of every platform beneath review. In this article, we evaluated the quality of the safety measures on each alternative.

Ultimately, we came across 10 crypto lending networks that possessed performed satisfactorily well following undergoing each of our review method. Note that every single platform contains separate reviews highlighting its one of a kind workings. You could peruse this content to get a far better understanding of as to why we have handpicked these websites.